5G mmWave not only is alive in the U.S. and Japan but is gaining momentum in multiple other regions across the world. 5G mmWave is now considered as a complementary technology to 5G at frequencies below 6 GHz. Its unmatched performance is enabling more use cases. Notably, it has greatly improved downlink and, more importantly, uplink capabilities. Even though smartphone applications have been driving innovations mainly on the downlink side, the advent of a decent uplink will open a bunch of new possibilities.

![]() System Plus Consulting and Yole Développement have been following the RF electronics industry for some time. Step by step, they have developed dedicated expertise in this domain by identifying the latest innovations and analyzing the market trends and companies’ strategies. Now, the two companies offer a special focus on 5G mmWave technologies for smartphones, making the link with the market’s evolution and identifying the underlying business opportunities. By combining their market and technical knowledge, Stéphane Elisabeth, Ph.D., senior technology and cost analyst at System Plus Consulting, and Cédric Malaquin, senior technology and market analyst, RF Devices & Technology at Yole, investigate the latest 5G mmWave innovations in a market led by Qualcomm until now. New players are coming. The goalposts are moving. The analysts offer you a snapshot based on a comprehensive collection of RF electronics reports and monitors: Cellular RF Front-End Technologies for Mobile Handset, Google Pixel 6 Pro 5G mmWave Chipset, RF Front-End Module Comparison, Smartphone Design Win Quarterly Monitor and Smartphone RF Quarterly Market Monitor 2021.

System Plus Consulting and Yole Développement have been following the RF electronics industry for some time. Step by step, they have developed dedicated expertise in this domain by identifying the latest innovations and analyzing the market trends and companies’ strategies. Now, the two companies offer a special focus on 5G mmWave technologies for smartphones, making the link with the market’s evolution and identifying the underlying business opportunities. By combining their market and technical knowledge, Stéphane Elisabeth, Ph.D., senior technology and cost analyst at System Plus Consulting, and Cédric Malaquin, senior technology and market analyst, RF Devices & Technology at Yole, investigate the latest 5G mmWave innovations in a market led by Qualcomm until now. New players are coming. The goalposts are moving. The analysts offer you a snapshot based on a comprehensive collection of RF electronics reports and monitors: Cellular RF Front-End Technologies for Mobile Handset, Google Pixel 6 Pro 5G mmWave Chipset, RF Front-End Module Comparison, Smartphone Design Win Quarterly Monitor and Smartphone RF Quarterly Market Monitor 2021.

Google is one of the more interesting smartphone manufacturers to track. The company is used to introducing breakthrough technologies. The radar motion sensor on the Pixel 4 is one of those. In that context, System Plus consulting already came across the newly launched Pixel 6 Pro, which supports 5G mmWave. A winning bet as the teardown highlights multiple key points.

First, it marks the commercial entrance of Samsung in a market in which Qualcomm had a monopoly. As depicted in figure 1, Samsung is providing all the key components of the system: the modem, the intermediate frequency transceiver, the mmWave RF transceiver, as well as the power management IC. Second, Murata is taking care of the antenna in package (AiP) assembly leveraging its in-house state-of-the-art MetroCirc™ substrate.

![]()

The result is an innovative, flexible antenna design enabling two radiation directions (rear and side) from a unique component, including a fully used 16-channel transceiver, an industry first as competing solutions are based on two components, each featuring a partially used 16-channel transceiver. Last but not least, innovation takes place inside the mmWave antenna package itself as shown in figure 2. The mmWave RF transceiver has been designed on Samsung’s FDSOI 28 nm platform (28 FDS). Another industry first. Why is it important?

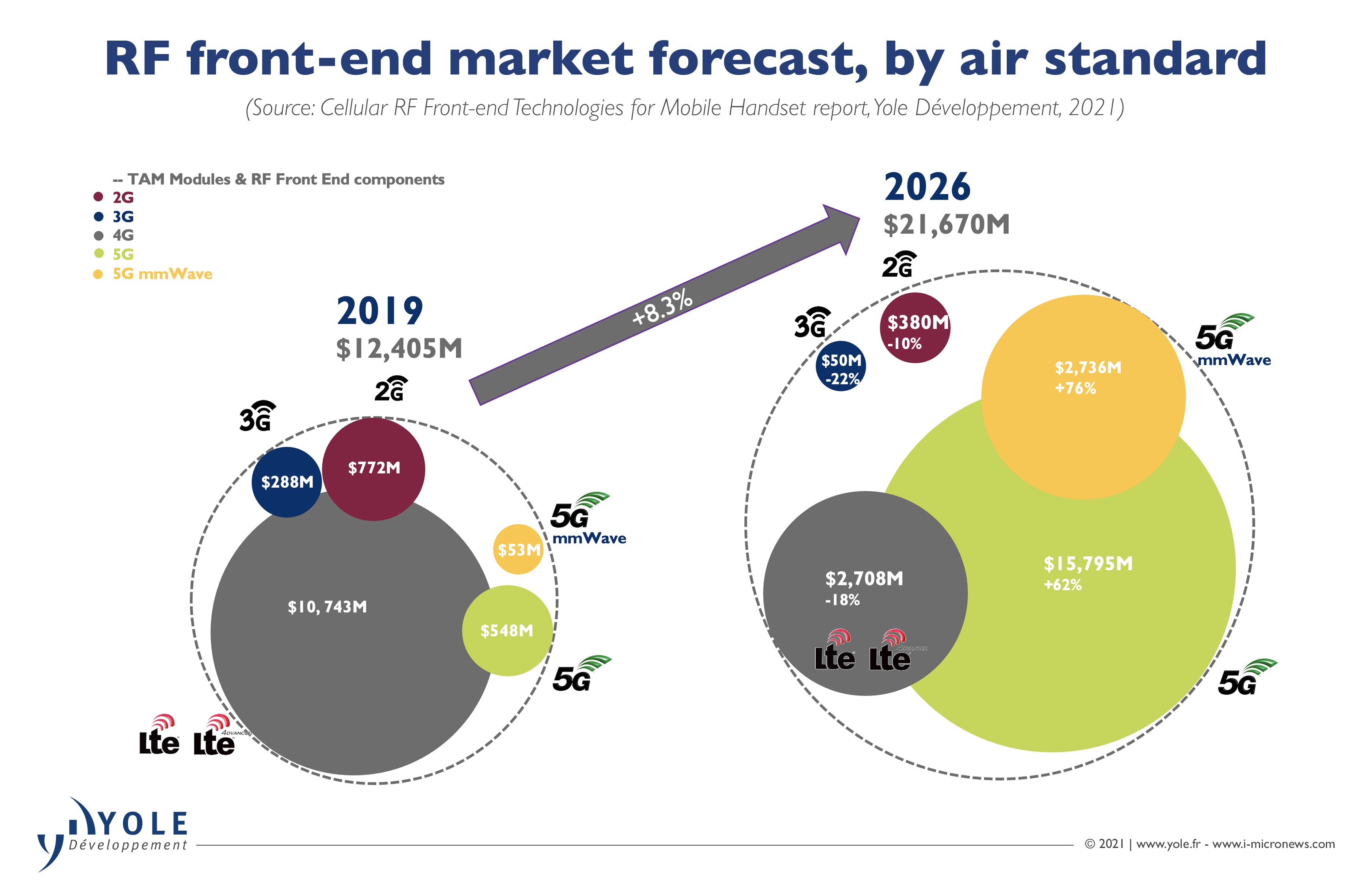

The 5G mmWave market is emerging and poised for high double-digit growth as shown in figure 3. The market research and strategy consulting company, Yole, expects the AiP and mmWave front-end module market to be worth $2.7 billion by 2026. With the introduction of FDSOI into this market, Samsung, using FDSOI substrates from Soitec, is bringing a serious alternative to Qualcomm’s bulk CMOS. This will likely propel 5G mmWave adoption.

In its latest cellular RF Front-End report, Yole expected a new entrant and FDSOI to penetrate the market as early as 2022. FDSOI is an ideal technology for 5G mmWave applications. It offers a fully integrated approach regrouping intermediate frequency –conversion to mmWave signal (and vice/versa) and mmWave RF front-end including the transmit and the receive paths. Besides this undeniable integration advantage of mixed signal and RF circuitry, FDSOI comes as a good technology for RF applications providing sufficient power level at mmWave frequencies with state-of-the-art power efficiency which directly translates into low heat dissipation and better battery life. And high-power level capability will enable a better radio link budget with the base stations, thus a better quality of service.