Across the world, mobile phones are the one united technology in all countries, nationalities and groups. Some estimates indicate that there are more cell devices than people, with countries like Hong Kong and Saudi Arabia at over 170 percent participation. Now that 96.5 percent of Americans have one, the competition for higher data speeds and increased customer retention has put carriers in a bind: How do you maximize cash flow and reduce expenses to fuel expansion?

Top executives of wireless carriers have a common goal: effectively covering more subscribers with less Operating Expenses (Opex). With over 285,000 cell sites in the United States, electrical usage could reach up to 712 million kWh per year. Gene Beall of Mobilite, a former senior leader at AT&T, recently stated that wireless carriers in North America will need to spend an estimated $25 billion during the next four years to improve and expand their existing wireless infrastructure, regardless of whether they use CDMA- or GSM- and HSPA-based protocols. According to Beall, an additional $3.5 billion is required to rollout 4G networks by the top four U.S. wireless carriers.

As in any other business, there are basically two methods to fund the expansion and rollout: 1) through external investments such as stock/bond offerings or 2) through internal cash flow. The first option, with volatile stock prices, remains more difficult in the economic downturn. AT&T, for example, has lost and regained one third of its stock price in the past three years, making them a harder sell to investors. One of the most efficient ways to promote a healthy cash flow is to reduce company Opex. In 2011, the top four U.S. wireless carriers spent more than $130 billion in overall operating costs. Shaving off even a small bit of this enormous expense can go very far for the carriers.

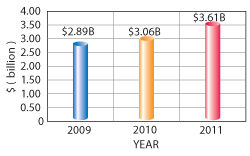

Leasing and renting third-party owned properties (both towers and rooftops) and managing their own properties is the single biggest portion of the on-going operating cost for a wireless carrier. AT&T, for example, has more than 10,000 towers of its own, yet according to its annual report, it spent $3.6 billion on rental fees alone in 2011 (see Figure 1). Reducing this section of the Opex has a direct impact to shareholder value as this affects the carriers’ bottom line and future success. Experts say that U.S. wireless carriers spend more than $20 billion a year just on leasing and rental to house their wireless equipment.

Figure 1 AT&T's annual rental expenses.

Ironically, for an industry dedicated to innovation and creativity with handsets, cell sites are still heavily reliant on less efficient, older technology. LDMOS power amplifiers have been in use for decades, with little improvement in power efficiency, power density, performance and thermal characteristics. In essence, LDMOS is too large, too hot and too inefficient to run lean, fast, powerful wireless networks for the biggest four carriers; they are burning money that could be used for expanding their networks.

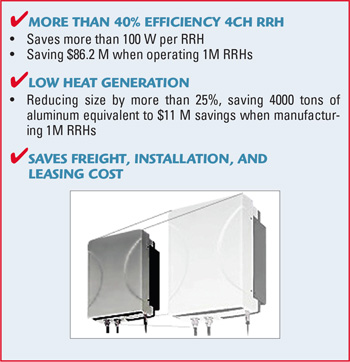

The better suited alternative is GaN transistors that have much higher efficiency for Remote Radio Head (RRH), while producing much smaller amounts of heat and leading to cost savings across the board.

For carriers, weight and size directly translate into the leasing and rental expenses in the same way that every pound of luggage on a commercial airline deprives profit. It is not just major airlines that are charging for additional weight; tower and building landlords are charging carriers for the weight and size of the wireless equipment on their properties. Naturally, carriers are making every effort to reduce the size and weight of their equipment to reduce the cost and, moreover, reduce expensive installations of heavy equipment.

GaN’s intrinsic wideband and high efficiency characteristics enable designers of wireless base stations, remote radio heads, and small cells to make systems smaller by reducing the heat sink size and power supply requirements. This directly translates to lower installation and equipment space rental expenses for carriers. Additionally, overall reliability also affects the carriers’ bottom lines by producing more reliable LTE services to end users, and also by reducing expected maintenance expenses. Furthermore, carriers can save on future upgrades as GaN-based RRHs can support multi-band, multi-mode and multi-carrier technology. RFHIC estimates that carriers would save billions just on the leasing and rental expenses alone. They also estimate that carriers can save $2 billion per year on electricity by adopting a GaN-based power amplifier for RF transmit needs, promoting carriers’ sustainability and corporate responsibilities. GaN can provide many benefits in all sorts of RF applications but for now, wireless infrastructure is the clear winner to take this great cost saving benefit of GaN technology.