The defense sector has been a technology incubator for RF technologies for decades. This article explores the latest market forecasts from Strategy Analytics and how spending on military systems will dictate demand for RF technologies such as GaN.

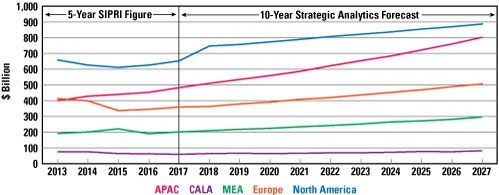

Strategy Analytics forecasts global defense spending will continue to grow, driven by force modernization requirements and political intent in the U.S., Western European and other advanced nations. A need to counter both resurging conventional threats from near-peers, coupled with ongoing asymmetric wars against non-state or pseudo-state actors, will drive military equipment and capability and support procurement opportunities for the defense industry supply chain to a forecast of $827 billion, part of the projected $2.58 trillion global defense budget in 2027 (see Figure 1).

Figure 1 Global defense spending outlook, by region.

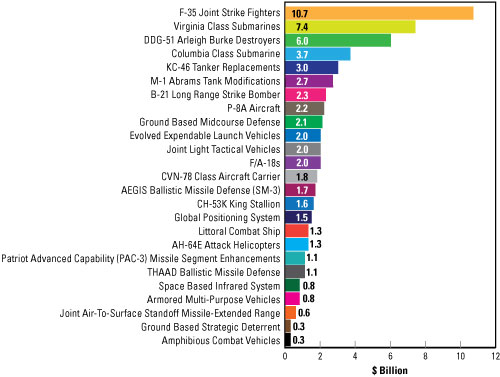

The U.S. will remain the largest defense market in the world. Strategy Analytics’ model forecasts U.S. defense spending will grow to $866.6 billion in 2026. The emphasis by the Trump administration to renew U.S. leadership across the world was reflected in the fiscal year (FY) 2018 budget and has been further cemented by the most recent FY 2019 budget request: $686 billion for the U.S. DoD with a number of major warfighting investments across airborne, naval, ground and space platforms and systems (see Figure 2). This will maintain momentum behind the U.S. defense industry, sustaining growth for major suppliers like Boeing, General Dynamics, Lockheed Martin and Raytheon, as well as the enabling technology supply chain epitomized by companies such as Microsemi, Qorvo, Teledyne and Wolfspeed.

Figure 2 Major U.S. defense program investments in FY19.

Globally, an emphasis on improved capabilities at the system level will drive demand for military radar, military communications and electronic warfare (EW), and capabilities will continue to provide opportunities for enabling technologies such as GaN.

RADAR

Active electronically scanned array (AESA) architectures enabled using GaN and GaAs semiconductor technologies will continue to underpin radar systems and serve to catalyze military radar market growth through 2027. Strategy Analytics Advanced Defense Systems service’s forecasts for the global military radar market, covering expenditure as well as system shipments across the land, air, sea and space domains, projects the global military radar market will grow at a compound average annual growth rate (CAAGR) of 4.6 percent over the 2017 to 2027 timeframe to be worth over $21.5 billion.

Suppliers of military radar systems are increasingly implementing AESA architectures at the core of their product offerings, highlighting advances in performance as well as lifecycle and total cost of ownership advantages over traditional radar designs. An AESA radar comprises a large number of transmit-receive modules that feed and collect multiple signals via an antenna array. Potential advantages of an AESA architecture include high beam steering agility, very low radar signature when illuminated and extremely low side lobes. Being able to digitally control transmit-receive module gain allows for refined power management, which is vital for reduced or low probability of intercept (RPI, LPI) operation. Beam steering agility also facilitates reduced or low probability of intercept scan patterns. From an operational perspective, the implementation of AESA architectures in military radar systems enables improvements in system reliability and reductions in total cost of ownership. Use on fast jet platforms is often cited as a good example where these metrics are best exemplified with mean time between failures being improved significantly from the 300 hours typically cited for conventional radar systems. Coupled with “graceful degradation,” where a radar system continues being functional even as individual transmit-receive modules fail, means that aircraft can stay operational with repairs being performed alongside the regular maintenance schedule of the platform.

The core enabling semiconductor technologies for AESA architectures have typically been GaAs-based, but as GaN technology has matured, the defense industry has looked to GaN as the new core enabler for AESA-based military radar. GaN offers the advantages of increased power, efficiency and robustness to improve the performance of land-, air- and sea-based military radar systems. This does not mean that GaAs technology will no longer be used, any more than it would be unwise to suggest that there will no longer be demand for vacuum tube-based RF transmitters. However, GaN does arguably offer the added flexibility of being able to displace GaAs, other RF semiconductors and vacuum tube technologies as the RF transmitter source in radar systems. With these advantages, GaN is becoming a key enabling technology and military radar demand for GaN is forecast to grow at a CAAGR of 19 percent through 2027.

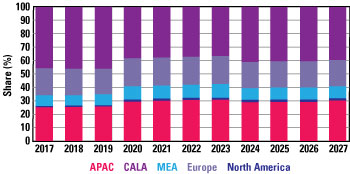

Figure 3 Forecast share of the military radar market, by region.

Strategy Analytics also predicts:

- North America will continue to represent the largest regional end market, but the fastest growth will come from demand in the Asia-Pacific region (see Figure 3).

- Airborne radar will represent the largest market, both in dollars and total shipments.

- Early warning, surveillance and fire control radars will account for around 76 percent of the global military radar market.

- L-, S- and C-Band will represent the largest market, followed by radars operating at X-Band, which reflect the primary frequencies used by surveillance, early warning and fire control radars.

- The total number of radar shipments is forecast to grow at a CAAGR of 4.6 percent through 2027 to reach 1,607 units. Fire control radar and early warning and surveillance radar shipments will account for 48 percent of 2027 military radar shipments.

- The associated market for semiconductors and other components will grow from $2 billion in 2017 to reach $5 billion in 2027.

EW

Operational requirements to establish freedom of action in contested and congested environments, as well as the ability to counter modern agile radar and communications will drive opportunities for the EW market. There is a renewed push to upgrade conventional EW capabilities that support anti-access/anti-denial (AA/AD) strategies. This will be coupled with the ongoing requirement to combat asymmetric threat scenarios. Future systems will employ wideband solid-state semiconductors to enable artificial intelligence (AI)-based machine learning algorithms to provide cognitive analysis of the threat environment. EW will play an important role in tackling the increasing complexity that comes with operating in a spectrally constrained environment.

Companies providing systems and enabling technologies will need to focus on solutions that employ wideband materials, such as GaN, and AESA architectures to enable machine learning-based cognitive analysis, planning and countermeasures activity that can either augment or circumvent the traditional threat library.