Since 2012, the broadband satellite industry has evolved at an unprecedented and unfathomable rate. This article discusses the major historical milestones, system developments and challenges of the past decade, focusing primarily on constellations in non-geostationary (NGSO) low earth orbit (LEO), while also mentioning developments in the geostationary (GSO) sector.

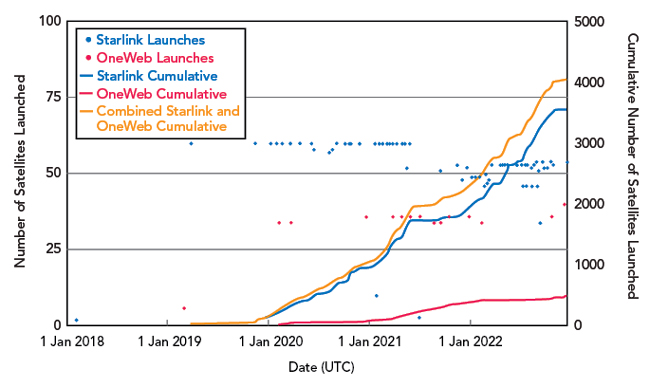

An April 2022 study conducted by researchers in the Olin Satellite + Spectrum Technology & Policy (OSSTP) Group found that more than 20 unique entities have filed U.S. Market Access applications with the Federal Communications Commission (FCC) for a total of 70,000 fixed satellite service (FSS) satellites operating across Ku-, Ka- and/or V-Bands.1 Of these systems, several entities (Starlink, OneWeb, Kepler) have started deploying satellites, with OneWeb and Starlink totaling more than 4000 NGSO FSS satellites in orbit as of December 1, 2022, as seen in Figure 1.

Figure 1 Number of U.S. NGSO FSS launches over time.

Much of the regulatory and technical framework that has enabled these systems to come to fruition was established in the late 1990s or early 2000s for systems like Skybridge and Teledesic. While these 1990s networks were not commercially successful, they moved the satellite industry forward. These efforts helped establish GSO interference mitigation techniques at the International Telecommunications Union (ITU) and refined the processing round filing framework within the FCC. These networks also drove technological advancements like low-cost user terminal antennas, along with gateway and teleport architectures that have been pivotal stepping stones for today’s industry.

SATELLITE BROADBAND HISTORY: A DECADAL REVIEW

An assessment of the latest generation of NGSO systems like OneWeb, Starlink, Lightspeed and Kuiper, begins in November 2012 as shown in Figure 2, when Greg Wyler filed for Ku-Band frequencies at the ITU. These frequencies had been studied at numerous World Radio Conferences (WRCs) in the 90s and were set aside for NGSO systems. In this same period, GSO high-throughput satellite (HTS) networks like Viasat-1 and medium Earth orbit (MEO) O3b, also founded by Wyler, were beginning to provide services. O3b was commonly described as the most successful satellite network to that point because it offered high capacity and it had never filed for bankruptcy.

Figure 2 Timeline for Greg Wyler’s satellite efforts.

As shown in Figure 3, Wyler brought his NGSO project to Google and for a brief period, he worked with a team in Google’s Access Division. After leaving Google and bringing the NGSO FSS project with him, Wyler and Elon Musk collaborated on the constellation effort but later split in 2015 giving birth to today’s OneWeb and Starlink constellations.

Figure 3 The evolution of LEO satellites.

At WRC-15, studies addressing NGSO protection criteria for GSO systems, referred to as equivalent power flux density (EPFD) limits, were evolving in V-Band along with NGSO bringing into use (BIU) requirements, high altitude platforms (HAPS) frequency allocations and terrestrial frequency allocations for 5G systems. The rules defined at WRC-15 would establish the framework for the future NGSO revolution. The same year, Wyler informed Telesat CEO Dan Goldberg of his LEO broadband constellation plans. Despite being initially opposed to LEO constellations, Goldberg filed through Canada for access to COMMStellation, an existing ITU network. When he was awarded spectrum, Goldberg formed what would eventually become Telesat’s Lightspeed NGSO constellation.

This started a rush as mainstays in the satellite industry, new startups and tech conglomerates began filing for NGSO constellations. In 2016, SES found their foothold in this race by acquiring O3b while Amazon announced their plans to launch the Kuiper constellation of LEO satellites. This is shown in Figure 4.

Figure 4 NGSO satellite activity after 2015.

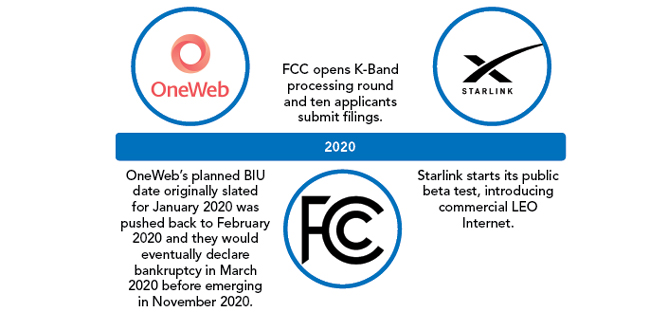

In 2017, Iridium upgraded their messaging service on their NEXT line of satellites launched through SpaceX. Despite some early success, LEO constellations were not without risk. Greg Wyler’s OneWeb, one of the largest players in the new landscape, declared bankruptcy in March 2020 due to funding uncertainties, but emerged from bankruptcy eight months later in November 2020. OneWeb managed to find new funding and they emerged from bankruptcy in November 2020, as shown in Figure 5.

Figure 5 The satellite industry speeds up.

In May 2020, the FCC announced the Ka-Band processing round with ten applicants filing for LEO constellation access. SpaceX also announced its public beta test in October 2020, introducing fast, low latency LEO internet for the masses. Even with its inherent risks, the NGSO satellite industry was expanding and evolving at a rapid pace.

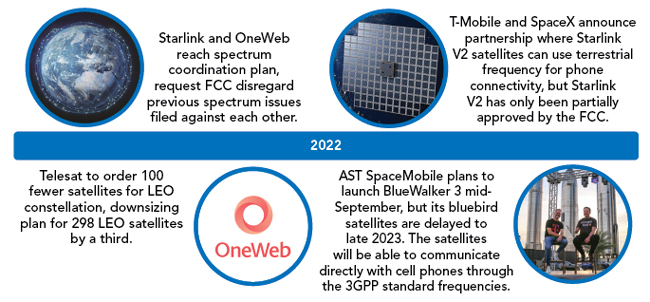

In 2021, this pace continued with Canada committing $1.15 billion to Telesat’s NGSO Lightspeed Constellation. But 2022 brought challenges to the satellite industry. The COVID-19 pandemic had already created logistical headaches and the war in Ukraine compounded these challenges. Telesat responded by decreasing their LEO satellite fleet by a third and OneWeb experienced launch delays.

Despite the headwinds, the industry experienced several noteworthy accomplishments; Starlink and OneWeb reached a spectrum coordination agreement and Starlink and AST announced plans for low-data rate (not broadband) services directly to cell phones with their next-generation satellites. ViaSat and Inmarsat, two of the largest GEO satellite services and broadband providers agreed to merge in a $7.3 billion deal (see Figure 6).

Figure 6 Recent developments in the satellite industry.

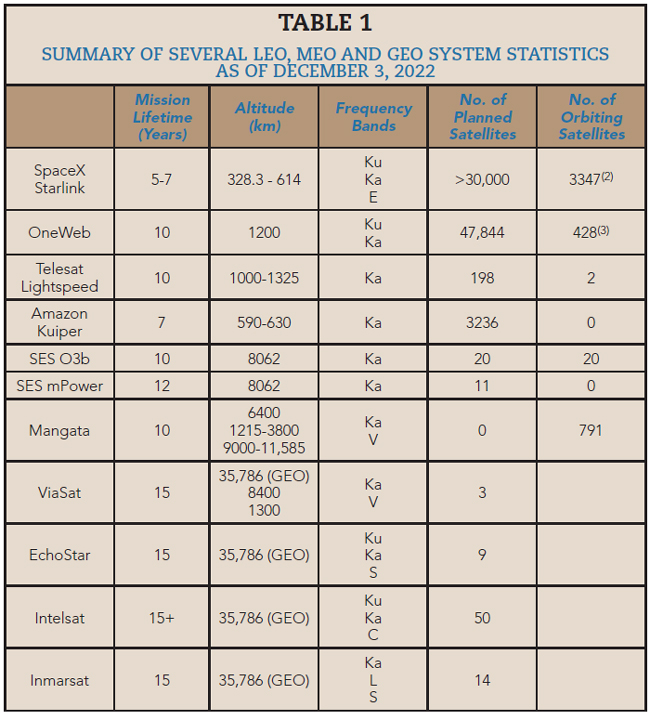

Table 1 provides a summary of the mission lifetime, orbital altitude, number of planned satellites (as submitted in filings), frequencies and current number of orbiting satellites for primary LEO, MEO and GEO players.

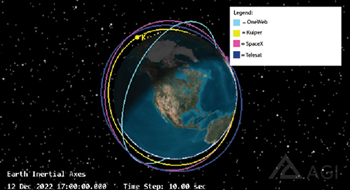

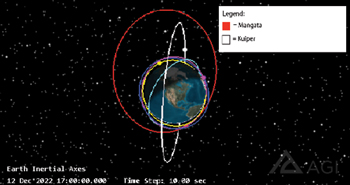

Figure 7 Orbital representation of satellite constellations in LEO.

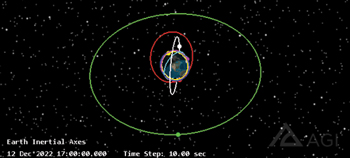

Figure 8 Orbital representation of satellite constellations in MEO.

Figure 9 Orbital representation of satellite constellations in GEO.

To conceptualize the various orbits of these networks more easily, a single OneWeb, Kuiper, SpaceX and Telesat satellite orbit is depicted in Figure 7 using AGI’s Systems Tool Kit (STK). Figure 8 adds the Mangata and Kuiper MEO systems to the LEO satellites of Figure 7. Figure 9 adds the geostationary orbit of a satellite like EchoStar, Intelsat and ViaSat, in green, to the LEO and MEO networks of the previous orbital representations.

TECHNICAL AND REGULATORY CHALLENGES

The incredible achievements of the LEO, MEO and GEO broadband satellite sectors over the past decade would not have been possible without overcoming technical and regulatory challenges. The primary technical challenges are the availability of low-cost, user terminals (UTs), efficient solid-state power amplifiers (SSPAs) and launch vehicle supply. The primary regulatory challenges have centered on interference mitigation (EPFD), BIU deadlines for ITU filings and an update of FCC NGSO licensing rules and sharing frameworks.4

TECHNICAL CHALLENGES

Due to tracking requirements for NGSO systems, user terminal technologies consist of a pair of traditional parabolic dishes or a flat panel phased array.5 While the parabolic dish is less expensive, it requires a second dish to support make-before-break satellite-to-satellite handoffs. The phased array antenna simplifies this process by electronically scanning a single beam or multiple beams, but it is considerably more expensive than the parabolic dish alternative.6 Starlink is currently selling its terminals at $599 and they are suspected to be selling them at a loss.7 It is also worth noting that these technologies must comply with ITU and FCC regulations such as power flux density (PFD) limits, earth station gain masks and equivalent isotropic radiated power (EIRP) density limits.8