From its very beginning, the RF/microwave industry has understood that a good electrical connection between coaxial components, modules, subsystems and large platforms should not be taken for granted. Like high tech plumbers, our professional predecessors developed the coaxial cable and connector systems that allowed microwave signals to flow with minimal disruption and insertion loss through the modular electronic building blocks of today’s communication, avionics, EW, radar, measurement, medical and industrial high frequency systems. In addition to addressing electrical performance, these manufacturers have also developed products that provide reliable and repeatable mechanical connections for all types of hostile operating environments and applications.

As modules and system technologies continue to evolve, so too does the state of interconnect technology. Similar to Moore’s Law, these systems follow a universal trend toward miniaturization and added functionality, placing new demands on the interconnect design. Meanwhile, pressure to reduce costs combined with the availability of cheaper offshore labor is changing the manufacturing landscape and global supply chain. Cost, miniaturization and complexity are leading factors in a changing RF cable and connector market. In this special report, Microwave Journal examines these market and technology trends as well as some noteworthy developments among manufacturers.

RF Connector Market Trends

According to connector/cable industry analyst Bishop and Associates Inc., the global RF connector market is expected to reach nearly $3 billion in annual sales this year. This reflects a decade’s worth of growth ranging from 8 to 11 percent per year. Seventy percent of RF connector sales are attributed to four major market sectors, namely communications, military, computers and industrial. These markets represent high volume consumer products as well as the high performance, low-volume/high-mix products required by aerospace and defense. Markets that are not traditionally associated with RF, such as transportation and medical applications are expected to show significant growth as wireless monitoring and machine-to-machine (M2M) becomes the norm.

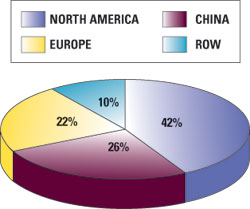

Fig. 1 Percentage of global RF connector sales in 2010, according to Fleck Research.

Fleck Research estimates the North American connector market to be valued at $1.3 billion, compared to a $765 million connector market in China and a $650 million European connector market. The rest of the world makes up the remaining 10 percent (see Figure 1). Emerging markets such as China and India are the fastest growing with CAGRs well into the teens.

Each market has its own driving factors pushing RF connectors toward miniaturization and increased bandwidths. Smaller connectors are critical to reducing the size of handhelds, tablets and the next generation of laptop computers such as Intel’s recently announced Ultra-book. Miniaturization also helps lower the overall weight of RF systems in airborne applications, which is needed to reduce fuel consumption. Conserving fuel is especially critical for launching spacecraft and lengthening the mission time and range of next-generation UAVs, such as the smaller platforms slated to replace today’s Predator force.

Mil/Aero

The military/aerospace market for cable assemblies represents approximately 11 percent of the worldwide market for all cable assemblies (including non-RF) at a value of $12.7 billion in 2010. In that year, China had the most growth, at 21 percent, and Japan had the least amount of growth at eight percent. The military and aerospace industry is a major source of technology development and jobs. Unlike other industries, the defense business depends critically on governments to be regulators, customers and investors. On average, over the last five years, governments worldwide have consistently spent 2.7 percent of their global gross domestic product on military expenditures.

In 2010, North America led connector sales to the military/aerospace sector with 47 percent of all worldwide defense end-market sales, according to research by Bishop and Associates. North America has consistently demonstrated strong connector sales to the aerospace/defense sector and enjoyed the second-largest year-to-year growth in 2010. According to the same report, China ranked behind Europe and Japan in overall connector sales to the military sector but exhibited the greatest growth over the previous year.

Much of China’s military spending for connectors and cable assemblies remains invisible to the outside world, as products are produced in government-run factories and many of the components are not purchased on the open market. The information that is available points to a rapidly growing market that may open up to commercial competition in the near future. RF connectors manufactured in China for internal consumption and export include a variety of types (discussed later in this article) such as SMA, SSMA, SMB, SSMB, MMCX, SMP, SMZ, SMC, SA, BMA, BNC, TNC, N, K, F and SPC3.5. These commonly have nickel- or gold-plated contacts. Compact variants MMCX, SSMA and SSMB, and 1.9, 1.85 and 1 mm units are also popular targets by manufacturers in China because of the miniaturization trend in targeted applications.

Meanwhile, the U.S. military will keep its defense systems updated with the latest and greatest technology, i.e. smaller, lighter, faster and more mobile systems, by frequently replacing the electronic modules in its older airplanes that may have a service life of thirty years or more. Therefore, modules must be connectorized to support regular replacement. This approach drives the demand for both standard and customized connector solutions.

Unfortunately, a recent report from Fleck Research confirms the overall weakening of demand for military connectors in upcoming years. Former Defense Secretary Robert Gates initiated the rethinking of future DoD spending citing a shift in the U.S. military’s global focus/priorities and in anticipation of funding cuts in an era of government austerity. As a result some new programs will be delayed or cancelled.

For the Marines, the F-35B Joint Strike fighter was threatened with a two-year delay. Recently, Defense Secretary Leon Panetta removed the F-35B model from its two-year “probation” a year ahead of schedule; this was only after its development was put back on track with two other F-35 models being developed for the U.S. Air Force and Navy. Still, the Marine Expeditionary Fighting (ship-to-shore) vehicle has been cancelled and the Army’s SLAMRAAM surface-to-air missile and over-the-horizon launch platform have also been nixed.

Aerospace and defense analyst Rob Spingarn projects that spending cuts on defense could total approximately one-third of the total $2.4 trillion spending cuts over the next 10 years as outlined in the debt deal from this summer’s debt ceiling fight between congress and the Obama administration. Spingarn believes that the majority of the DoD cuts are likely to be in procurement, starting in fiscal 2012 and 2013, with specific program cuts identified in early October 2011.

Good News for Drones

On the upside, Fleck Research considers the most significant factors governing future military connectivity include the federal government’s mounting interest in the use of UAVs and the escalating challenges to competing with China as a formidable military power. This past summer, Sen. Kent Conrad (D - ND) told reporters for Avionics Intelligence that the number one request he has heard from combatant commanders in battlefield situations is for more unmanned aircraft. Moreover, the demand for drone-enabled surveillance has spread into other vertical segments such as law enforcement and border control.

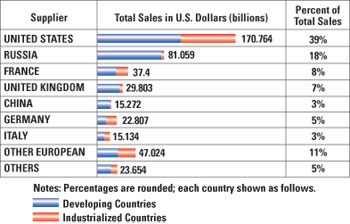

Fig. 2 Overall global arms exports in 2010.

Although the U.S. Defense budget may be flat or down slightly year-over-year, the U.S. market for arms export is still strong. Responsible for nearly 40 percent of the total yearly global arms sales in 2010, the U.S. is by far the largest exporter of arms. According to a report on Conventional Arms Transfers to Developing Nations (Sept. 2011) by Richard Grimmett of Congressional Research Services, U.S. arms exports totaled $170.7 billion, followed by Russia ($81 billion), France ($37.4 billion), UK ($29.8 billion), Germany ($22.8 billion) and China ($15.3 billion) (see Figure 2). Sale of advanced military hardware to areas such as the Middle East and Taiwan will help maintain the cable assembly market for mil/aero products through 2012.

Defense cuts have not affected the development and production of UAVs, with platforms that supposedly range from the size of a large insect, right up to that of a conventional fighter jet. For the period to 2015, it is projected that the market will have a 10 percent CAGR with the global market exceeding $94 billion by 2021 according to a Teal Group Corp. report from last March. Growth for RF connectors in UAV applications will likely track this 10 percent CAGR. In addition to offering ruggedness, performance and lower size/weight, RF connectors targeting use in UAV platforms will need to withstand altitudes up to 70,000 feet, temperatures from -60° to 75°C and frequencies up to 40 GHz.

Shifting Sands in the Market

Who will benefit most from this demand? Each market has its own set of priorities dictated by a variety of factors. Pricing certainly drives a portion of many buying decisions and is forcing suppliers to lower their manufacturing costs as best they can. And yet, the true cost of using a particular vendor’s connector or cable assembly includes additional considerations such as performance, quality, reliability, catalog (available products), on-time delivery, manufacturing capacity and the ability to successfully execute custom engineering in a timely manner.

Literally thousands of companies manufacture RF connector and cable assemblies globally. Leading vendors do well in various connector/cable assembly markets according to how strongly they compete in any of these areas and how important that attribute is to a given market. Reputation and existing customer relationships, along with continued investment in R&D to improve performance, size and manufacturing should allow these companies to survive and expand. Strong brand awareness and a reputation for quality and reliability have considerable value in the interconnect component market today. As foreign competition heats up and lower priced products hit the market, brand loyalty may help leaders to retain customers and maintain margins.

Regular, in-depth conversations with end-customers are often required to ensure that product specs meet or exceed their needs. Developing clear two-way communication for product and service related support builds trust and ultimately improves the end product. As a result, many leaders are successful in getting their products “spec’d in” to OEM requirements, which drives customer loyalty (by increasing switching costs) and allows for premium pricing relative to commodity products.

This dedicated in-house expertise has helped industry leaders expand their share within growing niches in the market. For example, companies focusing on the military and aerospace market have been able to develop long-term customer relationships with premium pricing arrangements. Industry specialization makes companies more attractive for take-over because specialization allows the new parent company to increase their exposure to specific end-customer markets. These acquisitions are often easier to integrate into the existing customer-based structure of the overall organization. As a result, premium valuations are frequently attached to any company targeted for a merger or acquisition if they have developed a clear specialization in the medical, military, aerospace and/or industrial markets.

Fig. 3 Cable assembly line in China (courtesy of Wellshow Technology Co.).

Still, the manufacturing supply side has been undergoing some interesting shifts over the past few years. Firstly, components are increasingly being manufactured in places where the labor costs less than in the U.S. A number of leading manufacturers have developed offshore manufacturing capabilities in order to achieve significant cost savings, especially for high-volume production runs. Although many companies outsource these activities, many leaders own and operate manufacturing facilities in order to retain greater control over quality and production schedules (see Figure 3).

As a result, electronic product manufacturing continued to migrate to China in 2011 despite recent increases in wages. One recent report indicated that average wages for Chinese workers will double by 2015. Therefore, the incentive for many U.S.-based companies to move into China is now focused more on being close to growth markets rather than low-cost manufacturing.

A second factor that may push development offshore is the DoD’s effort to restrict the flow of bleeding-edge technologies. ITAR is hindering the ability of U.S. companies to compete globally. By restricting the counties to which U.S. manufacturers can sell their best technology, ITAR limits the ability of these suppliers to generate revenue through exports while encouraging foreign markets to develop these technologies independently. The proposed ITAR reforms may help alleviate some of these issues, but they appear to be far from getting approved in the near future.

In the last two decades, regional shifts in manufacturing has left voids in some basic areas, including master tool and die making, precision metal working and assembly as well as high-volume production, particularly in small, high-volume systems. This trend is unlikely to change as long as Western labor must compete with the work conditions, hours and wages that are only acceptable to a worker in an emerging market. In the short term, markets relying on high levels of performance and manufacturing achieved through sophisticated engineering and automation will favor domestic production. Long term domestic production is at risk unless this advantage is maintained or the global landscape changes (i.e. scarcity of materials, trade barriers, security restrictions, etc.). Arguably, China’s competitive advantages are largely due to government subsidies, sparse regulation on the environmental impact of dirty manufacturing and most importantly – currency manipulation. The current political dialog of re-investing in American manufacturing and skilled training comes at a critical time but will also require a tougher stance on global trade and manufacturing processes to be effective.

Cable Assembly Manufacturing

Fig. 4 CMC semi-automatic stripper assures quality with precision and stable tolerance control.

The majority of system integrators have found it cost effective to shift their cable assembly design to specialized suppliers with established solution-oriented design, quality and manufacturing techniques. The given application will dictate whether the interconnect will be exposed to harsh outdoor conditions, require specific performance characteristics such as low passive intermodulation (PIM) and which cable type, i.e. hand-formable, semi-rigid or flexible is needed. Cable assembly houses also invest in the dedicated equipment necessary to produce high tolerance, reliable components, such as those shown in Figure 4.

A typical coax cable assembly house will have a number of critical component dimensions measured and controlled through their own proprietary statistical process control program. Hipot and continuity testing along with visual inspection and gauge measurements are used to ensure that the process is in control. Typical in-house testing includes parameters such as VSWR, insertion loss, phase and delay measurements, as well as most standard mechanical and environmental tests (temperature range, humidity, vibration, shock and abrasion) as required by the standards called for by the given application.

Cable types and connectors have become rather specialized to meet the exact demands of how and where they intend to be used. For instance, test cables are designed for precision, flexibility and reliability over numerous mating/unmating cycles. One of the ways manufacturers address the wear and tear of high connection cycles is through improved surface plating of the connector. Although gold, silver and nickel are still widely used, proprietary platings have been developed by many manufacturers that combine these materials, as well as add additional materials to provide improved plating options.

One leading supplier offers a proprietary tri-metal plating solution containing copper, tin and zinc as an enhanced alternative to nickel/gold plating. The non-allergenic, nickel-free connector offers low-contact resistance, over 1000 mating cycles, and reasonable corrosion resistance. It is also non-magnetic, so its PIM characteristics are comparable to silver. For even more abrasion and corrosion resistance, a non-magnetic nickel-phosphorus base material with a thin plating of gold is also available. This product provides for twice as many mating cycles as components based on standard gold plating, as well as low and stable contact resistance and added protection against oxidation and corrosion.

RF assemblies are increasingly found in remote wireless monitoring systems from oil fields and factory floors to hospital medical equipment. There are RF assemblies in the medical field, both in general and disposable applications. The proliferation and ubiquity of wireless systems and their RF interconnects has led to concern over environmental impact. Legislation regarding end-of-life product recycling and additional safety requirements is having an impact on cable manufacturers. Industry standard RG-type PTFE/FEP cables are extremely resistant to decomposition. Regulations mandating that manufacturers recycle products at the end of their service life will eventually off-set the cost-saving benefits associated with the continued use of PTFE cable. PTFE cables also contain halogen, which gives off highly toxic and corrosive gases when ignited, creating major safety issues. In response, certain manufacturers are beginning to offer cable products that are halogen-free and composed of recyclable plastics that are not as resistant to decomposition as PTFE.

Connector Types

RF connector types are segmented into primary families and sub-families, organized by size, frequency, coupling method and style. The frequency range of any connector is limited by the excitation of the first circular waveguide propagation mode in the coaxial structure. A decrease in the diameter of the outer conductor will result in an increase in the highest usable frequency. Filling the airspace with dielectric material in order to support the inner conductor will lower the highest usable frequency while also increasing the insertion loss.

Various connector types employ a range of mating technologies. The mating process typically changes the geometry of the mating surfaces and resistance loss at those interfaces as well as geometric changes, which result in variation of impedance and loss. This is an area where designers of high-precision connectors and cable assemblies focus their attention. Most connectors are designated as male or female depending on their internal structure. Many female connector types are designed with slotted fingers to accommodate tolerance variations of the mating male inner conductor. This design feature can reduce repeatability, introduce a small inductance and may eventually wear out after numerous re-connects.

Board-to-board connectors are commonly found among all the major markets and represent the fastest growing members of the connector family. One example is the notebook PC with built-in wireless card and multiple antennas. PC manufacturers are required to make their products field serviceable by designing them with replaceable screen and system boards. Board-to-board connectors allow these components to detach from each other. With thinner system packages and wide format screens, real estate is becoming a real challenge to connector suppliers. In addition, 802.11x devices operating at higher frequencies are driving the need for very small, high-performance interconnects as well as a rise in the number of multi-port coax solutions being offered on the market.

Many manufacturers are setting their sights on board-to-board connectors because of the variant’s low production costs and wide use in wireless equipment, including base stations, remote radio heads (RRH) and GPS devices. Several foreign enterprises have launched MCX, MMBX, IMP and SMP series. The last is composed of two connectors placed on two PCBs or modules and an adapter. In the next three to five years, these three parts are forecast to merge, which will help lower outlay and raise precision levels. Local makers therefore expect RF connectors to replace coaxial cable assemblies in board-to-board applications gradually. The latter, however, will continue to be the primary choice in the external connections of communication, military and industrial equipment.

Standard Class

The Type N connector was originally designed in the 1940s for military systems operating below 5 GHz. Most sources attribute the “N” designation to an RF engineer from Bell Labs named Paul Neil. Subsequent improvements to its design have pushed the mode-free performance up to 18 GHz. The “Bayonet Neil-Concelman” commonly known as the BNC was originally designed for military use but has gained wide acceptance in video and RF applications to 2 GHz. A threaded version known as the TNC helped resolve the connector’s leakage and geometric stability problems, allowing the TNC to be used up to 12 GHz. The 7/16 DIN is a high-power 50 Ω connector originally developed by Spinner. This relatively new connector is growing in popularity especially in wireless applications including cellular towers. This connector, which is plated in silver or gold, performs up to 7.5 GHz.

Sub-miniature Class

The SMA (Subminiature A) connector was designed by Bendix Scintilla Corp. and Omni-Spectra Corp. as the OSM connector, and is one of the most commonly used RF/microwave connectors. This connector is often used with semi-rigid cables, which are connected infrequently. In contrast, the subminiature B (SMB) snap-mount connectors are rated to 4 GHz but usable up to 10 GHz for applications requiring easy and fast connect/disconnect operations. Its mechanical design leads to poor electrical performance especially for low noise applications. The SMC is a threaded type connector that is ideal for size constraints and in the case where a threaded solution is viable.

Micro-miniature Class

Smaller versions of the SMA include the Sub-SMA or SSMA and OSSM types. At 70 percent the size of an SMA, these connectors are typically rated up to 26 GHz, but special high-performance versions are available with mode-free performance up to 40 GHz. Other snap-on types include the MCX family (MCX and MMCX), which are rated to 6 GHz. These connectors are 70 percent and 50 percent the size of an SMB connector, respectively, offering about the same number of reliable reconnects (∼500).

Precision Class

This class of connectors is used most often in a test environment where accurate and repeatable measurements are required. One well known type is the sexless APC-7 originally designed by Amphenol. Amphenol’s APC was the first instrument-grade coaxial connector series to achieve repeatable TE11 mode resonance-free signal transmission from DC to 50 GHz with a minimum return loss of 26 dB. These 50 W connectors were designed primarily for use in test and measurement equipment where reliable performance is critical for repeated connect/disconnect cycles. The “Precision SMA” connector was designed by Wiltron (now Anritsu), another test and measurement manufacturer. The two basic geometries are the 3.5 mm/Wiltron WSMA and the 2.92 mm/Wiltron K.

Quick Lock

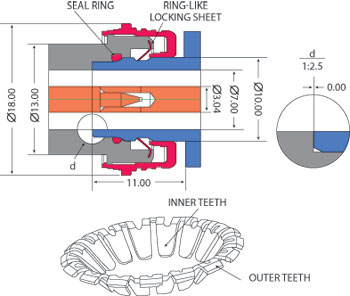

Fig. 5 Cross section of HPQN type quick lock RF connector mechanical design and locking ring.

This connector family was created by the Quick Lock Formula Alliance (QFL), which consists of leading connector manufacturers. Available since 2003, these quick-connect RF connectors were designed to replace the widely used SMA connectors and Type N connectors in cases where the connection/disconnect operation need to be faster and easier by eliminating the need for a torque wrench. In the case of QMA, its basic structural parameters and electronic performance are very close to that of the original SMA connector making it backward compatible with this design.

Variations on a QL N-type connector include the NQ, SnapN and HPQN. The QN designed originally between 2002 and 2004 eliminated the threaded coupling with a snap-in retention and an integrated sealing ring. Unfortunately, clearance between the contact surfaces of the outer conductors leads to instability and potential discontinuity of characteristic impedances. Because of this deficiency, the SnapN design placed a spring at the rear of the outer conductor of the plug rather than between the contact surfaces of the connector’s two outer conductors. While improving the performance, the elasticity of the spring made the connector performance susceptible to external forces such as heavy cable swing. The HPQN designed in 2007 improves on this design through the use of a ring-like locking washer, which is fixed in the plug and locks the mating slope of the jack (see Figure 5).

Summary

The HPQN connector represents one example of the ongoing efforts to develop new designs and manufacturing processes to deliver higher performance, lower cost, ease-of-use and a variety of other specific attributes targeting the increasingly specialized requirements for high frequency interconnect technology. The overall market is going at a steady clip of about 8 to 10 percent per year for the past decade, tracking the growth of its leading markets, namely computers, telecommunications, aerospace/defense and industrial. As market competition continues to drive design improvements, connector, cable and cable assembly manufacturers will strive to innovate with new and evolving products. These companies help keep the wireless world connected.