The biggest hit at MWC19 was flexible display technology that was shown off in 2 foldable phones, the Samsung Galaxy Fold and Huawei Mate X, and in a wearable smartwatch phone from ZTE, the nubia Alpha. While 5G was everywhere (I don’t think I saw one booth that did not mention 5G), it is just emerging into the market but will certainly take off later this year. Nokia voiced this timing in their press conference saying that they expect the first half o 2019 to be somewhat slow with 5G taking off more quickly in the second half of this year.

To date, the major 5G networks announced were Verizon’s Fixed Wireless Access last Oct and AT&T mobile 5G service toward the end of the year in the US. Korea was also one of the first to turn on their 5G network although devices don’t seem to be available yet. China is expected to launch in the first quarter this year while European deployments seem to be lagging. This was brought up constantly at MWC19 that the EU has been slow to allocate frequencies and authorize infrastructure sites which are putting Europe behind. The other major concern discussed constantly was security – how will 5G networks improve security especially for use cases that will rely on confidential enterprise transactions or ultra reliable life or dead applications like autonomous vehicles or remote surgery.

Despite the fact that 5G is just launching, there were many 5G phones introduced at or around the event including: the Huawei Mate X, LG V50 ThinQ 5G, Samsung Galaxy Fold, Samsung Galaxy S10 5G, Xiaomi Mi Mix 3 and ZTE Axon 10 Pro 5G. The Samsung Galaxy S10 5G promises to be the first 5G phone in operation probably in China and shortly after in the US.

Nokia made the most noise of the network equipment manufacturers by introducing a Fixed Wireless Access device called the FastMile gateway which is a self-contained residential device that connects wirelessly to the 4G or 5G network while creating a better and faster Wi-Fi experience within the home. The 5G gateway supports 4G so consumers get the best possible service in the home by utilizing the best quality signals received. The unit offer speeds up to 1 Gb/s and is a stylish, self-install gateway.

Nokia made the most noise of the network equipment manufacturers by introducing a Fixed Wireless Access device called the FastMile gateway which is a self-contained residential device that connects wirelessly to the 4G or 5G network while creating a better and faster Wi-Fi experience within the home. The 5G gateway supports 4G so consumers get the best possible service in the home by utilizing the best quality signals received. The unit offer speeds up to 1 Gb/s and is a stylish, self-install gateway.

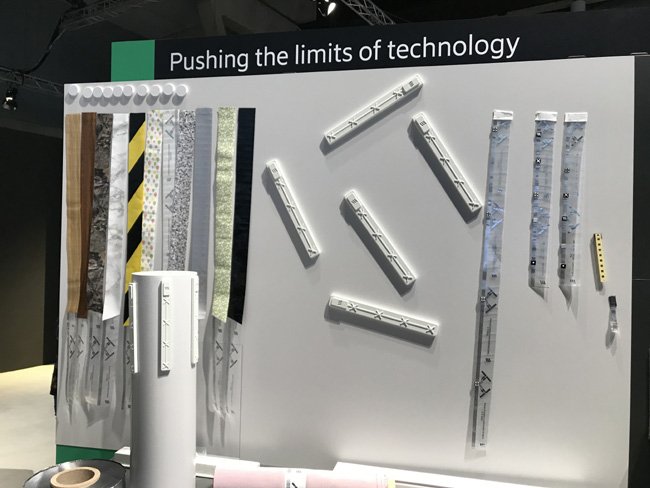

The Ericsson CEO said a couple of interesting things. The first was they plan to introduce spectrum sharing where they can use both 4G and 5G signals at the same time. The second was their project called Radio Stripes which are low cost antennas printed on a thin plastic film that can be deployed in large numbers seamlessly integrated into the architecture. The stripes can be run under carpet or cloth on walls and have different sets of antennas for different frequencies for thorough coverage in busy areas such as malls, airports and stadiums. The stripes are connected by Ethernet lines and could also contain control chips for each antenna set.

The Ericsson CEO said a couple of interesting things. The first was they plan to introduce spectrum sharing where they can use both 4G and 5G signals at the same time. The second was their project called Radio Stripes which are low cost antennas printed on a thin plastic film that can be deployed in large numbers seamlessly integrated into the architecture. The stripes can be run under carpet or cloth on walls and have different sets of antennas for different frequencies for thorough coverage in busy areas such as malls, airports and stadiums. The stripes are connected by Ethernet lines and could also contain control chips for each antenna set.

Sub 6 GHz 5G technology is relatively straight forward now that the first standards are in place. The technologies needed to realize devices and systems are well understood and testing methods are established. The only major challenge left is to realize the cost, power and size constraints needed to meet the financial goals necessary to achieve success. However, mmWave 5G technology is still emerging including the test methods needed to verify devices and systems. We saw several interesting mmWave architectures being developed that will compete for their share of the market. There are the highly integrated silicon SoC approaches from companies like Anokiwave, Qualcomm, Xilinx and IDT, the flexible more discrete architectures that typically use silicon control devices and GaN or GaAs power amplifiers from companies like Qorvo, NXP and ADI plus a couple of other novel approaches such as the low loss Gapwaves waveguide antenna front end approach and the low cost Pivotal passive holographic beamforming approach. It will be interesting to see which technologies emerge as the winners in this market.

Microwave Journal visited with many companies on site and here is a summary of what we found:

5G Americas, the industry trade association and voice of 5G and LTE for the Americas, announced the publication of The Status of Open Source for 5G. This 5G Americas white paper provides an overview of 5G architecture, with a focus on its application of open source principles, based on 3GPP Release 15-defined 5G system architecture. “Mobile operators worldwide are pioneering both 5G and Open Source technologies by leading the standards organizations and community-driven projects,” stated Chris Pearson, President of 5G Americas. “Mobile operators have begun deploying the solutions produced by various projects to demonstrate the benefits of Open Source for 5G.”

Anokiwave announced its third-generation of 5G silicon ICs during MWC2019, reflecting its plan to offer a full RF signal chain for each 5G millimeter wave band. The first of the third-generation products is a 28 GHz (n257 and n261) quad-core IC, which handles beamforming for either four channels of a dual polarization array or eight channels of a single polarization antenna. Anokiwave’s active antenna “innovator kits,” developed in collaboration with Ball Aerospace, were featured in several company booths at MWC19, demonstrating millimeter wave links. Anokiwave contributed hardware to the O-RAN Alliance millimeter wave “white-box” 5G radio unit demonstration, which was running in the Xilinx booth.

Anritsu Company had a big announcement for the wireless field test solution market with the introduction of the Field Master Pro™ MS2090A RF handheld spectrum analyzer. With the highest continuous frequency coverage up to 54 GHz, real-time spectrum analysis bandwidth up to 100 MHz, and a ruggedized design to withstand the demands of field test, the Field Master Pro MS2090A is ideal for a range of current and emerging field applications, including 5G, broadcast, regulatory compliance, aerospace/defense, satellite systems, and radar. Seven models are available with frequency coverage of 9 kHz to 9/14/20/26.5/32/44 and 54 GHz. The family features best-in-class performance, such as Displayed Average Noise Level (DANL) of <-160 dBm and Third Order Intercept (TOI) of typically +20 dBm, for more accurate spectrum clearing, radio alignment, and harmonic and distortion measurements. The 100 MHz modulation bandwidth, along with best-in-class phase noise of typically -110 dBc/Hz @ 100 kHz offset, permit highly accurate modulation measurements on digital systems to be made. A ±0.5 dB (typical) amplitude accuracy ensures highly confident measurements of transmitter power and spurious.

Anritsu Company had a big announcement for the wireless field test solution market with the introduction of the Field Master Pro™ MS2090A RF handheld spectrum analyzer. With the highest continuous frequency coverage up to 54 GHz, real-time spectrum analysis bandwidth up to 100 MHz, and a ruggedized design to withstand the demands of field test, the Field Master Pro MS2090A is ideal for a range of current and emerging field applications, including 5G, broadcast, regulatory compliance, aerospace/defense, satellite systems, and radar. Seven models are available with frequency coverage of 9 kHz to 9/14/20/26.5/32/44 and 54 GHz. The family features best-in-class performance, such as Displayed Average Noise Level (DANL) of <-160 dBm and Third Order Intercept (TOI) of typically +20 dBm, for more accurate spectrum clearing, radio alignment, and harmonic and distortion measurements. The 100 MHz modulation bandwidth, along with best-in-class phase noise of typically -110 dBc/Hz @ 100 kHz offset, permit highly accurate modulation measurements on digital systems to be made. A ±0.5 dB (typical) amplitude accuracy ensures highly confident measurements of transmitter power and spurious.

Cobham Wireless has delivered the first-ever city-wide digital Distributed Antenna System (DAS) network, capable of supporting a wide range of indoor and outdoor smart city and IoT applications, in Germany’s capital, Berlin. The company has created a blueprint for connecting and enabling the smart cities of the future, using its patented idDAS (intelligent digital DAS) technology and the C-RAN (Cloud/Centralised Radio Access Network) deployment model, which can share capacity across venues in a city, in a cost-efficient manner. Cobham Wireless’ idDAS now delivers scalable, high-capacity coverage to the Berlin Fan Mile, the Sony Center in Potsdamer Platz, and the Steigenberger Hotel. There are plans to further extend the system throughout 2019 and beyond, delivering coverage to a growing number of businesses and venues.

CommScope announced that they are collaborating with Nokia to develop passive-active antenna solutions which enable operators around the world to optimize tower space usage, increase cell site capacity and lay the groundwork for a 5G ready future. As operators seek ways to keep up with intense subscriber demand for mobile broadband, they must add capacity to existing radio technology layers. In many cases, as 5G roll-out momentum builds, 5G massive MIMO antennas capable of 3.5 GHz frequency bands may also need to be deployed at the same cell site. To address this requirement, CommScope and Nokia are developing new passive-active antenna solutions to significantly boost site capacity, while easing deployment considerations. The streamlined design of the passive-active antenna combines the capacity and beamforming benefits of massive MIMO adaptive antenna technology for 5G, as well as high performance antennas for existing radio technologies all within the available, often limited, cell site space.

Corning is developing RF products using their glass technology and showed their through glass vias process that creates high Q inductors to realize high performance filters. This follows their announcement last year of the development of through glass via packaging technology with Menlo Micro which achieved a major milestone in the development of its digital-micro-switch technology platform. The two companies have demonstrated the successful integration of through glass via packaging technology, enabling the expansion of Menlo’s high-performance RF and power products to ultra-small wafer scale packaging. They plan to introduce filters and antenna products using their RF glass process and think they can provide superior RF passive products for 5G applications for the high bands with insertion loss values in the 1.5 dB range which is much lower than competing technologies.

Dow Performance Silicones is known for polymer gaskets but now has entered into the EMI Shielding market. It is now applying its expertise to develop advanced silicone solutions that combine electrical conductivity with protection against EMI which is a growing challenge for engineers. As a backward-integrated chemistry powerhouse, Dow creates unique polymers with a combination of features and highly-tunable properties for wireless applications or devices that emit electromagnetic fields. The company’s advanced silicones are an excellent choice for meeting the varied challenges posed by today’s technologies because silicones maintain their properties over time and provide a precise balance of mechanical, electrical, and processing properties.

Filtronic announced a significant milestone leading up to the event as the company has shipped a total of 25,000 high-performance E-band transceiver modules since entering the market. The wide bandwidths available in E-band spectrum offer OEMs the ability to provide mobile network operators with multi-Gbps backhaul and fronthaul. E-band is now experiencing significant growth following its recent identification as one of the critical wireless technologies required to address the demanding backhaul capacity requirements of 5G networks. Systems containing Filtronic’s core E-band technology have been successfully demonstrated at data rates up to 40 Gbps.

Gapwaves is applying its proprietary Gapwaves waveguide technology to millimeter wave antenna arrays for 5G infrastructure. Gapwaves waveguide combines the low loss, steep filtering and thermal performance advantages of waveguide with a low-cost manufacturing process and the capability to integrate silicon or GaN front-end modules. A comprehensive discussion of the technology and demonstrated results was published in the February issue of Microwave Journal.

Gapwaves is applying its proprietary Gapwaves waveguide technology to millimeter wave antenna arrays for 5G infrastructure. Gapwaves waveguide combines the low loss, steep filtering and thermal performance advantages of waveguide with a low-cost manufacturing process and the capability to integrate silicon or GaN front-end modules. A comprehensive discussion of the technology and demonstrated results was published in the February issue of Microwave Journal.

Since refocusing its strategy on markets requiring differentiated process technologies, GLOBALFOUNDRIES has been strengthening its process portfolio and design tools for the wireless communications, automotive, optical networking and data center markets. At MWC19, Bami Bastani, senior VP, briefed Microwave Journal on the company’s extensive portfolio of silicon processes enabling RF and millimeter wave applications. The 22FDX® is a 22 nm SOI process with high ft/fmax that supports low power RF and millimeter wave applications, from Wi-Fi to automotive radar. The earlier generation 45RFSOI process is also a strong candidate for millimeter wave applications such as front-end modules and the beamforming ICs used in 5G phased array antennas. The 8SW RF SOI process is well suited for 4G and sub-6 GHz 5G front-end module components, including switches, tuners and low noise amplifiers. According to the company, the node has delivered more than $1 billion in design wins since it was launched in September 2017. Rounding out the wireless process portfolio, the 8XP, 8HP and 9HP SiGe BiCMOS nodes have long been used for millimeter wave applications, such as point-to-point radio and 5G fixed wireless access components.

To address the growing millimeter wave market for automotive radar and wireless infrastructure, Infineon has extended the performance of its internal SiGe BiCMOS process, increasing the fmax to 400 GHz, which improves the temperature stability of devices fabricated with the process. Well known for its 77 GHz automotive radar MMICs, Infineon is also developing MMICs for the 24 GHz ISM, 24/28 5G and 60 GHz unlicensed bands. Products include an integrated front-end with antenna for the 60 GHz band and a transceiver that covers 24 to 30 GHz with 18 dBm transmit power at 1 dB compression.

Although not RF, Infineon was highlighting an interesting time of flight (ToF) technology, comprising a module with a VCSEL that transmits infrared (at either 850 or 940 nm) and a image sensor array (with up to 100,000 pixels) that receives the reflected signal. The ToF module can be used for 3D scanning, AR/VR and secure facial recognition. The REAL3™ capability has been adopted by LG for the secure facial recognition in the G8ThinQ smartphone.

Keysight Technologies announced that more than 15 market leaders, including Qualcomm Technologies, Motorola Mobility (Lenovo), and Xilinx, used Keysight’s solutions to showcase their latest technology for 5G, IoT and connected car applications at the event. Keysight’s close collaborations across the mobile industry enable market leaders targeting first-to-market introductions to support both non-standalone (NSA) and standalone (SA) modes, through efficient technology development and design validation across sub-6 GHz and mmWave spectrum. The world’s top modem and device manufacturers have selected Keysight’s 5G network and channel emulation solutions to accelerate the first wave of commercial 5G smartphones, including: Qualcomm Technologies, Samsung, OPPO, Xiaomi, MediaTek, UNISOC (Spreadtrum) and Motorola Mobility.

Keysight Technologies announced that more than 15 market leaders, including Qualcomm Technologies, Motorola Mobility (Lenovo), and Xilinx, used Keysight’s solutions to showcase their latest technology for 5G, IoT and connected car applications at the event. Keysight’s close collaborations across the mobile industry enable market leaders targeting first-to-market introductions to support both non-standalone (NSA) and standalone (SA) modes, through efficient technology development and design validation across sub-6 GHz and mmWave spectrum. The world’s top modem and device manufacturers have selected Keysight’s 5G network and channel emulation solutions to accelerate the first wave of commercial 5G smartphones, including: Qualcomm Technologies, Samsung, OPPO, Xiaomi, MediaTek, UNISOC (Spreadtrum) and Motorola Mobility.

In addition, fellow O-RAN Alliance members showcased the industry’s first operating white box demonstration of an O-RAN 5G radio unit (RU), using Keysight’s end-to-end visibility, validation and performance test capability across RF and protocol measurement domains. Keysight showcased end-to-end solutions that enable users to accelerate 5G innovation including:

- IxLoad 5G core test engine – validates the user quality of experience by emulating massive UE traffic in a lab environment

- 5G base station manufacturing test solution – streamlines high-volume test of 5G NR infrastructure equipment and radio components

- 5G mmWave waveform generation and analysis testbed – accelerates base station characterization and 5G mmWave MIMO test across the product lifecycle

- Keysight’s PROPSIM 5G channel emulation solutions – designed for end-to-end realistic and repeatable real-world performance testing of 5G multi-mode devices and base stations in a lab environment

- Nemo Outdoor 5G NR drive test solution – scalable drive test and benchmark tools for measuring and monitoring wireless networks, now compatible with the Qualcomm X50 modem for 5G NR measurements

Keysight launched several new solutions that address the complexities introduced by new technologies, including wider bandwidths in mmWave spectrum, massive MIMO and beamforming. These solutions support faster commercial 5G deployments, allowing mobile operators to capture early market opportunities:

- Industry First Integrated Dual Channel 44GHz Vector Signal Generator with 2GHz Bandwidth – high-performance VXG microwave signal generators that address the most demanding wideband millimeter wave (mmWave) applications for 5G and satellite communications

- Nemo Intelligent Device Interface – connects LTE-A and 5G smartphones to Nemo Outdoor drive testing solution and Nemo Invex II benchmarking solution respectively, enabling mobile operators to perform accurate network field testing

Kumu Networks enables full duplex radios using analog RFICs and digital logic to cancel out the transmit signal and local reflections at the receiver, even in a dynamically changing environment. Self-Interference Cancellation makes it possible to transform a half-duplex radio into a full-duplex radio operating in the same spectrum with twice the throughput. Full-duplex radios are particularly desirable for backhaul links and point-to-multipoint networks. Their solutions can operate to 20 W with up to 80 MHz of bandwidth (160 MHz is in development). They showed us the initial products they are delivering for cellular networks and discussed other applications such as mesh networking, radio co-existence and spectrum sharing.

Laird Connectivity announced a flexible PCB antenna with a broad frequency range for LTE CAT M1 and NB-IoT devices. The new Revie Flex is designed for quick and easy mounting to a plastic housing. The highly efficient (>51%) PCB antenna features omnidirectional pattern coverage optimized for LTE CAT M1 and NB-IoT devices at 698-875 MHz and 1710-2500 MHz frequency bands. The combination of flexibility, multiple frequency bands, and an omnidirectional antenna pattern enables the Revie Flex to deliver higher performance in a variety of integration environments.

Unlike the broad measurement companies, LitePoint focuses on test systems for manufacturing, offering simplified yet complete test solutions for specific markets. At MWC19, LitePoint exhibited systems for the full range of wireless standards: 5G millimeter wave, Wi-Fi including WiGig, Bluetooth and ultra-wideband (UWB). The IQgig-5G is an integrated, non-signaling test system with up to 1 GHz test bandwidth for 5G components operating at 28 and 39 GHz. The single box contains all signal generation, analysis and RF front-end hardware, and the user software and license can be upgraded to comply with the evolving 3GPP standards. Also a single box system, the IQgig™ provides physical-layer testing for 802.11ad and ay (WiGig) modules and final products and is useful for R&D characterization and production, supporting a seamless transition from lab to manufacturing.

In early 2018, MACOM announced that STMicroelectronics would be its fab partner to ensure adequate capacity for GaN on Si power amplifiers for sub-6 GHz 5G base stations. With the imminent rollout of 5G this year, the companies announced that ST is adding production capacity for 150 mm wafers at its fab in Catania, Italy. MACOM will contribute some $23 million and ST will make a similar investment. MACOM is betting GaN on Si beats LDMOS and GaN on SiC for the power amplifiers in massive MIMO systems, saying the technology, when manufactured on 150 mm wafers in a high volume silicon fab, provides higher efficiency at lower cost than LDMOS. While MACOM has begun initial shipments of GaN on Si PAs using its own fab and the GCS foundry, it can’t support projected demand and pricing without capacity from a high volume fab. MACOM estimates a 32x to 64x increase in the number of power amplifiers — more than triple the dollar content — over the initial five years of 5G infrastructure buildout. Ensuring adequate fab and assembly capacity has been a longstanding concern of wireless infrastructure equipment manufacturers, as the industry has experienced high peak demand during the rollout of new cellular generations.

At last year’s MWC, Movandi announced the BeamX front-end modules for 28 and 39 GHz base stations, small cells and mobile broadband access points. The BeamX module integrates the power amplifier, low noise amplifier, up- and down-converters and frequency synthesizer/phase-locked loop for the designated band. Timed for MWC19 Barcelona, Movandi introduced the BeamXR, a system-level repeater developed to solve non-line-of-sight, high path loss and self-installation challenges. The BeamXR will be used between the base station and user equipment to improve coverage by spreading the beam, bending it around buildings or obstructions and improving penetration through low-emissivity glass. The BeamXR is a standalone solution with donor and relay antenna arrays, synchronization and signal processing. Separately, Movandi and NXP announced a joint partnership to collaborate on millimeter wave solutions for 5G networks, combining Movandi’s RF module and system expertise with NXP’s digital networking and signal processing capabilities.

To meet the data capacity needs for backhaul and fronthaul using millimeter wave radio links, NEC is extending its line of point-to-point radios to D-Band (110 to 170 GHz), including the MMIC and module components that power them. The company’s researchers are investigating orbital angular momentum (OAM) to increase the capacity of the radio without needing high-order QAM modulation. In December, NEC reported achieving 7.4 Gbps over a 40 m link at E-Band using 256-QAM and multiplexing eight OAM modes. The company is extending this OAM research to D-Band, setting the goal to achieve a spectral capacity of 128 bps/Hz over a 100 m link by the end of this year.

NI and Spirent Communications announced their collaboration to develop test systems for 5G New Radio (NR) devices. The collaboration will allow 5G chipset and device manufacturers to validate the performance of 5G NR smartphones and IoT devices in the lab without requiring access to expensive and complex 5G base stations (gNodeBs). Spirent Communications has adopted NI’s flexible software defined radio (SDR) products in the development of its 5G performance solution. Spirent’s solution will employ NI’s USRP (Universal Software Radio Peripheral) devices and mmWave Transceiver System and will include 5G NR test scenarios for mobile location, video, data, audio, and calling performance. Key architectural details of the solution include the use of LabVIEW FPGA to emulate layer 1 through layer 3 of the 5G NR protocol stack.

NI and Spirent Communications announced their collaboration to develop test systems for 5G New Radio (NR) devices. The collaboration will allow 5G chipset and device manufacturers to validate the performance of 5G NR smartphones and IoT devices in the lab without requiring access to expensive and complex 5G base stations (gNodeBs). Spirent Communications has adopted NI’s flexible software defined radio (SDR) products in the development of its 5G performance solution. Spirent’s solution will employ NI’s USRP (Universal Software Radio Peripheral) devices and mmWave Transceiver System and will include 5G NR test scenarios for mobile location, video, data, audio, and calling performance. Key architectural details of the solution include the use of LabVIEW FPGA to emulate layer 1 through layer 3 of the 5G NR protocol stack.

Narda Safety Test Solutions recently released an equivalent remote-controlled version of its SignalShark at an attractive price/performance ratio. This new Real-Time Remote Analyzer detects and analyzes, classifies and localizes RF signals in the frequency range between 8 kHz and 8 GHz to the highest degree of precision and reliability. It has been modified and optimized for universal applications requiring efficient, centrally-controlled monitoring of systems, the components of which may be widely spaced and spread out over a large area. The module solves complex measurement and analysis problems, thanks to its high RF performance (i.e. super sensitivity, yet with high immunity to overmodulation), ITU compliance, reliability, and speed. Within its 40 MHz real-time bandwidth, the SignalShark Remote Module is capable of detecting even brief pulsed signals with a duration of as little as 3.125 µs with 100% POI (probability of intercept), i.e., without any gaps. They also recently updated their RF safety device, the RAD Man 2. The replaces the previous version with protection in any field environment that displays a warning and the actual level of radiation detected according to the various standards used around the world. It now runs for up to 800 hours.

Although we didn’t hear much from NXP while Qualcomm was attempting to acquire the company, NXP was diligently investing in new products to strengthen its position in RF markets — particularly anticipating the arrival of 5G. A reorganization last fall combined the RF power segment NXP acquired from Freescale with NXP’s small-signal RFIC business to create a single business unit and an integrated strategy. That strategy is targeting 5G millimeter wave fixed wireless access, using NXP’s internal SiGe process, and sub-6 GHz base station power, using either the company’s mature LDMOS process or a proprietary GaN process jointly fabbed by NXP and an external foundry.

For the 5G millimeter wave bands, NXP believes the performance of its SiGe process — with +18 to +19 dBm peak output power — enables the “sweet spot” of EIRP and array size, i.e., between a larger array required by competing silicon ICs and a smaller but more expensive array using GaN front-end modules. NXP has developed a four-channel RFIC for 28 GHz, integrating the PA, LNA, phase shifter and switch, and is designing companion RFICs for the 24 and 39 GHz bands. For the 5 W average power amplifiers used in sub-6 GHz massive MIMO base stations, NXP gives its LDMOS technology the edge to 4 GHz. Above 4 GHz, GaN wins.

Complementing the millimeter wave strategy, NXP announced a joint partnership with Movandi to collaborate on millimeter wave solutions for 5G networks, tapping Movandi’s RF module and system expertise.

Perhaps the most interesting approach to millimeter wave fixed wireless access infrastructure is the solution developed by Pivotal Commware based on their Holographic Beam Forming® technology. The concept comprises an antenna array printed on a PCB with a single biased control component, such as a varactor diode, at each element. The incoming RF signal is steered by biasing the control components at each element, achieving ±70 degree steering in azimuth and ±35 degrees in elevation. The entire assembly is inexpensive, thin and light weight, with very low power consumption. An initial application of the Holographic Beam Forming technology is the Echo 5G® repeater, designed to overcome millimeter wave signal loss through glass windows, either from reflection or attenuation. The same repeater capability is also being applied to help service providers fill in dead zones obstructed or not in the line of sight between millimeter wave access points. Prior to MWC19, Pivotal announced it has joined the O-RAN Alliance, so its technology can be considered in the development of standards and reference designs.

Qorvo made several announcements tied to MWC19, beginning with smartphone design wins for the company’s latest RF Fusion™ front end modules. Qorvo said it has design wins with the top six mobile phone suppliers, reflecting a strategy to diversify and increase overall market share. Qorvo’s strength is in the mid and high LTE bands, where the company’s differentiated BAW filters can be combined with power amplifier and switches in highly integrated modules. Reflecting the announcements of 5G smartphones from numerous suppliers, Qorvo said its portfolio of 5G front-end modules, antenna-plexors and switches is ramping to high volume production. These include the QM78203 for 5G bands n77, n78 and n79; the QM75041 for band n41 and the QM77038 mid/high band module. Qorvo appears to be taking a “wait and see” position on millimeter wave components in the handset, initially ceding that ground to Qualcomm. Qorvo sees a small market for handsets with millimeter wave functionality, today limited to the U.S. China, which would certainly drive demand, has not yet decided how to use millimeter wave spectrum, evaluating its use through a Ministry of Industry and Information Technology (MIIT) study.

In contrast to the handset strategy, Qorvo is aggressively pursuing 5G infrastructure opportunities at both the sub-6 GHz and millimeter wave bands, developing all-GaN front-end modules for 28 and 39 GHz. The company said its 28 GHz products were used by Samsung in the 5G MIMO demo at the 2018 Winter Olympics. For sub-6 GHz, Qorvo released three new products: a dual-channel switch LNA module, ultra-low noise figure LNA and Doherty power amplifier. To underscore its strong position supporting 5G infrastructure, Qorvo touted shipping more than 100 million wireless infrastructure components for 5G since January of 2018 — an impressive volume.

Declaring the confluence of 5G, AI and cloud computing as the dawn of the “invention age,” Qualcomm arguably made the most new product announcements tied to MWC19, covering virtually all aspects of the 5G ecosystem. At the center of its 5G play, the company introduced the Snapdragon X55 5G modem, the second-generation 5G NR modem, supporting the sub-6 GHz and millimeter wave bands. A single 7 nm chip, the X55 supports all cellular standards from 5G back to 2G. As impressive, the company announced the second-generation of its millimeter wave antenna module for handsets. The QTM525 is thinner, fitting in smartphones 8 mm thick, and covers bands n257 (28 GHz), n258 (26 GHz), n260 (39 GHz) and n261 (U.S. 28 GHz). Qualcomm extended its envelope tracking solution to support the wide 100 MHz uplink bandwidth and 256-QAM modulation used with 5G NR, extending envelope tracking to 5G. Addressing industry concerns that the battery life in 5G phones will be substantially less than the day-long battery life consumers experience with 4G phones, Qualcomm introduced 5G PowerSave. It uses the connected-mode discontinuous reception (C-DRX) feature in the 3GPP specifications with additional system-level techniques to enhance battery life, claiming comparable 5G phone performance to Gigabit LTE devices. Qualcomm’s president Cristiano Amon said 5G PowerSave “puts to rest industry concerns about battery life.”

Declaring the confluence of 5G, AI and cloud computing as the dawn of the “invention age,” Qualcomm arguably made the most new product announcements tied to MWC19, covering virtually all aspects of the 5G ecosystem. At the center of its 5G play, the company introduced the Snapdragon X55 5G modem, the second-generation 5G NR modem, supporting the sub-6 GHz and millimeter wave bands. A single 7 nm chip, the X55 supports all cellular standards from 5G back to 2G. As impressive, the company announced the second-generation of its millimeter wave antenna module for handsets. The QTM525 is thinner, fitting in smartphones 8 mm thick, and covers bands n257 (28 GHz), n258 (26 GHz), n260 (39 GHz) and n261 (U.S. 28 GHz). Qualcomm extended its envelope tracking solution to support the wide 100 MHz uplink bandwidth and 256-QAM modulation used with 5G NR, extending envelope tracking to 5G. Addressing industry concerns that the battery life in 5G phones will be substantially less than the day-long battery life consumers experience with 4G phones, Qualcomm introduced 5G PowerSave. It uses the connected-mode discontinuous reception (C-DRX) feature in the 3GPP specifications with additional system-level techniques to enhance battery life, claiming comparable 5G phone performance to Gigabit LTE devices. Qualcomm’s president Cristiano Amon said 5G PowerSave “puts to rest industry concerns about battery life.”

Fabless mobile filter start-up Resonant showed “hot off the press” results of its XBAR ™ bulk acoustic resonator filter technology, which it says handles the wider sub-6 GHz 5G passbands with lower insertion loss and steeper filter skirts than the BAW technologies used by Broadcom and Qorvo. Resonant says XBAR has the strongest acoustic coupling of any technology and is better for high power applications, as the interdigitated metal fingers don’t move, which the company says is the failure mechanism for BAW filters. Data from an initial filter design covered 4.716 to 5.138 GHz, 8.6 percent bandwidth, with 1.5 dB insertion loss at the center of the band. Resonant says the manufacturing process steps for the XBAR filters are standard for MEMS manufacturing and the substrates are starting to become available. However, Resonant doesn’t manufacture SAW or XBAR filters. Describing itself as a licensing company, it uses its proprietary, finite-element modeling software — branded Infinite Synthesized Networks® — to design filters for customers that are manufactured by third-party fabs. Resonant’s business model is to collect royalty revenue on the production volumes.

Rohde & Schwarz had 2 booths covering solutions for 5G NR, mobile networks and the IoT to wireless connectivity and connected cars. R&S showcased its solutions for signaling and non-signaling testing of 5G NR devices, including two new wireless communication testers. Since traditional testing is not suitable for the active antenna systems used in upcoming devices, R&S has developed innovative OTA test solutions based on shielded test chambers. This includes a solution for testing in extreme temperatures ranging from –40 ° to +85 °C, as well as a compact antenna test range setup (CATR) for device verification and conformance testing. The company also displayed novel cloud-based testing concepts that leverage the benefits of cloud computing for advanced test applications. Automated test scenarios, e.g. for 5G NR base station testing, benefit from fast data processing for signal analysis.

Rohde & Schwarz had 2 booths covering solutions for 5G NR, mobile networks and the IoT to wireless connectivity and connected cars. R&S showcased its solutions for signaling and non-signaling testing of 5G NR devices, including two new wireless communication testers. Since traditional testing is not suitable for the active antenna systems used in upcoming devices, R&S has developed innovative OTA test solutions based on shielded test chambers. This includes a solution for testing in extreme temperatures ranging from –40 ° to +85 °C, as well as a compact antenna test range setup (CATR) for device verification and conformance testing. The company also displayed novel cloud-based testing concepts that leverage the benefits of cloud computing for advanced test applications. Automated test scenarios, e.g. for 5G NR base station testing, benefit from fast data processing for signal analysis.

Other highlights included the first mobile network testing solution for 5G NR, enabling operators and infrastructure vendors to measure 5G NR network coverage, performance and operation to ensure that when 5G transitions from trial networks to commercial deployment are made, these networks deliver the required performance and quality.

Rohde & Schwarz presented mobile network testing solutions that enable operators to seamlessly cover test scenarios and technologies over the entire network lifecycle from the lab to the field. One of the highlights is the Smart platform, a software suite that combines high-quality data acquisition with intelligent analytics to generate QoE-centric network insights, allowing operators to identify critical factors influencing network performance.

R&S also provides comprehensive test solutions that cover IP security to production. R&S performed NB-IoT field-to-lab testing under real network conditions, evaluate NB-IoT power consumption under real-world conditions and present IP security solutions at the event. In terms of wireless connectivity, Rohde & Schwarz will demonstrated two firsts: the first Bluetooth® Low Energy (BLE) testing solution covering both direct test mode (DTM) and over-the-air tests under signaling conditions and the first solution for WLAN IEEE 802.11ax 2x2 MIMO signaling testing.

Rohde & Schwarz has developed a strong portfolio for the automotive industry and its suppliers. These state-of-the-art test and measurement solutions for C-V2X testing in R&D and production using well-established wireless communication testers from Rohde & Schwarz and were on display.

Fabless SiGe RFIC supplier Sivers IMA develops transceiver MMICs for the 5G millimeter wave and unlicensed 60 GHz bands, targeting infrastructure and CPE applications. At MWC19, the company demonstrated its products jointly with Blu Wireless and Fujikura. One demo showed 1.2 Gbps data rates over a 400 MHz channel at 28 GHz using Sivers’ RFIC and antenna. Fujikura demonstrated a 5G NR patch antenna incorporating two Sivers RFICs tiled on each antenna. Prior to MWC, Sivers and Blu Wireless announced a demonstration achieving 1 Gbps over a 700 m link at 60 GHz. Reflecting the growing market opportunity for Sivers, Blu Wireless announced a contract with FirstGroup U.K. to connect First Rail trains to terrestrial infrastructure with 60 GHz links. The Blu Wireless base stations use Sivers IMA transceivers. The transceiver is also integrated into CPE equipment supplied by Blu Wireless to the U.K.’s CCS for the company’s 60 GHz, 360-degree MetNet Node access point and home unit.

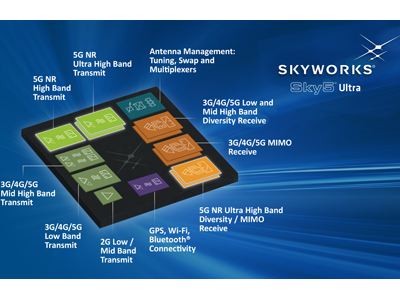

Skyworks Solutions launched its most advanced 5G cellular architecture yet, the Sky5™ Ultra. The company has developed a fully integrated, baseband agnostic solution that combines all of the critical front-end functionality required to enable high performance 5G mobile devices with global coverage in a very compact form factor. The platform features best-in-class transmit and receive capabilities with unprecedented efficiency and output power, enabling highly reliable network connections while optimizing battery life—both critical for 5G applications. In addition, the Sky5™ Ultra leverages DSBGA packaging, dramatically reducing the footprint, and advanced TC-SAW and BAW filtering providing the best performance at each targeted frequency band. The solution also supports up to 100 MHz wide bandwidth, maximizing data throughput at ultra-fast speeds.

Skyworks Solutions launched its most advanced 5G cellular architecture yet, the Sky5™ Ultra. The company has developed a fully integrated, baseband agnostic solution that combines all of the critical front-end functionality required to enable high performance 5G mobile devices with global coverage in a very compact form factor. The platform features best-in-class transmit and receive capabilities with unprecedented efficiency and output power, enabling highly reliable network connections while optimizing battery life—both critical for 5G applications. In addition, the Sky5™ Ultra leverages DSBGA packaging, dramatically reducing the footprint, and advanced TC-SAW and BAW filtering providing the best performance at each targeted frequency band. The solution also supports up to 100 MHz wide bandwidth, maximizing data throughput at ultra-fast speeds.

Skyworks also announced a partnership with Intel Corporation to create leading-edge 5G communications engines for a broad array of end markets. Initial modem-to-antenna products will support LTE and 5G architectures for mobile, wearable, automotive, M2M, tablet/PC, smart home and Internet of Things (IoT) applications, facilitating faster data rates, enhanced power efficiency and unprecedented product footprints. Skyworks Solutions also announced that MediaTek is utilizing its Sky5™ suite for their new 5G reference platforms. Skyworks’ complete 5G front-end architecture is being combined with MediaTek’s 5G baseband chipset to deliver highly integrated solutions targeting open market mobile products. The comprehensive sub-6 GHz system enables high-speed network experiences with optimized efficiency and near zero latency, empowering revolutionary emerging applications.

Sky and Space Global (SAS) is the first company to plan, build and operate a telecommunication commercial network over Nano-Satellites. Following the successful launch of its 3 first satellite (the 3 diamonds) SAS plan to launch 200 satellites, providing equatorial coverage and beyond. The satellites are placed carefully in synchronized orbits that circle the earth almost every hour and half. The satellites communicate between each other and each satellite beams down to in a circular footprint. The constellation thus creates a mesh in the sky where each satellite serves as both as a base station and a router. SAS operates in the S-band frequency range that enables a very small device with patch antenna (8 cm) or monopole antenna and low power consumption. The network of SAS is a narrow band communication network suitable for IoT, M2M, personal voice and messaging. Their nano-Satellites are fully operational satellites with a mass of less than 10 kg. Due to miniaturization of technology, Nano-Satellites are capable of providing accurate altitude and orbit control and communication services. They showed us some low cost hotspots used to track and provide services to vehicles such as trucks for the transportation industry.

Taoglas announced the launch of the Taoglas NR KSF.410, a new 5G millimeter wave beam-steering antenna targeting frequency bands 27.5 to 28.35 GHz. It is the first antenna utilizing beam-steering chipsets from Analog Devices. Taoglas’ beam-steering technology found in the KSF.410 array and chipset combination is configured to work with an algorithm to provide dynamic beam control. This new antenna array means the solution has extremely robust amplitude and phase control with very fine beam tuning. This can help to increase the link quality and deliver the best signal propagation and reception to power the next generation of uses cases that demand extreme data speeds and capacity as well as higher reliability and lower latency. They also announced the launch of the Taoglas iDAS antennas with superior PIM performance, two new MIMO LTE antennas designed for use in indoor distribution antenna systems (iDAS) to address in-building coverage issues and increasing demand for constant connectivity for indoor locations such as office buildings, stadiums, conference centers, shopping malls, hotels and other areas where high-performance indoor connectivity is required.

For the first time, Wolfspeed was at MWC, reflecting last year’s acquisition of the Infineon RF power business by Cree, Wolfspeed’s parent. In discussions with network equipment manufacturers, Wolfspeed was promoting three new GaN power transistors developed for the 3.6 to 3.9 GHz 5G bands . Operating at 48 V, the asymmetric and symmetric Doherty devices provide from 30 to 50 W average power, power levels and frequencies where “GaN wins” over LDMOS.

Leading up to MWC19, Xilinx announced the second- and third-generations of the Zynq® UltraScale+™ RF SoC portfolio. With production scheduled for June, the second-generation product, which supports the n79 band, is timed for 5G NR deployment in Asia. The third-generation family, which will be available during the second half of 2019, extends sampling rates to 6 GHz. It can also be used with block converters to process the millimeter wave 5G bands. Compared to the first-generation, the latest RF SoC reduces power and footprint by up to 50 percent, making it well suited for massive MIMO base stations. Beyond 5G, the portfolio includes RF SoCs for cable access, phased-array radar, satellite communications and test and measurement applications. At MWC19, the Xilinx booth hosted a demonstration of an O-RAN Alliance millimeter wave “white-box” 5G radio unit. This proof-of-concept demo was developed by Xilinx and other O-RAN alliance members, including Anokiwave.

Leading up to MWC19, Xilinx announced the second- and third-generations of the Zynq® UltraScale+™ RF SoC portfolio. With production scheduled for June, the second-generation product, which supports the n79 band, is timed for 5G NR deployment in Asia. The third-generation family, which will be available during the second half of 2019, extends sampling rates to 6 GHz. It can also be used with block converters to process the millimeter wave 5G bands. Compared to the first-generation, the latest RF SoC reduces power and footprint by up to 50 percent, making it well suited for massive MIMO base stations. Beyond 5G, the portfolio includes RF SoCs for cable access, phased-array radar, satellite communications and test and measurement applications. At MWC19, the Xilinx booth hosted a demonstration of an O-RAN Alliance millimeter wave “white-box” 5G radio unit. This proof-of-concept demo was developed by Xilinx and other O-RAN alliance members, including Anokiwave.

We also had the pleasure to meet with Ana Tavares Lattibeaudiere, head of GSMA North America to discuss the upcoming MWC19 Los Angeles. She said the event would lean toward media applications due to the local focus of movies and TV. The event takes place Oct 22-24 moving from its previous Las Vegas location to LA.

It was an exciting year at MWC19 with crowds that should have exceeded last years’ record attendance as the first year of 5G starts and flexible screens launch foldable and wrap around, wrist wearable phones. Look for our full event summary plus pictures and videos coming soon.