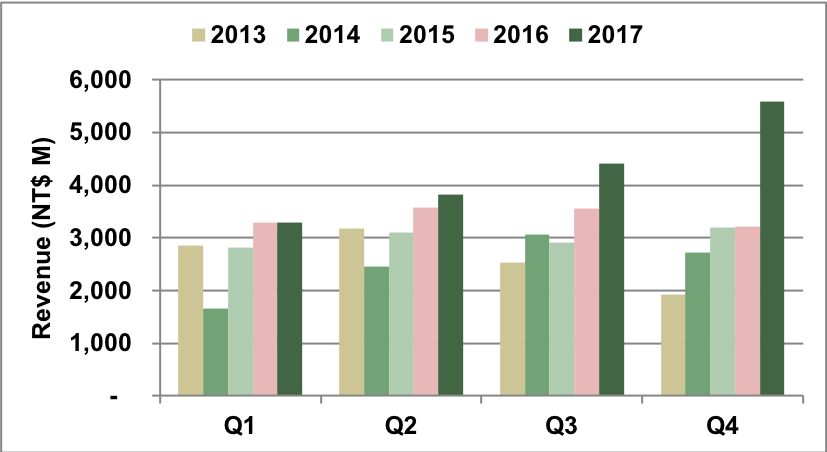

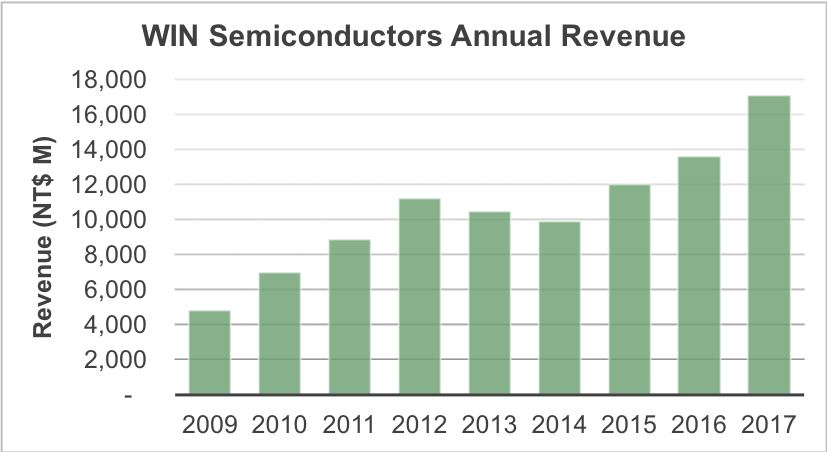

WIN Semiconductors grew revenue to record levels in the fourth quarter (Q4) of 2017 and the full year, aided by diversifying into optical devices for consumer products.

Q4 revenue was NT$5,581 million (approximately $188 million), up 27 percent from the prior quarter (Q3) and 74 percent above Q4 of 2016.

Notably, some 31 percent of the quarter’s revenue came from a new product category: optical devices for 3D sensing applications in handhelds, one of two markets that will drive WIN’s future growth. During the earnings call, Joe Tsen, the associate VP of finance, said, “WIN Semi is no longer a pure RF company.”

From the historic RF segments, cellular contributed between 30 and 35 percent of the quarter’s revenue, with Wi-Fi between 25 and 30 percent and infrastructure 10 to 15 percent. The company said the wireless communications business was “better than seasonal,” and fab utilization ran 100 percent during the quarter.

Gross margin was 38.3 percent in Q4, an increase from 37.8 percent for Q3 and 30.5 percent for Q4 of 2016. Operating margin improved as well: 28.9 percent compared to 27.9 percent in Q3 and 18.2 percent in Q4 of 2016. Earnings per share (EPS) was NT$3.31, compared to NT$2.93 in Q3 and NT$1.38 in Q4 of 2016.

WIN invested NT$1,470 million (approximately $50 million) in capital expenditures during Q4, preparing clean rooms to add capacity. WIN expects capacity to reach 36,000 to 37,000 wafers per month by the end of 2018, added in stages during the year.

For the full year, WIN’s revenue was NT$17,086 million (approximately $559 million), 25 percent more than 2016.

WIN said the company gained share in RF, growing in the “mid-teens” (revenue growth in percentage) compared to Strategy Analytics’ estimated market growth of 10 percent.

WIN expects Q1 revenue to decline sequentially, yet up year-over-year. In Taiwan dollars, Q1 revenue is expected to be down “by low twenties” percent if the appreciation of the Taiwan dollar doesn’t reverse.

Longer term, WIN expects growth to be fueled by 5G wireless, both sub-6 GHz and millimeter wave, and optical devices for 3D sensing and optical communications. In a release announcing the quarter’s results, WIN said,

Looking ahead, we continue to be optimistic toward the development of optical devices, especially with our leading position in 3D sensing applied on handhelds. For the next few years, with increasing penetration of 3D sensing into more handhelds and brands, future applications on AR/VR and the maturity of ADAS/LiDAR, we expect rapid growth for optical device applications.