Over the past few months, news outlets have shown us how fast a highly contagious virus can spread in a globally connected world. Factory shutdowns in China created major ripples throughout the electronics supply chain, leading to order delays and all-too-familiar component shortages. Now that the virus has spread beyond China, its effects have expanded beyond components and created shifts in manufacturing capacity. The U.S. and Europe are starting to feel the pinch due to shelter-in-place orders and economic turmoil, both of which contribute to reduced manufacturing capacity.

While containment measures are necessary to halt further spread of coronavirus, they are affecting production capacity for all types of products, including consumer electronics. What is interesting about these effects on demand and supply chain woes is how they shift with movement of the virus. Just as Chinese manufacturing capacity is prepared to ramp up to full strength, the virus has reduced demand for the products they produce, and the problems in the electronics industry have shifted from component shortages to demand shortages.

What’s Happening with the Supply Chain and Manufacturing Capacity?

China was the first to be hit with coronavirus on any major scale, which led to quarantining of 36 million people across the country. Larger electronics manufacturing services (EMS) operations in China were temporarily reduced or closed to prevent further spread of the virus. Obviously, manufacturing capacity is related to component supplies, and the initial reduction in Chinese capacity forced manufacturers to scramble to procure components and prevent order delays. This created the ripple felt farther up the electronics supply chain, resulting in production delays throughout the industry.

The IPC has been conducting surveys of member companies about these supply chain issues, and the results illustrate the important relationship between overseas manufacturing capacity, demand in Western nations and component shortages. These are economics issues as well as logistics issues. From examining the results reported in the February survey(1) and its March update,(2) we can identify some of the following common themes:

- By mid-February, some IPC member companies were reporting difficulties obtaining components from their suppliers. Some survey respondents(1) reported 4-5 weeks of leftover component stocks. This is due to quarantines and shutdowns at Chinese factories. Those factories that have stayed open have reported reduced workforce availability.

- In cases where suitable replacement component and raw material sources can be found domestically, US EMS providers are using these sources when cost allows and when lead times are minimal. Overseas EMS providers have been forced to import from the US/EU (at greater expense) or cobble together orders from multiple suppliers, as reported in the February IPC survey release.

- These supply chain problems started filtering down to the consumer level by February; some spot shortages have occurred, but widespread shortages have not been seen. Laptop, memories and data center equipment sales are up now that more US workers are working from home. Samsung reported a 20 percent jump in exports as of March 23.(3) Consumers should expect spot shortages and delays due to reduced manufacturing capacity and component shortages.(1)

- Some EMS providers are being forced into the “gray market,” i.e., using unauthorized distributors or resellers to procure critical components. This demands strict testing to ensure quality and identify counterfeit components.

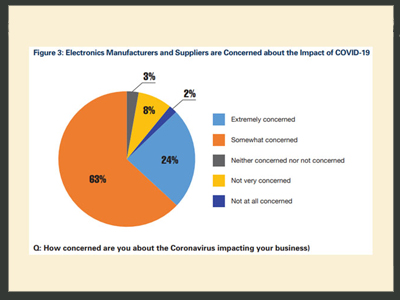

The uncertainty over lockdowns, shortages and demand can be cited as a primary reason for the historic market decline since February 29. Manufacturers and suppliers are expressing their concern about when business will return to normal (see the chart below(2)).

Governments in Western nations seem to have quarantine as the only available weapon to fight coronavirus. Most of us have received that ominous email stating an upcoming conference is cancelled out of an abundance of caution or by government mandate. These measures are necessary to wait out the virus, but they are causing a shift in the manufacturing landscape as onshore EMS companies and original equipment manufacturers (OEMs) shut their doors, move their capacity overseas or make their operations remote to the greatest extent possible.

- Manufacturing capacity is coming back online in China just at the time it is being reduced or going offline in other parts of the world. Larger US/EU EMS companies and OEMs with overseas capacity have been able to shift production away from a locked-down region. Smaller companies are forced to work with out-of-state or overseas services to fill orders.

- New lockdowns in the US and Europe are forcing board houses and EMS providers to look back to China and their out-of-state partners to get orders into production. The exception is medical and defense electronics manufacturers, which are allowed to remain open as they could be viewed as “essential businesses” in the parlance of shelter-in-place orders.

- As coronavirus started spreading beyond China, and eventually hit the US and Europe hard in early March, so did factory closures and reduced capacity. As an example, Taiwan-based manufacturer Hon Hai Precision Industry Co. (better known as Foxxconn) suspended production in India from March 25 to at least April 14 after the country imposed a total lockdown to contain the spread of coronavirus.(4) A government lockdown in the Philippines was enforced starting March 15, which forced Integrated Micro-Electronics to suspend work at its Luzon facilities.

- The PCB fabricators I talked to in mid-February were optimistic as they were seeing an uptick in orders, and they cited coronavirus and tariffs as the main reasons. Now with reduced gatherings being imposed, workers going remote, OEMs and larger board houses pushing their capacity back overseas, and a bit more foreign competition from Chinese fabricators, it seems the advantages were short-lived.

Overall, the March update to the IPC survey(2) concludes that consumer electronics will see the greatest impact as new product releases are delayed. I would agree with this sentiment as we’ve already seen spot shortages, and more are forecasted thanks to overseas factory closures. Chinese manufacturing capacity is extensive, but it doesn’t exist in a vacuum; factories need orders to produce, and the orders don’t exist when the rest of the world is on lockdown and consumers refrain from spending.

Where is Demand Coming Next?

In the short term, we may end up thanking President Trump for invoking the Defense Production Act (DPA) on March 18. This is the second time President Trump invoked the wartime measure. The DPA gives the administration the authority to force companies to produce specific goods in support of war efforts, natural disasters, or other national emergencies and the coronavirus crisis certainly qualifies. The President held off on using the act immediately, and on March 24 signaled it would be used to procure 60,000 test kits, although the Federal Emergency Management Agency found a way to procure the kits without placing DPA language in its procurement contracts.(5)

The DPA would give the administration the authority to procure all kinds of equipment to treat patients, including electronic equipment like ventilators and thermometers. Ventilators are already in short supply,(6) but renewed Chinese manufacturing capacity could help satisfy demand. Expect persistent demand at home if growth in new cases does not level off soon, especially in hard-hit areas of the US like New York and Washington. Africa will eventually confront the growth in caseloads seen in the US and Europe,(7), and African nations will need this equipment desperately.

Respirators and thermometers aside, the DPA invocation will not provide a major boost to the electronics industry as a whole, nor will it create undue demand for components that overseas manufacturers cannot handle. There is some inventory capacity that remains to be filled so that large EMS providers and OEMs can get their products produced, but the author doesn’t expect widespread shortages of components to increase in the coming months. Rather, the problem is in getting those components to end customers as freight, air and marine capacity is stretched to its limit. Supply chains are only built to handle a certain amount of demand at any given moment, and manufacturers may still need to cobble together orders from multiple suppliers in order to prevent further delays.

The real danger for the supply chain, economic activity and the electronics industry is long-term consumer sentiment. Some positive news around the virus would do much to turn consumer sentiment positive and, hopefully, get people out of quarantine and back to work. The fear that spending remains reduced for a prolonged period, even after new coronavirus cases are declining, is a real problem the industry needs to confront as consumer demand filters back through the supply chain.

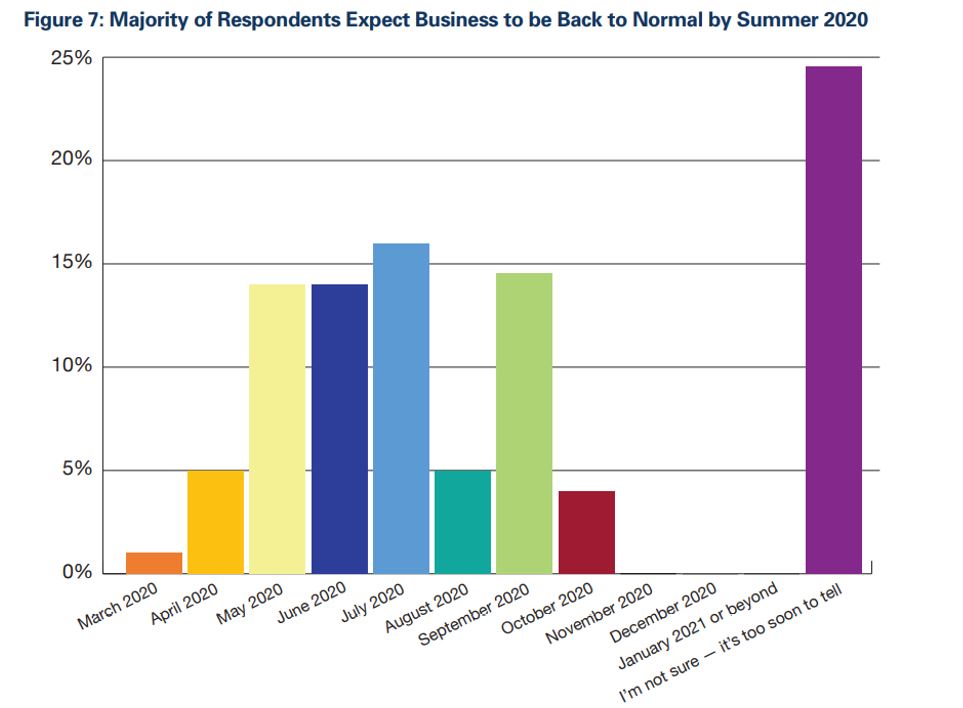

The March 2020 update to the February IPC survey provides some insight into the state of the industry, which reflects this view on consumer sentiment. shows that member companies expect to see reduced orders throughout 2020. According to the respondents, we shouldn’t expect business to be back to normal until at least June or July of 2020 (see the chart below(2)).

Note that, for the majority of companies, it is still too soon to tell how demand will change over the rest of 2020. There has been some positive news on the economic front as the U.S. Congress passed a $2 trillion emergency lending and stimulus package on March 25.(8) Markets reacted with the largest 1-day gains in history. However, one should not expect the news to bring electronics companies back into the black in 2020 as this will rely on increased consumer spending long after the virus is contained. Results from the IPC survey (March update)(2) agree with this sentiment. If cases in the U.S. and Europe begin declining, people can start working again, and consumer sentiment turns positive, one can expect the global economy to return to a strong growth position by the end of 2020. Assuming the virus in post-lockdown U.S., India and Europe follows the same course as it did in post-lockdown China, we’ve got another 8-12 weeks before the global economy and daily life regain some semblance of normalcy.

Lessons Learned

If there’s anything the electronics supply chain can learn, it is this: the electronics industry has been too reliant on China and southeast Asia as manufacturing hubs. Tariffs on imported Chinese goods, as temporary as they may be, underscore this point. Such a takeaway is reflected in the February IPC survey results: firms are accelerating plans to shift production outside of China.(1)

This all raises another question surrounding the supply chain for electronic components; will components suppliers in China be able to accommodate a sudden increase in demand? I think they will as they’ve brought back manufacturing capacity before being overwhelmed with renewed demand from Western nations. However, being a risk-averse individual, I am tempted to take the same position as the majority of IPC member companies: it’s simply too early to make predictions. The same could be said for bringing larger Western EMS operations and OEMs back to full-scale. This is a fast-moving situation that spans the globe, and Western economies need to rebound before anyone can take full advantage of returning Chinese manufacturing capacity.

References

- The Impact of the Coronavirus (COVID-19) Epidemic on Electronics Manufacturers. IPC, February 27, 2020.

- The Impact of the Coronavirus (COVID-19) Epidemic on Electronics Manufacturers: March Update. IPC, March 17, 2020.

- Home work triggers demand jump for chips, laptops, and network goods. Heekyong Yang and Makiko Yamazaki, Reuters, March 23, 2020. Retrieved from: https://www.reuters.com/article/us-health-coronavirus-tech-demand/home-work-triggers-demand-jump-for-chips-laptops-and-network-goods-idUSKBN21A0Y9

- Hon Hai suspends production in India to April 14. Chung Jung-feng and Frances Huang, Focus Taiwan, March 25, 2020. Retrieved from: https://focustaiwan.tw/business/202003250010

- FEMA: Defense Production Act no longer needed to secure thousands of test kits. Quint Forgey, Sarah Owermohle and Megan Cassella, Politico, March 24, 2020. Retrieved from: https://www.politico.com/news/2020/03/24/trump-administration-defense-production-act-146070

- 'Desperate' shortage of ventilators for coronavirus patients puts manufacturers on wartime footing. Emma Reynolds and Eoin McSweeney, CNN, March 19, 2020. Retrieved from https://www.cnn.com/2020/03/19/business/coronavirus-ventilators-manufacture-intl/index.html

- Africa Braces for Coronavirus, but Slowly. Burkina Faso, The New York Times, March 17, 2020. Retrieved from: https://www.nytimes.com/2020/03/17/world/africa/coronavirus-africa-burkina-faso.html

- Senate to vote Wednesday on $2 trillion coronavirus bill after landmark agreement with White House. Erica Werner, Mike DeBonis and Paul Kane, Washington Post, March 25, 2020. Retrieved from: https://www.washingtonpost.com/business/2020/03/25/trump-senate-coronavirus-economic-stimulus-2-trillion/