Qualcomm introduced the RF360 product seven months ago, and people are still asking me for insight into what it means. Are Skyworks and RFMD in trouble? What will Intel and Mediatek do? Is CMOS performance good enough?

Of course there are performance tradeoffs with CMOS power amplifiers. Basic physical properties give GaAs superior characteristics for efficiency/linearity/power tradeoffs. If performance was the only important metric, we would stick with GaAs discrete devices.

But performance is not the only important variable. Cost and flexibility are also very important, and CMOS has reached the point where its performance is acceptable in many applications. Here are some examples:

- In 2G applications, CMOS power amplifiers are taking over. Several start-up companies attacked this application first, because the constant-envelope waveform associated with GSM is the ideal starting point for a CMOS PA. Amalfi Semiconductor, prior to their acquisition by RFMD, aggressively reduced CMOS PA pricing and took over production of a large share in the GPRS market. Today, most GSM amplifiers shipped use CMOS technology, and EDGE applications are migrating over as well.

- When RFMD absorbed Amalfi Semiconductor, the economy of scale in their operations took an unprofitable product and put it back in the black. Today, RFMD owns half of the GSM market, and considers CMOS products to be a net positive on their bottom line.

- For 3G, several companies have developed CMOS PAs that can handle a high peak-to-average ratio and a few have now reached production. Avago’s acquisition of Javelin Semiconductor was a good move. All of the GaAs PA suppliers have realized that they need CMOS design engineers in their stable, because the technology is moving from the low-end GSM handset to the mainstream.

- Qualcomm announced the RF360 as an LTE front end. LTE represents another step up in linearity, with a higher peak-to-average ratio than 3G. The Qualcomm product also represents a multi-mode, multi-band power amplifier (MMPA). In order to achieve acceptable efficiency and linearity, Qualcomm added envelope tracking and antenna tuning to the product. The end result is that the RF360 performs about as well as today’s GaAs products, but not as well as next year’s ET GaAs PA with antenna tuning.

Over the past five years, Qualcomm lost a big chunk of the market to MediaTek and Spreadtrum, as these companies have addressed Chinese customers with low-cost products that are very simple to implement. With great local applications engineering support, MediaTek in particular was able to steal a sizable portion of the “reference design” market. Qualcomm’s strategy is to offer something even simpler than a “reference design”, by integrating the difficult RF portion into a module that is closely tied to the baseband, transceiver, and power management modules. Buying the entire chipset from one company can simplify the modem and radio integration...making the local applications engineering support less relevant. Think about it: PA sales won’t move the needle on Qualcomm’s $24B in revenue. By offering the RF solution, they have a chance to sell modems into 200-400 million entry-level smartphones in China in 2015.

Of course the game does not stop there. Intel and Broadcom have demonstrated CMOS amplifiers with envelope tracking, and we anticipate product announcements from them soon. Pressure is building on MediaTek to react with a “simpler” product of their own. Some of these baseband vendors will stick with GaAs, and others will introduce CMOS PAs. The RF Front End vendors will move to integrate their own Complete Front End modules. One way or another, Mobile Experts anticipates consolidation in Envelope Tracking and the PA market, to simplify R&D projects by pulling teams together into common ownership.

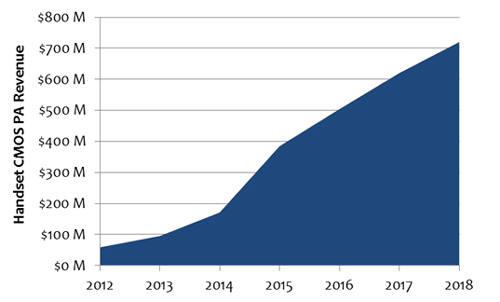

Will GaAs power amplifiers disappear in three years? Of course not. But the growth of CMOS PA revenue will essentially steal all of the revenue growth from the GaAs PA market over the next five years, leaving the GaAs PA market flat.