There is little doubt that tomorrow will bring additional engineering design opportunities in the ever changing, ever expanding global RF and microwave applications arena. In the time it takes to read this paragraph, a new opportunity has been identified in Asia involving high-speed data, and one or two systems engineers have been tasked to come up with several solution concepts by the end of this month. If a workable, profitable business plan can be put together quickly, then one of these solutions could be in design by the middle of next month. In rapid fashion, a slightly larger engineering team will be assigned and the design phase will commence. Thus another engineering project begins. The engineering team’s next few decisions will greatly impact the eventual time-to-market for the new product and the overall success or failure of the project. It is precisely at this point that experience is critical: The accrued knowledge of a component distributor’s seasoned field support organization can act as an extension of this engineering team to help improve both the profitability and the success trajectory of the project.

An optimal RF design process (see Figure 1) must include a “global perspective” for the project. The team will certainly have questions: How can we get help with architecture decisions? How many circuits should we design ourselves versus outsourcing? What are the best-fit critical parts for each circuit design? What are the ways to shorten our development time? How can we cost-optimize our designs while meeting all specifications? Who can help us to work simultaneously with part suppliers and end-customers on multiple continents? Partnering with a full-service, globally focused RF and microwave components distributor can help the team answer these questions and more.

Figure 1 RF design process.

It Takes a Global Perspective to Succeed These Days…

Even if a given design project is scaled to meet the needs of an application in just one country, the project team will benefit greatly by employing a global perspective. Knowledge of a novel application for an existing component or additional device characterization can often benefit engineers working on a completely different end product. Consider the challenge of searching through thousands of data sheets to find the best new technologies available for a specific circuit design. Are there reference designs and layouts available anywhere? Who can the team talk to about reliability concerns? Could a “development partner” be of help for prototyping… for testing… for supply chain… for manufacturing?

Think about it: At about the same time that the opportunity mentioned above presented itself in Asia, thousands of engineers are working worldwide on new RF and microwave circuit and component designs. Correspondingly, new information is just now becoming available. One of the keys to success is to make sure that the project team benefits from all this global information, global design support, global manufacturing and global supply chain logistics. The following case study highlights the benefits of this global perspective.

Case Study: Expert Support Helps the Project Succeed, Step by Step

An engineering manager from a small company in Asia contacted the local office of Richardson Electronics. The engineering manager and his company had been contracted to design, develop and deliver production units of a multi-stage power amplifier circuit, specified over three different frequency ranges. Each of the three new PA units had been requested by the business team to be in preproduction within four months—a daunting challenge (all too common in today’s marketplace, however). The engineering manager wanted to get as much help from the distributor’s design support resources as possible, and a meeting was set up to discuss the alternative design approaches and component options. The detailed specifications were sent immediately to the local field sales engineer (FSE), as well as to the field applications engineer (FAE) located in their regional applications lab, in order to prepare for the initial design support session.

Step 1: Engage design support from a knowledgable and established global component distributor early in the design process

As is the case in many engineering companies today, the designers did not have access to a large, in-house component engineering department to provide them with support. The component distributor is most often called upon to fill this role, acting as an “expert-level” component engineering department. The distributor is able to provide current advice regarding where any given part might be in its product life cycle, which components were more widely available, new products about to be released, reliability history in similar operating conditions, and the like.

The distributor’s FAE and FSE met initially with just the engineering manager and carefully reviewed the specifications and deliverables for each of the three power amplifiers. All were challenging designs in terms of meeting cost, performance and time-to-market goals. Two had significantly higher manufacturing quantity projections than the third, especially for the first 18 months of production. With the lower quantity unit, it was clear that the bills-of-materials (BOM) cost goals would be quite difficult to meet. The FAE asked the engineering manager about the possibility of focusing the design team on just the two higher-quantity PA units and looking to another supplier to customize an existing “off-the-shelf” design, in order to meet the project deliverables for the third PA. This would reduce the risk of the overall project.

Step 2: Brainstorm together looking at all alternatives, including “make versus buy” decisions when appropriate

The trade-offs included spending more on each individual unit and a small, up-front non-recurring expense (NRE) charged by the PA supplier to customize the design. The engineering manager was certain that his management would not approve this change and believed the team could complete all three designs within the allotted time and cost constraints.

The two next met with the small design team. Each of the three designers had completed a block diagram for their respective design. Each block diagram was discussed in turn, and the five worked together to consider the alternative device technologies—and corresponding circuit topologies—for each power amplifier design block. During this part of the discussion, specific RF power transistors were identified as possible candidates for each design, and the approximate cost, availability, and performance of each were evaluated against the overall project goals and performance requirements while still in the meeting.

Step 3: Evaluate together a number of circuit topology alternatives trading-off performance, cost and part availability

The application engineer not only had all of the latest published vendor information available to discuss, he also had knowledge of the newest parts and technologies that were just becoming available. One part was discarded, based on some recent returns from other customers that indicated a potential reliability problem. The design engineers were somewhat surprised to learn that some of their “preferred choices” had excessively long lead times and a couple had even recently been listed by the vendor as “not recommended for new designs,” having been superseded by newer power transistors. Conversely, some newly released capacitors and low cost, high power terminations were stock items which could be delivered that same week.

Step 4: Make sure that the vendors recommended by the distributor are a good fit with your design tools, and that the proper modeling information is available for your use

The next topic to discuss was “simulations and computer modeling.” It is important to match-up the design simulation tools used by the engineers with the types of models that can be provided by the individual vendors. A field application engineer has knowledge of the available models on a vendor-by-vendor basis, as well as what may not be published but could be obtained quickly on request. As a direct result of this discussion, the team was able to further refine the list of component options for each power amplifier.

The meeting moved forward with in-depth discussions regarding individual transistor and process cost trends, lead-time expectations, packaging alternatives, thermal management considerations, and quality/reliability field data. Trade-offs were discussed between cost and performance of the various transistor packaging alternatives. Plastic packaging was chosen as having acceptable electrical performance combined with low cost and stable lead times.

Near the end of this first meeting, the combined team settled on an LDMOS Doherty PA design driven by a high power driver. Each designer requested simulation models for two different power transistor alternatives as well as for multiple driver alternatives. These models were delivered to the team members electronically later the same day, while requests for samples and test fixtures were entered immediately for the most likely options. A second meeting was scheduled for two weeks later, with the goals established that simulations would be completed and preliminary BOM would be available for review.

During the next two weeks, the design team drew up initial schematics and simulated their power amplifier circuit designs using CAD tools. Support for the design team was provided as necessary by the applications engineer via phone calls and e-mails. In one case, a discussion needed to be facilitated between one of the PA designers and an engineer at one of the power transistor vendors. The designer’s simulation was showing larger than acceptable inter-modulation distortion (IMD) at the output of the PA. A different biasing scheme was suggested by the vendor’s engineer and this solved the problem immediately.

The second meeting was the first formal “design review” for the project. The preliminary BOMs had been e-mailed to the sales engineer two days before the meeting, giving him time to review all of the critical RF components in each design. It was time to start selecting specific components to move forward with building the prototypes.

Step 5: Preliminary BOM: Review together all critical RF components in the design

In this phase of development, certain areas should be explored:

- For each major RF part, is there a cheaper alternative available (with similar performance)? Are there more highly integrated or higher power options that may reduce the parts count and improve reliability?

- If simulated performance is marginal, is there a better performing part available?

- Are samples and (if needed) evaluation boards readily available for each key selected part?

During this design review meeting, it was apparent that one of the three PA designs (the one with the highest frequency range) had poorer performance margins than the other two. The power transistors seemed to be performing well in simulation and the engineer was not exactly certain how to improve the design. A more expensive transistor provided the additional margin needed (in simulation), but at a prohibitive cost. As the team reviewed his circuit, the field application engineer suggested that perhaps some better performing coupling capacitors would increase the design margin (while still using the cheaper transistor). He suggested two specialized High-Q RF capacitors with tight tolerances, and the extra cost for these was much more acceptable than that of the transistor option. It was decided to try the capacitor solution on the bench. In fact, all three designs could benefit from the higher-grade coupling capacitors and the BOMs were altered accordingly.

Step 6: Procure component samples and other items required for physical design testing

The field application engineer worked with the engineering team to identify all the parts that could be sampled by the distributor and those parts that would have to be bought by the design company through other channels (low-end resistors, bypass capacitors, etc.). While the most critical parts had been ordered even before simulation was complete, some additional items were now requested on a rush basis, including engineering sample kits for the passive components that would allow for a quick replacement if a change from the simulated value was required.

Step 7: Circuit Testing Support: Verify design for core RF circuitry via physical testing

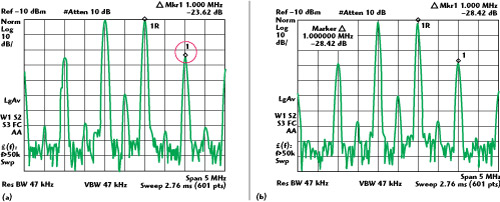

About two weeks later, after all of the sample parts, evaluation boards and test fixtures had been received by the designers, the testing commenced to verify the RF core circuitry. The testing went relatively smoothly, and the High-Q RF capacitors did address the required design margins. In each case, the PA circuit performed close to predictions, even with the lowest cost transistors in place. However, when the circuits were tested under the high temperature extreme, the PA with the highest frequency range was performing at a low margin and was a cause for concern. It was at this point the distributor’s applications lab manager, an experienced power amplifier designer, was consulted. After a brief design review with the team via conference call, the application manager suggested that a slight change be made to the design. He noted that the transistor in question was simply bolted down to the PCB according to the supplier recommendations. Recently, however, a new, low-cost clamping device had become available on the market which provided a better “thermal ground” for the transistor. The application note for the clamping devices described improved thermal and (surprisingly) electrical performance for the transistor, including improved P1dB and IMD3 performance (especially at high temperature). A sample was shipped overnight to the designer, and the performance margins under high temperature improved to a satisfactory level (see Figure 2).

Figure 2 IMD performance margin out of specification before clamping device (a) and within specification after clamping device (b).

Step 8: Prototype Build (Release prototype BOM, determine manufacturer and location for prototype build, order parts for prototypes)

The project moved forward to the prototype phase. The R&D company was not a manufacturer. Like most small design companies today, they used various manufacturers as needed to build their designs. In the past, they usually worked with one specific nearby manufacturer for both prototype builds and for smaller manufacturing runs. This time, however, their primary manufacturing resource was swamped and the lead time quoted for the build was not acceptable. The FAE suggested several other manufacturers known from past experience and offered to help to get an earlier “slot” for the build from one of them. The R&D company was a bit reluctant, mainly because the new manufacturer’s facility was not located nearby and there were some language-barrier issues. The applications engineer set up a conference call with one of his colleagues located near the manufacturer and with the manufacturer’s management team. In this way they convinced the customer that the new manufacturer would perform well, and the deal was struck for the prototype build. In the end, this saved approximately ten days for the project.

Step 9: Prototype Testing Support

After the PA prototypes were built and successfully lab-tested by the designers, the full system integration testing phase of the project began. The design team had scheduled time in their customer’s in-house system integration testing lab for these purposes. During the first few days of testing, several minor issues were discovered with each of the PA prototype designs. The biggest issue was that when the PAs were tested (in turn) in the system, the system noise floor was rising up just a bit too high for specifications.

The problem seemed to be layout related. The team identified design changes to the ground plane near the driver MMIC and added an inexpensive choke and 2 bypass capacitors to the design. They were able to make these changes in the field to the prototypes, and the PAs passed system integration testing.

Step 10: Prepare for Manufacturing

Preparation for manufacturing had been on-going since the release of the prototype BOM. Parts had been ordered and stocked at the distributor based on the limited production forecast. Inventory was reserved specifically for the design company, in order to guarantee availability of parts for the first three months of production. This is another key point in the process. Working closely together, the design team and the distributor were able to meet the delivery needs of the end-customer. One of the keys was the analysis earlier in the program, looking at lead time trends when key RF parts were being considered for the design. By carefully selecting parts that had adequate lead times, the design team and the distributor avoided some typical “back-end” problems related to parts availability.

Step 11: Manufacturing Support

In this case, the manufacturing support needed was fairly ordinary. Parts were ordered on time per the forecast and stock was available for the initial manufacturing runs of the three new power amplifiers. When the success of the project led to an earlier than expected jump in demand, components were pulled quickly from inventory in the US and Europe, arriving within three days. The key was the extensive communication and the close, step-by-step “tie-in” between the RF design company and the distributor. By working together closely, as would be the case if the designers worked with an in-house component engineering department, the designers and the distributor stayed in “lock-step” throughout each phase of the rapid development process, and each was able to make the best use of the information available to the two companies combined.

Trends in the electronic supply chain business…

With the latest economic crisis, supply chains have become more tightly coupled than ever. CFOs everywhere, working on the basis of “cash is king,” have driven down inventories of finished goods and raw materials at every step in the channel. While not currently a widespread problem, selected products are going “on allocation,” and any fluctuation in demand can have a dramatic effect on their associated lead times.

Some of this is beneficial. Supply chain optimization does result in a lower cost at the end, and customers who are able to provide reasonably accurate forecasts and allow for the lead times will see a benefit. But for others, especially those dealing with end customers in China or Korea and may have to deliver product six weeks after winning a contract bid, identifying products that are likely to be in stock or that can be delivered quickly is key. Salespeople at global organizations can monitor and pull stock from local hubs in Europe, North America or Asia and deliver it anywhere in the world in one to three days. Distributors often rate their suppliers’ on-time delivery performance, and also invest heavily in new product inventories, even in anticipation of demand that is not forecasted. Some distributors also integrate data from their many customers’ material requirement planning (MRP) systems. Sample quantities of any new part, as well as evaluation boards and test fixtures, are maintained since that is often the critical element in a design win. Knowledge on everything from loading of supplier wafer fabs to lead times on ceramic packages for power transistors helps keep designers better informed of not only current lead times but future risk.

Conclusion: A Global Perspective

It has always been an axiom that two heads are better than one when trying to solve a problem. As demonstrated in the case study above, when it comes to design projects, two companies working together can indeed be a powerful approach to solving complex design problems and to streamlining the overall design and development process for RF and microwave systems. Each competent design team needs to work together with an equally knowledgeable supply team (i.e., a specialist global distributor) to bring a product to market on time.

During the early design phases, information flow is critical to success. Data sheets, design guides, application notes and part quotes need to be provided in a timely and efficient manner. Design alternatives need to be evaluated quickly, and component decisions made that trade-off time-to-market, cost and performance. Further into the design process, a given project’s success or failure could ultimately hinge on the distributor’s ability to work simultaneously (on behalf of the design team) with component suppliers and system manufacturers on several continents at once (see Figure 3).

Figure 3 Global perspective supply optimization.

Working with the best RF and microwave component and solutions suppliers around the globe, the distributor’s field support team members are up-to-speed on the latest advances in the global wireless community. This global perspective is then used to provide the highly competent level of design support, on a step-by-step basis during the development, which has simply become the expectation for all design companies the world over.

Chris Marshall received his BS degree in Electrical Engineering (BEng) from McGill University, Montreal, Canada, in 1973, and has held engineering, global marketing and business management positions in the semiconductor and telecom industries in Canada and the US. He is currently Vice President, RF and Microwave Components for Richardson Electronics Ltd., LaFox, IL.

Bill Murphy received his BS degree in Electrical Engineering (BSEE) from the University of Illinois at Urbana-Champaign in 1981, his MBA degree from the University of Chicago in 1984, and his MSEE degree from the Illinois Institute of Technology (IIT) in 1987. He is currently the Technical Marketing Manager for Richardson Electronics Ltd., LaFox, IL.