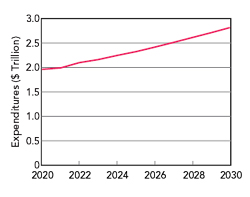

Figure 1 Global defense spending. Strategy Analytics forecast.

With chip shortages in the consumer electronics market, 5G and the latest handset offerings from Apple and Samsung dominating electronics and semiconductor news, it is easy to forget the key role the defense industry has played and will continue to play in the evolution of the compound semiconductor supply chain. From the MIMIC and MAFET programs with GaAs and, more recently, the development of GaN, defense agencies have supplied the funding and applications that have enabled these compound semiconductor technologies and other portions of the supply chain to grow and mature. The motivation behind this nurturing is a need for the highest performance technologies and products in defense applications, and the driver is global defense spending. Figure 1 shows the latest Strategy Analytics forecast for global defense expenditures.

The growth rate for global defense spending is not large, but the size of these expenditures makes this an attractive market. Defense spending in 2020 reached nearly $2 trillion, and we expect it to reach $2.8 trillion in 2028. A good portion of this spending goes toward the yearly expense of supporting and maintaining a standing army, but we expect that the portion of the defense spending used for material, equipment, R&D and training will approach an estimated $900 billion in 2030. The result is a large yearly injection of revenue into the electronics and semiconductor supply chains.

SEMICONDUCTOR TRENDS

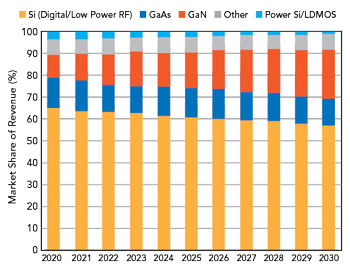

Figure 2 Defense component revenue segmentation by semiconductor technology.

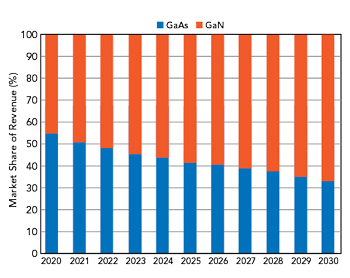

Figure 3 Defense component revenue split: GaAs vs. GaN.

Winnowing the expenditures from the top-level budget to equipment and semiconductor content, the available revenue to the supply chain shrinks; yet it is still a substantial number. Figure 2 shows the latest Strategy Analytics segmentation of semiconductor content in electronic warfare, radar and communications systems. Even though the expenditures are smaller at each step down the procurement chain, our latest forecast estimates semiconductor content in components will reach $6.5 billion in 2030. The details behind these numbers show some interesting trends.

The first significant trend for the semiconductor industry is that semiconductor revenue grows at a faster rate than top-level expenditures. This shows the reliance on electronics to support battlefield and mission strategies that increasingly reflect the concept of a global information grid with more networking and data capabilities. The second observation is the large share of defense market revenue occupied by Si semiconductors. Because of the performance, environmental and mission requirements, defense electronics are rarely as sleek and fashionable as their commercial equivalents, but they need as much or more processing with encryption and security capabilities. The final trend is the rapid growth of GaN. This forecast has GaN component revenue approaching $1.5 billion for defense applications in 2030. GaN has become the dominant RF power technology. Its performance characteristics support evolving battle philosophies that rely on higher operating frequencies, wider instantaneous bandwidths, better efficiency and higher linearity.

In the late 80s and early 90s, the U.S. Department of Defense (DoD) supplied funding, mentoring and system applications that enabled GaAs device technology to transition from digital to RF applications. In addition, the defense industry was instrumental in developing the processes and manufacturing, test and assembly ecosystems to the point where the performance and price of GaAs devices became attractive for commercial applications. In the early days of the GaAs-defense partnership, most of the RF components in the system block diagrams used GaAs technology. As other technologies mature, most notably Si and GaN, they are capturing market share from GaAs, and while GaAs no longer commands the overwhelming share of revenue in the block diagram, the defense market is still important for the GaAs industry.

Figure 3 shows the split in device revenue for defense applications between GaAs and GaN, and it illustrates the growing importance of GaN for defense systems. Despite an expected growth in GaAs revenue, Strategy Analytics’ latest forecast shows GaAs losing market share quickly to GaN. In 2020, GaAs device revenue was still substantially larger than GaN’s for defense applications, but we are forecasting GaN device revenue will be nearly twice as large as GaAs device revenue in 2030.

However, GaN and GaAs device revenue trajectories have become intertwined. As GaN grows, much of the market share captured by this technology comes from tube-based amplifiers, as these and other defense applications require high RF output power. The transmit amplifier chain usually has GaAs stages driving the GaN output stage. So the market share captured by GaN from tubes, combined with new production using GaN, will help GaAs revenue grow. We predict that revenue from GaN and GaAs devices will approach $2.2 billion in 2030, a significant opportunity for device manufacturers.

UNDERLYING DRIVERS

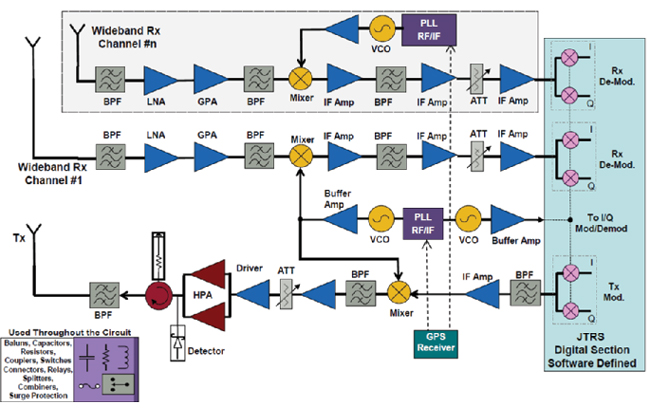

Defense applications do not create the same volumes as consumer devices, but devices for defense are characterized by higher prices, and this contributes to the attractiveness of the opportunity. Figure 4 shows a representative radio architecture that illustrates the breadth of the RF opportunity in defense. While the block diagram shows a radio architecture, electronic warfare and radar block diagrams, while differing in intent and complexity, also rely on a superheterodyne architecture.

Figure 4 Military radio block diagram. Source: Richardson RFPD.

The block diagram shows the array of active and passive elements in a radio. In the transmit chain, digital information at the intermediate frequency (IF) is up-converted to the transmit frequency by a mixer locked to the local oscillator reference frequency using a voltage-controlled oscillator (VCO)/phase locked loop (PLL) combination. The transmit signal is amplified through a multi-stage amplifier chain to the antenna.

To better process the wideband incoming signal, the receiver is channelized, i.e., with each channel filtered to a specific band. The incoming signal is amplified and filtered before reaching the same type of mixer/VCO/PLL combination, in this case down-converting the RF signal to an IF frequency. From here, the digital/processing section of the radio, shown at the right of Figure 4 extracts the data encoded on the incoming signal.

While this simple analysis does not do justice to the complexity and capability of tactical radios, we see the variety of low- and high-power amplifiers, control and signal conversion components and assorted filters and other passive elements sprinkled around the block diagram. The digital section in the figure is not detailed, but it contains an impressive array of digital, baseband, processing, security and encryption, all in Si. As we consider that fielded systems may have multiple transmitters and receivers, it is easier to see component revenue in the defense segment reaching $6.5 billion by 2030.

DEFENSE CAPABILITY EVOLUTION

The diagram in Figure 4 illustrates a radio architecture constructed from standard components from a variety of suppliers. The sharp-eyed will notice that the digital section references the Joint Tactical Radio System (JTRS). In 2011, the U.S. Army cancelled the JTRS Ground Mobile Radio, the centerpiece of this effort, but these development efforts did serve as a gateway to the evolution of software-defined radios (SDRs), and other tactical radio programs are using some of these waveforms.

Early implementations of system architectures used GaAs-based components for the vast majority of the active RF components. As technologies and requirements have evolved, the conversion stages (i.e., the oscillator, amplifier and mixer) are now Si ICs. The PLL/oscillator combination is now a Si synthesizer that may be included in the converter. Some of the control components and low-power amplifiers are now fabricated in Si, and GaN is rapidly becoming the power amplifier technology of choice.

Those developments are some of the specific component and technology changes that the defense industry has incorporated over time, but where is the industry headed? Figure 5 conveys Strategy Analytics’ thoughts on the evolution of capabilities that will be important to the defense supply chain. Not surprisingly, the evolution aims toward more functionality, more reliance on software and higher performance for all the components.

Figure 5 Evolution in defense technology capabilities.

Transmitters will evolve to higher instantaneous bandwidths to accommodate more and wider channels. Where the bandwidth of a system is too wide, the transmit chain will require a more efficient method for using multiple transmitters. Receivers will also need to manage wider band and higher frequency input signals, with better sensitivity. The industry is making great strides in analog-to-digital and digital to analog converters and digital signal processing elements to improve the resolution and sampling speed of the RF signal, enabling the conversion from RF to digital closer to the antenna and at higher frequencies.

For the processing and control functions, the operating spectrum for defense systems is becoming much more congested and contested. SDRs that can be configured and programmed for changing conditions in real time are evolving to integrate cognitive capabilities that enable systems to automatically adapt to the environment. The logical extension of this capability relies on the maturation and adoption of machine learning algorithms and techniques and on artificial intelligence. Defense agencies are reluctant to delegate complete responsibility for decisions to software, especially ones with lethal consequences. This “man in the loop” philosophy is likely to wane over time as technology and algorithms advance.

CHANGING U.S. DEFENSE PHILOSOPHIES

In addition to the hardware and software evolution we have discussed, the U.S. military is considering changes to fundamental battlefield philosophies. U.S. battle strategy has been succinctly summarized as one of “overwhelming force,” i.e., transporting a massive number of assets, whether troops, vehicles, airborne or naval platforms, to the front lines of the conflict. The goal of this approach is to deter a conflict from happening. If the conflict does intensify, the next step in the strategy is limiting the enemy’s command, control and intelligence capabilities by seizing control of the electromagnetic spectrum so U.S. forces have free rein of the field of battle.

The concern for the DoD is that other countries have had 30 years to observe these tactics in the Gulf War and the war in Afghanistan. The “Great Power Competition,” the uneasy balance of power among the U.S., China and Russia, is heating up: China’s defense spending growth rate is about double that of the U.S. and Russia is spending more on defense as their oil-based economy recovers. With so much time to observe U.S. tactics, defense spending from potential adversaries aims toward anti-access/area-denial (A2/AD) strategies to blunt the U.S.’s ability to control the electromagnetic spectrum in the battlefield. While the U.S. continues to fund the largest defense budget in the world, China’s and Russia’s budgets are among the five largest. In addition to A2/AD, spending in those two countries aims at developing platforms incorporating next-generation hypersonic, stealth and directed energy technologies, with China also spending heavily to improve and expand their naval capabilities.

The U.S. DoD recognizes that conflicts with U.S. involvement may occur in areas a great distance from the U.S. This presents a logistical challenge. The possibility of having multiple simultaneous conflicts in those areas exacerbates the challenge, and the DoD is concerned that trying to maintain an overwhelming force strategy on multiple fronts simultaneously will require a substantial investment, yet only result in a marginal force advantage.

In DARPA and DoD circles, “mosaic warfare” is an alternative strategy getting significant traction. It relies on capability overmatch, rather than overwhelming force. While it still relies on clear and significant superiority, the superiority comes from technology and capability rather than personnel and equipment. DARPA senior management coined the mosaic warfare term because it describes their vision of assets as tiles that can be arranged into different mosaics. In this vision, the tiles may be as simple as a sensor on a soldier or as complex as an F-35 or an aircraft carrier. Planners and commanders would arrange these tiles in different patterns to address different battlefield scenarios.

Table 1 shows DARPA’s vision of the evolution of the “kill chain,” the process from identifying a threat to neutralizing the threat. The legacy chains are distributed, meaning the identification, communication, decision and action functions happen in distinct locations. Battlefield philosophies have moved to a system-of-systems approach where the functions are distributed with parallel paths of fixed assets. The evolution to an “adaptive kill web” envisions a matrix with different assets capable of contributing to the identification, communication, decision and action functions and multiple paths through that kill chain matrix. While this allows more flexibility, it is still static, with only a fixed number of different paths.

The mosaic warfare concept envisions a web where the paths can be dynamically adjustable over time as battle conditions change. This end goal reflects a “more with less” philosophy that relies on technology and capability overmatch. By establishing this superiority, the U.S. believes it can conduct multiple military engagements anywhere in the world by quickly mobilizing and arranging mosaic tiles of functionality. Enabling this concept places challenging new requirements, from equipment to semiconductors. The equipment needs to be highly adaptable and scalable with the ability to network and process complex information quickly and efficiently. Semiconductors will need to operate at higher frequencies and bandwidths, with increased efficiency, linearity and processing capability.

CONCLUSION

The path forward for strategy, tactics, equipment and semiconductors is starting to come into focus, but geopolitical developments may change the course and pace of developments in the defense industry. China is becoming increasingly aggressive toward its neighbors in the South China Sea, particularly toward Taiwan. News agencies have reported record numbers of Chinese fighter jet and naval incursions into what China believes is its sovereign territory. U.S.-China trade sanctions and the ongoing semiconductor chip shortage have made Taiwan, the epicenter of Si semiconductor development, an attractive consolidation target in China’s “one country, two systems” philosophy. We also learned recently that China launched a nuclear-capable, hypersonic, low altitude missile that circumnavigated the earth without detection.

While military capabilities in Afghanistan are not significant, the recent U.S. withdrawal and resulting instability left a power vacuum. With many of Afghanistan’s neighbors in the Middle East and Southeast Asia having nuclear capabilities, countries looking to fill that power vacuum could add fuel to an already combustible situation. The concern is in a region known for instability and ongoing conflicts, added instability could have large ramifications.

We have not discussed the effects of the COVID pandemic because the defense supply chain has proven resilient. Of bigger concern is the global economic recovery. Defense spending links closely to a country’s gross domestic product growth, so there will be implications for defense spending if economies recover more slowly than expected. The U.S. is facing a slightly different, yet important offshoot of this linkage. Massive U.S. government economic stimulus packages have spurred economic recovery from the pandemic, but the new U.S. administration appears to prioritize social programs over defense spending in its initial budget. It is still unknown whether longer term defense spending caps will remain in the budget as it makes its way through Congress, but we do expect a slight drop in 2022 defense spending until the priorities of the Biden administration become clearer.

Even though defense expenditures face some uncharacteristic turbulence, we are optimistic that the segment will continue to provide good opportunities for semiconductors. GaN will see fast growth, GaAs will remain competitive and Si analog and digital devices will account for the largest portion of the estimated $6.5 billion semiconductor device revenue in 2030. Systems and philosophies are undergoing rapid evolution, and the implementation of these new requirements will be enabled by semiconductor and component developments. With growth returning to historical averages, we expect to see a healthy defense industry, with many opportunities over the next 10 years.