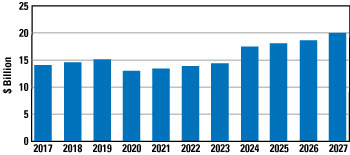

Figure 4 Global EW market forecast.

Strategy Analytics forecasts the global EW market will grow to $20 billion by 2027 (see Figure 4). The associated market for semiconductors and other components for RF-based EW systems will grow at a CAAGR of 8.4 percent through 2027. Future EW program will increasingly use GaN, making this semiconductor technology a staple ingredient in EW systems. This will be coupled with requirements for direct and faster digital synthesis of RF signals across the full frequency spectrum.

COMMUNICATIONS

Military communications operate under an umbrella of heterogeneous networks that enable the provision of interoperable voice, video and data services across a global environment, segmented according to security policies, transmission requirements and the individual needs of the end user. In terms of the networked battlespace, this can be summarized as:

- Upper level networking, consisting of infrastructure and networking components.

- Mid-level networking providing high capacity backhaul.

- Support to the tactical edge for end-users and sensors.

Similarly, 5G serves as an aggregator technology that encompasses a range of network types and technologies to serve traditional voice, video and data requirements to the end user, as well as enabling capabilities for connectivity across devices, including vehicles, machines, sensors and devices.

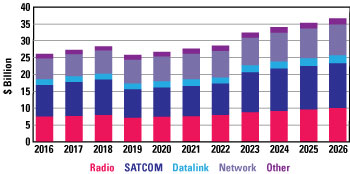

Figure 5 Global military communications market outlook, by segment.

Phased arrays, beamforming, mmWave frequencies, SATCOM, GaN, duplex communications and shared spectrum access are among the crossover technologies that will become common across both commercial and military communications.

Communicating voice, data and video simultaneously and securely over wider and higher bandwidths in an increasingly complex spectrum environment will underpin the trends in military communications system design and supporting components, including software-defined architectures, solid-state technologies such as GaN, radio-satellite communications and integration with wireless networks.

Strategy Analytics forecasts spending on global military communications systems and services will grow to over $36.7 billion in 2026, a compound annual growth rate of 3.5 percent (see Figure 5).

RF GaN GROWTH

Demand from military radar, EW and communications applications will provide the primary drivers for GaN market adoption, and this will be coupled with ongoing demand from the rollout of commercial wireless infrastructure. RF GaN market growth continued to accelerate in 2017, with revenues growing at over 38 percent year-on-year.

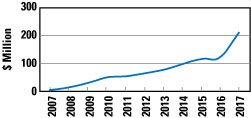

Figure 6 Historic defense system demand for RF GaN.

The military radar segment will remain the largest user of GaN devices for the defense sector. Substantial production activity in AESA radars for land-based and naval systems, in particular, is driving increasing demand for RF GaN, as many systems in development move to production. RF GaN demand from the military sector grew by 72 percent year-on-year in 2017, and this will grow at a CAAGR of 22 percent through 2022 (see Figure 6).

As highlighted earlier, operational requirements to operate in contested and congested environments, as well as the ability to counter modern agile radar and communications, will drive opportunities for RF GaN from the EW market. Communicating voice, data and video simultaneously and securely over wider and higher bandwidths in an increasingly complex spectrum environment will underpin trends in military communications system design and associated component demand, also increasingly favoring RF GaN.

CONCLUSIONSStrategy Analytics forecasts that the total RF GaN opportunity will cross the $1 billion barrier by 2022, with defense sector demand slightly greater than commercial revenue at that time.

As countries look to maintain a mix of both conventional and leading-edge capabilities, to counter both symmetric and asymmetric threats, global defense spending is forecast to reach $2.6 trillion by 2027. The emphasis on improving capabilities at the system level will drive demand for military radar, EW and communications systems and provide growth opportunities for enabling technologies such as GaN.

Companies will need to be able to “scale, integrate, incorporate and disrupt” to differentiate themselves in addressing the challenges and opportunities in the defense sector, as well as exploiting adjacent market growth opportunities benefiting from these same capabilities.