The impetus for reductions in energy emissions in the telecoms sector is anchored in the global fight to combat and mitigate climate change, as enshrined in the 2015 Paris Agreement. Urgency has grown markedly recently as governments seek to garner private sector commitments toward the central objective of keeping a global temperature rise this century to a maximum of 2°C above pre-industrial levels. This implies net zero for most countries by 2050.

In our report, “5G Energy Efficiencies, Green is the New Black” from GSMA Intelligence, we look at how the telecoms sector has emerged as a vocal supporter of proactive emissions reductions plans. This is enshrined in an industry-wide commitment to reach net zero emissions by 2050 and bolstered by a growing number of operators that have embraced carbon reduction efforts as a core business objective, with strict reporting targets.

For mobile telecom networks, 5G new radio (NR) offers a significant energy efficiency improvement per gigabyte over previous generations of mobility. However, new 5G use cases and the adoption of mmWave will require more sites and antennas. This leads to the prospect of a more efficient network that could paradoxically result in higher emissions without active intervention.

The mix effect of 4G LTE and 5G upgrades in emerging and advanced economies (led by the U.S. and China) will result in these technologies accounting for 60 percent and 20 percent of the global mobile connections base, respectively, by 2025. The impact of this shift will be a continued rise in mobile data traffic, estimated at 6.4 GB per user per month in 2019 and forecast to grow threefold on a per user basis over the next five years. When combined with the rising costs of spectrum, capital investment and ongoing radio access network (RAN) maintenance and upgrades, this means energy-saving measures in network operations are necessary rather than nice to have.

NETWORK COSTS AND PERFORMANCE

Irrespective of climate change, impetus for energy-saving measures from telecoms operators has grown because of sustained increases in network costs in a low revenue growth environment. The telco business model is based on network scale. In times of growing revenues, margins expand as the largely fixed cost base is monetized (positive operating leverage), unless the operator is sub-scale. This is broadly what happened in the 2G and 3G eras in the 1990s and 2000s when mobile phones were still new to people and subscriber growth consequently steadily rose. However, in periods of low or negative revenue growth, fixed costs are exposed, with resulting pressures on cashflow and longer-term investments. Network capital investments have increased to fund LTE and early 5G rollouts, while free cash flow margins have been mostly preserved through reductions in personnel and other costs.

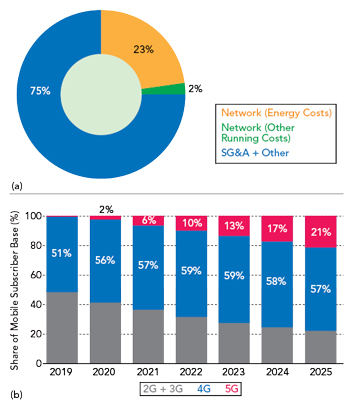

Figure 1 Energy (electricity and fuel) is a significant cost element for mobile network operators as it is one of the largest operating costs (a). Mobile data traffic will grow almost threefold by 2025 and new 5G use cases will require more dense and complex networks (b). These are averages so will vary by operator. Source: GSMA Intelligence.

Given the industry imperative to invest in networks, Capex is followed more closely than the costs of ongoing maintenance (Opex). However, this is changing with the rapid adoption and incorporation of energy efficient technologies. Both offer material savings in Opex. Network Opex tends to account for around 25 percent of the operator cost base, or 10 percent of revenue. Around 23 percent of network opex costs are spent on energy consisting mostly of fuel consumption as shown in Figure 1a. Most of this spend powers the RAN, with data centers and fiber transport accounting for a smaller share.

The good news is that the shift from fossil fuels to renewables has started to feed through to Opex savings, as have the phased retirements of legacy 2G and 3G networks that are less energy efficient than LTE or 5G NR standards. Looking ahead, however, as LTE and 5G progressively account for larger shares of the overall global user base, data traffic rises are inevitable - and with this comes the pressure on energy consumption (see Figure 1b).

There is no one method of increasing energy efficiency or reducing power usage. Instead, a mixed approach is generally being used, comprising renewables, AI-driven network sleep states, more efficient batteries and decentralized site deployments with compute power pushed toward the edge. The results will feed through over a period of years.

ENERGY CONSUMPTION IN RUNNING A NETWORK

Past transitions to new wireless standards have entailed a significant improvement in the cornerstone metric of energy efficiency: kilowatt hours per gigabyte. Though 5G NR also offers a significant energy efficiency improvement per gigabyte over previous technologies, new 5G use cases and the adoption of mmWave will require more sites and antennas. This leads to the prospect of a more efficient network that could paradoxically result in higher emissions, without active intervention.

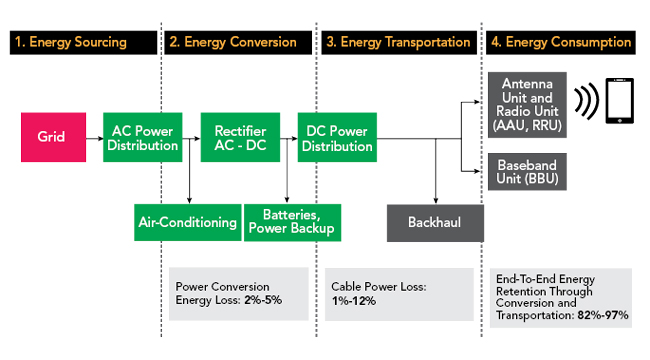

One way to visualize a network is as a linear progression of stages, or phases, across which energy flows to provide power to base station sites, radio access nodes and backhaul links. Figure 2 outlines this journey, starting with energy sourcing from the grid and moving through to site and equipment consumption.

Figure 2 End-to-end energy loss from grid to the RAN. Source: GSMA Intelligence.

PHASE 1: ENERGY SOURCING

There are significant daily fluctuations in energy demand, while electricity supply is relatively static. This makes the price of industrial electricity vary on an hourly basis. Daytime energy prices in peak hours can be significantly higher than off-peak times during the night. Network operators can save money by buying energy at off-peak hours to be stored and used when data traffic peaks in the early evening, typically between 18:00 and 22:00. Operators can also sell excess peak-time energy back to the utility grid. This relatively nascent practice will require further investment in energy storage technology and batteries alongside partnership agreements with utility providers. Updated central energy management platforms to calculate and forecast site-level data traffic and consumption are also important to ensure each site has enough backup energy to operate safely, with no service interruptions.

PHASE 2: ENERGY CONVERSION

Energy utility providers sell AC electricity, while most of the site-level energy consumption happens in DC. For this reason, each cell site needs to have a rectifier module to convert AC to DC. Most cell sites in a typical portfolio are more than 10 years old and operate with less efficient passive infrastructure, including the rectifier module. New rectifier technology is much more efficient so it is a big opportunity for improving energy efficiency. The cost to upgrade is significant up-front but crucial to more efficient conversion and lower consumption over the long-term. New rectifiers are also key to cover the potential increased energy consumption before installing 5G equipment and ensure smooth capacity expansion.

PHASE 3: ENERGY TRANSPORTATION

When power is transmitted at high voltages, the efficiency of energy transportation increases (with a lower rate of leakage) because of a lower electric current in the conductors. Operators can improve efficiency and reduce power loss by increasing voltage with boosters, using power equipment closer to the load and decreasing the power supply distance.

PHASE 4: ENERGY CONSUMPTION

This phase represents the ‘lowest hanging fruit’ for efficiencies. Operators transform DC energy into radio waves and receive and process incoming signals. This category can be further broken down into areas such as architecture optimizations, signaling, network shutdowns, cooling and beamforming that wastes less energy than omnidirectional transmission.

SITE, RAN AND NETWORKWIDE INNOVATIONS

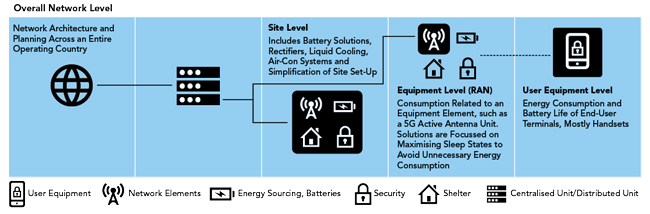

Alongside technical improvements to reduce energy leakage as power passes through the network phases, solutions to improve efficiency holistically across the network are available. Our analysis focuses on sites, the radio access level and broader network planning considerations. We exclude efforts targeted at handsets and other end-user terminals as these do not directly contribute to a mobile operator’s carbon emissions profile. Figure 3 summarizes the holistic network-wide approach.

Figure 3 Energy-saving methods differ between site level, RAN equipment and network planning. Source: GSMA Intelligence.

SITE INNOVATIONS - BATTERY SOLUTIONS

In off-grid areas, mobile operators are often forced to use diesel generators to guarantee the reliability of power supply for base stations. This is less than ideal considering generators emit high levels of carbon dioxide and have onerous cost implications associated with refueling, particularly if in hard-to-reach, sparsely populated areas (such as in African countries) requiring labor callouts and security protection.