The space industry is in the midst of an exciting and dramatic change. NewSpace is a term that’s been coined to describe that change. According to NewSpace Global (www.newspaceglobal.com), it defines an emerging global industry of private companies and entrepreneurs who primarily target commercial customers, are backed by risk capital seeking a return and profit from innovative products or services developed in or for space. While NewSpace signifies an exciting time for the space industry, it’s also driving disruption — the likes of which haven’t been seen since the original space race in the 1960s. These disruptions include the challenges for electronic design and test strategies and processes that NewSpace’s new business models create. Overcoming these challenges is critical to enabling the higher volume, lower cost and high quality products that NewSpace demands. Let’s take a closer look.

NewSpace 101

Today a huge number of companies are entering the space business. When NewSpace Global started in 2011, it was tracking about 125 companies. NewSpace Global now tracks well over 800 companies, about 700 of which are privately held. Most people have seen the press coverage of SpaceX, OneWeb, Google and Facebook and their change the world scale plans for space. These companies will certainly drive disruptive change on a massive scale, but they are far from the only ones. Hundreds of other companies are getting into space with an amazingly wide variety of business models and mission types, from communications, earth imaging and weather forecasting to mining asteroids and interplanetary human existence. The NewSpace movement is not limited to new entrants. Many traditional space companies and organizations are adapting and working to understand how best they can take advantage of the opportunities that NewSpace presents. Alliances have been and continue to be formed between new entrants and established space players.

All of this has significant implications for electronic design and test. To better understand these implications, it’s important to highlight the characteristics that distinguish NewSpace from traditional space. Unlike traditional space companies, NewSpace companies primarily target commercial enterprise, and that means commercial business principles apply. Accordingly, most NewSpace endeavors construct business models based on a level of investment, ongoing cost structure and revenue stream that results in a profitable outcome. Funding in NewSpace endeavors comes from sources not historically associated with the space industry (e.g., venture capital, crowd funding and angels). One of the most telling attributes of NewSpace is risk tolerance. With traditional space ventures, risk is viewed as bad, and tremendous amounts of time, effort and expense are employed to eliminate it. NewSpace companies, on the other hand, understand that risk is something to be considered, assessed and managed, rather than be eliminated at all cost.

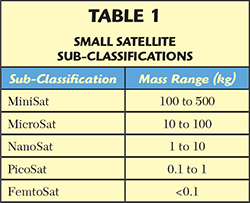

One key trend enabling NewSpaceis lower launch cost. Some of the methods that have emerged to enable that are ride-sharing, use of reusable boosters and development of small launch vehicles designed to deliver smaller payloads at a lower price and with higher launch frequency. The rapid growth of relatively low cost small satellites (SmallSats) is another driving force in the NewSpace movement. SmallSats range in size from extremely small (e.g., PocketQube at 150 g) to 500 kg and are categorized according to the sub-classifications shown in Table 1. Business models vary significantly across these classes. Also, the number of satellites associated with many NewSpace business models/missions is much larger than traditional space norms. In fact, many SmallSat businesses are planning to deploy large constellations — tens, hundreds even thousands of satellites — the majority of which will be in low earth orbit (LEO). Intended mission lifetimes are much shorter, two to five years or less, rather than the 15 years which is common for most traditional satellites. The large number of companies deploying constellations, the size of the constellations and the relatively short orbital lifetimes are combining to drive dramatic volume growth in SmallSat production, with some estimates predicting 2500 to 4000 new SmallSats in orbit by the end of the decade.

With less stringent design requirements, many SmallSat designs are relying heavily on commercial off-the-shelf (COTS) parts. Intended for terrestrial industries, these parts are far less expensive, more available and typically further advanced in performance than space-qualified parts. While their use does introduce risk, NewSpace developers generally perform some level of qualification of COTS parts that is consistent with their mission, risk profile and business model to make them “somewhat space qualified.” Automotive and industrial parts, which are subject to a more rigorous qualification process than consumer electronics, are also widely used and are still far less expensive than space-qualified. Unlike traditional space development, a number of NewSpace companies are also employing agile methods for developing spacecraft in months rather than years. Several companies have even extended agile methods into orbit by launching a prototype capability, learning from it on-orbit and then feeding those learnings back into the next revision.

Warning: Challenges Ahead

While the NewSpace movement provides great opportunity, some significant business challenges face the industry. For example, with risk tolerance comes the requirement for an effective approach to dealing with risk, one that includes both mitigation and contingency plans. NewSpace companies also face pressure to deploy satellites sooner. In some cases, that schedule pressure is driven by the market and competition, but it may also be driven by a specific launch window or the need to get satellites in orbit quickly to replace those approaching end-of-life, without disrupting the revenue stream. Another challenge is being able to scale to the volumes required for NewSpace while maintaining product quality. In order for the NewSpace business model to work, cost targets must be achieved. This is driving the need to control development, product and deployment costs across the enterprise. Finally, to sustain a strong business model and remain competitive, NewSpace companies must continuously innovate, while controlling cost and maintaining schedule. Given that space is hard, this is a fundamentally difficult task. Overcoming these challenges and delivering continuous innovation requires a lot of high quality technical talent, and this makes attracting and keeping experienced technical professionals and new graduates a top priority.

Figure 1 Typical electronic product development cycle.

Electronic design and test are integral to any spacecraft development and deployment. As NewSpace drives change with its volume, cost and schedule challenges, the philosophies, strategies, processes and requirements associated with electronic design, development, production, test and measurement must change as well. Utilization of best practices from the commercial electronics sector, efficiently aligned with the unique needs of space, offers one way to ensure a successful and sustainable NewSpace business model. The basic construct of the electronic product development cycle, as shown in Figure 1, is common across industries. Key elements that distinguish different industries are the definition of each stage, the criteria for moving between them and the rigor with which the process is followed. In very low volume conditions like traditional space, the lines between development, validation and production are often blurred. With the volumes of many NewSpace businesses, however, the lines must be well defined in order to scale volume efficiently. As volumes increase, it’s particularly important to clearly define criteria for the release to production. Debugging design problems in production impacts cost and schedule and slows down the primary function of production, which is to ship products. Additionally, different industries and companies have different approaches to how much they utilize innovation cycle feedback. This loop is integral to meeting the business challenge of continuous innovation. Simulation and measurement tools that support this feedback mechanism are also key.

Best Practices For Success

Achieving business success in NewSpace, requires defined electronic design and test strategies and processes that are consistent with your business model and business realities. Business considerations drive design and test objectives, which dictate the attributes of the design and test process required to meet those objectives and, ultimately, drive a specific implementation approach (see Figure 2). Some of the key considerations relevant to the design and test strategy are:

- functional, performance and physical requirements

- timeline and market window

- cost requirements

- volume and throughput requirements

- risk profile

- future plans

- core versus context.

Figure 2 Design and test process definition flow.

While many of these may seem obvious, others are not as clear or often get overlooked in a challenging schedule and cost-constrained environment. Documenting and tracking requirements, which can get pushed aside in very schedule-driven developments, is a perfect example. When this happens, confusion between the designers and test developers often results in schedule slippage.

A critical part of achieving business success is having a design and test process that aligns with your risk profile. Historically, the design, validation and test approach employed in the space industry has differed greatly from that of the commercial electronics industry. The highest priority of the process in traditional space was to eliminate risk, often at the expense of schedule and cost — test everything and test it a lot. NewSpace, however, is willing to accept some level of risk. Consequently, a key element of its test strategy is to define what risks are and are not acceptable, i.e., establish and document a risk profile. Suppose, for example, that you are willing to accept a 5 percent failure rate over a two year period and plan to mitigate this risk in your system design. A detailed assessment of risk will help drive the test strategy and process. A test process targeted at a 5 percent failure rate is quite different from one that targets 1 or 20 percent. One that targets 1 percent would achieve the 5 percent target but may exceed cost and schedule targets.

It’s also important to consider your future plans as part of the process definition. Assess short, medium and long-term goals. Do you plan to grow in volume, expand your product portfolio or increase complexity? If your need will change in the future, you should make choices now that will allow you to adapt and upgrade over time. Often overlooked in the process definition is the concept of core versus context. Core refers to content an organization is uniquely capable of executing better, faster or cheaper than an outside source. Context is everything else that is necessary for business success but is not part of the core. The more you focus on your core by outsourcing context items, the higher the likelihood of a successful and sustainable process. Of course, what’s defined as core or context may change over time, so it’s important to review it regularly; this will help you maintain focus on key differentiators as business conditions change.

Given these considerations, there are a number of ways NewSpace companies can achieve much higher volume with much lower cost while maintaining high product quality. These include:

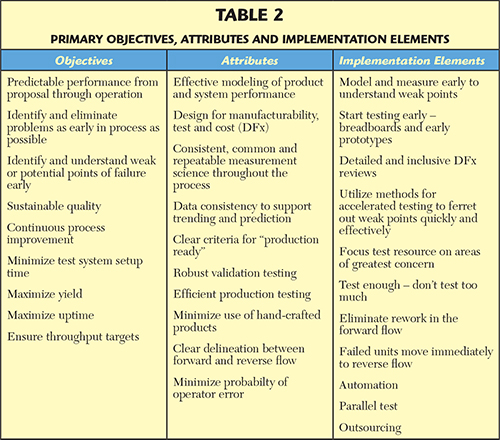

Process Objectives, Attributes and Implementation: The objectives, attributes and specific implementation approach of a design and test process (see Table 2) are very tightly linked and often get blurred. It’s critical that the attributes align with the objectives, and the implementation aligns with the attributes and achieves the objectives. No single implementation approach will fit every NewSpace business model. However, focusing on the items discussed here will provide the context to make the best implementation choices for a given business model. While all of the items in Table 2 have some level of impact across the business model, each also has a primary impact in one of three broad categories: design robustness, volume enablement and cost management.

Design Robustness: Effective and accurate modeling increases confidence that a given product or system concept will meet requirements and align with the business model. Simulation tools used should support margin analysis and the ability to incorporate measured data. Improperly managed margins can add significant cost and risk to a program. If margins are too tight, unnecessary costs are pushed down to subsystems and components. If margins are too loose, they could stack up unfavorably, leading to poor system performance or failure. Simulation and models help properly manage margins for optimum performance and cost tradeoffs. Simulation and test data consistency throughout the process also enables trending and improved prediction over time. It’s key that the measurement science employed at each stage is repeatable and consistent with other stages. Modeling also provides early insight into the problem areas and potential weak points in the design. Problems caught early in the process are far less costly, in terms of money and schedule, than problems found late in the process; start testing early. Build breadboards and early prototype assemblies and rigorously test them. Hardware-in-the-loop should be integrated with your simulation software and models to increase the fidelity of your system simulations. Doing so will help ensure the system’s proper operation at its first turn on.

Highly accelerated life testing (HALT) or highly accelerated stress testing (HAST) are also effective approaches for early detection of design problems and infant mortality. The level and formality of HALT/HAST used should be consistent with the product and business model. For example, to test the lifetime quality of electrical connections, a combined thermal and vibration environmental test can be done to add additional stresses. This may lead to the detection of fatigue or a fracture that would normally take years to manifest itself as a failure. By doing a rapid test that might constitute some percentage of the lifetime number of cycles expected, issues can be caught without the need for extremely long test cycles.

Volume Enablement: Design-for-manufacturability, design-for-integration, design-for-test, design-for-quality and design-for-cost are essential for a profitable business model. These DFx techniques are tightly related and, therefore, must be considered and reviewed early in the process. The reviews should include all of the key stakeholders (R&D, test engineering, production and quality). Early feedback on DFx issues pays off in production with improved throughput and yield. It is also crucial to have clear and aligned criteria for “production ready.” Rigorous and broad testing and debugging of the design should be focused on the development and validation phases.

As you move into production, focus on the areas of greatest concern. Consider not testing or only sample testing the areas that have little cause for concern, and test at a level that’s consistent with the risk profile and potential failure modes. In the production test process, it’s critical to have clear distinction between forward flow and reverse flow to achieve throughput objectives. If a unit fails in forward flow, it must be removed and transferred into reverse flow. When failed units remain in forward flow for debugging, they create a bottleneck that slows, or even stops, product shipments.

Process automation is a powerful tool in a volume test process, bringing significant advantages like reduced test system setup and measurement time, reduced risk of test operator error and maximized usage of capital equipment. It also improves yield and reduces rework and re-test as well as human attended test time. However, automation typically incurs additional up-front expense and initial setup time. The level of automation that is sensible will be dictated by several factors. Assess and determine what level of automation best delivers the target metrics defined above. Parallel testing can take several forms, such as multiple channels, multiple measurement types and multiple units under test (UUT). The primary objective is to ensure that throughput and asset utilization objectives are achieved.

Cost Management: Outsourcing is widely used in the commercial electronics industry. For those areas deemed context rather than core, outsourcing may be a viable alternative, providing advantages in process efficiency and overall cost. Outsourcing also helps address the challenge of attracting technical talent, as contract resources may be available where permanent hires are not. While outsourcing is certainly not something to be taken lightly, it should be considered as part of an effective business model.

When aligning the design and test process with the business model, one of the primary factors to understand is how it impacts cost. Primary contributors to cost include yield, test time and throughput, utilization and equipment cost. When computing the equipment cost, it’s essential to take a total cost of ownership (TCO) view of the process and the associated value delivered. TCO is defined as the total cost to own and operate a piece of equipment over its useful life. Often, the equipment cost is viewed only in terms of the initial purchase. TCO is key to understanding the real cost and associated impact on the business model.

Conclusion

NewSpace is creating tremendous excitement in the space industry. New companies are entering the industry and traditional companies are adapting. Many completely new business models are emerging, which challenge existing electronic design and test strategies and processes. Fortunately, there are now some approaches that can be used to help overcome these challenges; however, ensuring product quality while dramatically increasing volume and reducing cost continues to be difficult. To fully realize the promise of NewSpace, it will be critical to strike a strong balance between commercial electronics and traditional space industries and couple this with completely new discoveries. Likewise, realizing the promise of NewSpace business models will require bringing together the best of commercial and aerospace electronic design and test.

Gregg Peters is vice president and general manager of Keysight’s Component Test Division, where he manages a global team of engineers, architects, product line managers, technical marketing engineers and business development managers. He joined Hewlett-Packard (HP) in 1984 and has held a variety of positions within HP, Agilent and Keysight Technologies. Gregg holds a bachelor’s degree in electronics engineering from Iowa State University and an MBA from the University of Colorado.