Tell us about today's point-to-point radio environment, considering microwave penetration by region and radio's share vs. fiber.

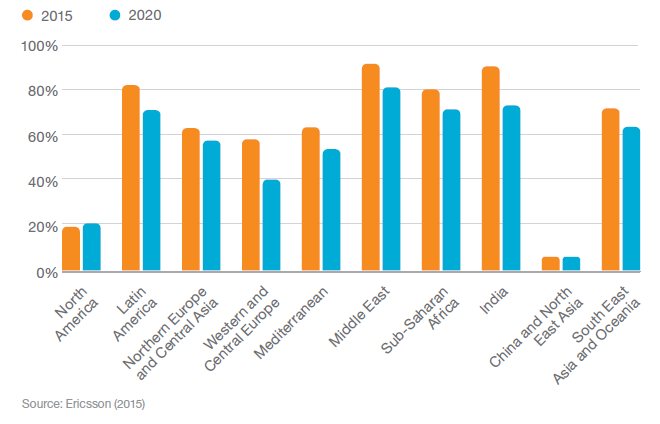

The world is divided and will remain divided for the foreseeable future when it comes to the use of microwave versus fiber. From the outset, microwave has been the backhaul medium of choice when speed and cost make fiber not viable. Looking at today’s picture, fiber availability has grown dramatically in recent years, but microwave remains the dominant backhaul technology to connect radio base stations to the next level of the network — the one exception being northeast Asia, where fiber penetration is extremely high.

Microwave capacities and latency will continue to support mobile broadband networks in the future. In most regions — India and southeast Asia as well as the Middle East and Africa — microwave will continue to be the dominant backhaul medium in 2020 and beyond (see figure).

Similarly, give your view on typical backhaul capacity and modulation type in the highly utilized bands (such as 13, 15, 18, 23 and 38 GHz).

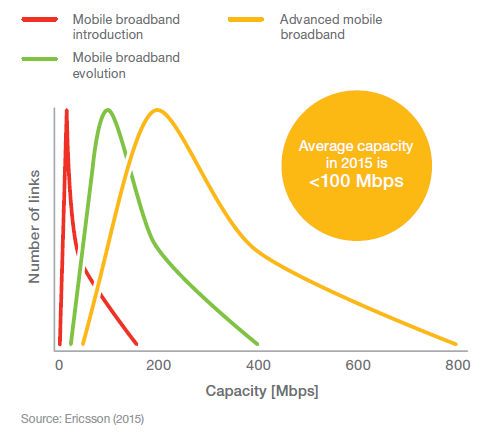

There is a clear drive to “future-proof” the backhaul networks, and many operators are starting to plan for networks where they can easily upgrade to gigabit (Gbps) capacities. Looking globally, there is a huge spread of the capacities that backhaul networks need to carry, as some regions — North America being a good example — have moved to LTE-Advanced, while other regions are only really starting to roll out 3G HSPA networks (see figure). The GSM networks in rural areas still remain and will remain for the foreseeable future in many cases. With this mix of access generations in the global networks, the backhaul networks need to efficiently provide everything from very low capacities of tens of Mbps in a GSM network to very high capacities in LTE-Advanced — above 500 Mbps.

With the availability of hitless adaptive modulation, operators are using the highest available modulation as much as they can. Currently, networks contain 1024 QAM and will, in the coming year, start to deploy 2048 and 4096 QAM in volume.

Discuss the macro factors that are driving the point-to-point radio market.

First, I will consider user data demand. The fundamental growth in mobile data traffic continues — the Ericsson Mobility Report estimates that we will see 9.2 billion mobile subscriptions by the end of 2020 — and this drives both extended coverage needs and increased capacity needs in the radio and backhaul networks. Smartphone traffic will grow by 10 times between 2014 and 2020 and 60 percent of mobile data traffic will consist of video in 2020.

Regarding network architecture, there is a global move to packet networks while the need to cater to TDM traffic in the backhaul networks remains, as operators are in most cases choosing to keep the GSM base stations for coverage and to meet opportunities in the Internet of Things (IoT). Operators are also moving toward providing different services on their network, which drives Internet protocol multiprotocol label switching (IP-MPLS) further out.

Simultaneously, software defined networks (SDN) and microwave use cases, where the SDN controller can implement different rules depending on signaling of bandwidth or other information from the spread network, bring additional possibilities to implement traffic control all the way out to the last hops of microwave networks. Another important development is centralized or cloud RAN (C-RAN), where centralization of basebands opens up new use cases for gigabit capacity point-to-point transmission, with common public radio interface (CPRI) over microwave and millimeter wave.

Significantly too, small cell deployment is still at an early stage. Outdoor coverage needs can, in many cases, be solved with additional macrocell coverage; the main challenge for operators is to solve indoor coverage. From a microwave perspective, connecting the Ericsson Radio Dot or Wi-Fi installation is not a challenge for capacity or latency issues, rather a question of ease of use and total cost of ownership.

Explain the difference between backhaul and fronthaul and how the requirements for the radio generally differ.

Fronthaul is the name for the interface between baseband and the remote radio unit in a base station. In the discussion about C-RAN and connected topics such as “baseband hotels,” wireless fronthaul has become an important concept. For C-RAN to be possible, high capacity and reliable connections between the remote radio units and the co-located basebands are required. It is clear that fiber will not always be readily available, which makes point-to-point radios an interesting alternative. In addition, wireless fronthaul can support radio access planning to be able to better optimize a radio cell by the placement of a certain remote radio unit — on an adjacent rooftop or at the other side of a parking lot, for example — something that would have been difficult using fiber connectivity.

Describe the concept of the multi-band radio link. What motivates this architecture and what are the benefits?

The multi-band concept arises from the move to a new paradigm in planning backhaul networks as we move from TDM to packet. For TDM, the network was optimized for availability — the highest minimum capacity guaranteed 365 days a year. Packet planning, on the other hand, focuses on the highest average capacity, which together with features such as priority queues and radio link bonding, opens the opportunity to combine a high availability radio (+100 Mbps at 99.999 percent availability) with a high capacity optimized radio (+1000 Mbps at 99.9 percent availability) and create a 2+0 radio link that provides more than 1 Gbps more than 364 days per year.

Considering all these drivers, what are the projected requirements for the radio in 2020, such as capacity, frequency bands, modulation type and efficiency (bits/Hz)?

To cater for 5G speeds in the 2020 timeframe, backhaul will need to support tens of gigabits of capacity. As important are the high requirements for latency with some 5G use cases.

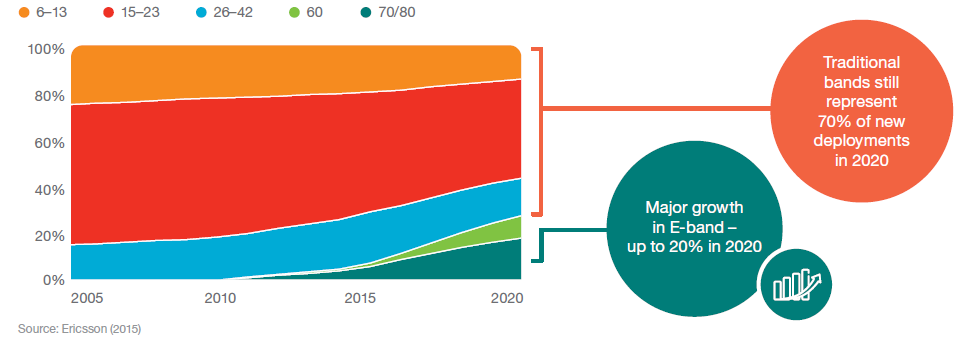

As radio access will be moving upwards in frequency band usage, the point-to-point radio backhaul will start to explore new bands, starting with V-Band (60 GHz) and E-Band (70 and 80 GHz) and continuing with >100 GHz. As important is the optimization and re-farming of currently available bands. Most bands currently used for microwave are not fully utilized, and the broadening of channel bandwidth to 56 MHz and even 112 and 224 MHz will be an important regulatory activity, as well as block licensing to give further opportunity for non-line-of-sight (NLOS) and near-line-of-sight (nLOS) installations.

The modulations will be moving to 2048 and 4096 QAM in the coming five-year period, and further modulation techniques will be deployed in 2020 and beyond. The technology will continue to improve efficiency, also with compression techniques and MIMO. An important area in the coming years is to improve the quality of antennas used, as lower category antennas make for sub-optimized spectrum usage. The focus on equipment cost over total cost of ownership for spectrum will need to shift.

The difference between using microwave or millimeter wave radios for backhaul or fronthaul comes back to the characteristics of the CPRI traffic that is transmitted. CPRI was designed for fiber and is extremely inefficient. CPRI is designed to run directly on the physical layer (L1), and there is no tolerance for jitter or latency, which makes the requirements on the point-to-point radio even higher.

How will the RF components in the radio need to evolve to meet the needs of the radio in 2020, such as the PA, LNA, VCO, up- and down-converters?

In the 2020 time span, we expect an increasing content of RF CMOS and a higher degree of integration. Wider bands call for increased output power and higher orders of modulation for lower phase noise. Doherty or similar PAs will be required for high-end radios. We also expect RF-DACs and RF-ADCs to become available and affordable.

What is your view of the “best” technology for each of these functions (i.e., GaAs, GaN, RF silicon)?

If it can be made in CMOS, it will be made in CMOS; 5G evolution will also drive this. Otherwise, GaN for PAs and probably still GaAs for LNAs, but 5G phased array solutions may also change the game in favor of CMOS there.

We have been expecting significant growth in V- and E-Band radios for quite a few years, yet haven't really seen the "hockey stick" inflection point. What is the status of radio deployment and the projected growth?

For E-Band there are clear indications that 2016 will contain major deployments in several regions globally. The inflection point is here. The technology is mature. Vendor equipment is reaching a maturity level where the feature set for E-Band is supporting mobile broadband deployments.

Spectrum regulations are available in all regions globally, although still lacking in some countries, optimized for FDD. Also important is that spectrum regulations are reasonably harmonized, which make the requirements on the microwave equipment better aligned. This supports a quicker uptake of the new technology.

E-Band use cases include a range:

- Increase backhaul capacities: E-Band can be used standalone at up to 5 km distances or in combination with standard frequencies at longer distances.

- Decrease spectrum fees: In some countries, E-Band is used mainly to reduce spectrum cost and not for capacity buildout. Low spectrum fees are important to facilitate high capacity deployments, but care should be taken to avoid the short-term need to reduce spectrum costs, as this can lead to future spectrum problems. Millimeter wave is the only wireless technology that could give >5 Gbps when those capacities are needed.

- University and company networks: So far, E-Band for private networks has been noted mainly in North America, although there have been some deployments in other parts of the world.

- Fiber extension for fixed networks: Main implementations have been seen so far in Eastern Europe but are seen globally as a business opportunity for operators and Internet service providers to cover enterprise customers with 5 to 10 Gbps capacities with a new generation of E-Band products.

Concerning V-Band, the uptake is slower. This is connected with the very short distances that V-Band is ideal for (~1 km) that makes the primary use case for V-Band small cell backhaul. On a global scale, small cells and densification of urban networks are still waiting for the main question to be fully addressed: how to reach the necessary total cost of ownership levels, where installation and operation and maintenance as well as site availability are the key issues to solve. V-Band can cater to both FDD and TDD.

The primary V-Band use case is for low street-level networks with less than 400 m hop lengths, which offer very high spectrum utilization.

Discuss the status of V- and E-Band radio development. Are there component limitations (e.g., performance or cost)? If so, what are the gaps?

On the component level, the technology available for E-Band is still not as mature as for traditional bands, but it is quickly moving in the right direction. As volumes start to materialize, this will drive further improvements in cost and options. For V-Band, the situation is somewhat different. The 60 GHz band has several different use cases. Point-to-point radio is one, but WiGig technologies are also developed for 60 GHz. This will lead to the availability of very high volume components and interesting opportunities developing competitive V-Band products in the long run. In the short-term, the many different requirements of V-Band make the technology mature somewhat slower.

For the operator, what is the trade-off between V- and E-Band?

60 GHz (V-Band) has very high attenuation that gives short distances but also low interference, while 70/80 GHz (E-Band) is a new paired spectrum that supports up to 5 km distances and very high capacity backhaul.

Are you developing radios for even higher frequencies above E-Band?

With the ongoing work to make more spectrum available for access technologies in the preparatory 5G discussions, it is a great opportunity to explore even higher frequencies for point-to-point backhaul radio technologies. For >100 GHz, industry work is starting to target Electronic Communications Committee (ECC) recommendations and reports containing guidelines on deployment of fixed services operating in the allocated spectrum from 92 to 114 GHz and 130 to 174 GHz, including future requirements in the fixed services (e.g., deployment scenarios, propagation models, radio channel arrangements, etc.).

Ericsson research in this area is demonstrated by the collaboration with Chalmers University targeting the 140 GHz bands, which was announced last fall.

Aside from backhaul, how is your underlying microwave radio technology being applied to evaluating high data rate links for 5G?

As 5G emerges, the frequencies used for microwave and radio access are coming together. This means that microwave technology can be used to support the development of radio access in the higher frequency bands. In addition, many of the fundamental technologies such as MIMO, modulation schemes and antenna technologies will be possible to drive 5G networks as a whole.

More information

Download and read the Microwave Towards 2020 report.

Karolina Wikander shares highlights and insights from the Microwave Towards 2020 report.

Karolina Wikander is the head of the microwave product area in Ericsson's radio business unit. She leads the development of Ericsson's wireless transmission portfolio for mobile broadband capacity and coverage. Prior to this role, Wikander served in leadership positions in many different functions in Sweden, Brazil and the U.S. She holds a master’s degree in law and biology from the University of Gothenburg.