With the shift towards electric vehicles, end-users are becoming less concerned about traditional differentiators like engine horsepower and are placing greater emphasis on smart interior functions. This trend is compelling automotive OEMs to invest more efforts in enhancing interior features, thereby adding greater value to their products and distinguishing them from other vehicles.

Driven by regulations such as Euro NCAP, driver monitoring systems (DMS) have gained significant traction and have transitioned from a luxury feature to a new norm. As of 2024, most DMS utilize 2D near-infrared (NIR) cameras. Due to their relatively low costs, they are anticipated to be increasingly adopted, emerging as the dominant enabling technology for DMS. For automotive OEMs to further set themselves apart from competitors, advanced features such as gesture control, child presence detection and seat belt detection are also expected to gain momentum, especially in mid to high-end vehicles. Currently, the 3D time-of-flight (ToF) camera stands out as the most widely used technology for DMS, while some automotive OEMs, such as Volvo and Tesla, are incorporating in-cabin radar modules.

Radar has played an important role in advanced driver assistance systems for over two decades. Utilizing radio waves with a frequency-modulated continuous wave coding system, radars can accurately measure the distance and relative velocity of objects within their field of view. However, historically, radar modules have predominantly been employed for exterior sensing rather than interior applications.

Radar has played an important role in advanced driver assistance systems for over two decades. Utilizing radio waves with a frequency-modulated continuous wave coding system, radars can accurately measure the distance and relative velocity of objects within their field of view. However, historically, radar modules have predominantly been employed for exterior sensing rather than interior applications.

As of 2023, according to Tesla's website, the in-cabin radar operates within a frequency range of 60 GHz to 64 GHz, falling within the license-free ISM band. The detection distance of these radar modules typically ranges from 0.4 to 2 m, effectively covering the interior space. Though unconfirmed officially by Tesla, recent news suggests that their cybertruck is equipped with in-cabin radar modules for occupant monitoring, including functions such as child presence detection and seat belt reminders.

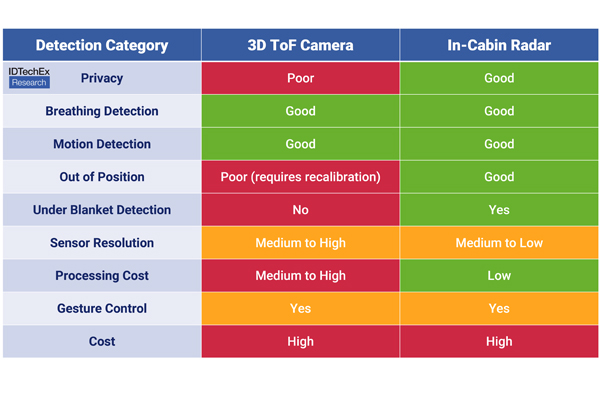

Similar to radar modules, 3D ToF cameras also find application in occupant monitoring. 3D ToF cameras operate by utilizing near-infrared illuminators like LEDs or vertical cavity surface emitting lasers (VSCELS), in conjunction with image sensors. However, privacy concerns surround the use of cameras, even though some suppliers assert that they can address this issue by either blurring people's faces or storing data solely onboard.

An additional limitation of 3D ToF cameras is that, unlike in-cabin radar modules, they are unable to detect people or objects through obstacles. Furthermore, due to their reliance on computer vision technology, cameras necessitate intricate algorithms and recalibration, introducing technical complexity to their implementation. Despite these drawbacks, some suppliers are actively working to address privacy concerns and improve the overall capabilities of 3D ToF cameras for occupant monitoring in automotive applications.

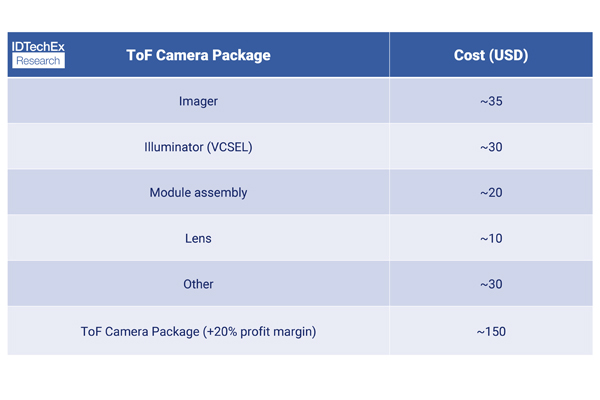

As of now, 3D ToF cameras are more well-adopted for OMS and have advanced features compared with radar modules. However, by comparing the costs and functions of radar modules and 3D ToF cameras, IDTechEx believes there are potential opportunities for radar modules. 3D ToF cameras are adopted in Li Auto L9, BMW iX and the new ARCFOX αS series, whereas radar modules are expecting adoption in Tesla and Volvo. The table below, from IDTechEx's latest research "In-Cabin Sensing 2024-2034: Technologies, Opportunities and Markets," estimates the costs of 3D ToF cameras.