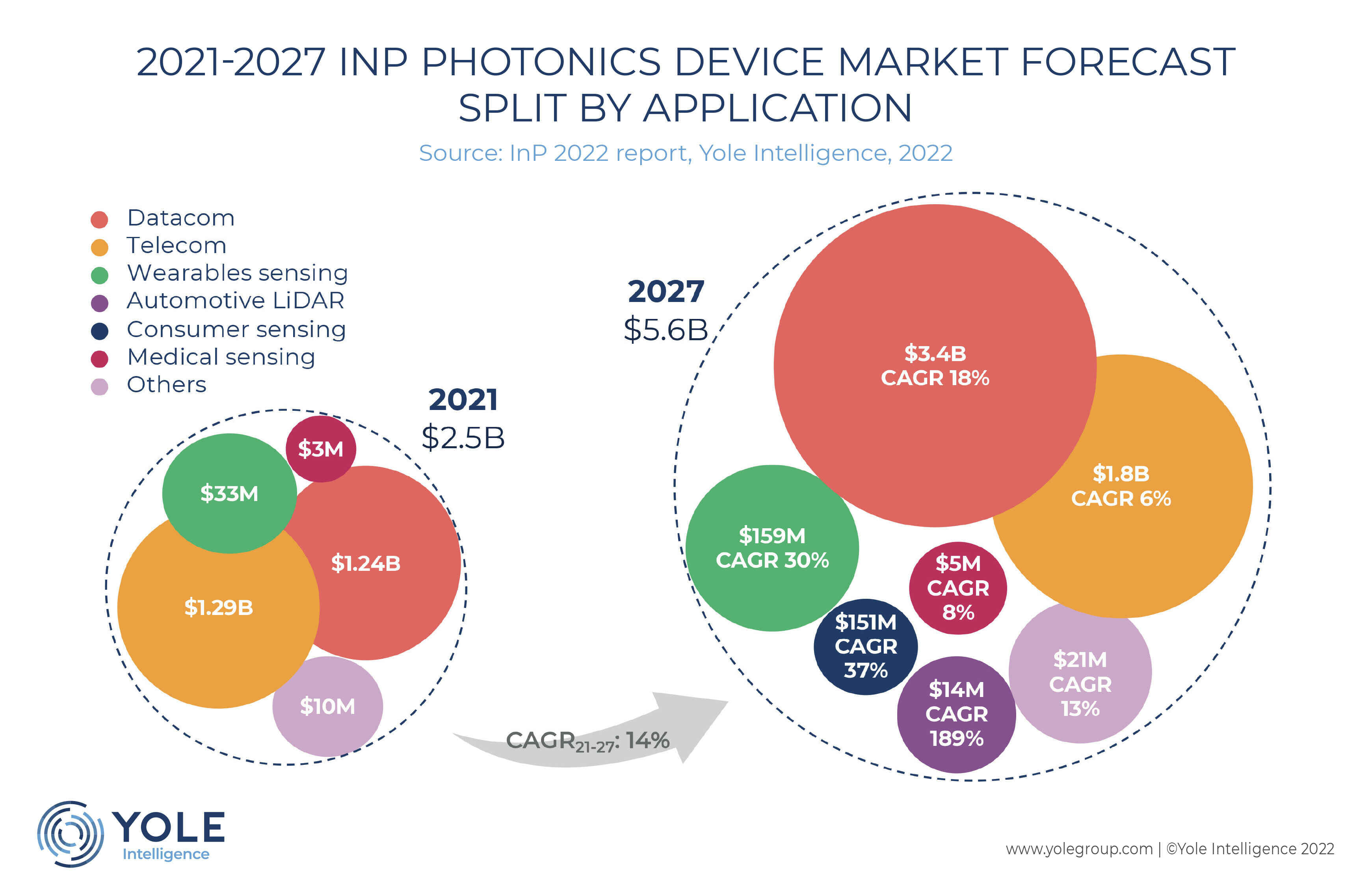

The migration to higher data rates, lower power consumption within data centers and the deployment of 5G base stations will drive the development and growth of optical transceiver technology in the coming years. As an indispensable building block for high-speed and long-range optical transceivers, InP laser diodes remain the best choice for telecom and datacom photonic applications. This growth is driven by high volume adoption of high-data-rate modules, above 400G, by big cloud services and national telecom operators requiring increased fiber-optic network capacity. With that in mind, the InP market, long dominated by datacom and telecom applications, is expected grow from US$2.5 billion in 2021 to around US$5.6 billion in 2027.

Yole Intelligence has developed a dedicated report to provide a clear understanding of the InP-based photonics and RF industries. In its InP 2022 report, the company, part of Yole Group, provides a comprehensive view of the InP markets, divided into photonics and RF sectors. It includes market forecasts, technology trends and supply chain analysis. This updated report covers the markets from wafer to bare die for photonics applications and from wafer to epiwafer for RF applications by volume and revenue.

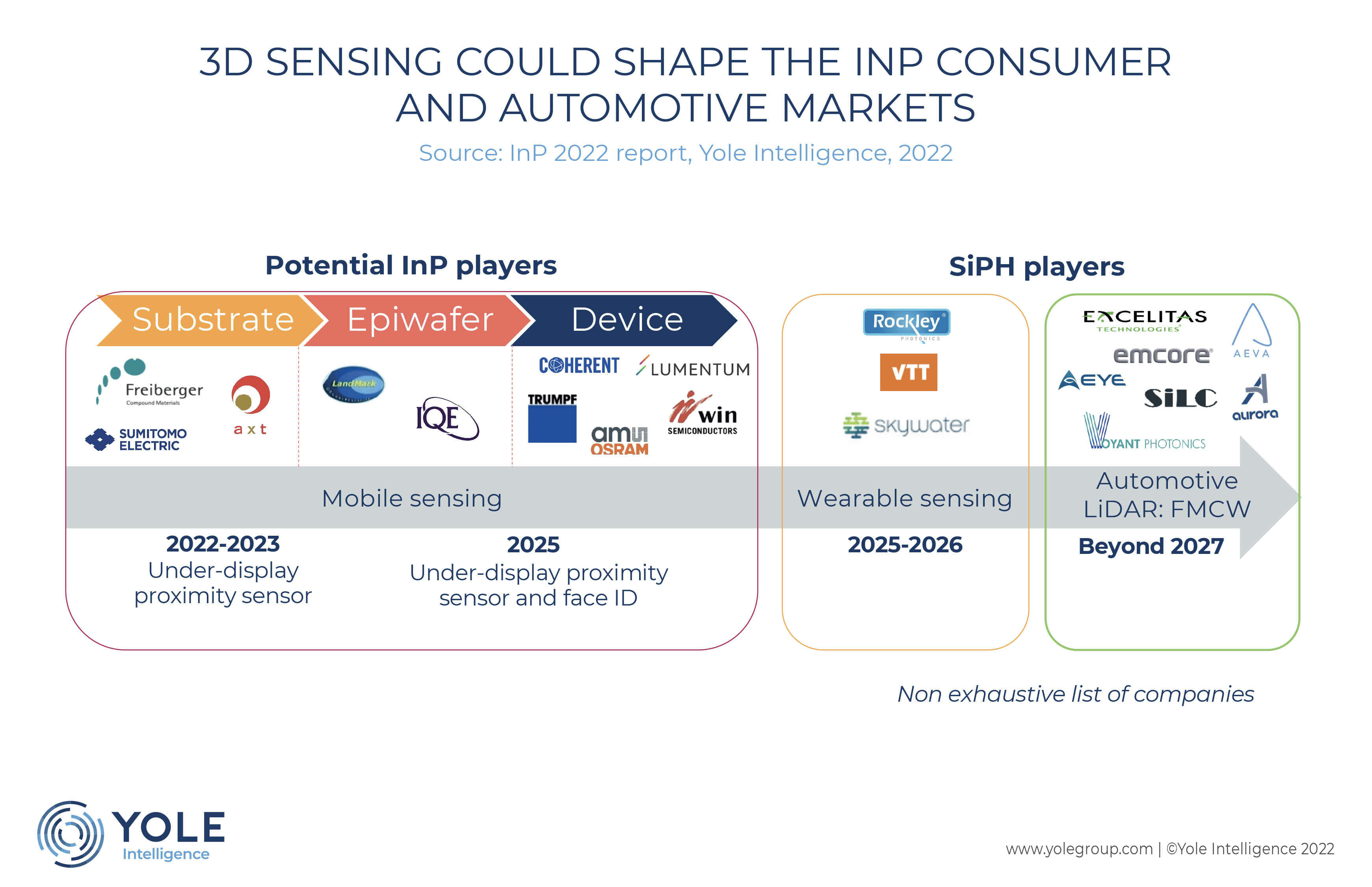

Ali Jaffal, Ph.D., Technology and Market analyst at Yole Intelligence said, “There has been a lot of speculation on the penetration of InP in consumer applications. The year 2022 marks the beginning of this adoption. For smartphones, OLED displays are transparent at wavelengths ranging from around 13xx to 15xxnm.”

OEMs are interested in removing the camera notch on mobile phone screens and integrating the 3D-sensing modules under OLED displays. In this context, they are considering moving to InP EELs to replace the current GaAs VCSELs . However, such a move is not straightforward from cost and supply perspectives.

Yole Intelligence noted the first penetration of InP into wearable earbuds in 2021. Apple was the first OEM to deploy InP SWIR proximity sensors in its AirPods 3 family to help differentiate between skin and other surfaces. This has been extended to the iPhone 14 Pro family. The leading smartphone player has changed the aesthetics of its premium range of smartphones, the iPhone 14 Pro family, reducing the size of the notch at the top of the screen to a pill shape.

To achieve this new front camera arrangement, some other sensors, such as the proximity sensor, had to be placed under the display. Will InP penetration continue in other 3D sensing modules, such as dot projectors and flood illuminators? Or could GaAs technology come back again with a different solution for long-wavelength lasers?

The impact of an innovative company like Apple adding such a differentiator to its product significantly affects companies in its supply chain, and vice versa.

Traditional GaAs suppliers for Apple’s proximity sensors could switch from GaAs to InP platforms since both materials could share similar front-end processing tools. Yole Intelligence certainly expects to see new players entering the InP business as the consumer market represents high volume potential. In addition, Apple’s move could trigger the penetration of InP into other consumer applications, such as smartwatches and automotive LiDAR with silicon photonics platforms.