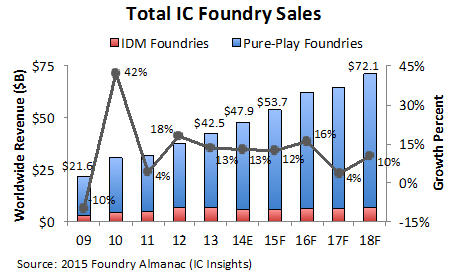

Worldwide foundry revenues for integrated circuits were expected to rise 13% in 2014 to a new record-high level of $47.9 billion, after increasing 13% in 2013 and 18% in 2012. These estimates are from the new 2015 edition of The Foundry Almanac, a jointly produced annual report by the Global Semiconductor Alliance (GSA) and market researcher IC Insights. The seventh edition of The Foundry Almanac forecasts IC foundry sales to grow 12% to reach another record high of $53.7 billion in 2015.

Foundry-made IC products are on track to account for 37% of total worldwide integrated circuit sales in 2014 compared to 24% in 2009 and 21% in 2004. By 2018, foundry-made ICs will represent 46% of the industry’s total integrated circuit revenues, based on the forecast contained inThe 2015 Foundry Almanac. The new report shows total sales of foundry-made ICs increasing at a compound annual growth rate (CAGR) of nearly 11% between 2013 and 2018. This is more than double the projected CAGR for total IC industry sales in the five-year forecast period of the report.

Currently, about 88% of contract wafer-processing sales are generated by pure-play IC foundries with 12% coming from integrated device manufacturers (IDMs) that provide foundry services to other companies. The pure-play foundry portion of dollar volumes is expected to exceed 90% in the next two years, according to the GSA-IC Insights jointly produced report, which includes IC Insights’ forecast and analysis of foundry revenues by end-use applications, region, and process technology generations as well as rankings of suppliers, capital spending projections, and findings from worldwide wafer- and mask-pricing surveys conducted by the GSA.

Among key conclusions and highlights in The 2015 Foundry Almanac are:

- Pure-play foundry sales are forecast to increase 13% in 2015 to $47.8 billion after climbing 17% in 2014 and 15% in 2013. Meanwhile, IDM foundry revenues are projected to grow just 2% in 2015 to $5.9 billion following a decline of 12% in 2014 and a 2% increase in 2013.

- Capital expenditures by IC foundries (pure-play and IDMs) are on track to grow by about 9% in 2014 to a record-high $23.2 billion compared to the previous peak of $21.3 billion in 2013, which was just a 3% increase from 2012. Foundry capital spending is forecast to grow 7% in 2015 to set another record high of $24.8 billion.

- Wafer-fab utilization at the four largest pure-play IC foundries will increase to an estimated 92% in 2014 compared to 89% in 2013 and 88% in 2012.

- Fabless customers are estimated to account for 77% of pure-play foundry revenues in 2014 with IDMs representing 18% and systems makers being about 8% of total sales. In 2008, the sales split was 69% to fabless customers, 29% to IDMs, and 2% to systems companies.

- Communications ICs represented an estimate 53% of pure-play foundry sales in 2014, followed by consumer-product ICs at 18%, “other” ICs (for such applications as automotive, industrial, and medical systems) at 15%, and computer ICs at 14% of the total revenue.

- Customers based in the Americas will account for nearly 62% of pure-play foundry sales in 2014, followed by Asia-Pacific customers at 29%, Europe at 6%, and Japan at just 4% of the total.