GaN technology continues to deliver performance and efficiency in both the defense and the telecom markets. The RF market applications are currently dominated by GaN-on-SiC devices. While GaN-on-silicon (GaN-on-Si) does not threaten the dominance of GaN-on-SiC now, its emergence will impact the supply chain and possibly shape future telecom technologies.

In the 1990s, the U.S. Department of Defense recognized RF GaN-on-SiC’s higher output power and efficiency compared to materials such as InP, GaAs HBT, GaAs HEMT and Si LDMOS. RF GaN has a wider bandwidth and offers the ability to reduce system size. Both of these capabilities are in demand as the telecom infrastructure extends its frequencies and base station models. These power and efficiency attributes led to widespread adoption in defense, where RF GaN-on-SiC could meet the challenges of thermal conditioning in higher-power applications, such as airborne radar.

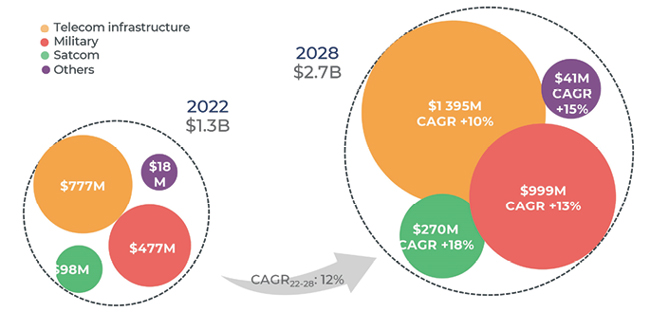

Defense remains one of the largest sectors in the RF GaN market. In parallel, RF GaN has started being adopted by the satellite communications (satcom) market, where its high efficiency, compared to other materials, enables smaller device sizes, freeing up valuable space at the system level. Yole Group’s RF GaN 2023 report forecasts that the defense and satellite communication sectors are expected to see a compound annual growth rate (CAGR) of 13 percent and 18 percent, respectively, from 2022 to 2028. This will propel the defense market to an estimated $1 billion in revenue, while the satcom market will grow to reach an estimated $270 million in revenue in 2028. Yole Intelligence’s forecast for RF GaN revenue and segmentation is shown in Figure 1.

Figure 1 Forecast and segmentation of RF GaN device revenue from 2022 to 2028. Source: RF GaN 2023 report, Yole Intelligence, 2023.

RF GAN IN TELECOM INFRASTRUCTURE

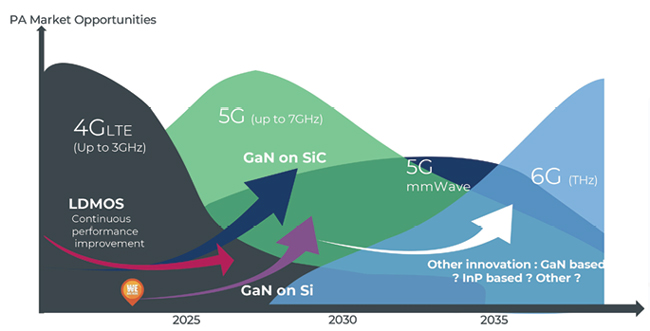

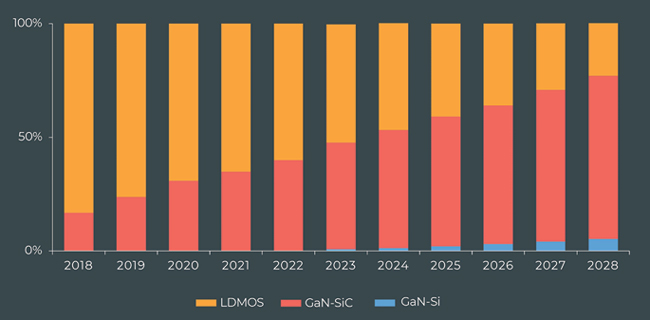

In 2023, the mainstream GaN technology is on a SiC substrate. This mature technology demonstrates remarkable characteristics such as enhanced power-added efficiency, thermal conductivity and power density in sub-6 GHz frequencies. First introduced by Huawei in 2015, volume production of GaN-on-SiC began in 2020 for 4G base stations. Since then, the GaN RF telecom industry has evolved into a high volume market by driving the need for cost-competitive 6 in. SiC wafers. As of 2023, 6 in. SiC wafers are commercially available and the transition at the facilities of leading players is ongoing. There have also been large investments from companies around the world, such as SEDI, Wolfspeed, NXP and Qorvo, ensuring GaN-on-SiC dominates in its target applications and replaces its counterpart Si LDMOS. Figure 2 shows the anticipated evolution of market share in the telecom infrastructure market for various RF power technologies.

Figure 2 RF GaN penetration in the telecom infrastructure market as of 2023. Source: RF GaN 2023 report, Yole Intelligence, 2023.

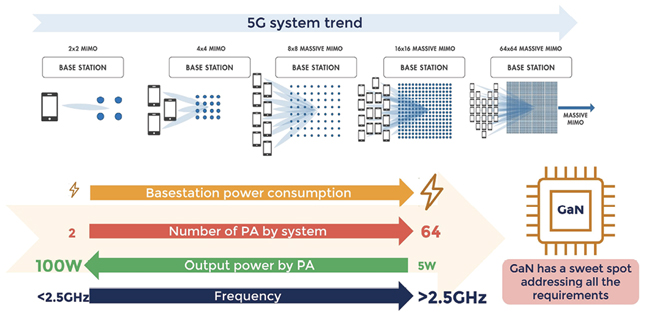

4G micro and macro site base stations are predominantly based on remote radio heads (RRH), which integrate the base station’s RF chains and analog-to-digital conversion components with up to eight multi-stream power amplifiers (PAs) at up to 100 W of output power. As the 4G era is coming to an end, the reliance on LDMOS-based PAs in 3 GHz base stations is expected to recede. Emerging sub-6 GHz 5G base stations are moving from a 2 × 2 MIMO model to a 64 × 64 massive MIMO (mMIMO) model with active antenna systems (AAS) to replace RRHs. In addition to increasing the number of PAs, this architecture is expected to be at a lower output power for each PA. These output powers will range from 100 to 5 W. There is also the requirement for the PA to reduce power consumption while handling increasing data traffic volumes. Figure 3 shows a vision of the evolution of 5G telecom infrastructure.

Figure 3 Telecom infrastructure system trends. Source: RF GaN 2023 report, Yole Intelligence, 2023.

GaN can address all these requirements. The LDMOS market share is expected to decline as GaN-on-SiC addresses frequencies up to 7 GHz for 5G. In the short term, RF GaN-on-SiC is also expected to benefit from further penetration as new regional markets, such as India, adopt AAS in building the telecom infrastructure. For 5G mmWave and 6G, as the requirements focus more on high frequencies and lower-power, RF GaN technology is expected to face tougher competition with other materials such as SiGe and InP.

MAKE ROOM FOR GAN-ON-SI

As the sub-6 GHz 5G telecom base station requires PAs with lower power, GaN-on-Si could find a sweet spot in 32T32R and 64T64R mMIMO base stations below 10 W. Over the last two years, the ecosystem has grown. Players such as STMicroelectronics with MACOM, OMMIC (now part of MACOM), GCS, Infineon Technologies and foundries like Global Foundries and UMC have been working on introducing RF GaN-on-Si technology.

The reduction in output power with the adoption of mmWave small cells having two or four streams and operating at 28 to 60 GHz also presents a potential opportunity for GaN-on-Si. As telecom infrastructure continues to move toward lower output power systems, AAS and small cells will drive the adoption of GaN-on-Si to meet multi-stream, small cell and mmWave beamformer performance demands. The next generation, 6G, will have even higher frequencies and GaN-on-Si is likely to play a role here, sharing the space with the incumbent GaN-on-SiC technology.

WHAT ABOUT GAN-ON-SI AVAILABILITY?

GaN-on-Si technology is commercially available today with mainstream 6 in. wafers, while 8 in. GaN-on-Si wafers are becoming available and 12 in. GaN-on-Si is being developed. Starting this year, companies like STMicroelectronics and Infineon Technologies, are introducing GaN-on-Si. It is important to note that these companies do not offer GaN-on-SiC; they are entering the telecom market only with GaN-on-Si technology. On the other hand, MACOM has expertise in both GaN-on-SiC and GaN-on-Si technologies. They have recently acquired OMMIC to expand their portfolio and cater to mmWave applications, primarily focusing on satcom applications.

In addition to being available at a lower cost than GaN-on-SiC, GaN-on-Si is of interest because it could be compatible with existing silicon manufacturing lines. The possibility to scale up to 12 in. GaN-on-Si could be a game changer if the market pull happens. As of 2023, players such as IQE, Global Foundries, UMC, GCS and Soitec are pushing for GaN-on-Si technology.

MAKING ROOM IN AN EXPANDING MARKET

Telecom infrastructure remains the largest single market for RF GaN devices. According to Yole Intelligence’s “RF GaN Compound Semiconductor Q2-23” report, revenue in this market segment is expected to increase in value from nearly $777 million in 2022 to around $1.4 billion by 2028, a CAGR of 10 percent. However, an expanding telecom infrastructure market for GaN-on-Si does not mean GaN-on-SiC will be completely eclipsed. Instead, the increased telecom market will allow room for growth in both the GaN-on-SiC and GaN-on-Si sectors. GaN is predicted to make up more than 75 percent of telecom infrastructure device shipments by 2028. Of this, more than 70 percent will be GaN-on-SiC, and 5 percent will be GaN-on-Si, with the rest of the total market attributable to LDMOS, which will continue to lose market share. Figure 4 shows the latest Yole Intelligence forecast for the market share of the various RF power technologies in the telecom infrastructure market.

Figure 4 RF power market share forecast for telecom infrastructure. Source: RF GaN Compound Semiconductor Market Monitor Q2 2023, Yole Intelligence, 2023.

Today, as the primary platform, GaN-on-SiC has a well-established supply chain. Device suppliers such as SEDI, Qorvo, Wolfspeed and NXP, as well as defense-related companies Raytheon, BAE Systems and Northrop Grumman, offer GaN-on-SiC technology. In 2022, SEDI, Qorvo and Wolfspeed were the leading players in RF GaN. The newcomer in the GaN space, NXP, has experienced significant growth by entering the telecom market supply chain with the opening of its 6 in. GaN-on-SiC fab in the U.S. in 2020. In a short time, the company, which also has an LDMOS offering, has become a leading player in the GaN-based telecom infrastructure sector. Now this expanding industry makes more room for GaN-on-Si technology, where low-power GaN solutions are promising for 32T32R and 64T64R mMIMO base stations below 10 W with more and more products becoming available this year.

But that is not all for GaN-on-Si technology! There is also a promising opportunity emerging for 5G handset PAs in the new Frequency Range 3 (FR3) band. Although there is potential for GaN-on-Si in sub-7 GHz and 5G mmWave frequencies for handset PAs, it is important to note that well-established GaAs solutions already exist for sub-7 GHz, and silicon-based solutions have gained traction for mmWave applications. These existing technologies have matured in terms of both technology and supply chain, posing as significant competitors. In the case of FR3, where the competition is still open, GaN-on-Si could potentially fulfill the requirements and find an opportunity for implementation. However, it is essential to consider that integrating GaN-on-Si into handset systems requires complex design changes, making the adoption of this technology in the FR3 band a longer-term goal. The final word is always said by the smartphone OEMs like Apple, Samsung and Xiaomi, which could be an inflection point for the GaN-on-Si industry.

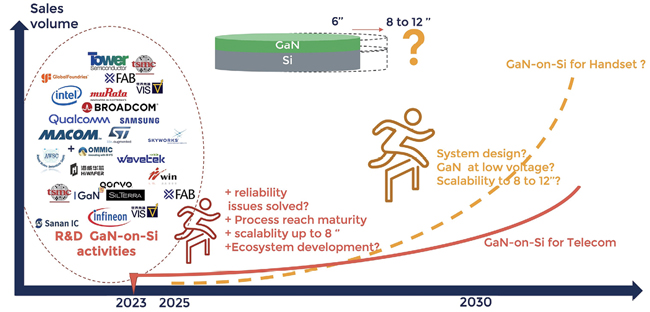

Regarding the GaN-on-Si ecosystem over the last few years, companies such as STMicroelectronics, MACOM, Infineon Technologies and foundries like Global Foundries and UMC have been actively involved in the development and introduction of RF GaN-on-Si technology. These players are working towards bringing this technology to the market. Additionally, there are innovative companies like Finwave, which is focused on developing 3D GaN FinFET technology on 8 in. GaN-on-Si wafers. They are utilizing standard silicon foundry tools in their development process. Alongside these innovative companies, established companies like GCS, UMC and Global Foundries have the potential to quickly adapt and enter the market. The players are getting ready for these killer applications to run their technology and open a new era for high volume GaN-on-Si manufacturing in the RF industry. Figure 5 shows some of the major RF GaN device manufacturers, along with a possible scenario for the adoption of GaN-on-Si for handset applications.

Figure 5 The ecosystem and potential evolution of GaN-on-Si for handset applications. Source: RF GaN 2023 report, Yole Intelligence, 2023.

In 2023, GaN-on-SiC is still the primary platform for RF GaN, benefiting as it does from a well-developed supply chain. Yole Group expects to see GaN-on-Si entering the market starting at the end of 2023 and begin taking some market share in the coming years. This will not be at the expense of GaN-on-SiC, which will continue to grow with the rollout of 5G, 6G, multi-stream small cells and wireless backhaul systems. Instead, the market share for LDMOS is expected to diminish as PA requirements change.

High volume production of GaN-on-Si is not expected for another three to five years, allowing OEMs time to adopt new technology. Today, the industry is working on solving the challenges, including reliability, process maturity and scalability to 8 or 12 in. wafers in a market segment where cost is key. Remarkable tech advances and the involvement of industry giants are more promising than ever. It is evident that in the medium to long term, GaN-on-Si will capture market share, potentially extending to the handset market.