The development of automotive radar was a little stop-start early on but has gained considerable momentum, interest and investment in recent years. This article plots the path from innovation to application and the move to commercialisation for automotive radar. It considers its early beginnings and current activity and identifies the technological trends driving the sector forward.

Let’s begin by briefly offering some background into the roadmap for the development of automotive radar. Automatic cruise control (ACC) systems based on millimetre-waveradar have been the focus of significant research and development for several decades now. In the early 1970s, the first test vehicles with 35 GHz sensors were set on the road because, for the first time, 35 GHz antennas were small enough to fit into the front grill of a normal sedan.

It was not until 1998 that the Mercedes-Benz DISTRONIC system at 77 GHz became the first operational series product within the Mercedes-Benz S-Class, a premium type sedan. Eight years later this was followed by the DISTRONIC PLUS system, which combined a 77 GHz long range radar (LRR) sensor with two 24 GHz short range radar (SRR) sensors, making the system fit for urban traffic. Today this technology has moved to the commercial stage with all major automotive manufacturers introducing ACC systems, including the small car sector.

Figure 1 10 GHz automotive radar system built by VDO in the early 1970s (Source: private collection of the author).

Besides 77 GHz for LRR, the 24/26 GHz frequency range was adopted for short range automotive radar sensors, employed either for blind spot detection (BSD) or as a lane change warner (LCW). Narrowband (NB) systems, operating in the ISM-Band (24.05 to 24.25 GHz) and ultra-wideband (UWB) systems between 21.65 to 26.65 GHz, with different advantages and disadvantages, are on the market today. Very recently digital beam forming (DBF) antenna technology combined with electronic scanning techniques have been introduced.

Today, existing radar sensors can be easily adjusted for new applications. For example, a BSD sensor can be adopted to function as a rear cross traffic alert (RCTA) sensor. Entirely new market opportunities are opening up, such as the adoption of medium range radar (MRR) systems in the 24/26 GHz range. In 2011, with the introduction of the Mercedes-Benz B-Class, COLLISION PREVENTION ASSIST (CPA) at 24 GHz became available as a standard series product in smaller cars and thus the democratisation of automotive radar has clearly begun.

History

In the early 1970s, the general requirements for automotive radar applications were developed within NTÖ 49, a German research program supported by what was then the Ministry of Science and Technology (BMFT). The necessary range (100 m) and corresponding antenna requirements (2.5 by 3.5° for az and el) were theoretically calculated and tested. This demonstrates that even then, the idea of using automotive radar as a means to reduce the accident rates on our streets was being considered.

Figure 2 16 GHz automotive radar system built by Standard Electric Lorenz (SEL) in 1975 (Source: private collection of the author).

Figure 3 35 GHz automotive radar system built by AEG-Telefunken in 1974 (Source: private collection of the author).

Applying the newly developed 35 GHz technology, based on two terminal devices, like IMPATT, GUNN and Schottky diodes, made it possible, for the first time, to fit such a radar unit into the front of a standard sedan. Before that, a 10 GHz roof installation or a front bumper set up at 16 GHz had been the only options. Various cars, buses and trucks were equipped with radar sensors (see Figures 1-3 and Figure 8) and tested worldwide – in the beginning at very different frequencies: 24, 35, 47, 60 and 94 GHz; the latter being a ‘leftover’ from military applications and thus available components.

Figure 4 Antenna configuration schematic of DISTRONIC PLUS, where orange is a 77 GHz LRR-sensor and green is a 24 GHz SRR-sensor (Source: Daimler AG, Stuttgart, Germany).

The Japanese 60 GHz approach was political; both mm-wave radar and communication systems could be investigated, employing the same semiconductor devices and mm-wave components. The introduction of 77 GHz as a worldwide standard for automotive LRR (see Figure 4) within WARC 89 clarified the situation.

A first BSD sensor was presented as early as 1971 by Bendix Research Laboratories in Southfield, MI, USA, employing slotted array type antennas with waveguide feeds at 16 GHz. The description given was: “The antenna patterns intersect adjacent lines to illuminate the blind spot areas and to warn of the presence of approaching automobiles with a light or audible signal.”

More than 20 years later, in 1995, HE Microwave Corp. (Hughes Electronics) in Tucson, AZ, USA, proposed 24 GHz for their side detection sensor (SDS) system for trucks (shown in Figure 5). The description here was: “The SDS was conceived to assist the driver in accessing the viability of lane change.” Today 24/26 GHz is the general frequency approach, being taken for BSD sensing (see Figure 6). Companies, like Valeo or Hella in Germany, to mention just two, already produce more than one million such sensors each per year (2012 statistics).

Figure 5 24 GHz SDS system built by HE Microwave, 1995 (Source: HE Microwave publication, IEEE MTT-S, 1995, San Francisco, USA).

Figure 6 Blind spot detection (BSD) incorporating two separate 24/26 GHz SRR sensors (Source: Daimler AG, Stuttgart, Germany).

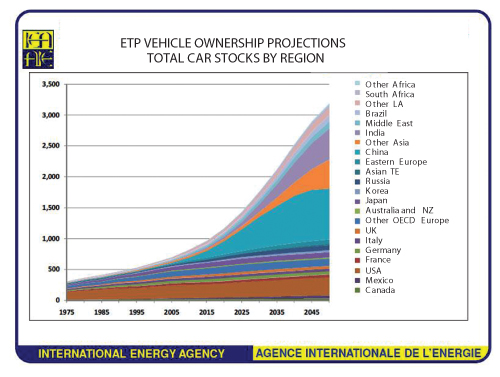

New market developments for technically innovative products like automotive radar are typically a reaction to social developments and specific emerging needs. The trend towards megacities worldwide accompanied by the democratization of mobility in highly populated countries (shown in Figure 7) like the BRIC (Brazil, Russia, India and China) countries, which accounted for more than 40 percent of all car sales in 2012, has led to a dramatic increase in traffic density and thus accident rates on the streets, prompting the need for enhanced vehicle safety and more driver assistance.

Figure 7 Total car stocks by region – projections (Source: International Energy Agency (IEA)).

Figure 8 24 GHz CWS system built by EATON-VORAD, 1996 (Source: private collection of the author).

Due to their unique physical performance, automotive radar sensors are the worldwide backbone of modern vehicle safety and driver assistance systems. Though they are not the only means – laser scanner and video camera systems are competing technologies. Based on expected trends, it is quite simple to forecast that the density of radar systems will explode like the worldwide number of cars over the next few decades. The higher the growth in radar density, the more important it will be to guarantee the interoperability of such sensors, especially as we move from simple comfort to highly sophisticated safety applications, employing automotive radar systems.

Early Systems and Results

As early as 1992, the EATON-VORAD collision warning system (CWS) at 24 GHz was installed in more than 4000 buses and trucks in the U.S., from Greyhound buses (see Figure 8) to rental trucks, providing an acoustic warning for the driver only. Having been driven on more than 900 million kilometres of road, it can be confirmed that the amount of accidents per km travelled could be reduced by more than 50 percent; more than that, the resulting severity of accidents still occurring was heavily reduced. However, the radar units had to be de-installed, due to protests from the U.S.-driver-unions as the CWS radar made drivers ‘transparent’ to their employers and the drivers objected. Clearly, the time was not yet ready for such a system.

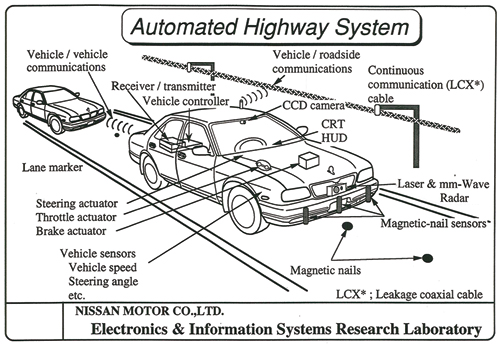

In the 1990s, an automated highway system was built and tested in Japan on about 100 km of a newly built highway. Vehicle2roadside communication, using a leakage coaxial cable (LCX), magnetic nails in the road surface and corresponding sensors for lane control, as well as mm-wave radar for distance control, dubbed the automotive collision avoidance system (ACAS), were utilized for these first driverless cars, not forgetting a CCD camera for lane marker detection (see Figure 9). The Electronic Information Systems Research Laboratory of Nissan Motor Co. Ltd. was one of the protagonists of this system. The achieved results were quite promising, however, at the time, the necessary environmental installations – LCX, magnetic nails, etc. – were thought to be too expensive.

Figure 9 Automated Highway System built by NISSAN Motor Co. Ltd. (Source: Nissan Motor Co. Ltd.).

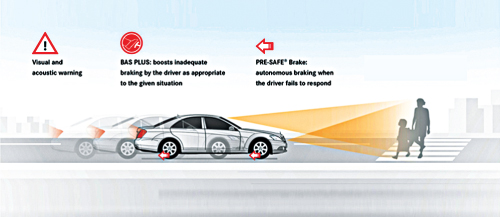

Later that decade, when Mercedes-Benz first introduced the DISTRONIC system, the take-up rate was not at all favorable at the beginning, and the timed spread from S-Class to other classes was quite slow. However, since the introduction of DISTRONIC PLUS eight years later, the situation has changed significantly. With Brake Assist Plus and PRE-SAFE Brake having become part of the system package (shown in Figure 10), these systems have become directly driver recognizable and well perceived by the public. The paradigm change from comfort to safety systems has started to take place.

Figure 10 Pre-safe brake – developed and confirmed for sedans – now in trucks (Source: Daimler AG, Stuttgart, Germany).

State-of-the-Art

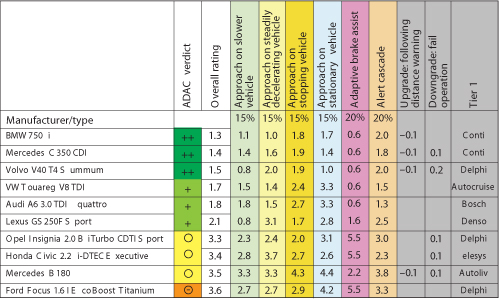

In September 2012, the ADAC, Germany’s major automobile club and thus the political driver lobby, tested all the available automotive radar systems in Germany. Ten different cars: BMW 750i, Mercedes C 350 CDI, Volvo V40 T4 Summum, VW Touareq V8 TDI, Audi A6 3.0 TDI quattro, Lexus GS 250F Sport, Opel Insignia 2.0 BiTurbo CDTI Sport, Honda Civic 2.2 i-DTEC Executive, Mercedes B 180 and Ford Focus 1.6 EcoBoost Titanium were tested.

Different radar sensors being built-in and commercially available from seven – mostly European – manufacturers, including TRW-Autocruise, Autoliv, Bosch, Continental, Delphi, elesys (U.S.) and Denso (Japan) were carefully investigated (see Figure 11). The results are quite good, ratings from “++” to “0-” were given, as well as tips for specific car systems to be enhanced in the future with some minor adaptations. However, the main issue of significant safety enhancements due to these systems being installed could be confirmed by these tests.

Figure 11 Available ADAS systems in Germany (Source: ADAC Test Zentrum, Landsberg, Germany).

Under such conditions, it is quite obvious for any OEM investigating the next generation of radar that it will not be sufficient to utilize a sensor that has demonstrated to be insensitive compared to others. The sensor itself has also to be proven not to disturb or to blind others. To check this for the OEM, as well as for the corresponding supplier, it would be advisable to use something like a norm-interferer as a qualification or test device. Such a device should be able to cover a large variety of modulation schemes and bandwidths that the sensor under question could be tested against.

Another goal has to be keeping the opportunities open to meet future demands in the move towards interoperability. One prominent issue of concern is the corresponding frequency band as well as the bandwidth taken per sensor to allow for, e.g., frequency hopping. Future frequency regulation strategies should aim to get worldwide access to higher frequency bands, using larger bandwidths per sensor. A minimum bandwidth of 2 to 3 GHz is very likely to be required for future traffic scenarios, like pedestrian recognition or side-impact-alert.

As a consequence, this requires a concerted effort by radar manufacturers, backed by their corresponding OEMs, to identify and to agree upon a common design rule book. Such guidelines should quote commonly agreed countermeasures to combat interference, while keeping opportunities open for each manufacturer to develop his individual radar. The EU-funded MOre Safety for All by Radar Interference Mitigation (MOSARIM) project was a first step in the right direction. MOSARIM was openly described and broadly discussed within the community during EuMW 2012 in Amsterdam; the EuMC/EuRAD WS23 being the official and final event of the program.

- The technical requirements of future (and more complex) driver assistance and vehicle safety systems, demanding higher resolution and accuracy in space and time.

- Vehicle integration and sensor packaging demands miniaturisation, while enhancing sensor performance.

- Cost reduction based on ‘economies of scale’ – shifting to the 76 to 81 GHz range enables the development of radar modules that can be used for all automotive radar types from LRR via MRR to SRR.

- Interoperability, since the market penetration of automotive radars will explode; interference mitigation has to become the key for further market growth. A large bandwidth enabling frequency hopping or other efficient frequency separation procedures has to be mandatory and is available worldwide only between 76 to 81 GHz.

However, more ongoing efforts concerning automotive radar performance necessary to meet future requirements are already under development. This can be evidenced at European Microwave Week 2013 where workshops (W20, 24, 26), the EuMC and EuRAD opening ceremonies, as well as regular sessions (EuRAD 12, 13), The Defence and Security Forum and the MicroApps (Thursday morning session), within the European Microwave Exhibition, will describe and discuss automotive radar issues thoroughly and put them into context.

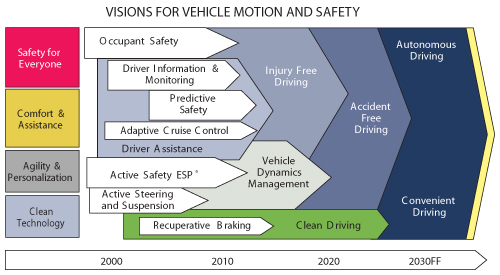

Figure 12 Visions for Vehicle Motion and Safety (Source: Bosch GmbH, Stuttgart, Germany, during EuMW 2012).

Future Directions and Trends

Figure 13 New Mercedes-Benz S-Class, featuring a rear-pre-crash sensor alongside a LRR and four SRR sensors (Source: Daimler AG, Stuttgart, Germany).

Following on from today’s radar sensors that are already available on the market, injury free driving and better and more efficient vehicle management, resulting in lower consumption, will be an imminent future issue (see Figure 12). Applications like RCTA, supporting a driver while backing-up from a parking lot or rear-pre-crash (RPC), detecting and calculating critical objects approaching from the rear, are being implemented, e.g., in the new MB S-Class, launched in July 2013 (shown in Figure 13). Accident free driving and subsequently autonomous driving can technically be viewed as a medium to long range vision.

Within Horizon 2020, the upcoming new six year research plan of the EU, the further reduction of traffic fatalities is a major consideration, taking automotive radar sensors besides cameras into focus for the future. The European slogan of the current decade with regards to the direction of automotive sensor development is: 2011-2020 – the Decade of Action for Road Safety.

The rollout of EuroNCAP is one of these EU road safety targets for 2020, asking for ACC, BSD, LCA, RCTA and other back-up aids, as is the autonomous emergency braking system (AEBS) for trucks. The mandatory implementation of AEBS for commercial vehicles in Europe – a very near term issue – will significantly increase the take-up rate in trucks from a few percent in 2013 to full installation in 2015.

Figure 14 The Hongqi Q3 test car on the Beijing-Zhuhai-Highway (Source: Hongqi, China).

It has to be assumed that the already established 77 GHz technology will be used when the AEBS function becomes mandatory. After 2015, an annual growth rate of 3 percent has to be envisioned. However, other sensor technologies or radar systems using different frequencies may take over parts of this huge market, which amounts to about 1 million sensors per annum for trucks in Europe alone.

Autonomous driving as such is the final and long term direction of EU research. However, China and Japan are on this track too. In China, a driverless car (a Hongqi Q3) drove from Changsha to Wuhan (286 km) with a speed of about 90 km/h, while passing 67 vehicles on the way (see Figure 14). This car was developed and built by the University of Defense Technology and unlike foreign unmanned vehicles, relying on GPS information and digital mapping, China’s Hongqi Q3 used surround sensing systems and intelligent decision making to control the vehicle.

Being part of the China Intelligent Vehicle Challenge, the goal was set to: “in 2015 China should have the technologies for completely unmanned vehicles, able to operate continuously for more than 200 km in a natural environment, and on 2,000 km on the expressway, respectively.” The Hongqi Group – one of China’s major vehicle manufacturers, as well as First Automotive Works (FAW), cooperating with Volkwagen AG of Germany, have been part of the challenge since 2011, with the National natural Science Foundation Commission of China (NSFC) coordinating the competition.

Figure 15 The Lexus Advanced Safety Research Vehicle (Source: Toyota, Japan).

In Japan, the organizer of the autonomous driving project is the Ministry of Land, Infrastructure, Transport and Tourism (MLIT). The OEM participants of the project are Toyota Motor Corp., Nissan Motor Co. Ltd., Fuji Heavy Industries Ltd., Honda Motor Co. Ltd., and Mazda Motor Corp., with the Tokyo Institute of Technology taking the chair. Toyota announced details of its entry into the autonomous vehicle race at the annual Consumer Electronics Show (CES) 2013 in Las Vegas, USA in January. The Advanced Safety Research Vehicle, a Lexus RS (see Figure 15), utilized a variety of technologies, including GPS, mm-wave radar, laser tracking and stereo cameras, to achieve its autonomy.

A very interesting idea was proposed by MLIT: an operating company undertakes the operation of the driverless vehicle for a certain period of time or a certain distance. To use this service, the owner of this car makes a contract with the operating company and pays a fee. If an accident occurs during automated driving, the operating company will take responsibility. As a result, neither the car maker nor the driver has to take responsibility in the case of an accident instigated by the use of automated cars.

Within EU-projects like ‘Interactive,’ the utmost benefit of adding a laser scanner and a mono vision camera system to long and short range radar has been evaluated. It could be demonstrated that radar and laser scanners are intelligent additions to each other, solving the majority of perception challenges. What they leave unsolved is done by mono vision camera support. Hence, for the foreseeable future, LRR and SRR sensors will remain the workhorse of the automotive industry.

The EU commission’s ICT for Transport is searching for new solutions; C2C RadCom, utilizing the 76 to 81 GHz radar bands on a timeshared basis (e.g., by means of OFDM modulation) for ID and information exchange between closely operating cars, is such an application, enhancing radar operation.

The concept of employing even higher frequency bands than the 77 GHz range for automotive use, e.g., 158 GHz for ACC or 122 GHz for near-range parking sensors are trends being encouraged by the EU commission. Within the European ‘success-project,’ which was finalized in May this year, the appropriate technology for 122 GHz was developed and investigated.

Other EU projects should be mentioned, such as SAfe Road TRains for the Environment (SARTRE), whereby research is ongoing under the lead of Volvo Trucks for platooning, i.e., enabling very close separation distances between trucks at normal speeds by means of highly automated longitudinal and lateral control in a road train. Some years ago Mercedes-Benz Trucks worked on a similar project dubbed “elektronische Deichsel” (electronic towbar). The applicability and usefulness of this approach was tested during several test campaigns carried out on the Brenner highway between Austria and Italy in the 1990s. Issues like the ones just described will be discussed in detail within W24 on Automotive Radar, as part of the EuMC/EuRAD program at EuMW 2013.

Conclusion

Taking all of the trends and assumptions described as a whole, it is apparent that the paradigm change that had to come, has already taken place: Until today all automotive systems had only a narrow planning horizon – the driver takes action with the system re-acting; in the future we will have a substantially longer planning horizon – the system will take action, while the driver is in control only; and advanced driver-control systems need a very good explanation for proper use – ADAC requires easy-to-understand demo video(s) to make it easy for people to comprehend.

Automotive radar in all its facets, from LRR via MRR to SRR, has shown that it has the capability to reduce the number and the severity of road accidents. We are currently in the “decade of action for road safety 2011-2020” and autonomous driving has come into direct focus with automotive radar being the workhorse for this ADAS approach in the future.

To put it into words: today we are already able to drive with:

- “Feet off” – employing ACC systems like Distronic Plus

- “Hands off” – becomes feasible using the upcoming ‘Autobahn Pilot’

- “Eyes off” – has still to be demonstrated and made possible.