“The revolutionary transition toward 5G implementation in the next five years is dramatically reshaping the RF technology landscape," announces Zhen Zong, technology & market analyst from Yole Développement (Yole).

This is true for smartphones application but not only--RF telecommunication infrastructure applications above 3 W and 5G is offering enormous business opportunities for compound semiconductors in this RF power market.

The “More than Moore” market research and strategy consulting company Yole releases the report titled “RF Power Market and Technologies 2017: GaN, GaAs and LDMOS Report." Under this new analysis, Yole invites you to discover the overall RF power market segments including telecom and military and many others. This report offers a complete analysis of the competitive landscape with RF power players such as NXP, Ampleon, Qorvo, Infineon, Sumitomo Electric, MACOM, Wolfspeed, UMS, Analog Devices. Yole reviews in details the devices developed and implemented in power amplifier applications and proposes a detailed comparison of the technology landscapes for LDMOS, GaAs, GaN and SiGe.

The RF power market will boom. Which technology, LDMOS, GaAs, GaN or SiGe GaN, will lead the industry?

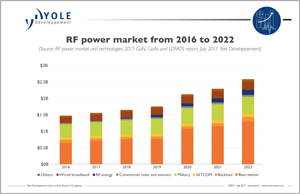

Yole expects the market to grow strongly in coming years with increasing demand for telecom base station upgrades and small cell implementations. Overall market revenue could increase 75 percent between 2016 and the end of 2022, posting a 9.8 percent CAGR during this period. This would be a change from US$1.5 billion in 2016 to more than US$2.5 billion in 2022. Today the market is standing at the threshold of completion of 4G network and then beginning the transition to 5G. There are still a lot to be settled and established. However, some things are for sure: the new radio network will require more devices and higher frequencies. Chip providers therefore have a tremendous opportunity, especially RF power semiconductor sellers.

“At Yole we estimate the market size of telecom infrastructure including base stations and wireless backhaul accounts for about half of the total market size," announces Dr. Hong Lin, technology & market analyst at Yole. In addition, she adds: “It will continue growing fast at an expected 12.5 percent CAGR for base stations and 5.3 percent CAGR for telecom backhaul over 2016 to 2022.”

In the meantime, defense applications are also providing good opportunities for RF power devices, as there is a trend of replacing old vacuum tube designs with solid-state technologies exploiting GaAs and GaN. These new technologies provide better performance, reduced size as well as robustness in various use cases. Therefore, they are gradually taking more market share. This market segment’s revenue will increase around 20 percent by 2022 with a 4.3 percent CAGR between 2016 and 2022.

To discover in details Yole’s RF power technology & market report, visit the RF reports section on i-micronews.com.