The CIS telecommunications market is recovering after the crisis period. In euro terms, the market closed 2010 with double-digit growth, chiefly due to the improvement of macroeconomic indicators and the gradual strengthening of local currencies. This year, the market is also expected to increase fuelled by further development of broadband services.

Russia Leading

The telecommunications market in Russia is by far the largest among all CIS countries. Revenues generated only on the Russian market represent approx. 70 percent of the total value of the CIS telecommunications market, which means the share of the remaining eleven countries all together is 30 percent. According to the latest data by PMR, the value of the whole CIS telecoms market amounted to €36.3 B in 2010, of which €25.5 B was the value of the Russian market while the remaining €10.8 B accounted for the other CIS countries.

The telecoms market in CIS will continue to grow in 2011. By the end of the year the combined value of the market will reach €39 B, of which €27 B will represent Russia. The region will benefit from a further expansion of broadband in the residential sector as well as a growing demand for data transmission services. Factors behind broadband’s rapid growth will be the relatively low broadband penetration, decreasing tariffs and the development of new technologies in the market.

CIS Countries Differ

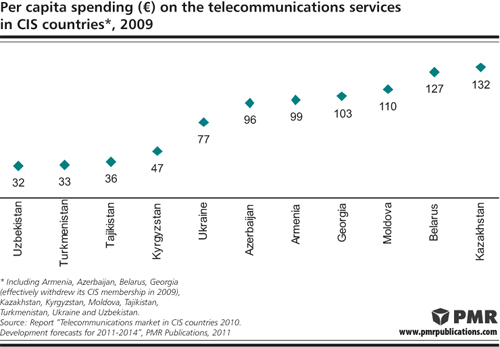

Even setting aside Russia, it is important to point out that the CIS region is far from homogeneous. The telecommunications markets in the CIS countries are different by size, maturity, availability and quality of services. Market attractiveness for the investors, and as a result the development of fixed or wireless infrastructure in the countries, is closely connected with the geographical conditions and economic development of CIS states, but also with liberalisation of the regulatory environment and cultural differences. The three biggest telecommunications markets in the CIS region besides Russia are Ukraine, Kazakhstan and Belarus followed by Uzbekistan and Azerbaijan. However, by per capita spending, the regional leaders are Kazakhstan, Belarus and Moldova.

Mobile telephony remains the biggest segment of the telecommunications market in all of the CIS countries. The ISP segment remains the least developed and its share in the value of the telecommunications market is still low. On the other hand, the provision of internet access was booming in 2009-2010 in spite of the economic crisis, presenting providers with the possibility to compensate for declining revenues from the fixed-voice services. The ISP market in CIS region is still far from saturation. ISPs have significant capacity for further growth, even in the most advanced CIS countries.

The problem of most of the CIS countries, especially in Middle Asia, is that they have limited development of copper telephone networks, which restricts the growth of ADSL lines and blocks investments coming in this area. Therefore, a solution of last mile access in the CIS is offered by mobile operators, which have launched UMTS networks. “It is also interesting to note that for Russian major mobile operators, CIS countries represent a valuable testing area for trials of new technologies and network developments. The LTE trial network rolled out last year by VimpelCom in Kazakhstan is one of the examples of those” – Pawel Olszynka, a PMR Analyst, comments.

In Belarus and Moldova, 3G became an auxiliary technology used in parallel with fixed broadband. In Middle Asian countries and Caucasus states, wireless access plays an important role, as for many users it is the only way to be connected to the internet. The problem is the poor capacity of external gateway and backbone networks while domestic informational resources are limited. Therefore, internet access in Middle Asian countries with limited external data exchange capacity is – in spite of the available wireless broadband – also extremely expensive. Last but not least, it should be added that in the past the construction of WiMAX networks was announced in most of the CIS countries and in Belarus and Ukraine this technology has already been launched, however, it has not gotten mass recognition so far.

Over the next four years PMR expects telecommunications markets in CIS countries and Georgia to experience dynamic growth driven by fixed and mobile internet access services. The main competition will take place between fixed and mobile operators for the internet users. The share of ISP services in the telecommunications revenues will grow. Finally, the development of telecommunications markets in the CIS countries over the next four years will be driven by the expansion of Russian telecommunications companies in the neighbouring states. The Russian telecommunications market is by far more matured and especially mobile operators have already started to look at the possibilities for further expansion.