Describe the mission of Gapwaves. What market impact are you aiming for as a company?

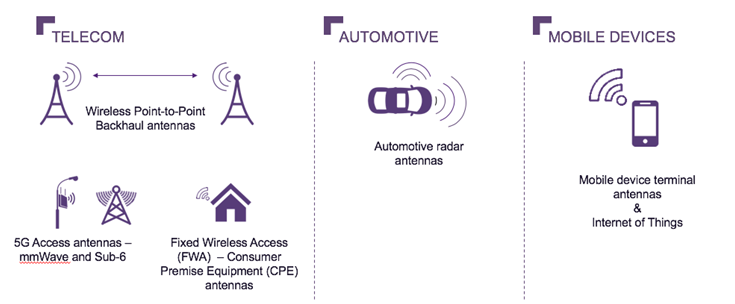

Our mission is to develop and sell antenna products based on the patented gap waveguide technology in three business areas: telecom, automotive and mobile devices.

Our vision is to become a leading provider of wireless technology — antennas — and contribute to a faster and more efficient implementation of 5G for the telecom industry and major improvement of radar technology for the automotive industry, going for autonomous driving. We also have promising technology for mobile devices at a research stage.

Gapwaves offers wireless communication solutions based on the gap waveguide technology, with great potential for millimeter wave antennas that can be applied to telecom 5G systems and automotive radars. The most important impact is very low loss compared to PCB-based patch antennas, and our advantages increase with higher frequency.

In a 5G millimeter wave solution at 28 GHz, our technology provides the opportunity to make a phased array antenna with integrated circuits, such as a GaN PA and LNA, making an antenna product with EIRP levels of 65 dBmi and beyond, as well as handling the thermal situation. This means better coverage — at least 10 km range — from a 28 GHz base station.

In an automotive radar solution at 77 GHz, our unique antenna technology improves the range due to lower feed losses and higher antenna gain compared to patch antennas and enables a compact form factor with our 3D building practice, i.e., with all active components placed within the antenna aperture.

What is the story of Gapwaves’ formation?

Gapwaves was founded in 2011 to commercialize the research and patents around the gap waveguide technology from Professor Per-Simon Kildal and his team at Chalmers University of Technology in Gothenburg, Sweden. Before that, Professor Kildal had spent over 25 years in research around microwave and antenna technology, which had resulted in numerous patents, inventions and companies. Bluetest is a successful company selling reverberations (anechoic) chambers for OTA (over-the-air) testing, founded by Professor Kildal in 2010. Bluetest is well-known within the telecom industry.

In late 2016, Gapwaves was listed on Nasdaq First North in Stockholm, and a rights issue to fund the growth of the company was conducted. Shortly thereafter, several people with long-time experience from the industry were recruited to commercialize the gap waveguide technology into antenna products, in particular for millimeter wave telecom and automotive radar applications.

You’ve said your products are based on the unique gap waveguide technology. Tell us about the technology and what makes it compelling.

The technology enables multilayer waveguide solutions having extremely low losses and operating from below 10 GHz to THz for various applications. The technology is based on an artificial magnetic conductor (AMC) that replaces the waveguide walls in a rectangular or ridge waveguide structure, thus creating the low loss transmission lines without the need for brazing, soldering or gluing together the parts. This enables very efficient and low-cost, high volume manufacturing, which is crucial for this type of application.

Antennas based on the gap waveguide technology have over ten times lower loss than microstrip lines, over three times lower loss than SIW (substrate integrated waveguide) and approximately the same loss as rectangular waveguide. The gap waveguide technology has unique possibilities for creating tightly integrated solutions, including planar antennas, filters, diplexers and other components. Gap antennas with integrated electronics are highly suitable for beamforming applications.

The superior performance of the gap waveguide technology, both as a transmission line for making advanced microwave circuits and as a packaging technology, have been verified and described in a large number of scientific journal articles, letters and conference papers.

You’ve talked about applying the gap waveguide platform to develop antennas for various markets. In general, what system-level benefits do they provide?

For any antenna containing electronics that needs to be tightly integrated, as in all of the mentioned applications, the gap waveguide technology provides system-level advantages in terms of extremely low loss for the transmission lines and transitions from chip to waveguide and, at the same time, enabling very good cooling capabilities, as the whole structure is made of aluminum or zinc.

On top of this, the AMC structure is also used for replacing shielding walls in closed compartments, as is common in every electronics-equipped microwave or millimeter wave component, thus freeing up valuable surface for component routing. All in all, the system-level performance is increased significantly due to the lower loss on the transmitter and receiver and, thereby, improving system gain and increasing power efficiency.

Considering a millimeter wave phased array base station for 5G, describe how your antenna will be integrated with the RF front-end, beamforming and baseband processing elements of the radio.

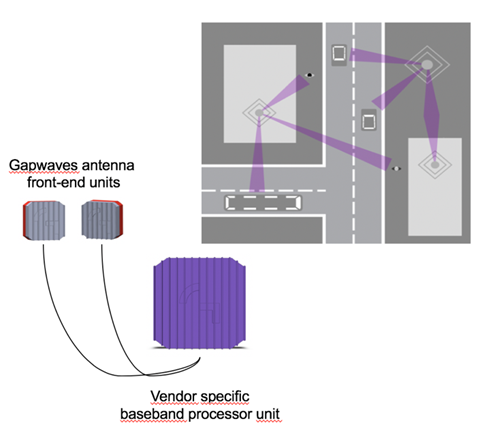

The Gapwaves 5G millimeter wave active antenna system is a highly integrated antenna array system with outstanding power efficiency, capable of analog or digital beamforming. The Gapwaves antenna is integrated in vendor-specific, all outdoor antenna units or deployed as front-end units connected to a vendor-specific baseband processor unit.

The RF front-end connects directly to the waveguide structure through a specific gap waveguide transition having virtually no loss, thus maintaining high efficiency for the transmit chain and high sensitivity for the receiver. Within the same millimeter wave building structure, the beamforming circuits are connected and shielded by a gap waveguide AMC structure to avoid the use of regular shielding walls. Analog, hybrid or full digital beamforming circuits are used for optimizing power consumption, bandwidth and the size of the antenna. An analog or fully digital high speed interface connects to the vendor-specific baseband board.

In some of the emerging markets you’ve targeted (e.g., 5G and automotive radar), multiple, distinct technologies are being integrated, blurring the traditional supply chain. Do you see your customers as the network equipment and radio manufacturers? Will you supply products or, perhaps, license your technology?

The technology developed by Gapwaves has shown very good performance for the high frequencies that both 5G and vehicle radar are using. The company's antenna technology is patented, tested and verified and, for a company in our position, there are two main business models to choose from to commercialize the technology:

- Be a component supplier.

- License our IP.

In the telecom and automotive business areas, we have chosen to position Gapwaves as an independent component supplier to secure our leadership, independence and control of the delivered products. We are open to an alternative business model, such as licensing our IP with a volume-based royalty when there are clear benefits in cooperation with our customers.

Our antenna solutions represent a small but very important part of a complex system. Our prospective customers are primarily global system suppliers of telecom and radar solutions.

Given the cost pressures in markets such as 5G and automotive radar, how will you manufacture your products to meet these expectations?

One major advantage of the gap waveguide technology is its ability to be manufactured using well-known, low-cost manufacturing methods such as die casting and injection molding in plastic, zinc or aluminum. Compared to automotive radars with patch antennas, we can reduce cost while increasing the performance and reducing the size of the radar. In discussions with customers in both 5G and automotive markets, low-cost manufacturing is essential; high performance is not enough if it is not at a competitive price.

In high volumes, typical for the automotive industry, we believe we can offer both increased performance and reduced price compared to current alternatives, which obviously is an attractive combination for our customers.

You’ve said your waveguide technology is capable of supporting applications into the THz frequencies. What determines the upper limit? Are you seeing any interesting applications in the THz region?

The upper limit is defined by the manufacturing technology setting the tolerances of the AMC structure. For frequencies above 100 GHz, different manufacturing technologies are applied, such as silicon MEMS lithography or specific molding technologies. Circuits up to 500 GHz have been manufactured with good results.

The THz region offers some very interesting applications such as THz imaging, point-to-point radios (when new frequencies have been decided at WRC in 2019) and also various near-field sensors in the range of 120 to 500 GHz.

Give us a snapshot of the financial side of Gapwaves, such as your revenue, growth, profitability, number of employees.

Gapwaves is still in a product development phase, on the verge of commercializing our technology. Historical annual revenues have been around SEK 1 million to SEK 3 million ($110,000 to $329,000) with negative profits and cash flow. From the beginning of 2017, the number of employees has grown from five persons to approximately 25 people, including consultants. As a publicly traded company, we have not yet published any forecasts, as profits and cash flow are not expected to be positive until 2021.

Our way forward will be financed via proceeds of SEK 110 million from a rights issue that was closed in Q2 of 2018. Our revenues are also expected to increase as we enter into customer financed development projects, although such revenues will be offset by corresponding costs. As we expect our technology to be an integrated part in, for example, next-generation automotive radars that will be on the market in 2020 or 2021, revenues and profits are expected to increase radically, supported by high volumes in these markets.

What was the path that led you to Gapwaves and the role of CEO?

I started with a business development project for Bluetest AB (also funded by Professor Kildal) in October 2013, to introduce their technology of OTA testing to the automotive industry. Per-Simon and I started to cooperate in early 2014, as he was seeking a business-driven, experienced leader who could commercialize his inventions, such as the gap technology. We both felt a very good fit, he the experienced innovative inventor and me technical but very experienced in sales and business development with global customers.

We worked together closely with the development of the company until April 2016. Then Per-Simon suddenly, sadly passed away. It was a difficult situation, but I proposed the family continue the path Per-Simon and I had planned, going for a listing at Nasdaq First North to get funding for the business development. In November 2016, I was formally employed as the CEO of Gapwaves, and we made the IPO on Nasdaq First North, 18 November 2016.

The company has since grown a lot, with many experienced employees, and the brand and the technology have been very well received at many customers in the telecom and automotive industries. Average daily trading volume was 190,000 shares per day from September 2017 through January 2018 and, today, we have over 5,000 shareholders. Approximately 25 million shares implies a market capitalization of almost €40 million.

During my years together with Per-Simon, we developed many important relationships — academia, Chalmers University, global associations of antennas and other industrial connections — as global customers and distributers.

I do have over 30 years of experience from very interesting and exciting jobs, but this one is really my favorite. Building a global company based on disruptive, genuine invented technology which really makes a difference is fascinating!