Ultra-wideband (UWB) technology is increasingly being deployed in the automotive sector for a variety of reasons. One common application is to use the technology to surmount the vulnerabilities of RFID-enabled key fobs, which can easily be hacked and allow vehicles to be stolen. It is also being considered as a radar technology to ensure children are not left behind in the back seat.

AUTOMOTIVE ENTRY SYSTEMS

The 1982 Renault Fuego was the first model to use a remote key fob to unlock the car doors. Although the growth of this approach was initially slow, it accelerated in the 1990s. By 1995, around a third of vehicles made that year had the feature, with the penetration rate exceeding 50 percent in 2000.

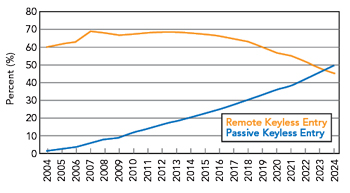

Figure 1 Demand for remote and passive keyless entry systems. Source: TechInsights.

In 1993, the Chevrolet Corvette was the first to use a passive entry system. In this system, an enabled fob would send out low frequency (LF) signals to unlock the car doors when it was near the vehicle. By 2014, penetration of passive entry systems reached 20 percent and this has now grown to 50 percent in 2024, with essentially all vehicles now being fitted with either remote or passive entry systems. Figure 1 shows data from TechInsights on the market share of remote and passive keyless entry systems.

Early passive entry systems were proprietary systems based on the ISM band before being replaced by the Bluetooth standard. The 2017 Tesla Model 3 was the first model to feature a Bluetooth Low Energy (BLE)-based entry system. The fob in this system used a Texas Instruments TMS37F128 controller chip. Replacing the earlier LF solution, BLE has become the communication standard for passive entry systems. Another technology being deployed in automotive entry systems includes near-field communication (NFC). The first model fitted with an NFC entry system was the 2016 Mercedes-Benz E-Class. Here, an enabled key card or smartphone handset is placed over an NFC reader on the vehicle to unlock the doors. Tesla models also come with NFC cards for use in valet parking.

Digital Key

Both NFC and BLE have now become the standard communication protocols for the Car Connectivity Consortium (CCC). These protocols were defined in its second and third digital key releases in April 2020 and July 2021, respectively. The purpose of the CCC is to develop and standardize entry systems for vehicles to add convenience to families and fleets sharing identical vehicles and enable new services. Members of the CCC include many original equipment manufacturers (OEMs), automotive Tier 1 integrators, mobile OEMs and semiconductor suppliers, including Infineon, NXP and STMicroelectronics.

These new services include car-sharing and remote delivery, among others. Enabling the new services is the digital key. The digital key dispenses with the need for mechanical blade keys that have been the cornerstone of the automotive sector since the 1950s, when they were first used to start engines. With such virtual “keys,” the same vehicle can be used by different drivers without the costly need for service centers to hold different keys. This technology can provide many benefits. Cars-for-hire companies stand to gain with lower operating costs and a delivery can be made to a vehicle instead of a customer who could be away from home. These digital keys can be exchanged via an app on a smartphone.

Standardization enables interoperability between different suppliers and OEMs in the automotive and mobile sectors. It also ensures the security of the resulting systems. In addition, it raises competition between suppliers to make the digital key concept affordable and bring about widespread adoption.

UWB

Hackers can intercept the LF BLE and/or NFC transmission and gain access to the unlocking codes from the fob. This allows a thief to steal a vehicle without needing to be in close proximity. This is where UWB provides an advantage. UWB has the resolution to accurately determine the position of the enabled device and ensure that the actual owner of the vehicle is approaching the vehicle. Jaguar-Land Rover was the first OEM to implement UWB technology when they put it on the 2018 Jaguar I-Pace electric crossover and the Range Rover SUV. Other OEMs that have now adopted UWB-based keyless entry systems include BMW, Hyundai, Mercedes-Benz, NIO, Tesla and Volkswagen.

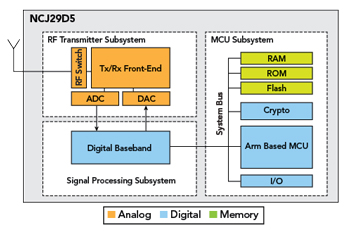

Figure 2 NXP Trimension NCJ29D5 functional block diagram. Source: NXP.

NXP supplied the IC that was installed in these first vehicles and the enabling fob. That IC carries the IP developed by a Dublin, Ireland-based start-up called Decawave, which Qorvo acquired in February 2020. NXP has since become a major chip supplier of UWB solutions in the automotive sector, supplying the Trimension NCJ29D5 IC to BMW vehicles and the SR100T IC to smartphone handsets. Figure 2 shows a block diagram of the NXP Trimension NCJ29D5 IC.

For mobile applications, Apple and Qualcomm are the leading vendors of UWB-enabling chips. These chips are often integrated into system-on-chip (SoC) packages. Infineon is another key player. In October 2023, Infineon acquired 3dB Access, a start-up based in Zurich, Switzerland. 3dB Access brought its design capabilities for incorporating integrated SoCs into UWB systems. Infineon has leveraged this capability to become a major supplier, which includes supporting Volkswagen for both the vehicle and enabling fobs.

3dB Access has brought some valuable capabilities to Infineon. Where the CCC Release 3.0 standard calls for the high-rate pulse (HRP) version of UWB, 3dB offers a solution that encompasses both HRP and low-rate pulse (LRP) methods. The IEEE sets out these methods in its 802.15.4z standard. The 3dB dual-mode solution has an LRP method that has a lower frequency of pulses at a higher energy, resulting in lower power consumption. This dual-mode solution proved ideal for battery-operated devices such as key fobs. The HRP part of 3dB’s solution reduces current consumption in both the transmitter and receiver yet remains compliant with the standards.

The new IEEE 802.15.4z standard, released in 2020, optimizes UWB signaling to exploit best the energy stipulated in the two rules regulating the use of the UWB frequency spectrum. The first rule limits the maximum mean power spectral density (PSD), which is the radiated power within a given bandwidth when averaged over 1 ms, to -41.3 dBm/MHz or 74 nW per MHz. The second rule addresses the strength of a single pulse that can be transmitted. It limits the power of the UWB signal to a maximum of 0 dBm when passing it through a filter with a bandwidth of 50 MHz. This is 10 percent of the energy of the original 500 MHz wide signal. This second rule prevents solutions involving just one large pulse. The IEEE is currently working on IEEE 802.15.4ab, an enhanced version of the UWB standard. This version aims to include various new features such as narrowband (NB)-assisted UWB, lower power consumption, higher data rates, security and more.

Chinese automakers are also keen to offer this feature to their customers, particularly start-up electric vehicle makers. A group of Chinese semiconductor vendors is offering UWB solutions to the market. These vendors include Chi Xin Semiconductor, Ultraeption, Yuducomm and UniSoC, whose SoCs embed UWB capability. However, it is interesting to note that these vendors are not members of the CCC.

CHILD PRESENCE DETECTION

UWB is also being considered for use in sensing cabin occupants. Impulse radio UWB (IR-UWB) is already a well-established method for radar sensing and UWB radar has the resolution necessary to detect small movements. This capability allows for motion detection, presence sensing and vital sign detection for “sleeping” consumer electronics devices. This can save power or detect intruders in surveillance systems.

Automotive radars are increasingly being developed for child presence detection (CPD) systems. Such sensors have the resolution to detect movements from heartbeats or breathing. CPD alerts drivers of any children who could be left behind in the rear seats and suffer injuries from hot conditions in the vehicle. In 2023, 29 children reportedly died in the U.S. from heat stroke while left in vehicles. Also, in 2023, CPD was included in the European New Car Assessment Program (Euro-NCAP) five-star safety award criteria. In 2016, 20 automakers made an agreement with National Highway Traffic Safety Administration (NHTSA) and Insurance Institute for Highway Safety (IIHS) to fit rear seat alert systems as part of CPD by Model Year 2025. Because of the Hot Cars Act of 2021 (HR 3164), the 2021 Build Back Better Act also required NHTSA to consider the mandated fitment of CPD as early as 2027.

In the above applications, the same UWB chipset can be used not only for ranging in applications like entry systems but also for sensing. The sensing application typically requires a different software configuration that comes with a higher feature set. This gives UWB radar a cost advantage over conventional 60 GHz frequency-modulated continuous wave (FMCW) radars that require a dedicated electronic control unit (ECU) and chip to implement the sensing functions.

OEMs can also reduce the system bill of materials by repurposing chip devices already in use. For example, a CPD radar can be used for intrusion detection in a security system, to “sleep” display screens or to turn off interior lights. Another use case for these devices is a kick-sensing application where a UWB device operating in radar mode is used to detect a kick gesture from a user to open the trunk. Presently, there are no standards for UWB radar, but the IEEE 802.15.4ab standards team is working on standardizing UWB as a radar for mono- and multi-static sensing.

MARKET DEMAND

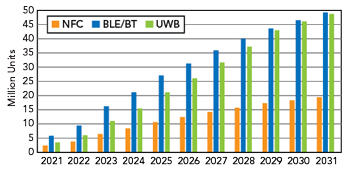

The cost of implementing digital key systems will mean that penetration of digital key-enabling passive entry systems (with NFC and BLE) will be highest in North America, South Korea and Western Europe, as well as among the premium brands. China will also see a high level of demand, primarily from the technology-leading electric vehicle start-ups, but not at the same level of penetration. Additional demand will also come from Eastern Europe and Japan. TechInsights forecasts that global demand for BLE and Bluetooth (BT)-enabled systems will increase from 16 million units in 2023 to 40 million in 2028 at a cumulative annual average growth rate (CAAGR) of 20 percent and reach nearly 50 million in 2031. In addition:

- Mature market regions like North America, South Korea and Western Europe will see penetration rates increase from around 26 percent in 2023 to around 65 percent in 2031

- Eastern Europe and Japan will see penetration rates increase from 13 to 14 percent in 2023 to around 50 percent in 2031

- China will see slower growth in the adoption rate, increasing from 15 percent in 2023 to 40 percent in 2031

- Thailand will see penetration rates increase from 9 percent in 2023 to 37 percent in 2031

- India and Brazil will see penetration rates increase from 5 percent in 2023 to around 30 percent in 2031.

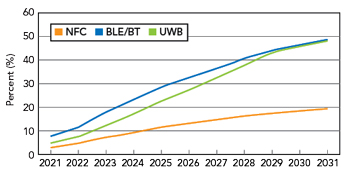

Within the demand for these passive entry systems, BLE will see more rapid growth than NFC because of the added convenience to the user and the challenging requirement to integrate NFC-reading antennas into the vehicle.

- NFC will be deployed in lower volumes to support car-sharing services and to provide valet parking for premium brands. It is assumed that NFC will be deployed in around 40 percent of digital key-enabling passive entry systems.

- UWB will also see rapid growth among passive entry systems because of the added security it brings to BLE-based passive entry systems. It is assumed that all digital key-enabling passive entry systems will deploy BLE, with UWB seeing penetration rising steadily from 58 percent of digital key-enabling passive entry systems in 2021 to 99 percent by 2031.

Figure 3 shows the latest TechInsights forecast for the volume of passive keyless entry systems in automotive applications from 2021 to 2031. It shows the expected volumes for NFC-, BLE/BT- and UWB-enabled systems. Figure 4 shows the expected market share for the three different technologies over the forecast period.

Figure 3 Demand for NFC, BLE/BT and UWB in passive keyless entry systems. Source: TechInsights.

Figure 4 Penetration of NFC, BLE/BT and UWB in passive keyless entry systems. Source: TechInsights.

At this early stage in its development, internal radar demand is estimated to be very low. However, deployments and interest are growing. The Acconeer 60 GHz pulsed coherent sensor, manufactured by Alps-Alpine, is deployed on the 2022 Volvo EX90 electric SUV, 2023 Lotus Eletre and Polestar 3. The pulse-coherent sensor uses time-of-flight measurements from a sequence of pulses that are pulsed in picosecond intervals. The technique is an alternative to FMCW, which has a higher power consumption.

CONCLUSION

The convenience of remote keyless entry and passive entry systems is resulting in faster adoption of these technologies by the automotive industry. The CCC is leading efforts to standardize and enhance security as the automotive sector embraces the digital key concept, with consumers embracing the added convenience. Some of the other benefits of this approach are a reduction in operating costs for fleets and car-for-hire operators and the growth of new mobility services such as car-sharing. Efforts to enhance security will drive UWB demand. This demand will see steady growth as solution providers leverage the resolution UWB offers to accurately determine the position of the enabled device and ensure that the actual owner of the vehicle is approaching. Furthermore, the technology offers dual-use capabilities and could provide an alternative occupant detection requirement currently being pursued through the adoption of 60 GHz radar solutions.