Access to the internet and voice calls can be considered a utility, like water, power, gas or railways. In this context, telecom infrastructure is quite similar to other general utility infrastructure, as it consists of a large set of facilities and systems required to support a basic consumer need. Yet telecom infrastructure has two intrinsic differences with the infrastructure of other utilities. On the one hand, telecom infrastructure requires significant and frequent upgrades; on the other hand, telecommunications is the only utility where the subscription price has continuously declined over the last decade. Data services become less profitable for operators while, for example, the worldwide cost of energy or water keeps increasing.

These two points are of interest to understand the telecom infrastructure market’s dynamics and trends. First, the continuous need for network upgrades stimulates the creation of new technological approaches, such as active antenna systems (AASs). Second, reduced profitability has motivated telecom operators to look for additional sources of growth and the development of new protocols to address new markets, such as enterprise and industrial. These two trends are directly linked to 5G and how it has been defined.

WHAT IS 5G?

As a general observation, 5G is not what is motivating the opening of new markets, allowing new applications and offering new technological approaches. 5G is the tool that the telecom industry developed to reach these goals. The economic development expected from this new generation was conceived and defined before the first 5G base station was even installed.

Over past decades, multiple concepts have emerged regarding the connection between people, machines and vehicles. The concept of a wireless sensor network has been around since the early 2000s, with multiple developments such as ultra-low power electronics that did not reach large scale market acceptance. The idea of networks of sensors easing industrial automation and increasing plant performance has been actively looked at, yet one of the main hindrances has remained, the access to efficient protocols and infrastructure. Similarly, communication among automobiles has received intense attention from regulators, leading to the allocation of the 5.9 GHz frequency band for vehicle-to-vehicle communication. Again, the concept had limited potential, as it could not communicate with the general network.

In this context, operators and system makers understood the opportunity for a communication protocol that could unite all these new markets, offering tremendous growth as well as a solution for the world’s communication needs. This was the core focus of 5G during its definition a decade ago.

WHAT CONSTITUTES 5G?

5G technology is often referred to as the intersection of three concepts: enhanced massive broadband (eMBB), ultra-reliable low latency communication (URLLC) and massive machine type communication (mMTC). These three come directly from the world’s communication demands. URLLC is linked to mission-critical communication, such as safety for inhabited vehicles or disaster management; mMTC is linked to large-scale sensor networks, such as wearables and industrial/building automation; eMBB is linked to consumer demand for increased data throughput, resulting from the development of video content, cloud gaming and virtual reality. Therein lies the essence of 5G, designed as the one communication technology to rule them all.

Once this is understood, it is easier to apprehend the focus for the future of telecom infrastructure. Apart from standard network upgrades, it will need to cover the newly appearing use cases, providing a new approach for networks in plants and enterprises while offering tele-transmission on roads and so on. Unfortunately, even though these use cases have been motivated by industry, an actual market pull is not really evident today in most of these prospective markets. Proposed solutions, albeit appealing, have not reached massive deployment…for now.

THE TECHNOLOGY INSIDE

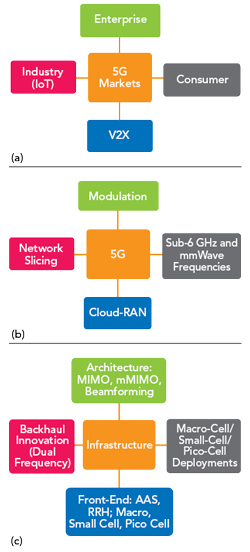

Figure 1 Flow-down from market need (a) to 5G architecture (b) to infrastructure capabilities (c). Source: 5G’s Impact on RF Front-Ends for Telecom Infrastructure report, Yole Développement, 2021.

From a technological standpoint, this market-oriented approach has direct repercussions for protocols, frequency bands, transmission capabilities and so on (see Figure 1). To illustrate, we can correlate the technical trends to foreseen applications: the need for URLLC means, among other things, a strong backhaul link, which creates the demand for dual-band backhaul connectivity when using wireless links and boosting the use of optical fiber backhaul connections. Today, URLLC is the toughest challenge for technologists regarding 5G implementation. The high throughput requirements of eMBB coupled with the lack of available spectrum motivated the use of the mmWave FR2 bands, i.e., frequencies above 24 GHz. The need for higher throughput also led to the use of more advanced OFDM modulation techniques that require ever more precise communication, i.e., with less interference and better coverage. This led to beamforming and the creation of AAS. The new frequencies needed for increased throughput led to adoption of a new semiconductor technology platform for power amplifiers and the transition from LDMOS to GaN. The requirements of industry and enterprise applications led to an aggressive development of small-cell structures and distributed antenna systems.

This list can go on and on. Nonetheless, when looking at how the 5G infrastructure will meet the increases in throughput (eMBB), number of devices addressed (mMTC) and reliability (URLLC), the main RF system innovations are:

- New frequency bands, both sub-6 GHz (FR1) and mmWave (FR2)

- AAS

- Smaller-reach devices (e.g., small cells and distributed antenna systems).

For the RF front-end, the RF system innovations lead to:

- High frequency and wideband components and new technology platforms (e.g., GaN and SiGe) and new circuit designs (e.g., triple-stage Doherty)

- Completely integrated mmWave systems for infrastructure, which did not previously exist

- Reduced component power consumption, as active antennas use more RF channels to transmit a similar EIRP

- Increased number of components (e.g., switches, PAs, LNAs) as AASs have more RF channels

- Complex last-mile backhaul for small-cell deployment, such as integrated access and backhaul.

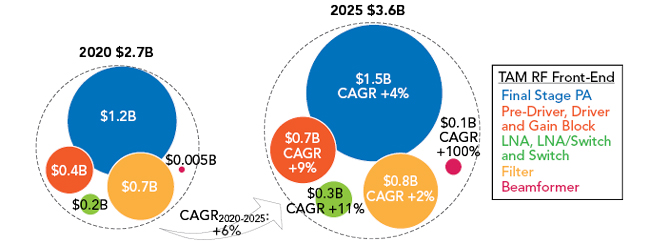

Yole Développement has assessed these changes and their impact on the market, in terms of player landscape, industrial dynamics and market value. In our market report, “5G’s Impact on RF Front-End for Telecom Infrastructure 2021,” we forecast the infrastructure market is expected to grow from $2.70 billion in 2020 to $3.66 billion in 2025, peaking at $4.26 billion in 2023 (see Figure 2).

Figure 2 RF infrastructure front-end market forecast. Source: 5G’s Impact on RF Front-Ends for Telecom Infrastructure report, Yole Développement, 2021.

These technological changes are only the visible part of the proverbial iceberg. For baseband processing and data management, 5G has massive repercussions. The tremendous network slicing innovation enables the complete virtualization of the communication network and the creation of seamless communication across industries, as well as enabling private networks supported by worldwide operator coverage. For the radio access network (RAN), significant changes in infrastructure management are being implemented through innovative approaches like cloud RAN and open RAN (O-RAN). “Mutualizing” RAN resources will decrease the cost of network operation and the environmental impact.

5G’s ENVIRONMENTAL IMPACT

A short digression is appropriate regarding the environmental impact of all these innovations and new applications on 5G infrastructure. 5G is power hungry. AASs consume more power and increasing the number of data exchanges also increases power consumption. On the other hand, there is tremendous effort at the technology level to increase efficiency and reduce the power consumption per bit of data processed and exchanged. But the actual mitigating force in this environmental mess is not at the transmission and processing level, it is at the application level.

As stated before, 5G means connecting industry, connecting enterprises and so on. One of the objectives of using 5G in industrial automation is reducing manufacturing cost through process optimization. Although not the primary objective - cost improvement is - this directly leads to a reduction of manufacturing power and material consumption. For example, NB-IoT will help with fleet management and reduce gas consumption for package delivery. In-plant mmWave networks will help “smart” management and machine vision to improve manufacturing yields. With such a direct impact on the industrial environment, creating a connected world can mean creating an energy-efficient world. Looking at the big picture should be the focus for environmental improvement. In any case, continuous work on energy optimization must be ongoing at all levels of 5G, and this is clearly one of the industry’s focuses.

CONTRIBUTING TO INFRASTRUCTUE EVOLUTION

Telecom infrastructure diverges from other utilities by its need for continuous upgrades, with future generations of standards directly linked to a pre-defined vision of how the future should look. 5G was defined at an abstract level a decade ago, and the current technological choices are just the practical implementation of this vision - the main goal being unifying communication across industry, with global automation and efficiency improvements.

Today, 6G is already being defined, and it follows the current global technological trends for artificial intelligence, cloud computing and data needs, with a strong focus on improved throughput, reduced power consumption and optimized data manipulation. Any industry member can contribute to the collective future by acting now to define 6G, through participation in ongoing consortiums and workshops, especially as 5G technology and its implementation are fixed and cannot be changed.

Defining the future of the telecom infrastructure is in everyone’s hands, not only those of the telecom operators. Any member of society can take part in defining the longer term “7G” evolution. As the future of communication is dictated by our way of consuming data, anyone can act on these next generations by adopting the behavior of what the future should look like. Telecommunication infrastructure will always be the translation - 10 to 20 years in the making - of the technological dynamics of our complex society.