Yole Développement (Yole) just published a new report on the GaN market. According to Yole, the overall GaN RF market is expected to reach USD 2 billion by 2024, driven by two main applications: telecom infrastructure and defense as noted by Ezgi Dogmus, PhD. Technology & Market Analyst at Yole Développement (Yole). Antoine Bonnabel, Technology & Market Analyst, also part of the Power & Wireless team at Yole, added that worldwide investment in telecom infrastructure has remained stable in the past decade, with a recent increase coming from Chinese government efforts. But in this steady market, the trend toward higher frequencies offers a sweet spot for RF GaN in PA in 5G network at frequencies below 6 GHz.

In their new RF GaN report, RF GaN market: applications, players, technology, and substrates, Yole’s analysts offer a deep understanding of GaN implementation in different market segments and an overview of 5G’s impact on the wireless infrastructure and RFFEs , the GaN based military market including current market dynamics and future evolution. In addition, Knowmade, based on its IP expertise, reveals the related competitive landscape from a patent perspective. Key patent owners, IP & technology strategies, and future intents have been analyzed by the analysts in the RF GaN 2019, Patent landscape analysis report.

Current GaN Market

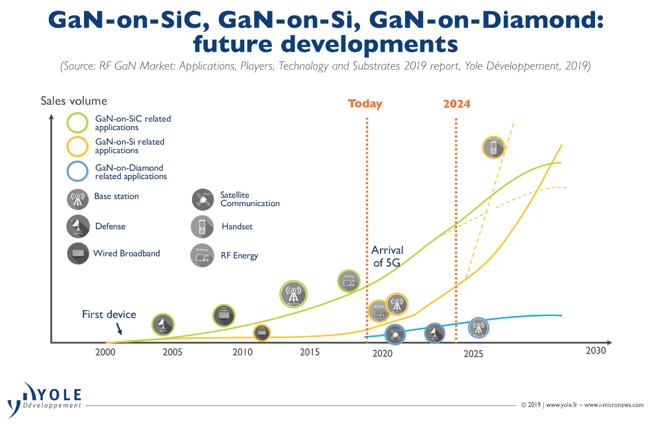

Since the first commercial products 20 years ago, GaN has become a serious rival to LDMOS and GaAs in RF Power applications, with a continuous improvement of performance and reliability at lower cost. The first GaN-on-SiC and GaN-on-Si devices appeared at almost at the same time, but GaN-on-SiC has become more technologically mature.

Currently dominating the GaN RF market, GaN-on-SiC penetrated the 4G LTE Wireless infrastructure market and is expected to be deployed in RRH architectures in 5G’s sub-6 GHz implementations. In parallel, there has also been remarkable progress in cost-efficient LDMOS technology, which is likely to challenge GaN solutions in 5G sub-6 GHz active antenna and massive MIMO deployments.

GaN-on-Si is a potential challenger with possible expansion to production on 8-inch wafers, and promises cost efficient solutions for commercial markets. However, as of Q1-2019, GaN-on-Si remains in low volume manufacturing - it is expected to challenge the existing LDMOS solutions in the BTS and RF energy market.

Another target of GaN-on-Si companies is the high-volume consumer 5G handset PA market, which can open up new market opportunities in coming years, if successful. With eventual ramp-up of GaN-on-Si products, a coexistence of both GaN-on-SiC and GaN-on-Si in the market would be possible. Last but not least, innovative GaN-on-Diamond technology is entering the competition, promising very high power output density with smaller footprint compared to its GaN rivals. This technology targets performance-driven applications, such as in high power BTS, military and satellite communications.

Status of the Supply Chain

As a mature technology, GaN-on-SiC has a well-established supply chain with numerous companies and different levels of integration. At the RF component level, the top market players are:

• Sumitomo Electric Device Innovations (SEDI), Cree/Wolfspeed and Qorvo

• Upon becoming a public company, RFHIC has significantly increased its revenue since 2017

• Leading compound semiconductor foundry Win Semiconductors is now actively offering GaN RF products

In the GaN-on-Si RF industry, STMicroelectronics is a leading actor in collaboration with MACOM targeting global 5G base station applications with expansion of production capacity of 150 mm GaN-on-Silicon and further expansion to 200 mm. Furthermore, ST has announced its interest in GaN-on-Si handsets, which could open exciting new market opportunities for the GaN RF business. Yole and Knowmade had the opportunity to meet Filippo Di Giovanni, Director Strategic Marketing, Innovation & Key Programs for New Materials and Power Solutions Division, Automotive Products Group, at STMicroelectronics. They discussed the technology's status and roadmap for the coming years. The full interview on i-micronews.com.

Within the military market, countries and regions are individually strengthening their GaN RF ecosystem. GaN adoption is driven by strong players such as Raytheon, Northrop Grumman, Lockheed Martin in the USA, and is boosted in Europe with UMS, Airbus, Saab, and in China by leading vertically-integrated company, China Electronics Technology Group Corporation (CETC).

However, in the telecom market the situation is different. Strategic partnerships and/or mergers and acquisitions have marked 2018. The market leader SEDI and II-VI established a vertically-integrated 6-inch GaN-on-SiC wafer platform to address the increasing demand within 5G. In parallel, Cree acquired Infineon’s RF Power Business including and packaging and test for LDMOS and GaN-on-SiC technologies. There is a lot going on in the market so it will be interesting to keep following the players here to see how the market evolves.