5G has commercial deployments have started with the launch of Fixed Wireless Access (FWA) in the US by Verizon in Oct which will be followed shortly by the first standards compliant mobile 5G service being launched in the US by AT&T. Other US carriers will follow in the first half of 2019 with likely deployments in Japan and China in the same time frame. Ericsson has just released their Mobility Report Nov 2018 and on a global level, they predict major 5G network deployments from 2020 and by the end of 2024 estimate 1.5 billion 5G subscriptions for enhanced mobile broadband. They think this will account for close to 17 percent of all mobile subscriptions at that time. Since the report is more than 30 pages, I thought I would extra some of the overview and devices specific data important to the RF/microwave community.

Subscriptions

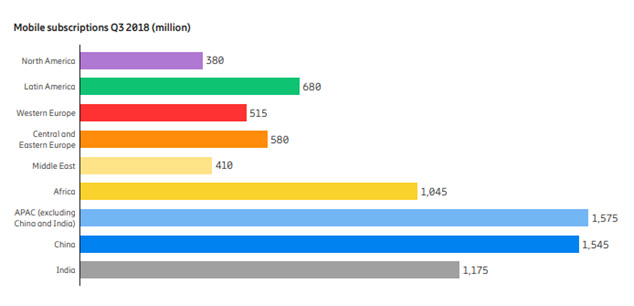

The report says the number of mobile subscriptions grew at 3 percent year-on-year and currently totals 7.9 billion. China had the most net additions during the quarter (+37 million), followed by India (+31 million) and Indonesia (+13 million).

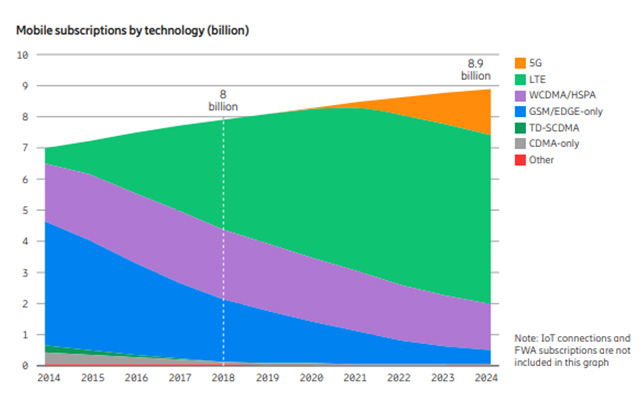

The number of mobile broadband subscriptions is growing at 15 percent year-on-year, increasing by 240 million in Q3 2018 for a total 5.7 billion now. The number of LTE subscriptions increased by 200 million during the quarter to reach a total of 3.3 billion. The net addition for WCDMA/HSPA was around 60 million subscriptions. Over the same period, GSM/EDGE-only subscriptions declined by 110 million (other technologies declined by around 30 million). Subscriptions associated with smartphones now account for more than 60 percent of all mobile phone subscriptions. Around 360 million smartphones were sold in Q3, which equates to 86 percent of all mobile phones sold in the quarter.

Ericsson thinks that 5G subscription uptake will be faster than for LTE, which has been the fastest subscription uptake so far. The number of LTE subscriptions leading the way since 2017, they think it will continue to grow strong and is forecast to reach 5.4 billion by the end of 2024, when it will make up more than 60 percent of all mobile subscriptions. The number of WCDMA/HSPA subscriptions has declined slightly during 2018, though the technology is still estimated to account for close to 17 percent of all subscriptions in 2024. Cellular IoT connections and fixed wireless access (FWA) subscriptions supporting new use cases will come on top of the mobile subscriptions shown in their graph.

IoT

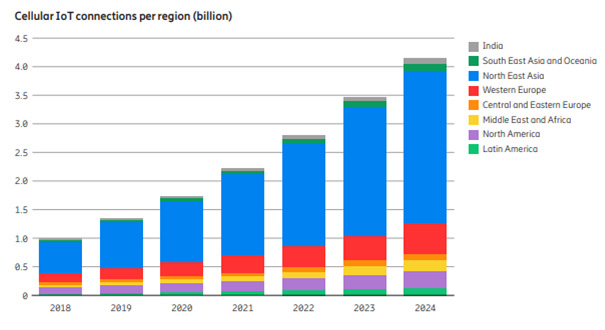

In the area of IoT, they see an emerging trend toward communications service providers deploying one IoT network that supports both Cat-M1 and NB-IoT technologies. This enables providers to address the diverse and changing requirements across a wide range of use cases in different verticals, such as utilities, smart cities, logistics, agriculture, manufacturing and wearables. They see massive IoT cellular technologies such as NB-IoT and Cat-M1 are taking off and driving growth in the number of cellular IoT connections worldwide. Of the 4.1 billion cellular IoT connections forecast for 2024, North East Asia is anticipated to account for 2.7 billion. These complementary technologies support diverse low-power wide-area (LPWA) use cases over the same underlying LTE network.

Devices

Ericsson states that while the mmWave bands are an important topic in North America, other markets will concentrate on sub-6GHz spectrum in different forms and variants. This means chipset and infrastructure vendors need to work on three non-standalone 5G variants together. Those include TDD for mmWave, TDD for mid-band, and FDD for low band plus standalone 5G is starting to emerge.

Device and infrastructure vendors are now announcing products for mmWave, mid-band and low-band variants. More than 20 devices were announced in October 2018 alone. There are strong indications that indoor customer-provided equipment and pocket routers for mid-band will be available by the end of the year. For smartphones, they forecast a strong lineup for Q2 2019. At this point it is difficult to accurately predict release timing or number of vendors, but second-generation chipsets are expected by the end of 2019, which will enable more 5G-capable devices with enhanced architectures and lower power consumption. Modules for laptops and industrial applications are expected within the same time frame. The situation for mmWave looks very similar to that for mid-band but with more challenges in the area of power consumption, antenna technology and additional maximum power reduction.

In summary, 5G will take off in 2019 and 2020 will be the year in which 5G enters the mass market. At this point in time, third-generation chipsets will have been introduced and a large number of devices will be available.