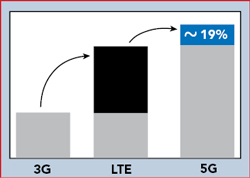

Figure 1 5G requires added spectrum, as the specifications provide only modest data rate improvements.

We are currently witnessing a global rush to 5G. Nations, mobile operators and handset manufacturers are all vying to be the first to deliver the next-generation of cellular connectivity - or at least to get in the game early. Worldwide, there are robust plans for rapid 5G deployment, especially in regions where the wide bandwidth provided by new 5G bands can provide significantly higher data rates for consumers. Indeed, it is this access to New Radio (NR) bands with the refarming of existing LTE bands that provide the greatest impact on data rates (see Figure 1). Unlike the 3G to LTE transition, the change in underlying 5G specifications provides only a modest data rate improvement. This explains why, to facilitate fruitful 5G deployment, countries are rapidly allocating new spectrum in both of the newly designated ranges: sub-6 GHz (FR1) and mmWave above 24 GHz (FR2). South Korea, Britain, Italy and Spain, among others, raised billions of dollars in spectrum auctions during 2018, and the U.S., China, Japan and Australia will hold auctions and make allocations in 2019. Operators in many countries, including the U.S., plan to start rolling out 5G services in 2019, and several major handset makers have said they will produce 5G phones supporting these services. Overall, these initiatives are driving toward widespread 5G coverage in developed countries by 2021.

Yet the global drive to 5G does not mean that we will see global 5G handsets. In contrast to the situation with LTE, it may not be feasible or cost-effective to build global 5G handsets that support roaming across 5G networks worldwide. Instead, 5G will likely drive the handset market in the opposite direction - toward greater regionalization.

Figure 2 Use of the “global” n77 and n78 mid-band spectrum varies by country.

5G BANDS NOT GLOBAL

First, new “global” FR1 bands (n77, n78 and n79) are, in practice, anything but global; in many cases, countries are allocating different narrow subsets of these bands (see Figures 2 and 3). Second, FR2 mmWave allocations are following a similar pattern, multiplying the problem. Third, many operators will initially deploy Non-Standalone (NSA) 5G, which introduces complex, hard-to-manage interactions between 5G and regional LTE bands.

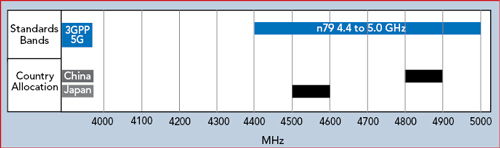

Figure 3 China and Japan plan to use small and different portions of the n79 band.

Those with long memories may remember the dawn of the LTE era, when bands 1 and 7 were heralded as global. Unfortunately, both were only adopted in some regions, not in others. Other bands that have been considered global candidates, such as band 41, were deployed with regional allocation differences. For example, the U.S. allocated the full available bandwidth, yet China chose only a narrow subset and, in practice, usage was even narrower, since China Mobile was only one of the three operators in China to fully deploy the allocated frequency range. Only now, many years after launch, is a more unified band 41 allocation structure being considered, with the aim of deploying 5G NR in the refarmed band n41.

The same fragmentation is occurring with the new “global” ultra-high bands n77, n78 and n79 and for the same reason. Little has changed in the way countries and regions allocate spectrum or auction it to mobile operators.

HANDSET WOES

The resulting differences in regional allocations have big implications for handset manufacturers, who must figure out how to support conflicting desires. Operators generally want handsets optimized for the subset of a band used in their respective regions. However, handset manufacturers want to sell devices globally, or at least regionally, supporting the different bandwidths and carrier aggregation (CA) combinations used in all their target markets.

Further, leading manufacturers have chosen to participate in the Global Certification Forum’s (GCF) interoperability certification, which provides benefits for roaming with LTE handsets. The common GCF practice is to certify operation over the full bandwidth of the designated band, which begs the question: what happens when an operator, or group of operators, has only deployed subsets of the allocated band?

Consider the case of n77, which covers 3.3 to 4.2 GHz. In theory, a single n77 solution would support worldwide use in all regions using this band. In practice, operators want solutions optimized for the subset of spectrum allocated in their respective regions - in some cases, as narrow as 100 MHz. If n77 will not work as a global solution, how about n78, which has a narrower 3.3 to 3.8 GHz allocation? Think again. So far, only a few operators intend to deploy the 3.3 to 3.4 GHz portion of either n77 or n78. Should a handset manufacturer be required to enable operation in a frequency range that is not even deployed? Operators vying for the best operation certainly will not demand it.

Implementing a more regional solution could deliver performance benefits, largely because handset manufacturers can tailor filtering and optimize power and low noise amplifier tuning for subsets of the bands. For example, at initial launch, the majority, if not all, of the front-end modules for n77 will use a non-acoustic filter, which provides good performance for the very wide 900 MHz of spectrum - much wider than any LTE band today. When a much narrower subset of n78 is used, say 400 MHz, a bulk acoustic wave (BAW) filter with steep filter skirts offers better performance, providing improved rejection of out-of-band frequencies and lower insertion loss at the band edges. This is one example of the tradeoff for handset manufacturers. Focusing on the regional solution would improve performance for a few targeted mobile operators, while losing the capability for true global roaming - or at least reducing the number of SKUs to service the global 5G market.

A similar dilemma exists for band n79 (4.4 to 5 GHz). China favors the 4.8 to 4.9 GHz portion of the band, while Japan is considering 4.5 to 4.6 GHz. A solution that supports the entire band would work in both countries, but it would not be optimized for either of the narrower allocations. If you were an operator in one of those countries, would you choose the global n79 solution or the one that provides better performance for the users in your country? On the other hand, as a manufacturer, would you want to build separate SKUs for China and Japan or have a single handset to cover both? These decisions trade off more than performance.

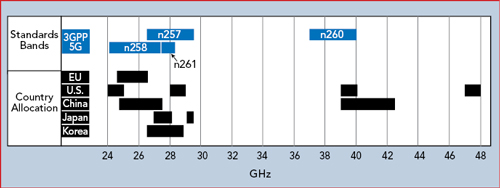

Regional allocations of FR2 spectrum make the fragmentation problem even more challenging, with differences between regions and among the operators within each region (see Figure 4). Handset RF implementations for mmWave are perhaps more frequency dependent than sub-6 GHz implementations, considering the antennas. If the phone must support multiple, widely spaced mmWave frequency ranges, it may require multiple antenna arrays or, at the very least, a more complex and lossy antenna. This could be a requirement even within regions, where multiple mmWave frequency bands are being allocated. Adding to the challenge, it is likely that mmWave front-ends will be implemented in multiple placements in the handset, each consuming precious real estate within an already space-challenged form factor. This is a difficult proposition considering handset size is approaching the practical limit for maintaining portability.

Figure 4 Use of the mmWave 5G bands will also be fragmented by country.

NSA, SA and LTE

Regions vary in their initial approaches to implementing 5G. In many areas of the world, operators are planning to accelerate 5G deployment by employing NSA 5G. NSA uses an LTE anchor band for control and a wider, 5G band to achieve higher data rates. This approach allows operators to deliver 5G sooner, by leveraging their existing LTE networks and not building out a new 5G core. However, some China operators plan to quickly transition from NSA to Standalone (SA) 5G or, in some regions, directly from LTE to SA 5G. SA removes the need for an LTE anchor, requiring a full 5G network buildout, yet easing the implementation of multi-band CA combinations, particularly on the uplink (UL).

Although NSA helps operators deliver 5G speeds sooner, it introduces considerable RF complexity: requiring dual LTE and 5G connectivity. In many cases, operators will add a 5G band to the existing regional CA combinations of multiple FDD LTE bands, with one LTE band serving as the anchor. The NSA specification requires the handset to transmit on one or more of these LTE bands while receiving on a higher frequency 5G band. This increases the likelihood of interactions between the LTE and 5G bands, with harmonics of the LTE transmit frequencies potentially desensing the 5G receiver.

To illustrate, consider the NSA combination of 5G band n78 with LTE anchor bands 3 or 66. Harmonic frequencies generated during transmission on the LTE band fall in the n78 band, potentially reducing receive sensitivity. To alleviate the possibility, additional filtering could be applied to the band 3 path, which will increase the losses on band 3. This presents problems in handsets designed for global use, particularly in regions where 5G is not yet available or with operators without n78 spectrum. In those locations, band 3 would be a main data path, and the added losses would penalize handset performance without providing any benefit to the user.

For some 5G bands, the global picture is even more complex, due to the need to support SA and NSA operation. For example, LTE band 41 is being refarmed as 5G band n41, which will provide much greater single-channel bandwidth than the 60 MHz LTE limit. North American handsets will need to support dual-transmit NSA operation using LTE band 41 together with 5G n41. This extra 5G bandwidth comes with a penalty, however. Due to reverse intermodulation products created when simultaneously transmitting on both LTE band 41 and n41, the output power must decrease to meet emissions masks, potentially reducing coverage. In China, however, n41 can be used in wideband SA mode without supporting dual transmission. Using n41 in SA mode will allow a wider bandwidth UL while maintaining the coverage that operators have achieved with LTE on band 41, and it can be supported with a single power amplifier, reducing the size and cost of implementation.

As regions move to SA 5G, many of these problems will become simpler. However, that is not likely to happen soon. I believe 5G will be around for a decade or more before SA becomes the predominant implementation across the globe. In the race to global 5G deployment, we have to accept a long period of RF complexity caused by the NSA standard.

WILL CONSUMERS BUY GLOBAL 5G HANDSETS?

Despite all these challenges, is it possible to build a global 5G handset? Probably. However, will global roaming justify the cost and other tradeoffs?

One question is whether consumers are prepared to pay for a more expensive global 5G phone. Whether the handset is regional or global, the cost will increase because the manufacturer will have to pay 5G technology license fees, in addition to the current fees for LTE. The substantial increase in RF content to provide global 5G coverage - especially considering the regional band variations - will add cost. It may be hard to justify, even for the specialized group of high-powered business travelers who want data roaming wherever they travel.

Recall the early days of LTE, when LTE was implemented regionally and GSM was used for roaming. When global LTE handsets emerged, quite often much of the handset LTE content was dormant. Content that adds cost yet is not used is often short lived, especially when a market matures from its infancy.

Even with a regional design, adding a single 5G band increases the RF content and cost. Additional components are required for the 5G band and to manage the signal flow through an increasingly complex signal path to antennas, due primarily to NSA and the myriad CA combinations operators have requested. Antennas are already strained to cover existing frequencies used for LTE; 5G will make the range even wider. While the challenge can be solved using antenna tuning and antenna-plexers, which maximize the number of signal connections to each antenna, both solutions add content to the handset.

Figure 5 The complexity of a 5G handset will require larger form factors.

5G will also mean big phones, at least initially (see Figure 5). The additional RF content requires extra space, especially for mmWave coverage, which will be difficult to fit in today’s handset form factors. Manufacturers do not want to reduce space allocated for batteries and other features that directly appeal to consumers. To accommodate the additional content, 5G phones may need to be “plus” devices. Even with regional 5G handsets, standard form factors may not be plausible at the outset. A quick look around will tell you that not everyone likes large form factor phones, which represent the minority of units sold. We may have to await further size-shrinking technologies before it is feasible to fit 5G into svelte 18:9 form factor phones that easily fit in a pocket.

CONCLUSION

5G is driving the market toward further regionalization of handsets. Consumers do not want to pay for RF content they will not use, and manufacturers cannot justify the cost of adding content that will be rarely used. Manufacturers may also find it difficult to squeeze the RF content into handsets while maintaining battery life and the other features consumers value. The desire to keep handset cost and complexity within reasonable limits will lead manufacturers to design regional 5G handsets, similar to the regionalization in many of today’s mid-tier LTE smartphones.

To be very clear, none of these factors will slow down the impending 5G rollout. They will just fragment the market. In short, 5G handsets will be anything but global.