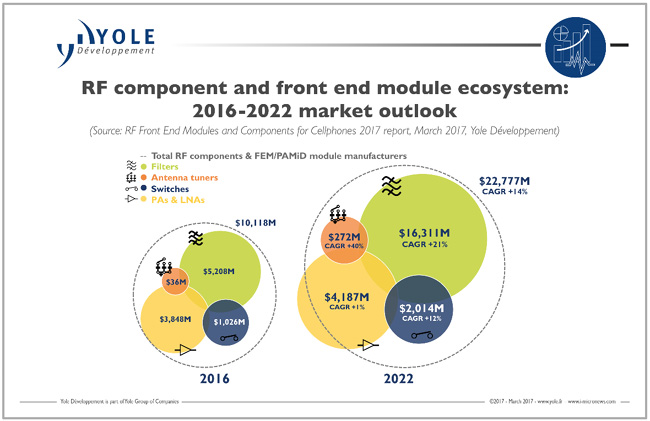

“The RF front end modules and components market for cellphones is highly dynamic”, asserts Claire Troadec, Activity Leader, RF Devices & Technologies at Yole Développement (Yole). And she adds:” From being worth US$10.1billion last year, it is expected to reach U$22.7 billion in 2022.” Such high growth is definitely something that players in other semiconductor markets would envy: a market that will more than double in six years! However, the growth is not evenly distributed…

Yole Group of companies including Yole and System Plus Consulting investigated the RF industry and proposes today two reports focused on the FE part of the market, at the modules and components level:

- RF Front End Modules and Components for Cellphones 2017 : this industry is undoubtedly complex today. This status is due to the diversity of products and technologies but not only... Facing to the smartphones market needs (more high resolution video and so more bandwidth….), RF FE players have to find a way to develop competitive products and so answer the market needs. Yole’s report proposes an impressive picture of the status of this market and analyzes the evolution of this industry in term of architecture, design and materials. With a mix of lot of M&A and disruptive technologies, RF requires today high attention.

- Smartphone RF Front-End Module Review points out the current technical challenges. This report is a detailed comparison of the current solutions proposed by the leaders of this industry. It highlights the technical choices to be done to answer to the smartphone market evolution.

The upcoming 5G communication technology is creating a new order in the communication market. Major RF FE players are battling to provide powerful devices that could be integrated in smartphones. “Not all technologies suit the 5G requirement, but every player could win something”, explains Stéphane Elisabeth, RF and Advanced Packaging Cost Engineer at System Plus Consulting. “There will be opportunities for low cost competitors in the SAW filter market for low band communications like GSM, 2G or 3G, as high quality competitors shift focus to the 4G and 5G market with BAW filters.”

This comes along with better integration of all the FE communication devices, now in just one module.

“Filters represent the biggest business in the RF front end industry, and the value of this business will more than triple from 2016 to 2022”, announces Claire Troadec from Yole. Most of this growth will derive from additional filtering needs from new antennas as well as the need for more filtering functionality due to multiple CA.

PAs and LNAs , the second biggest RF FE business, will be almost flat over the same period. High-end LTE PA market growth will be balanced by a shrinking 2G/3G market.

In parallel, LNA market will grow steadily, especially thanks to the addition of new antennas.

Switches, the third biggest business, will double. This market will mainly be driven by antenna switches.

Lastly, antenna tuners, a small business today with an estimated US$36 million market value, will expand 7.5-fold to reach US$272 million in 2022. This growth is mainly due to tuning being added to both the main and the diversity antennas.

Yole Group of Company is definitely involved in the RF FE industry. Based on its market, technology, reverse engineering and manufacturing costing expertise and its knowledge of the “More than Moore” industry, analysts are answering the industry questionings with a comprehensive analysis of this RF sector for smartphones applications.