A review of the microwave and wireless industry in France ahead of EuMW 2019 in Paris.

Figure 1 Locations of the main areas (in red) of microwave industry in France.

At the end of September this year, European Microwave Week (EuMW) once again returns to France, but this time to a new venue - the newly refurbished Paris Expo Porte de Versailles. France has a thriving microwave industry, mainly focused on three clusters of high technology companies, which are centered around Paris, Toulouse, Grenoble and the Côte d’Azur (French Riviera) as shown in Figure 1.

The main application sectors are aerospace and defense, plus a significant telecoms emphasis too. France also has a strong presence in the semiconductor industry, boasting both compound semiconductor and RF silicon fabs run by UMS, OMMIC, NXP Semiconductors and STMicroelectronics, as well as silicon on insulator (SOI) wafer production at Soitec in Paris, which also recently acquired GaN capability through its takeover of EpiGaN. The industry is supported by some highly respected universities, including XLIM, IEMN at Lille, Brive-la-Gaillarde, LAAS in Toulouse and ENSI at Caen.

Defense

Defense is a key market, and possibly the most dominant for RF and microwave technology in France. A number of companies have stressed the importance of maintaining French (or European) sovereign capability in components and subsystems that are proven in performance and reliability for defense applications. A growing concern about cybersecurity is cited as one of the reasons for keeping defense manufacturing as local as possible.

*Some bread, some wine, some cheese, some microwaves.

The French defense industry is dominated by Thales, which is Europe’s largest defense electronics company and is a leading supplier of ground, sea and air surveillance radars to armed forces, both within Europe and worldwide. A large ecosystem of SMEs has built up in France to supply Thales, and there is a growing impetus to strengthen this local supply chain even further as the climate within U.S. industry appears to be becoming more protectionist.

Dassault Aviation is a French defense and aerospace company with a long history. Part of the Dassault Group, it manufactures both military aircraft - including the Rafale - and business jets. At the 2019 Paris Air Show in June, Dassault and its industrial partner Airbus Defense & Space unveiled a full-scale model of a proposed next-generation stealth fighter - the Future Combat Air System - that is progressing towards a first demonstration phase for eventual deployment around 2040.

Another large company in this sector is Paris-based Safran Electronics & Defense, which specializes in avionics, helicopter controls and UAVs.

Aerospace

Aerospace represents a large sector of the French industry, particularly in the region of Toulouse, where Airbus has its French headquarters. Thales Alenia Space, based in Cannes, is a joint venture between Thales (67 percent) and Leonardo (33 percent), and is a leader in Earth observation satellites, based on high resolution optical and radar payloads that cover military, dual and civilian missions, including intelligence gathering and mapping, as well as meteorology, oceanography and climatology. It is also involved in space exploration missions to Venus, Mars, Titan and to asteroids and comets within the Solar System, and in the development of satellites for the Galileo European navigation system. In a consortium with Maxar Technologies, Thales Alenia Space has recently been selected as one of two contractors for the design phase of the Telesat LEO satellite constellation, with the aim of designing an end-to-end communications system, including satellites, landing stations, user terminals, operations centers and ground network.

Nearly 48,000 people are employed in France by Airbus, whose headquarters is located in Toulouse, where the final assembly of its commercial jet airliners - the A320, A330, A350 and A380 families - takes place. Other sites in the country for aircraft manufacture are in Saint-Nazaire, Nantes, Marignane (near Marseilles) and Paris-Le Bourget. Airbus’ defense facilities are in various locations around the country, including Toulouse and Élancourt, in the Île-de-France region.

Airbus’ satellite business is based on another site near Toulouse, where the company develops, assembles and tests both standard-sized and miniature satellite systems for applications that include Earth observation, meteorology, mapping, reconnaissance and the monitoring of natural resources, as well as for scientific research.

OneWeb Satellites is a joint venture between OneWeb and Airbus, and its 4,600 m2 assembly facility in Toulouse was brought into service in June 2017 to begin the production of the communications satellites for OneWeb’s low Earth orbit (LEO) satellite fleet (see Figure 2). The Toulouse facility served to validate the large-scale production methods needed to manufacture 900 of these high performance satellites, and to establish the framework for the larger OneWeb Satellites factory near the Kennedy Space Center in Florida. The development of this facility was supported by Bpifrance within the framework of the French PIA program (Programme d’Investissements d’Avenir).

Figure 2 OneWeb Satellites inaugurated its pilot assembly line in Toulouse in 2017.

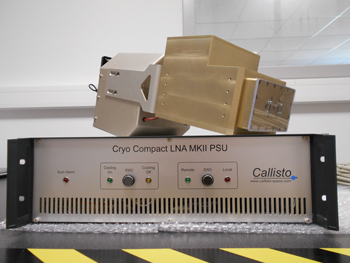

Callisto Space is one of the smaller companies in the Toulouse aerospace cluster. Callisto designs and manufactures high performance LNAs and provides consultancy, engineering design and services, principally for satellite ground stations. It operates independently as part of the Celestia Technologies Group. Callisto has carried out hardware and software product development for ground stations including a range of both narrowband and wideband cryogenic low noise amplifiers (LNA), room temperature LNAs and a measurement system for noise temperature.

Figure 3 Callisto Space “Compact” range cryogenic dual-channel LNA for use in Earth Observation Ground Stations.

The use of cryogenically cooled LNAs can provide improved ground station G/T at a fraction of the cost of increasing antenna diameter. Figure 3 shows one of the new generation “Compact” range of cryo LNAs, which has been developed for use in Earth Observation Ground Stations and applications where low power consumption, low maintenance, small size and low weight are of critical importance. This dual-channel cryo LNA is able to reach ~80°K physical temperature with a compact cryo cooler that can operate reliably for around 10 years without requiring maintenance.

Telecoms

France’s previously strong position in mobile communications has declined somewhat in recent years with the sale of Alcatel-Lucent to Nokia and the licensing of its handset products to Chinese manufacturer TCL. Nokia still retains a large R&D presence in France, with campuses at Paris-Saclay and Lannion in Brittany that house global competence centers for 5G, cybersecurity and the IoT. France is also the second largest site for Nokia Bell Labs.

Orange, formerly France Télécom, is a French multinational company that employs 95,000 people in France. It is the tenth largest mobile network operator in the world, and the fourth largest in Europe, as well as running the landline and internet services formerly offered by France Télécom and Wanadoo before their rebranding to Orange in 2013. Orange Labs is its group of R&D centers, eight of which are in France, located at Issy-les-Moulineaux, Caen, Grenoble, Rennes, Lannion, Sophia Antipolis, La Turbie and Belfort. As would be expected, Orange Labs’ current development projects include work on 5G infrastructure development, but also on new telecoms applications such as connected and autonomous vehicles (CAV), agritech and eHealth.

In April, Renault, Orange and Ericsson announced plans to work together on connected vehicles and 5G. This collaborative project aims to assess the potential for 5G to improve communications between vehicles and their environment in a hybrid vehicle-to-everything (V2X) architecture that will include 5G network slicing and Mobile Edge Computing technologies.

Huawei is also particularly active in France. It has recently opened an R&D center in Grenoble, which is its fifth R&D team in the country. Others are in Sophia Antipolis and in Paris, while two existing teams are based at Huawei’s facility in Boulogne-Billancourt, and these are working on 5G standards and algorithms. In 2011, Huawei began a collaboration with the Paris Institute of Technology (ParisTech) to launch the “Seeds for the Future” program in France, later extended to other universities. More than 90 French students have already taken part in the program, which Huawei intends as a means for students to understand more about both China and the ICT industry.

Automotive

As CAVs are beginning to emerge as a new application area for microwave devices, it is interesting to note that France has a flourishing supply chain in the automotive sector. Valeo is an automotive supplier and partner to car OEMs worldwide. It is a technology-led company designing innovative solutions for smart mobility, with a focus on intuitive driving and reducing CO2 emissions and is a notable potential customer for the semiconductor suppliers. France’s indigenous automotive manufacturers, Renault and the PSA Group, which makes Peugeot and Citroen cars and, more recently, also Vauxhall and Opel, provide a ready home car OEM market, in addition to the possibility of exports.

South of France

A number of microwave companies are located in the science and technology park of Sophia Antipolis, near Cannes, which is also the home of the European Telecommunications Standards Institute (ETSI), which has over 850 member organizations drawn from over 60 countries and five continents.

As the recognized regional standards body dealing with telecommunications, broadcasting and other electronic communications networks and services, ETSI’s role includes supporting European regulations and legislation and the development of European Standards (ENs), many of which are used not only in Europe but all over the world. It is also a partner in both the international Third Generation Partnership Project (3GPP), helping to develop 4G and 5G standards, and in the oneM2M partnership project to develop standards for machine-to-machine communications.

Other companies based at Sophia Antipolis that have activities related to RF and microwave include Broadcom; Cadence Design Systems; Qualcomm; Dassault Systèmes, parent company of SIMULIA; Huawei; Infineon; Maxim Integrated; NXP Semiconductors; Orange; ST Ericsson; and STMicroelectronics.

Semiconductors

France has been successful in retaining a sovereign RF semiconductor manufacturing industry while fabs in other European countries have been diminishing in number since the 1990s. OMMIC, in Limeil-Brévannes near Paris, is a successful compound semiconductor fab, providing GaAs, InP and GaN MMICs and offering professional foundry services.

“The French microwave industry has many medium to small companies, whose size typically makes them agile and flexible,” said Cédric Corrège, international sales manager of OMMIC. “This is certainly the case with OMMIC, and our strong innovation policy is the main reason that we are one of the few remaining III–V fabs in Europe. Our success is not confined to France, as 95 percent of our sales turnover comes from abroad.”

Figure 4 A view of OMMIC’s production clean room, which was extended in 2017 to provide additional capacity for high volume 5G chips.

Having previously focused on the space market with its low volume, high value mix, OMMIC has recently released a new 100 nm gate length GaN on Si process that offers new high volume opportunities. OMMIC has focused on developing a versatile process that is good both for RF power and for low noise and aimed at producing mmWave devices for 5G base station and 5G automotive applications as well as space and SATCOM. In 2017, it commissioned a new 800 m2 production clean room (see Figure 4), which doubled production capacity and is eventually planned to increase sevenfold to more than two million chips per year to address the high volume 5G market.

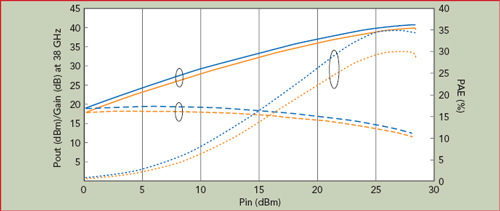

One of the latest GaN devices to be released is the CGY2651UH/C1 high-power amplifier (see Figure 5) which gives 10 W output over 37 to 43 GHz, with 30 percent power added efficiency (PAE) at Psat and 40 GHz. OMMIC also continues to work on mmWave applications from E-Band up to THz frequencies and is finalizing a new process to go up to 300 GHz. In addition, the company is working on increasing the frequency for GaN power devices with the release of a 60 nm gate length process and is working towards a 40 nm process.

Figure 5 Power output, gain and PAE vs. Pin for OMMIC CGY2651UH/C1 high-power GaN amplifier at 38 GHz.

It has been 52 years since Motorola first opened a semiconductor manufacturing facility in Toulouse, which was its first outside the U.S. This site now belongs to NXP, since its merger four years ago with Motorola’s semiconductor spinoff Freescale. NXP in Toulouse specializes in the design of RF semiconductors and sensors and is also involved in developing V2X communications to help enable CAVs and smart cities.

GaN and LDMOS RF PAs for 4G and 5G base stations and infrastructure are a major product line for NXP, which exhibited a suite of 5G base station PAs at IMS2019, including massive MIMO-based active antenna systems for sub-6 GHz and other products for 5G mmWave.

NXP has a second French semiconductor manufacturing site at Caen in Northern France making SiGe devices, which was formerly a Philips facility. The SiGe devices are being used to power highly integrated analog beamforming products at frequencies ranging from 24 to 40 GHz, for 5G mmWave infrastructure for both FWA and RAN applications.

STMicroelectronics in Grenoble is a leading player in the supply of RF GaN on Si ICs, through its collaboration with MACOM. The company was created as SGS-Thomson Microelectronics in 1987, resulting from a merger of SGS Microelettronica of Italy and Thomson Semiconducteurs in France. Although now headquartered in Geneva, it still retains much of the character of a French company from its Thomson heritage.

Through the MACOM partnership, STMicroelectronics is targeting global 5G base station applications with an expansion of its production capacity of 150 mm GaN on Si and further scaling up to 200 mm wafers, has announced plans to extend this to handset applications.

United Monolithic Semiconductors (UMS) is a German-French Group with a site in Villebon, France that employs around 200 people, and a German site in Ulm. UMS was founded in 1996 as a joint venture between Thales and Airbus Defence and Space. Its core expertise is in the development and production of RF and mmWave GaAs, GaN and SiGe MMICs for telecoms, automotive, defense and space applications, offering a range of standard and custom products up to 100 GHz as well as a foundry service.

Like OMMIC, UMS also export many of their products since the big French space and defense OEMs export a high proportion of their systems. New opportunities are emerging however, with smaller entrants into the space market, such as those making CubeSats, and UMS also sees that the deployment of a new infrastructure networks for 5G will change the characteristics of their market. Automotive collision avoidance radar has provided a high volume market, which along with defense and space products, are delivered to both its parent companies Thales and Airbus plus other leading players around the world.

“Although UMS has recently introduced several high performance GaAs products, much of our current product development is focused on GaN, which is bringing new families of products such as HPAs for X-Band, wideband HPAs for defense applications and highly-integrated front-ends for 5G mmWave,” said Eric Leclerc, field marketing manager of UMS. “We also are developing powerful and smart approaches for 5G sub-6 GHz requirements.”

In April, UMS announced that it had been selected to develop, manufacture and qualify GaN power transistors for the realization of a SAR system for the seventh Earth Explorer Mission of ESA, Biomass, which is targeted at the global observation of above-ground forest biomass. Two packaged transistors at 15 and 80 W were developed for the driver and the power stage, respectively, of the SSPA the UMS space-evaluated 0.5 µm GaN process (GH50). They were assembled into hermetic metal-ceramic packages, and all qualification tests were successfully completed.

A recent product introduction is the CHA3656-FAA, a 5.8 to 16 GHz LNA designed on the UMS GaAs 0.25 µm process, which is evaluated for space communications by ESA EPPL, and is also suitable for radar, test instrumentation and similar hi-rel applications. It has a noise figure of 1.75 dB and a low power consumption of 70 mA at 3.3 V. It also features an OIP3 of 25 dBm and a gain of 20 dB, with a 1 dB compression point of 14.5 dBm. Three alternative biasing options provide additional flexibility, and the device is housed in a 6 mm x 6 mm hermetic package.

Other Components and Interconnect

France has a long history of producing high quality passive components, cables and connectors at RF and microwave frequencies. Among the companies manufacturing passive and interconnect products in France are Exxelia, Radiall, Axon’ Cable, C&K Components, Esterline-Souriau and Draka Fileca.

Although headquartered in New Zealand, crystal specialist Rakon has three manufacturing facilities in France, at Gennevilliers, Mougins and Pont-Sainte-Marie. The Gennevilliers team is focused on OCXO and SC-Crystal design and manufacture. Specialized low volume manufacturing is carried out on site, while high volume designs are transferred to the lower cost Indian facility. The Rakon team in Mougins and Pont-Sainte-Marie are designers and producers of high precision and high-reliability frequency solutions for space and defense applications, designed to operate in extremely demanding environmental conditions. The product portfolio includes space and defense qualified OCXOs, TCXOs, VCXOs, XOs, crystals, SAW oscillators and pulse compression sub-systems.

Test & Measurement

Noise eXtended Technologies (Noise XT) develops cost-effective test & measurement products, specializing in phase noise analyzers and signal generators. Founded in 1992 as Europtest, the company was bought out by its employees in 2009 from its then parent company Aeroflex. Since 2017, Noise XT has been a subsidiary of Spherea Test and Services.

Its instruments find applications in space applications, where long-term frequency stability generation and analysis is required and there is a need for very low jitter signals for data transmission and conversion. Radar and defense applications need very low phase noise and a high spectral purity, and these also form an important part of the company’s market.

“With 12 employees, we are a small but stable company with a strong record of innovation,” said Guillaume de Giovanni, head of the business unit and founder of Noise XT. “Thousands of small companies like us have been able to thrive, thanks to the French culture of encouraging research and development and the strong links here fostered by industry with academia.”

Government and EU Support

The current French government, led by President Emmanuel Macron, has expressed a wish to revive France’s declining manufacturing sector, and to stem the loss of hardware production to Asia and Eastern Europe, and keep key knowledge located both within the country and in Europe. A number of funding initiatives and tax incentives are available to support innovation, one of which is France Brevets, which supports businesses in monetization and protects French technological innovations by filing international patents. Created in 2011, with an initial commitment of €100 million and a further boost of €100 million in 2016, France Brevets is owned by the French State and the Caisse des Dépôts Group.

Recently, the French government collaborated with Germany, the U.K. and Italy to support the microelectronic industry with the launch of Nano 2022, the French component of a wide-ranging Important Project of Common European Interest (IPCEI). Launched in March at STMicroelectronics’ facility in Crolles, Grenoble, Nano 2022 involves an investment of €5 billion over five years, including €1 billion of public funding. Along with STMicroelectronics, the other beneficiaries include UMS, Soitec and CEA-Leti. This strategic partnership with the French government and the private sector targets the research and development of innovative semiconductor technologies, with a special emphasis on making the move from prototypes to volume production. The French Ministry of Defense (DGA) is also providing strong support for semiconductor technologies that are strategic to military needs, notably GaN for high pulsed power generation.

“For Space, CNES is a very strong support, either directly through national programs or as the financing body of European Space Agency (ESA) programs such as ARTES or GSTP,” said Jean-Louis Cazaux, innovation manager at Thales Alenia Space, who is also chairman of the Component and Technology Board (CTB) of the European Space Component Consortium (ESCC). “There is a tight coordination between CNES and DGA, especially on military space, but also on basic technologies such as GaN, MMIC, etc.”

ANR is also participating on some programs. Industrial partners are expected to co-finance grants from CNES, DGA or ANR with their own R&D investment, typically at 50 percent or more, but the grants still provide a significant stimulus to innovation. At a European level, both the EU Horizon 2020 program and ESA are providing support for the industry and helping to stimulate the commercialization of European innovation.

Summary

Overall the French industry landscape is characterized by strong defense and space sectors. This is coupled with a high level of academic expertise in microwave technology within universities and higher education, particularly in electronics and semiconductor physics, and this has supported an innovation culture in France. The French government is providing an especially nurturing culture for startups and SMEs, resulting in a very healthy microwave industry across all sectors of the supply chain, from wafers to large systems.