The telecommunications industry is exploring growth opportunities in private networks, particularly with the rise of 5G private networks that enhance services, automation and efficiency globally. Private networks provide exclusive wireless access, meeting the security and data needs of modern enterprises.

“Deployed worldwide, private networks are crucial for digital transformation, with significant activity in Asia, China, Europe and the United States. In sub-6 GHz private small cells, steady growth is forecasted, driven by the increasing use of 8TRx small cells. However, 2 TRx and 4 TRx small cells will remain the primary sub-6 GHz solution,” said Cyril Buey, Ph.D., technology and market analyst in RF and wireless communication at Yole Intelligence.

The small-cell and mmWave radio RFFE market was US$160 million in 2022. This market is projected to show a 10 percent CAGR to over US$320 million by 2028. In this dynamic context, GaAs technology dominates for small cells below 1 W, showing an 8 percent CAGR.

With 44,000 wafer starts in 2022, expected to exceed 75,000 by 2028, the industry focuses strongly on sub-3 GHz and C-Band deployment. While the use of mmWave small cells is growing slowly, their application in FWA for connectivity to Wi-Fi gateways is notable.

Indeed, private networks have emerged as a driver for the RAN business. Yole Intelligence, part of Yole Group, has combined its long expertise in semiconductors and its deep knowledge of RF technologies and markets to deliver the new "RF for Private Network 2023 report." This study aims to complement and extend the RF for Radio Access Network 2023 analysis.

It provides volume forecasts for cellular private networks, sub-6 GHz small cells and mmWave radio units. This report also delivers market metrics and forecasts for RFFE components of each system, as well as wafer forecasts for RF Front-End components. Market drivers, challenges, and the competitive landscape for 5G telecommunication and cellular private networks are also well-detailed in this new report.

“Baseband virtualization (V-RAN) in the 5G standalone architecture shifts baseband and core functions to servers, streamlining cellular private network deployment,” explained Buey. “Two main private network types are standalone (isolated from public networks) and shared (integrated with MNO networks).”

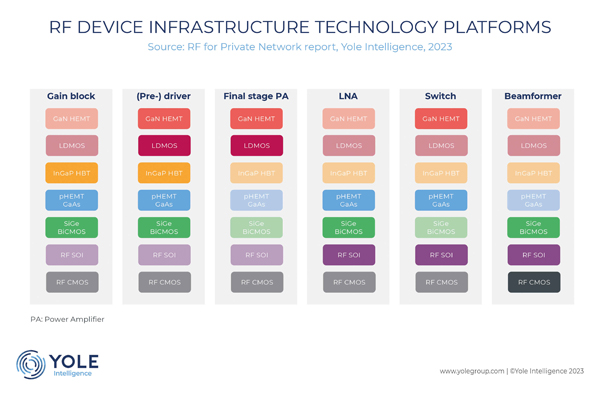

Private wireless networks require infrastructure (radio access network, core network, devices) and key services (network applications, security, management). RF lines use GaAs for low power and LDMOS/GaN for higher power.

In mmWave radios, massive MIMO and hybrid beamforming increase the number of RF lines. Beamformers manage RF functions and use RFSOI, CMOS or SiGe technology with 8 to 32 channels.

Cellular and Wi-Fi, though similar, serve different roles in enterprises. Private 4G/5G networks have complex architectures, while Wi-Fi is simpler, user-friendly and widely compatible. Verticals benefiting from cellular private networks include manufacturing, mines, oil and gas, government, public safety, distribution, retail and public services.