Join the discussion on LinkedIn about this subject:

RF and Microwave Community Discussion on the BIP

On February 17, 2009, President Obama signed the American Recovery and Reinvestment Act (ARRA) into law, allocating $7.2 B in grant and loan funding to expand broadband/wireless access to rural unserved and underserved parts of the country. The Department of Agriculture, Rural Utilities Service (RUS) and the Department of Commerce, National Telecommunications and Information Administration (NTIA) will distribute the funds to competitively chosen awardees. This special report takes a look at this Broadband Initiative Program, the potential impact on the microwave industry and the US economy as a whole.

The Economic Impact of Broadband

In July 2007, the Brookings Institution released a report on economic policy entitled, “The Effects of Broadband Deployment on Output and Employment: A Cross-sectional Analysis of US Data,”1 detailing how high-speed Internet access and the underlying infrastructure have become essential to the global information economy. At the start of the decade, there were only four million broadband lines in the US allowing one house in 30 to download at speeds of 200 kbps or greater. Six years later that number soared to more than 53.5 million (49 million residential). An April 2009 study conducted by the Pew Research Center’s Internet & American Life Project found that 63 percent of adult Americans have broadband at home, up 15 percent from a year earlier.2

Correlating broadband access to economic growth, the report notes that “for every one percent increase in broadband penetration in a state, employment is projected to increase by 0.2 to 0.3 percent per year. For the entire US private non-farm economy, this suggests an increase of about 300,000 jobs.” Information Computing Technology (ICT) contributed 59 percent to labor productivity from 1995 to 2000 and 33 percent from 2000 to 2005. A sample of 21 free-market (OECD) countries between 1970 and 1990 found that about one-third of the per capita GDP growth (0.59 to 1.96 percent per year growth rate) could be attributable to telecommunications infrastructure investment. At the start of this decade, over 2,000 US firms across the economy confirmed that Internet business solutions added a net gain of almost $600 B and are expected to add a total of 0.43 percentage points to US productivity growth through 2011.

In January, the Washington, DC-based Information Technology and Innovation Foundation (ITIF) released a report entitled, “The Digital Road to Recovery: A Stimulus Plan to Create Jobs, Boost Productivity and Revitalize America,” estimating that an investment of $30 B in America’s IT network infrastructure in 2009 will create approximately 949,000 US jobs. Specific to broadband networks, the report estimates that a stimulus package supporting $10 B of investment in one year will result in an estimated 498,000 new or retained US jobs for a year.3

US Global Broadband Ranking

Several studies have looked at broadband access from the perspective of global competition. According to a report by Strategy Analytics, 60 percent of US households accessed the Internet via broadband in 2008, compared to 95 percent in South Korea (see Table 1). The US ranked 20th and will likely drop to 23rd place worldwide by next year. The median US download speed currently is 1.97 megabits per second compared to the 61 megabits per second in Japan, South Korea (median 45 megabits), France (17 megabits) and Canada (7 megabits).4

Internet speed has a direct impact on productivity. A 10 megabyte file takes about 15 seconds to download with a 5 Mbps connection (over twice the US median speed). Download time is almost 2½ minutes with the entry-level 545 kbs connection speed found in many areas in the US. Superfast speeds supporting critical applications such as telemedicine are directly tied to network capacity, which relates back to infrastructure and the microwave industry via wireless access and backhaul.

Currently, the Federal Communications Commission (FCC) defines “high speed” as 200 Kbps, a benchmark adopted more than a dozen years ago when dial-up service was the rule. At the moment, RUS and NTIA are favoring the current threshold because “it leverages the FCC’s expertise, utilizes an established standard, facilitates the use of many currently common broadband applications (e.g., web browsing, VoIP, and one-way video), allows for consideration of cost-effective solutions for difficult-to-serve areas and is the most technology-neutral option (because it encompasses all major wired and wireless technologies).”5

This past April, the FCC opened proceedings that could redefine broadband access speeds and plans to study the competitive nature of the US wireless industry and how to “encourage further innovation and investment.” By August, US telecommunications regulators announced they were seeking public comment on how to define “broadband” as it drafts a national broadband plan that is slated to be submitted to Congress in mid-February.

In March, the New America Foundation (NAF) recommended several policy proposals to encourage greater rural deployment. The NAF encouraged greater wireless deployment through increased access to spectrum, doing so through the thousands of “locally-grown” wireless ISPs (WISP). Recent spectrum occupancy studies by the Shared Spectrum Co. and funded by the National Science Foundation exposed large swaths of vacant spectrum especially in rural areas. For this reason, the NAF recommended a hybrid approach for rural access, utilizing different technologies and resources to tap under-utilized spectrum. The foundation also recommended mapping public spectrum capability for a more complete and transparent accounting of available frequency-by-location data.6

Another major proposal calls for increased access to high-speed Open Access and wholesale middle-mile infrastructure. The middle mile is defined as broadband infrastructure that does not predominantly provide service to an end user, but which includes interoffice transport, backhaul, Internet connectivity or special access. Connecting last-mile networks (service to end-users) to the Internet backbone is a major obstacle for operators. The typical rural ISP is 91 miles from its primary backbone connection. The NAF’s proposal advocated installing “dark fiber” or excess capacity in conjunction with all new road construction and repair.

Meanwhile, Harris Stratex advocates a wireless solution to the backhaul problem, stating that the transmission cost per bit is approximately 40 to 50 percent lower than the cost of fiber (according to ABI Research). According to a Harris Stratex white paper, the deployment cost for fixed wireless (including microwave) link is about $50,000 per 100 Mbps fully installed versus $200,000 to $800,000 per mile for fiber.7

Back-story: Bringing Broadband to the Heartland

Government investment in infrastructure has a long and successful history of reshaping the nation from the building of the roads, canals and ports, which extended commerce in pre-Civil War America; the transcontinental railroads that transformed the country into a continental power in the late nineteenth century; to the immense public works program that brought telephone and electrical service to rural America during and since the Great Depression. In the 1950s, the federal government funded the ambitious highway construction program, opening up remote areas to more residents. As sprawl and technology advanced, many missed out on the services and opportunities that came with the emergence of IT over the past 30 years. Currently, only 38 percent of Americans living in rural areas subscribe to broadband, compared to 57 percent in urban and 60 percent in suburban areas.8

The FCC defined the unserved and underserved in a recently released report. As of 2008, 83 percent of US citizens had access to DSL, and 96 percent had access to cable modems. The number of high speed lines increased by more than 11.5 million lines, approximately 10 percent, during the first six months of 2008 to more than 132 million lines. Assuming the economy slowed this growth rate over the last year, the number could still be nearing 145 million lines. This means that only 1 or 2 percent of US subscribers are now without the ability to get basic broadband. The report goes on to reveal 68 percent of the US population have broadband access with rates 2.5 Mbps or greater, with 8 percent having access greater than 10 Mbps. This implies that the underserved segment of the market is significantly more in need of stimulus infrastructure spending. The report concludes that the stimulus Broadband Initiative Program (BIP) should be spent on broadband infrastructure that will last for 10 years or more, supporting the argument for aggressive bandwidth targets.9

The USDA Rural Development Agency got involved with broadband back in 2000 with a $100 M pilot loan program (an extra $80 M was provided by the Agriculture Appropriations Act of 2002). The initial program delivered 28 loans totaling $180 M in 20 states and established what the needs and interests were for broadband in rural America.

By 2007, the program had approved loans in 40 states, serving 1,263 communities (582,000 household subscribers) totaling over $1.22 B of investment. According to the agency, this program established broadband access as a transformative technology that allowed rural communities to drastically enhance the quality of their health care, education and economic opportunities. Forty percent of the early projects were successfully completed, while 30 percent of the loans defaulted, resulting in changes to the risk-mitigating rules applied to subsequent loan programs including the current loan/grant application process.10

RUS’s BIP intends to create thousands of jobs while providing the benefits identified during earlier programs. The recovery act requires that 75 percent of a BIP-funded area “lacks sufficient access to high-speed service to facilitate rural economic development.” Regulatory policies must promote technological neutrality, competition, investment and innovation to ensure that broadband service providers have sufficient incentive to develop and offer such products and services. These technologies include fiber to the home, wireless, satellite, broadband over power lines and hybrid fiber/coax systems.

Rural needs and challenges

One of the fundamental decisions behind a cost-effective rural communications network is the choice of physical network technology. With relatively rapid deployment speed, low cost and ability to cover large areas with a single base station, wireless is one of the more viable options. For sparsely-populated areas, it is much more cost effective than deploying fiber-to-the-home. In North America, it takes six to nine months to deploy fiber in a location, representing the time required to plan, engineer, order, install and build the fiber according to an ABI Research report on Mobile backhaul – Global market analysis and forecast 2009-2014.7

Figure 1 Wireless backhaul diagram for cellular/PCS, 3G/4G, WiFi and WiMAX (courtesy of Polimetrix Systems).

Rural networks serve far fewer customers per square mile and are typically more expensive to deploy and maintain (see Figure 1). While these networks are fundamentally similar to urban networks with local access and a backhaul component, rural broadband networks are geographically farther from Internet backbone nodes. In many cases, the provider will need to obtain backhaul transport, or “middle-mile” facilities, from more than one provider, often over facilities that were designed for voice telephone or cable television services. Currently, some of these “middle-mile” facilities have insufficient capacity, causing the transmission speed on otherwise adequate last-mile broadband facilities to come to a crawl or stall before the data reaches the Internet backbone (see Figure 2).

Figure 2 Block diagram of wireless point-to-point (P2P) microwave backhaul system (courtesy of Texas Instruments).

According to an FCC report on its rural broadband strategy from this past May, overcoming this issue will require the construction of dedicated facilities, driving up costs and deterring last-mile broadband investments. Moreover, even when the last-mile provider acquires access to adequate middle-mile facilities, that access may be prohibitively expensive. It is argued that the stimulus funding is needed to trigger deployments that would not otherwise occur.11

There is no one solution to addressing middle mile transport costs in rural areas. Comments to regulators suggest explicitly encouraging middle-mile build-out, revising universal service funding to help cover costs of the middle-mile, and using current or potential infrastructure more effectively by coordinating with other infrastructure projects to shrink deployment costs, and reforming interconnection obligations.

Delivering high capacity services such as WiMAX will require significant backhaul scale. Each site may have requirements growing up to 50 to 100 Mbps per tower. Multiple tower sites may need to be aggregated together across a single link before reaching fiber, which will drive some backhaul capacities up to nearly a gigabit. Greg Friesen, Director of Product Management for Dragonwave, identified some of the major challenges on the backhaul side of these deployments. Leading concerns include: capacity for future scalability; network reach to rural areas; limited site options for deployment; long repair times, driving redundancy and uncertain economic viability after the initial capital expenditures.12

According to Dragonwave, the first backhaul challenge is to deliver the required high Ethernet capacity at each of these sites. Some recently licensed Ethernet microwave systems cannot offer capacities of 400 Mbps up to over a gigabit. These solutions can provide high capacity last-mile transport. They can also serve on aggregation links shared among multiple sites. In addition, some of these radios have capacity scalability via remote software keys. This can enable a lower initial cost without sacrificing future scalability.

The wide range of distances that will be required for these deployments will drive a wide range of frequencies. In rural areas, for long hops, 6 GHz may be required. The downside to this is that there are only 30 MHz channels in this band, limiting the throughput to about 200 Mbps per license. In addition, at 6 GHz there is a minimum antenna size of six feet, making deployment more difficult and expensive, and driving up tower space leasing costs. A good alternative is 11 GHz, which supports an antenna size of 2.5 feet, and 40 MHz channels allows close to 300 Mbps throughput per license, with a much simpler installation, and reduced infrastructure requirements.

For the shorter hops, where NTIA funding is focused on covering underserved areas, 18, 23 and even higher bands like 28 GHz can be considered. Some of these bands allow one foot antennas and they all have 50 MHz channels, enabling up to 400 Mbps throughput per license. In addition to considering multiple spectrum options, reach can be significantly increased though Adaptive Modulation, which is now available on some licensed microwave systems. Adaptive modulation shifts to a lower capacity and modulation during rain fade (or other environmental effects), maintaining the link but at a reduced capacity. During this event, the link will prioritize the critical traffic, to ensure services such as voice calls are maintained. Adaptive Modulation allows the service provider to engineer the link distance based on modulation.

Another wireless technology that could benefit in the wake of the broadband stimulus package is 802.11y, the 3.65 to 3.70 GHz WiFi standard approved by the IEEE in September 2008. The “lightly licensed” spectrum allows prospective operators to pay a small fee for a nation wide, non-exclusive license and then pay an additional nominal fee for each high powered base station that they deploy. Neither the client devices (which may be fixed or mobile), nor their operators require a license, but these devices must receive an enabling signal from a licensed base station before transmitting. All stations must be identifiable in the event they cause interference to incumbent operators in the band. The higher power level can provide good backhaul in rural areas in the Southwestern and Southern United States and municipal WiFi networks.

Just as satellites provide necessary links for telephone and television, they can also provide links for broadband. Downstream and upstream speeds for satellite broadband depend on several factors, including the provider and service package, the consumer’s line of sight to the orbiting satellite and the weather. Typically, a consumer can expect to download at a speed of about 500 Kbps and upload at a speed of about 80 Kbps. These speeds may be slower than DSL and cable modem, but they are about 10 times faster than the download speed with dial-up Internet access.

In testimony to the FCC this past August, Ken Carroll, President and COO of WildBlue Communications, one of the two primary providers of satellite broadband today (along with HNS), discussed the state of broadband satellite and its potential role in provided broadband to the unserved. Satellite broadband is currently serving one million customers. Carroll projects that in five to seven years there will be close to five million satellite broadband consumers, primarily rural, unserved and underserved.

Today, the company’s two satellites operate on a first generation platform, combining to generate about 10 gigabits of capacity. The next generation platforms will bring significantly more capacity and speed. With the next generation, each satellite brings approximately 100 gigabits of capacity, allowing speeds of 10 to 15 megabits and significantly more volume throughput. Also, satellites don’t have some of the middle-mile issues that the rest of the wireless industry does. Satellites have gateways and are able to aggregate traffic and usually locate those in competitive fiber market areas in order to get the best pricing on that “middle-mile.”13 On the negative side, satellites require more expensive end-user equipment and have technical issues, such as latency (500-700 ms) and signal loss due to precipitation.

The Cost of Connecting Rural America

Long link range is critical to giving wireless an economic advantage. For a base station link range of 1/2 km serving an area of 22811 km2, 29044 base stations would be required. At a per base station cost of $50,000, the total cost would be $1.4 B or $2,250 per person for a population density similar to that in southwest Virginia. If the link range could be extended to 15 km, the number of required base stations would drop to 32 at a cost of $1.6 M or $2.51 per person.14

To help extend the link range, Brett Glass, founder of LARIAT, a non-profit co-op serving unserved/underserved areas, implored the FCC to devote more nonexclusive licensed spectrum to wireless broadband, with mandatory spectrum etiquettes to enable cognitive radio and effective spectrum sharing along with an increase of power limits in rural counties (population <200K) by 9 dB for Part 15 WISPs on 900 MHz, 2.4 GHz, 5.3 to 5.8 GHz, and 60 GHz (for inter-tower links).

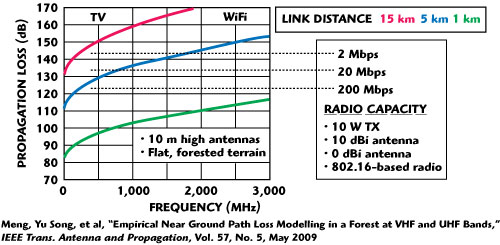

Figure 3 Propagation loss vs. frequency and link distance.

Smart radios and autonomous dynamic spectrum utilization was also advocated by Mark McHenry, CTO of Shared Spectrum Co. The reasoning is, while spectrum may be allocated and assigned, most of it is unused, especially in rural areas. The coveted spectrum includes the (VHF/UHF) frequency bands which increase link range and reduce propagation loss by selecting the “best” frequency for building penetration and minimal foliage attenuation, as shown in Figure 3.15 Cognitive radio, often thought of as a software-defined radio extension (Full Cognitive Radio), is the proposed method to better utilize this spectrum by 10 to 100 percent. Much of the research work is currently focusing on Spectrum Sensing Cognitive Radio, particularly in the TV bands. The essential problem of Spectrum Sensing Cognitive Radio is in designing high quality spectrum sensing devices and algorithms for exchanging spectrum sensing data between nodes.

Gary Kim, a contributing editor with TMCnet, is less than optimistic about the broadband initiative being able to meet its goals. He places the number of unserved broadband locations at around 600,000. At a cost per new location of about $9,000 for construction and equipment, it would take $5.4 B. With $2.5 B to spend, RUS could connect something less than 278,000 new locations. Beyond that, there might be eight million or so rural locations that already have gotten some RUS support in the past, and which might be upgraded for as little as $500 per location, using wired facilities. That implies additional investment of $4 B. There also might be another one million locations more than 18,000 feet from a central office or repeater and which might be upgraded for broadband, using wired facilities, for about $4,000 a location. That would imply an extra $4 B in investment.15

Dave Burstein, editor of the DSL Prime newsletter and panelist on the FCC workshop on the National Broadband plan, is more optimistic and pragmatic with his advice to the regulators. He agrees with Kim that 50 to 70 percent of unserved homes can access megabit speeds for under $400. Thirty to 40 percent (up to four million homes) of these locations get cable TV and could receive data with a cheap upgrade; another 20 to 30 percent would require new towers or DSL repeaters at an average cost of $2500 per home. Total cost would be about $7 B to cover all but one to two percent of the US with megabit speed. As this last group gets into the $10K+ range per home, they may best be served by satellite. Burstein also recommends bringing down backhaul cost by special access (middle-mile investment) and staying away from subsidies for home equipment, routers and switches.16

Looking at Past Government Tech Spending

On May 25th, 1961, President Kennedy announced to a joint session of the US Congress that, “I believe that this nation should commit itself to achieving the goal, before this decade is out, of landing a man on the Moon and returning him safely to the Earth. No single space project in this period will be more impressive to mankind, or more important in the long-range exploration of space; and none will be so difficult or expensive to accomplish.” With the political conflict, military tension, scientific and economic competition of the Cold War escalating, Kennedy decided the country needed to impress mankind (and the communist block countries, in particular) with an unprecedented accomplishment of scientific achievement, despite the difficulty or cost. Internal memos in the White House reflected the administration’s fear that countries around the world would eventually align themselves with the winner of the space race, regardless of ideology.

At the time of Kennedy’s speech, only one American had flown in space (less than a month earlier) and NASA had not yet sent a man into orbit. As the administration was proposing a program that would have a final cost between $20 and $25.4 B in 1969 dollars (or approximately $150 B today), the country was experiencing a brief recession. While some cynics expressed their concern and opposition to this spending, the majority of the country gathered around the effort and supported its successful completion.

Money spent on the space program was ultimately responsible for much of the early development of the integrated circuit, communications, GPS, LandSat and other technical advancements in high-frequency electronics. Much of the world’s present day economy is based on the technologies derived from this government investment. The impact on people was equally impressive as a whole generation of Americans pursued an education in math, science and engineering. Government spending is often controversial (especially during a recession), yet the favorable long-term economic impact of this current broadband program seems undeniable. The big unknown is whether the complexity of serving a diverse and sparsely located population with a myriad of technologies can be done in such a way that both tax payers and government watchdogs feel good about the long-term return on investment.

References

1. http://www3.brookings.edu/views/papers/crandall/200706litan.pdf.

2. Pew Internet & American Life Project, Home Broadband Adoption: 2008 (available at http://www.pewinternet.org/pdfs/PIP_Broadband_2008.pdf).

3. http://www.itif.org/files/roadtorecovery.pdf.

4. http://www.strategyanalytics.com/default.aspx?mod=PressReleaseViewer&a0=4748.

5. http://www.ntia.doc.gov/frnotices/2009/FR_BBNOFA_090709.pdf.

6. http://www.newamerica.net/files/NAF_RuralBroadbandStrategy_Comments.pdf.

7. Harris Stratex White Paper, “Wireless and Stimulus: A Perfect Match,” May 2009.

8. Report on Rural Broadband Strategy before the FCC, Comments of the Telecommunications Industry Association, GN Docket No. 09-29, March 25, 2009.

9. http://www.fcc.gov/wcb/iatd/recent.html.

10. http://www.rurdev.usda.gov/rd/pubs/RDBroadbandRpt.pdf.

11. Report on Rural Broadband Strategy before the FCC, Comments of the Organization for the Promotion and Advancement of Small Telecommunications Companies, GN Docket No. 09-29, March 25, 2009.

12. http://www.convergedigest.com/bp/bp1.asp?ID=585.

13. http://www.broadband.gov/docs/ws_04_deploy_un_transcript.rtf.

14. http://www.broadband.gov/docs/ws_technology_wireless/ws_technology_wireless_McHenry.pdf.

15. http://4g-wirelessevolution.tmcnet.com/broadband-stimulus/topics/broadband-stimulus/articles/60739-rural-broadband-initiative-will-fail.htm.

16. http://www.broadband.gov/docs/ws_deployment_unserved/ws_deployment_unserved_underserved_Burstein_1.ppt.