Figure 1 Strategies to address the counter-UAS opportunity in the civilian sector.

The success of unmanned aerial systems (UAS) in providing real-time information to military commanders has contributed to both mission effectiveness and protecting personnel. The expansion of commerical UAS could bring about disruptive uses, intentional or not, as well as their use in asymmetric warfare. Combating these potential threats will require a new front in electromagnetic spectrum operations. As a starting point, we can address some of the key issues that will define both the utilization and countering of drones, in terms of some of the broader issues that need to be addressed across both defense and commercial applications. The ability to manage spectrum within current and next generation networks requires an understanding of bandwidth optimization, latency and the underlying economics, underpinned by the use of more complex modulation, phased arrays and other approaches designed to increase spectral efficiencies, which will enable UAS use and provide strategies to monitor and counteract the use of drones.

The RF payloads, ground systems and jamming and monitoring capabilities of counter-UAS systems need to be optimized from the antenna to baseband, and this requires an understanding of which technologies span the RF front-end to the digital backend. Monitoring of the environment will evolve beyond fixed or portable systems to include handheld units constrained by size, weight and power (SWaP) to optimize battery life, which in turn requires an understanding of advances across baseband and application processes, displays, memory and other components. Ultimately, this will push semiconductor requirements toward higher frequencies and broadband performance of the RF front-end, with the range of technologies offering trade-offs in monolithic or modular integration. Digital processing requirements will also increase, and this will come with the expectation that there is no compromise on power consumption—ideally, power consumption decreases.

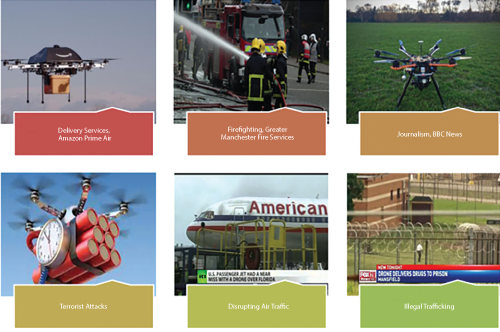

The potential market for counter-UAS platforms requires understanding where the system demand is presently on the growth curve and how forthcoming opportunities are best addressed. As military system suppliers attempt to migrate their experience in the defense sector to address the counter-UAS opportunity in the civilian sector, they will need to implement four primary strategies (see Figure 1):

- Scale—achieved through either consolidation or manufacturing strategies that include partnerships, to enable full solution sets for counter-UAS solutions.

- Integrate and incorporate—to bring together technologies and subsystems that provide integrated solutions, to meet the needs of the end market, which may also involve moving up the supply chain. Companies will need to provide value-add capabilities, such as providing spectrum management alongside the necessary software and graphical user interfaces to optimize the experience for the end-user.

- Disrupt—either through the use of emerging technologies or exploring how best to bring experience from other sectors, in this case the military counter-UAS experience, into the civilian sector.

MILITARY UAS PLATFORMS

The use of UAS platforms is an example of how differentiation on the battlefield is central to military strategy, borne out by technologies developed for standoff, force projection and force multiplication through stealth. Asymmetric theaters such as Iraq and Afghanistan drove the demand for intelligence, which provided the initial opening for UAS platform use. What is clear is that technology remains the differentiator for both conventional and asymmetric conflicts, as well as the growing trends for scenarios that combine elements for hybrid situations. Understanding and being able to operate in these environments opened the door for UAS platforms, while maintaining a strong emphasis on solutions that are also cost effective. Size, weight and range define the different categories of UAS platforms (i.e., micro, mini, tactical, MALE, HALE), initially to provide additional layers of surveillance capability.

As UAS use has proliferated, the mission envelope for these platforms has expanded to incorporate other capabilities, and they have become integrated into the conventional manned fleets for special mission requirements such as airborne ground surveillance and airborne surveillance and reconnaissance. Some of the more prolific UAS examples include the Predator, Reaper, Hermes and ScanEagle platforms. Despite this growing proliferation, UAS platforms will be used to augment rather than replace manned platforms in the area of intelligence, surveillance and reconnaissance (ISR), where there are no payload size constraints limiting performance, and human-in-the-loop expertise can be leveraged to contextualize the data being gathered for conversion into actionable intelligence.

Use of these platforms is also starting to grow in other areas, such as maritime patrol, and these added mission envelopes have expanded the payloads to incorporate radar capabilities that augment electro-optic (EO) and infrared (IR). UAS platforms also form an integral part of the integrated net-centric communications environment, providing layered communications capabilities that extend beyond line-of-sight (BLOS) communication, providing tactical support to frontline troops as well as “reach back” to the strategic command. Expansion into electronic warfare (EW) is also being explored. An early representative example is the U.S. Army Gray Eagle-based Project NERO, which uses a Raytheon electronic attack payload as part of the U.S. Army’s Networked Electronic Warfare, Remotely Operated (NERO) system to provide BLOS jamming to support ground troop operations. Another example is the MQ-9 Reaper platform, which has been used to incorporate a Northrop Grumman electronic attack payload for use by the U.S. Marine Corps (USMC), with subsequent work exploring the ability to integrate the platform into the USMC C2 network, to enable control of the aircraft’s EW payload. Beyond the expansion of mission envelopes for existing platforms, we are also seeing the development of new platforms designed to meet specific roles, such as combat (UCAV) and aerial refueling.

Figure 2 Good and bad uses for commercial drones.

CIVILIAN USE—GOOD AND BAD

UAS platform use in civilian airspace is gaining ground as regulatory authorities implement strategies that allow their use for a wide range of non-military applications, applications that legitimately use drones, including deliveries, emergency services, journalism, traffic/parking management and asset inspection. Conversely, these same uses can be illegal or harmful (see Figure 2). For example, delivery services translate to trafficking drugs and other illicit goods across borders and into prisons. Drones can also be used to perform industrial espionage or disrupt operations at critical infrastructure. The ability to carry payloads presents another avenue for terrorists to deliver lethal effects. Other examples include disruption of air traffic, e.g. near misses, and drones gaining proximity to high profile individuals. So while the use of drones in civilian airspace undoubtedly has benefits, there is a market for solutions that can effectively bring drones down without compromising safety.

COUNTERING UAS CHALLENGES

The typical commercial UAS platform has at least two radio links: the uplink is used for the remote control of the drone, and the downlink provides telemetry data and/or receive video. The typical frequencies used for drone operations are in the ISM bands (2.4 or 5.8 GHz), at UHF (433 MHz) or HF (27, 35 or 72 MHz). Presently, the ISM frequencies are the dominant frequencies used for the uplink and downlink. The 2.4 GHz band is primarily used for the uplink using frequency hopping spread spectrum (FHSS), direct sequence spread spectrum, Wi-Fi or Bluetooth. Both the 2.4 GHz and 5.8 GHz bands are used for the downlink, with video downlinks typically streamed in an MPEG format. The typical effective radiated power for the ISM uplink is around 100 mW, compared to 10 mW for UHF uplinks.

An effective counter-UAS system needs to effectively manage four tasks:

- Monitoring the spectrum

- Finding the signal

- Finding the threat

- Neutralizing the threat.

Monitoring the spectrum is the first step in an effective counter-UAS strategy. A key challenge for monitoring the spectrum is identifying the Wi-Fi, Bluetooth, Internet of Things (IoT), microwave ovens and other signals that comprise the cluttered spectra in a commercial environment. A wideband receiver is a key component to effectively monitor the spectrum, and it should have at least 20 MHz bandwidth. The receiver needs to be accompanied by software that can handle several functions: banded searches and setting a noise floor that accounts for the existing environment, then monitoring for signals that emerge above this threshold. Other desirable aspects of this monitoring equipment include: detecting FHSS signals, automatically detecting and classifying the signals of interest, reliably separating the signals, offering no false alarms and recording the activity, to support legal proceedings.

Once identified, the next step is accurately finding the signal of interest. Two primary techniques are used, direction finding (DF) and time difference of arrival (TDOA). Both have advantages and disadvantages; the final choice comes down to customer preference and cost. DF-based systems have faster processing, as they use a single receiver. However, the receiver is complex; with this complexity comes added cost and limited mobility, since the receiver is typically placed in a specific location. The TDOA-based approach uses multiple receivers and can, potentially, provide greater accuracy. However, accuracy depends on effective placement of the receivers within the area of interest. Other potential limitations of TDOA receivers include handling small band signals and significantly slower processing, since the information from the receivers must be collated and transmitted for processing at a central location.

Beyond the RF spectrum, the counter-UAS system needs to sense the threat using a combination of radar, EO-IR, acoustic and other sensors to detect, track, locate, verify and identify the drone that is potentially encroaching into a sensitive area.

The final stage is neutralizing the threat. From an RF perspective, jamming can be applied to disrupt the remote control link between the operator and the drone. This can either force the drone to land or return to the operator. Where a drone is following a predefined route based upon waypoints defined by a global navigation satellite system (GNSS) signal, RF jamming can be applied to disrupt the signal to bring the drone down or cause it to revert to default programming that takes it back to the operator. Another option is using a high-power electromagnetic (HPEM) pulse to neutralize all the electronic systems, which will force the drone into an uncontrolled descent. This approach raises the question of responsibility for a drone crash, an issue further complicated if the drone is carrying an explosive payload. Other interesting approaches to neutralizing drones include lasers, conventional guns, nets and birds of prey.

Figure 3 Hensoldt Xpeller Counter-UAV solution.

COUNTER-UAS SOLUTIONS

A growing number of counter-UAS solutions are being offered in the marketplace. The following examples, no means exhaustive, represent the different business strategy approaches:

- In-house capabilities

- Partnerships that combine the capabilities of multiple companies.

The Hensoldt Xpeller counter-UAS solution (see Figure 3) is an example of the former, i.e., combining the radar, camera and jamming elements from different branches and subsidiaries of the Hensoldt organization. The radar is based on the company’s Spexer 500, a 4 W, X-Band active electronic scanned array (AESA) FMCW radar. It has detection ranges up to 4 km and can handle targets with a 0.2 m2 radar cross section (RCS). The radar is coupled with the NightOwl ZM-ER thermal and color camera. The RF jammer from GEW Technologies covers 20 MHz to 6 GHz and has configurations that offer both directional and omnidirectional antennas and output power from 10 to 400 W.

Hensoldt is also partnering with companies for technologies not available in-house. So the Xpeller solutions can be configured to include the Discovair acoustic sensor from Squarehead Technology AS and close-in RF detectors from myDefence. Hensoldt has possibly realized that shoehorning systems originally designed for military applications may not be optimal, exemplified by their acquisition of U.K.-based Kelvin Hughes. Hensoldt cited the ability to target cost-sensitive markets as one of the motivations behind the acquisition. Kelvin Hughes offers capabilities around their GaN-based X-Band pulse Doppler SharpEye radar and command and control software that allows the integration of multiple radar and camera sensors into a comprehensive display.

Figure 4 Anti-UAV Defence System.

Another example of adapting solutions developed for the military sector is the Rafael Drone Dome system, which adapts the company’s existing Dome family of solutions designed for ground-based aerial defense to counter drones. In this case, Rafael is essentially the systems integrator, combining a range of systems from industry partners. RADA provides an S-Band RPS-42 GaN-based AESA radar, which has a detection range up to 10 km with a 60 W output and can detect drones in the nano to mini class. This is coupled with the Controp MEOS-U uncooled thermal imaging camera, with the option to add day/night capabilities and laser rangefinders. Spectrum monitoring and jamming is provided by Netsense and C-Guard systems, respectively, both of which are provided by Netline. The Drone Dome system adds a fourth layer of countermeasure capability with lasers adapted from the Iron Beam system, which Rafael has been demonstrating for ground-based air defense.

As an example of a system developed through a partnership-based strategy, the U.K.-based Anti-UAV Defence System (AUDS) has been successfully demonstrated to the U.S. military (see Figure 4). Radar detection is provided via Blighter’s A400 radar system, which is a Ku-Band FMCW GaAs-based radar that offers 4 W of output power, with a 10 km range detecting targets down to 0.01 m2 RCS. The radar is coupled with Chess Dynamics Hawkeye DS & EO Video Tracker system, comprising the Piranha 46 HR camera, a thermal camera and an EO video camera. Enterprise Control Systems provides the Directional RF Inhibitor, which features an RF jammer and quad-band antenna system to provide disruption and inhibition capabilities.

The Guardion modular drone system is another example of a partnership-based capability. Led by Rohde & Schwarz, the system features all four elements described earlier. The sensors include the Rohde & Schwarz Ardronis system, which provides RF analysis of the surrounding environment using DF. This is coupled with sensors that include a 360 degree radar, an acoustic array and a PTZ and IR camera. Effectors are based around disrupting Wi-Fi, jamming of the remote control links, GNSS waypoint jamming and a Diehl-based HPEM capability. This is complemented with a command and control system provided by ESG, which connects all the systems and fuses the sensor data to a map display. The system is also configured to allow personnel in the field to monitor the environment with tablet equipment. This system was used during the 2015 G7 Summit and the U.S. presidential trip to Hanover in 2016.

Figure 5 Market estimate for airport counter-drone radar systems.

THE MARKET FOR COUNTER-UAS

The market for counter-UAS systems remains at a preliminary stage, and the early market demand continues to be driven primarily by the military sector. The airport industry presently has the largest pain point, given threats posed by potential collisions with aircraft and the disruption to other operations around commercial airports, such as drones used to disrupt boarding. Trafficking of illicit goods is another potential early market driver, to stop drugs and other contraband being smuggled across borders or into facilities such as prisons. Other factors that need to be resolved include the regulations governing drone use in civilian airspace, although progress is being made.

Strategy Analytics forecasts the market for airport counter-drone radars alone will grow to $50 million by 2026 (see Figure 5).

CONCLUSION

The success of UAS in providing real-time information to military commanders has contributed to both mission effectiveness and protecting personnel. Despite budgetary pressures, an expansion of the mission envelopes will help drive continued demand for UAS platforms. The expansion of commerical UAS could bring about disruptive uses, intentional or not, as well as their use in asymmetric warfare. Combating these potential threats will require a new front in electromagnetic spectrum operations, using a combination of radar and EW, in conjunction with other technologies. The market for counter-drone systems is still in the pre-event phase, with threats seen as hypothetical and no budgets allocated. Dedicated systems are needed to effectively counter the drone threat, and the market should avoid trying to shoehorn military systems into the commercial space.