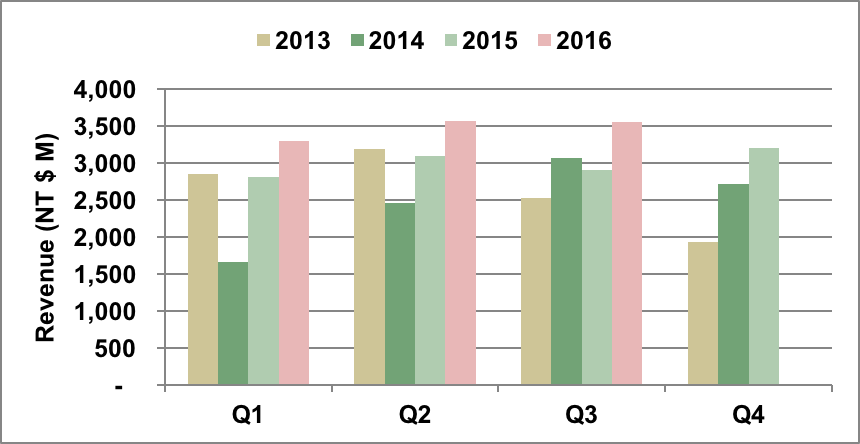

WIN Semiconductors Corp. reported fiscal third quarter (Q3) 2016 revenue of NT$3,553 million ($112 million), up 22 percent from Q3 of 2015 and down 0.5 percent from the prior quarter. Year-to-date revenue was NT$10,417 million ($329 million), up 18 percent from the prior year period.

WIN's gross margin declined sequentially by 3.9 percentage points to 35.3 percent, and operating margin decreased 4.8 percentage points to 24.3 percent. The increase in fixed costs and depreciation expenses for WIN's new 150-mm Fab C, which began commercial production in May 2016, contributed to the decline in margins. Nonetheless, earnings per share (EPS) were NT$2.14, compared to NT$1.19 for the second quarter of 2016. Year-to-date EPS were NT$4.62, greater than the EPS for all of 2015.

In the press release announcing the quarterly results, WIN management said, “For the third quarter of 2016, following a traditionally stronger season with active restocking for the smartphone market in the second quarter, our July revenue reached a record high for a single month, and then gradually entered into a transition period for end products."

Providing guidance for Q4, WIN management said, "As the fourth quarter is a traditional low season, we expect revenue for the fourth quarter of 2016 to decline by low teens quarter-on-quarter. We expect gross margin to be flat at or slightly lower than the third quarter level."