IDT is one of the semiconductor companies I’m following, as it quietly makes a play in RF/microwave, intending to become a significant presence in communications infrastructure.

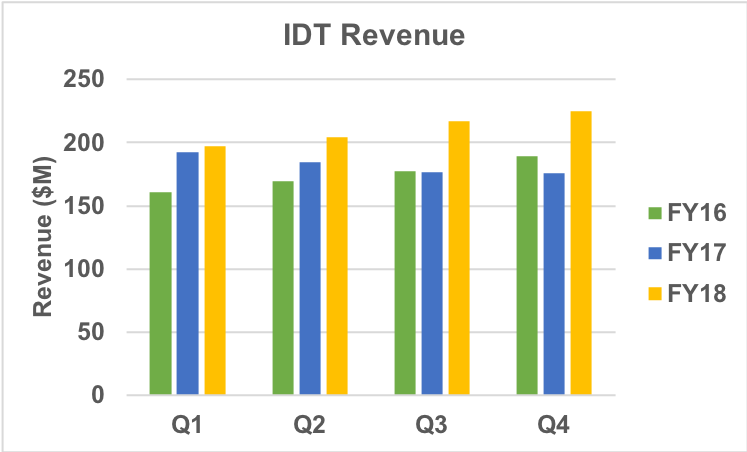

For IDT’s 2018 fiscal year (FY18), which completed on April 1, the company reported revenue of $843 million, reflecting 16 percent growth above FY17. Fourth quarter revenue was $225 million, up 4 percent sequentially and 28 percent year-over-year.

The communications infrastructure segment grew 4 percent sequentially in Q4, to $66 million, which was 29 percent of IDT’s total revenue during the quarter. During the earnings call, CEO Greg Waters characterized the market as “flattish,” yet said IDT gained share in RF and advanced timing products.

ZTE Hit

The U.S. government’s ban on exporting products to ZTE will impact IDT: ZTE contributed some $20 million over the past 12 months, with a forecast of $4 million for the first quarter of fiscal 2019. Following the export ban, IDT eliminated all ZTE revenue from the forecast and financial guidance. If the ban is lifted, any revenue will be upside to the forecast, according to the company.

Outlook

During the earnings call, Waters said the company is performing well, and he expects “continued above market revenue growth,” even without revenue from ZTE. He characterized the revenue potential from design-ins as the largest in at least a decade, citing advanced timing, memory interface, sensors, RF, automotive, industrial and wireless power as outperforming expectations.

The company’s estimate of revenue for Q1 is between $222 million and $232 million. The midpoint of the range represents flat quarter-to-quarter and 15 percent year-over-year growth.

RF Strategy

IDT’s RF product portfolio has been based solely on silicon, initially developing products targeting applications below 6 GHz (read Microwave Journal’s Fabs and Labs profile). Using a strategy dubbed “smart silicon,” IDT has introduced several innovative design concepts:

Glitch-Free™ — eliminating transient overshoot in switches and digital step attenuators (DSA) during transitions.

Constant Impedance — maintaining constant impedance when switching between RF ports, to minimize transients and maintain VSWR.

FlatNoise™ — keeping a constant noise figure while reducing the gain of a variable gain amplifier (VGA).

Zero-Distortion™ — reducing the noise floor and third-order intermodulation distortion in mixers.

More recently, IDT’s focus has shifted to millimeter wave, with the intent to play in the emerging market for 5G fixed wireless access systems at 24, 28 and 39 GHz.

IDT released an integrated modem for millimeter wave systems in February 2017. In August, IDT agreed to pay $17 million to acquire SpectraBeam, called “a small but elite RF technology company” by Waters. SpectraBeam was developing millimeter wave beamforming products for 5G and satellite communications.

During IDT’s Q3 earnings call on January 29, Waters said engagement with customers was proceeding “well ahead of plan. This new product family continues to generate exceptionally strong customer demand in all regions and is considered to be a fundamental technology for 5G wireless deployment.”

During the most recent call, he affirmed customer interest, saying “it’s one of the areas when customers have come to us and said, 'you really need to hire more engineers now'.”

IDT’s millimeter wave strategy seems to put it on the field competing with Anokiwave and Movandi.

With 5G being launched, IDT is definitely a company to watch. Staking positions at both sub-6 GHz and millimeter wave, let's see how it converts its technology and products to market share and revenue.