According to Yole Développement, the RF GaN industry is showing high growth with a 23% CAGR between 2017 and 2023 driven mostly by telecom and defense applications. By the end of 2017, the total RF GaN market was close to US$380 million and 2023 should reach more than US$1.3 billion with an evolving industrial landscape. In 2017-2018, the defense sector accounted for more than 35% of the total GaN RF market and the global defense market shows no signs of slowing down.

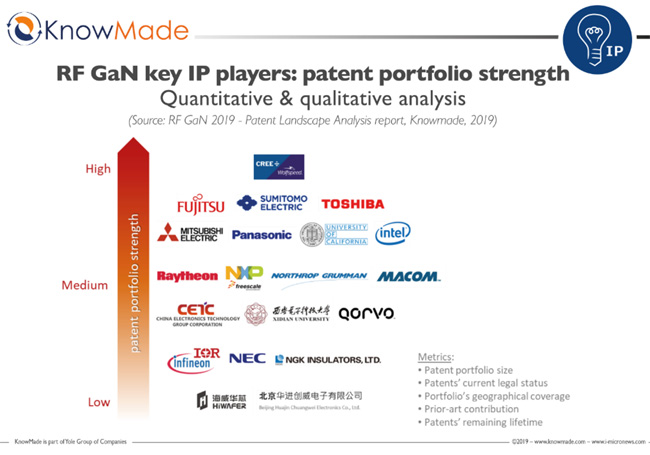

Yole’s partner, Knowmade, has snalyzed the RF GaN IP landscape and has a dedicated report, RF GaN 2019 - patent landscape analysis. This report reveals the competitive landscape from a patent perspective. Key patent owners, IP & technology strategies, and future intents have been deeply analyzed by Knowmade’s analysts. “Cree (Wolfspeed) has the strongest IP position, especially for GaN HEMTs on SiC substrate,” said Nicolas Baron, PhD., CEO and co-founder of Knowmade. “Sumitomo Electric, the market leader in RF GaN devices, is well positioned but far behind Cree.” Sumitomo Electric has been slowing down its patenting activity while other Japanese companies like Fujitsu, Toshiba and Mitsubishi Electric are increasing their patent filings and thus today have strong patent portfolios as well.

Intel and MACOM are currently the most active patent applicants for RF GaN, both especially for GaN-on-Silicon technology, and are today the main IP challengers in the RF GaN patent landscape. Other companies involved in RF GaN market, such as Qorvo, Raytheon, Northrop Grumman, NXP/Freescale, and Infineon, hold some key patents but do not necessarily have a strong IP position. CETC and Xidian University dominate the Chinese patent landscape with patents on GaN RF technologies targeting microwave and mm-wave applications. And the emerging foundry HiWafer, entered the IP landscape three years ago, is today the most serious Chinese IP challenger.

From a device perspective, Cree (Wolfspeed) has also taken the lead in the GaN HEMT IP race for RF applications.“The analysis of Cree’s RF GaN patent portfolio shows it can effectively limit patenting activity in the field and control the freedom-to-operate of other firms in most key countries,” explains Nicolas Baron from Knowmade.

Intel, which entered the GaN HEMT patent landscape later, is currently the most active patent applicant and it should strengthen its IP position in coming years, especially for GaN-on-Silicon technology. New entrants in the GaN RF HEMT related patent landscape is mainly Chinese players: HiWafer, Sanan IC and Beijing Huajin Chuangwei Electronics. Other noticeable new entrants are Taiwan’s TSMC and Wavetek Microelectronics, Korea’s Wavice and Gigalane, Japan’s Advantest, and America’s MACOM and ON Semiconductor.