TRANSFORMATION OF THE LEO SATELLITE INDUSTRY

In recent years, the arrival of well-established commercial launch services has brought launch costs down significantly lowering the barrier to entry. This has opened the market to new players and innovators in the low earth orbit (LEO) satellite industry.

In parallel with reduced launch costs, satellites have decreased from the size of a bus to something you can hold in your hand. The combination of lower launch costs and smaller satellite size is reducing the overall mission cost. Gone are the days of space missions belonging only to space agencies such as NASA and legacy satellite companies.

NON-SPACE INDUSTRY DRIVERS

Commercial space applications are rapidly growing in non-space industries such as energy and mining, agriculture, automotive, telecom, medical and education. Companies in these industries are investing in space to differentiate and expand service offerings to diversify revenues. This “Space-for-Earth” economy industry disruption is driving new use cases, capabilities and users for satellite-based data. There are many examples of the space sector already playing a role in non-space industries. Geospatial satellite technology helps the mining industry by identifying areas for oil exploration and providing imagery of mining sites. Global positioning systems (GPS) satellite technology guides ride-share services such as Uber and Lyft and as the automotive industry moves towards a driverless future, the accuracy of maps becomes a priority. Satellite data helps the agricultural industry make more informed crop development decisions by improving weather forecasts. Satellite technology is changing access to healthcare for remote regions worldwide and satellite data is advancing medical knowledge.

The private sector is increasingly and actively securing assets in space with these efforts driven by the need for internet access and data. We expect exponential growth of this data-based, Space-for-Earth economy and we expect the emergence of a “Space-for-Space” economy with space-based services and products to support life in space.

NON-SPACE DRIVER EFFECTS

As more companies turn to space for business opportunities that they hope will expand revenue streams and enhance life on Earth, the space industry risks saturation. Satellite manufacturers and launch services will need hardware and software solutions from system equipment, component, test and measurement and software companies to make these new satellite constellations and business models a reality.

INDUSTRY LIFECYCLE

As is the case with many new industries, some companies in the early stages of the LEO satellite boom may not survive and there will be consolidation as this industry matures. Companies that serve this market will need to understand how to adjust and strengthen their business strategy and build infrastructure as the LEO satellite industry evolves through the industry lifecycle. Semiconductor companies with proven maturity in the space market should be aware of where the LEO satellite industry is in this lifecycle. This will help them make wise decisions about partnering with end customers along with developing resilient and sustainable infrastructure.

Figure 1 shows the five stages of the satellite industry lifecycle and some characteristics of those phases. Currently, the LEO industry is in a period of rapid growth and evolution and it has entered the Shakeout phase of the lifecycle. In this phase, some companies are naturally eliminated because their business strategies do not keep up with the growth of the market, but some companies can prosper versus their competitors in this phase. At this point in the commercial space industry, non-traditional space investors and influencers are realizing the value of new capabilities arising from the vast amount of high speed data provided by LEO satellites.

Figure 1 Industry lifecycle.

WHAT HAPPENS NEXT?

The increase in data traffic enabled by LEO satellites is creating demand from satellite manufacturers, launch services and service providers. These companies are facing rising pressures to reduce launch costs and product development times. They must develop systems and networks that address the increased demand for BIG data, along with the desire for ubiquitous connectivity and reduced propagation delay. To achieve these goals, companies are developing innovative models for data analytics and increasing digitization.

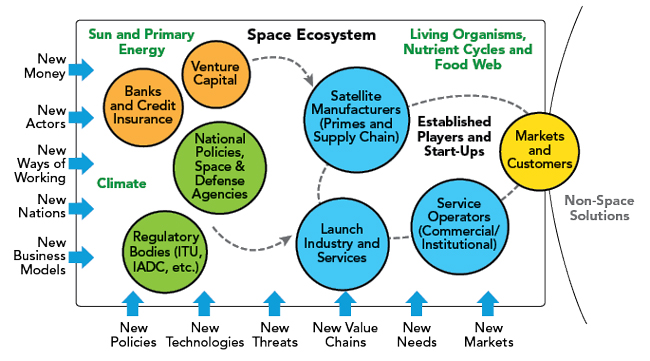

Business-to-business companies that enable these manufacturers and services must adjust to shifting market demands with innovative solutions that support these challenging applications. This is leading to a natural selection process where companies looking to capitalize on emerging space opportunities are starting to choose suppliers with a proven reputation for high-reliability products in commercial space applications. Through proof of resilience, scalability, growth and sustainability, stronger companies will begin to eliminate the weaker competition. Larger, well-established companies in the commercial space ecosystem may choose to strategically acquire companies that are smaller or struggling. This consolidation phase will affect the entire ecosystem as consumers, service providers, system/sub-system manufacturers and component companies start to define and differentiate their niche in the Space-for-Earth economy. How companies survive the Shakeout phase of Figure 1 will depend on where they fall in the ecosystem of commercial space as noted in Figure 2.

Figure 2 Commercial space ecosystem.

SURVIVING THE SHAKEOUT

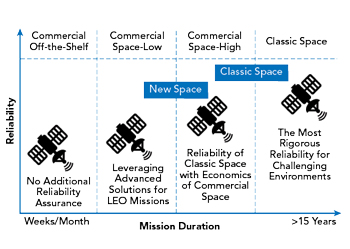

Figure 3 Space product classification at ADI.

Semiconductor companies such as Analog Devices, Inc. (ADI) fall within the “Satellite manufacturers” circle as a supplier. Historically, a large part of Analog Device’s business supports the traditional geostationary Earth orbit (GEO) satellite market segment where satellites are larger, more expensive and designed for longer missions. To survive the Shakeout phase in the commercial space industry, companies like ADI must develop business models that enable customers to meet the demands of this new LEO satellite space dynamic (see Figure 3).

The following are descriptions of focus areas that are critical for success in the future:

Mission-Based Product Offering

Performance and reliability are critical attributes of the space industry, but companies must also focus on reducing costs to customers, especially in the high volume LEO market. ADI has expanded their portfolio of space products to include two new grades addressing the wide-ranging needs of the emerging commercial space satellite industry. These new product grades focus on LEO satellites and mega-constellations orbiting in low radiation environments as well as addressing the evolving cost pressures on more traditional GEO satellites. With over five decades of heritage building space-grade components, ADI is focused on developing products that meet levels of flexibility, reliability and quality suitable for any mission profile.

Commercial Space Low (CSL)

This product grade targets cost-constrained or high volume requirements. CSL offers basic testing and screening suitable for LEO constellations orbiting in lower radiation environments.

Commercial Space High (CSH)

This product grade targets applications with the highest level of reliability. With this product grade, customers can take advantage of cost savings and advanced features in comparison to traditional space products. CSH offers the highest screening and radiation qualification level with the most rigorous testing. This product grade can be used where no hermetic package option is available (equivalent to QML V using SAE AS6294 as a guideline). CSH includes everything offered by CSL, plus high-reliability screening and high-reliability quality conformance inspection.

PLATFORMS FOR COMPLEX FUNCTIONALITY

The time to develop new technology and payloads and then launch satellites has dropped from years to months. This shortened development cycle, coupled with an increase in IC functional complexity creates a need for solutions that evaluate parts faster in system applications. Customers do not have time to build evaluation boards and develop code to integrate parts in their system, so supply chain companies are helping customers get their solutions working with minimal time, effort and investment. ADI is addressing this opportunity by releasing turnkey, system-level open platforms. Their beamforming “bits-to-beams” platforms allow customers to start evaluating and confirming beamforming algorithms faster. These efforts enable faster development cycles to support the dynamic growth that the industry is experiencing.

WE ALL WIN

The growth of private sector industries embracing the commercial space market is driving the growth of satellite services. As opportunities expand, the satellite industry is addressing the need for reduced launch costs, smaller satellites, mega-constellations and the reality that satellite-based data demand is rising rapidly. As companies enter this market, business leaders will need to develop business models and strategies to take advantage of the rapid growth while allowing for scalability and sustainability. As with any growing industry, making these decisions can be both challenging and rewarding as companies look to capitalize on market growth. The industry will focus on the challenges of developing more sophisticated, cost-effective products to meet the evolving size, weight and performance requirements of high density LEO constellations, while simultaneously reducing time-to-market.