“Handset shipments have not seen a sequential YoY decline since the global economic crisis of 2008-2009. Although seasonality regularly brings a negative impact in Q2, the economic crisis in Western Europe has compounded the issue, leading to an uncommon annual contraction of handset shipments for two consecutive quarters,” say ABI Research senior analyst Michael Morgan.

Despite the seasonal and economic headwinds faced by the handset industry, both handset and smartphone shipments were able to eke out small QoQ gains.

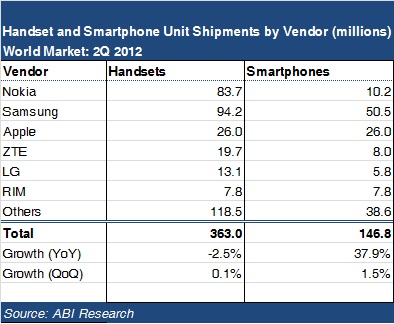

Below the surface of the macro economic factors, many of the leading handset OEMs continued to struggle with demand difficulties of their own making. Apple experienced a 26% QoQ decline in shipments in Q2 as consumers withheld purchasing an iPhone in anticipation of the new model to be released in late Q3. RIM and Nokia experienced 14% and 30% QoQ declines respectively in smartphone shipments as both companies raced to transition to new operating systems before their cash reserves were depleted.

As expected, Samsung’s performance remained a beacon for others to follow during the gloomy Q2. In Q2, Samsung was able to offset a 13% decline in feature phone shipments with a 16% increase in smartphone shipments. “It is becoming increasingly apparent that Samsung, not Apple, will be the OEM who will bring mobile computing to the masses over the near to mid-term,” says ABI Research senior practice director Jeff Orr.

ABI Research’s quarterly data on mobile device and smartphone shipments are part of the company’s Mobile Devices Market Trackerwhich includes additional Competitive Analyses, Vendor Matrices, Market Data, and Insights.