We have not reached half-time yet with 5G, but the 6G clock is already ticking. Research on 6G is gaining momentum, and governments worldwide are contemplating how this next-generation mobile standard aligns with their broader technology roadmaps. China outlined its vision in a 6G white paper published back in 2021 titled, “6G Vision and Candidate Technologies,” targeting a 2030 launch. In 2023, the government of India announced plans to prepare the operators for commercial 6G by 2030. Meanwhile, the South Korean government aims to have commercial 6G networks operational by 2028, two years ahead of the International Telecommunication Union’s scheduled approval for the 6G standard. As the industry grapples with defining the roles of AI, Cloud radio access network (RAN), automation and ESG in the 6G era, we will stay away from the shiny objects and focus on the basics: what spectrum will be utilized for 6G and why ongoing RF innovation is crucial for transforming 6G from a concept into reality within the next five to six years.

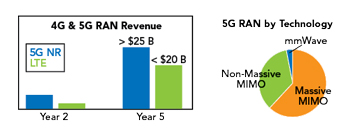

Figure 1 5G revenue and technology segmentation.

To begin, we need to assess the current state of 5G. Recent estimates indicate that the 5G RAN market has experienced rapid growth during the initial five years of commercial operation, surpassing the developmental pace of previous mobile technologies. One contributing factor to this remarkable rise is the diminished regional gap between advanced and less advanced mobile broadband (MBB) markets. During the LTE era, there was a five- to seven-year disparity between the development in the U.S. and China/India, respectively. However, with the advent of 5G, China took the lead and the Indian RAN market already reached its peak in 2023, just a year after North America’s RAN peak in 2022. Widespread small cell adoption has also contributed to the market distinction between 4G and 5G, in part because the LTE small cell market was negligible in the first half of the 4G era while 5G New Radio (NR) small cell revenues already account for more than 10 percent of the combined 5G NR macro plus small cell market. Figure 1 shows Dell’Oro Group’s most recent estimate on the 5G status.

One of the key drivers behind the success of existing mobile broadband (MBB)/fixed wireless access (FWA) use cases and a major contributor to the 5G ramp is the widespread adoption of sub-6 GHz massive MIMO (mMIMO). Initially seen as primarily suitable for hotspot scenarios, mMIMO has made significant strides over the past five years. Apart from its capacity benefits, mMIMO has played a crucial role in extending the range and compensating for the higher carrier frequencies typically associated with the upper mid-band. This enables operators to leverage their existing 4G grid without the need for substantial incremental cell site investments.

Not surprisingly, mmWave NR comprises a low, single-digit share of total 5G NR investments to date. This is largely due to the less favorable RAN economics associated with the high-band relative to the upper mid-band. This is especially true with the current mmWave approach that relies on small cell infrastructure and “lower” EIRP levels.

The journey toward 5G-Advanced and eventually 6G will not be trivial. It depends on a confluence of factors, with the type of spectrum being one of the more critical unknowns that can completely change the trajectory and velocity of the entire 6G ramp. After all, the 5G capital expenditure (capex) envelope would look entirely different if not for the large swaths of spectrum in the upper mid-band, coupled with mMIMO.

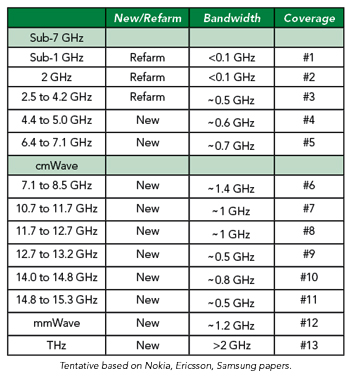

Figure 2 5G/6G spectrum chart.

Presently, the prevailing notion is that the 6 GHz band and the centimeter wave (cmWave) spectrum will play pivotal roles as anchor bands in the 6G era with frequencies spanning from 6.4 to 15.3 GHz. This band will be akin to the functions carried out by the C-Band in the 5G era. Concurrently, the mmWave spectrum transitions from a backseat position in 5G to a potential passenger seat with 6G in this multi-layered spectrum approach, encompassing new and existing sub-7 GHz, cmWave and mmWave spectrum. Figure 2 shows the details for these particular spectrum bands.

However, achieving economic viability for the broader 6G coverage layer complicates the situation and poses challenges with small cell infrastructure. Consequently, the 6 to 15 GHz base stations will need to make use of the existing macro grid. Ideally, future mmWave systems will also increasingly leverage the macro infrastructure for MBB applications.

As the saying goes, nothing in this world can be said to be certain, except death, taxes and the inevitability of greater propagation losses with rising frequencies. According to the Hata model for a medium-sized city, the received power drops by approximately 7 dB when comparing the 6 GHz band with the C-Band. Another loss of approximately 7 dB occurs at 12 GHz in comparison to 6.5 GHz.

In essence, RF innovation becomes crucial for operators aiming to deploy large bandwidth and wide area 6G in new spectrum. At a broader level, there are three main efforts already part of the 5G journey, including boosting the RF output power, adding more transceivers and incorporating more antenna elements. For 6G deployments within the upper 6 to 15 GHz range, advancing mMIMO becomes indispensable to achieve equivalent upper mid-band coverage. Leading vendors are currently exploring configurations such as 128T/128R or 256 transceiver channels to compensate for different loss parameters. Though it is still early days, preliminary testing shows promise. For instance, Huawei has verified in small-scale tests that the propagation delta between the 6 GHz and C-Band is manageable with higher-order MIMO.

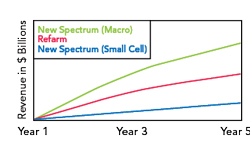

Figure 3 6G RAN spectrum.

So far, mmWave deployments have primarily centered around FWA and low-mobility MBB applications, partly due to challenges related to coverage and performance degradation in higher-mobility scenarios. In response, technology leaders are now boosting the EIRP to tackle coverage limitations. One of the suppliers has already verified that co-site deployments with macros using 70 dBm+ EIRP and intra-band coordination with sub-6 GHz spectrum, can deliver Gbps performance throughout the cell. More innovation is also required to smooth out the handovers. Notably, the UL is typically the limiting factor and more work is needed to address the approximately 20 dB gap between the mmWave bands and the C-Band.

SUMMARY

From a spectrum perspective, three high-level 6G “anchor” options present themselves, each with vastly different capex considerations: 1) re-farmed spectrum, 2) new spectrum using the macro grid as primary and 3) new spectrum using the small cell grid as primary. The base-case scenario currently leans towards new spectrum (upper 6 GHz to 15 GHz) with the macro grid playing a leading role. Figure 3 shows Dell’Oro’ Groups thoughts on the relative importance of these different spectrum options to the overall 6G market revenue going forward. However, there remains a considerable RF journey ahead to transform this vision into reality.