Canalys has been providing some nice, detailed data since the beginning of the year on smartphone shipments around the world for 2018. I have summarized their last few reports here.

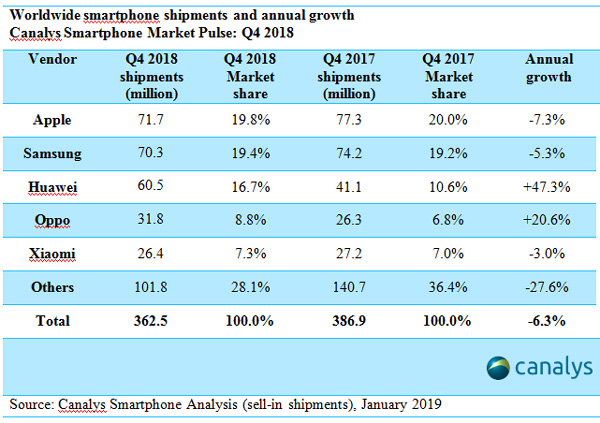

According to Canalys, the global smartphone market declined for the fifth consecutive quarter, falling 6% to 362 million in Q4 2018. Apple overtook Samsung to become the largest vendor in Q4, shipping 71.7m units of iPhone. Huawei, Oppo and Xiaomi completed the top five vendors. For the full-year 2018, global smartphone shipments totaled 1.4 billion, down 5% from 1.5 billion in 2017.

Canalys Senior Analyst Ben Stanton said, “It is no shock to smartphone vendors that the market has passed its peak. People are clearly keeping phones for longer as product innovation slows. But the speed and severity of shipment decline has caught many vendors, investors, and other companies in the value chain off guard. International factors like the US-China trade war, weak consumer spending in developed markets, and a buoyant market for refurbished phones, have catalyzed the decline of smartphone shipments.” Below is a summary of the worldwide smartphone shipments and annual growth for Q4 2018:

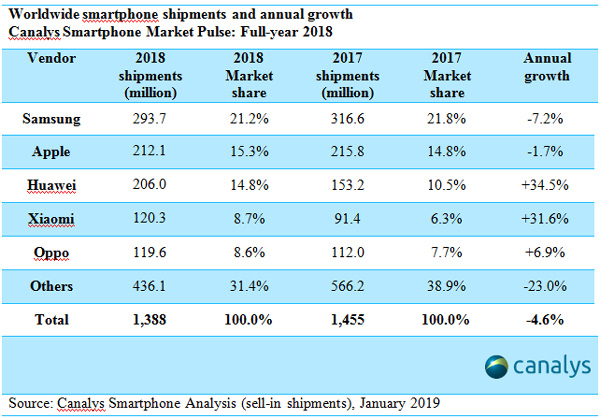

For the full year in 2018:

Canalys also recently reported smartphone shipments for several key Asian/Indian markets:

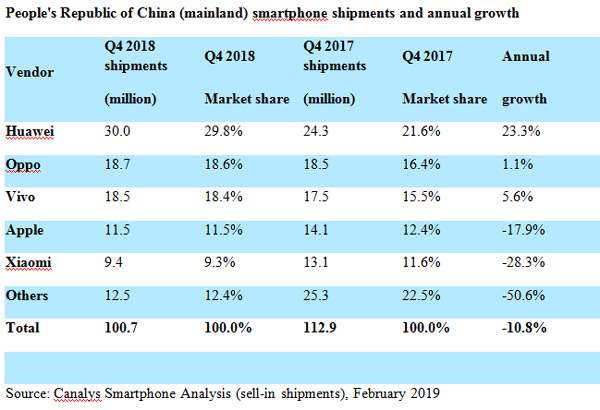

According to Canalys initial China report, smartphone shipments fell to their lowest level since 2013, at about 400 million units. The natural slowdown as consumers keep their smartphones for longer is one factor, but it has been amplified considerably by the economic slowdown in China and consumers’ weakened purchasing power. The latest quarter, Q4 2018, marked a 10.8% year-on-year drop, and the seventh consecutive quarter of decline. Here is their updated China summary for Q4 2018:

Canalys reported that Indian smartphone shipments up 10% to 137 million in 2018, unfazed by global decline.Leading manufacturers will have even less breathing space in 2019, as Canalys expects the Chinese smartphone market to fall by 3% to 385 million units. Amid these conditions, 2019 will mark the beginning of the 5G era in China, as manufacturers prepare to release 5G devices and operators start to roll out their commercial 5G networks. Consumption in China is shifting toward high-end and higher quality. As a result, the average selling price of smartphones is expected to exceed US$400 in 2021. Competition in the upper mid-range and high-end segments will intensify, and vendors must focus on bringing the latest technology to consumers to justify higher price points.

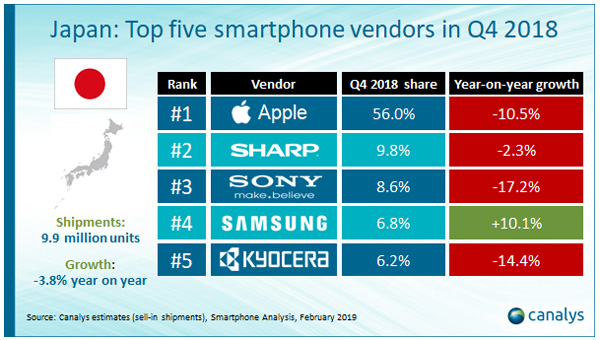

Smartphone shipments fell 3.8% year on year in Japan to 9.9 million in Q4 2018, marking a fourth consecutive quarter of shipment decline. In terms of shipment numbers, Japan came fourth worldwide, behind China, the US and India. 32.5 million smartphones shipped in Japan in the whole of 2018, 1.9% fewer than in 2017.

The performance of the Japanese market has been adversely affected by the notoriously high mobile tariff costs and increasing device costs, especially for iPhones, given mobile operators are given lower subsidies, capped by the MIC and JFTC. This has slowed the replacement cycle, especially as 48-month contracts have been introduced by the major operators. On the other hand, this has given a boost to lower-cost SIM-only contracts and the secondhand smartphone market.

Despite a sharp 10.5% decline in Q4, Apple still enjoys a dominant position in Japan, its full-year market share exceeding 50% for the first time in 2018, up from 48.0% in 2017 and 48.2% in 2016. Sharp, in a distant second place, only accounted for 11% of shipments in 2018. Competition is becoming more intense for Android vendors. Local names, such as Sharp, Sony and Kyocera, which used to account for a sizeable share of the market, are being increasingly challenged by Samsung, Huawei and Google, which have pushed in with aggressive spending on marketing.

Canalys forecasts a modest 2.7% year-on-year decline for Japan in 2019, as it is further affected by the lengthening refresh cycle. A changing market dynamic is forthcoming in 2019 – a price cut in mobile subscription costs of up to 40% is imminent due to pressure from the regulators. Premium handset and local vendors, such as Sharp and Kyocera, whose sales rely on subsidies and operator promotions, are expected to be dealt an even heavier blow. There will be growth opportunities for mid-to-low-end handsets via MVNOs and open channels. Moreover, Rakuten, which is due to launch its own network in October 2019, will become Japan’s fourth operator, further adding to channel competition. As Japan aims to be 5G-ready in 2020 for the Tokyo Summer Olympics, operators have rushed to launch the first commercial 5G network. But the big three operators may find it hard to fund investment amid the impact of further mobile cost regulation on their revenue.

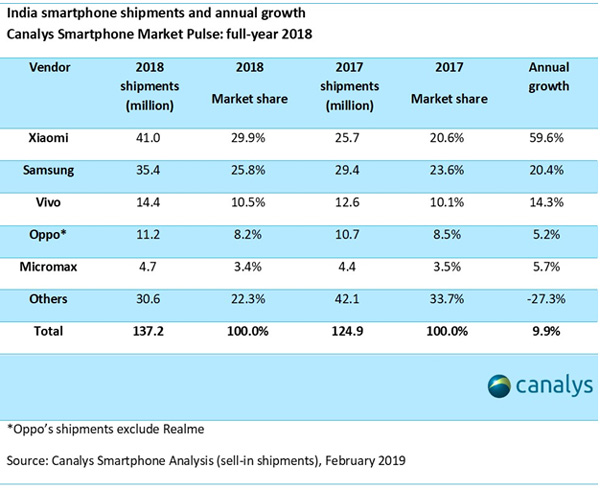

India remained one of the bright spots in an otherwise declining global smartphone market in 2018. Smartphone shipments in the country were up by more than 12 million at 137 million, the best growth of any market in absolute volume terms. India now accounts more than 10% of the world’s smartphone market, up from 6% five years ago. It is one of six markets in the top 20 that posted positive full-year growth, with its performance outshone by Indonesia (17.1%), Russia (14.1%) and Italy (10.0%). Of these four markets, India is the only one that has seen consecutive growth for the past three years.

In terms of vendors, Xiaomi took pole position for the first time in 2018, shipping 41.0 million units to take 30% of the total Indian smartphone market. Despite being knocked off first place, Samsung still grew shipments by 20% and took a 26% share of the market. Vivo, Oppo and Micromax held third, fourth and fifth place, respectively.

“2018 was a defining year for smartphones in India,” said Canalys Research Manager Rushabh Doshi. “The impact of a declining Chinese market on vendors such as Oppo, Vivo and Xiaomi was pronounced, with Oppo and Vivo reducing both their above- and below-the-line marketing efforts significantly to counter falls in their Chinese businesses. Xiaomi, on the other hand, focused heavily on India, with excellent results. India is now the biggest market for Xiaomi worldwide. The Chinese vendors have done well to ride the spread of 4G and the boom in local apps and services. 2018 was undoubtedly the year app-based economies flourished.” In Q4 2018, Xiaomi shipped 9.4 million smartphones to China, and 10.0 million to India.

“2019 will be more disruptive than 2018,” said Doshi. Since 1 February, the Indian government has restricted online marketplaces, such as Amazon and Flipkart, from selling devices exclusively on their platforms. It has also banned online marketplaces from having equity stakes in seller accounts. “The FDI policies are going to slow market development spending by these platforms, thereby denting overall online smartphone sales. There will be a see-saw shift toward offline channels this year, and many vendors will start engaging with distributors or offline retailers in a bid to protect their growth ambitions. While operations at Amazon and Flipkart are likely to stabilize within six months, uncertainty over future regulation will weigh heavily against these platforms.”

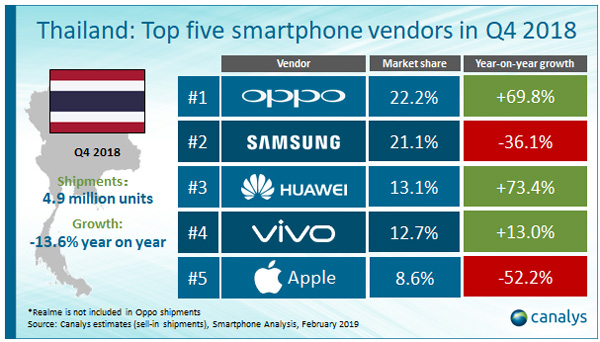

Thailand, the second largest smartphone market in Southeast Asia, suffered another fall in shipments in the fourth quarter of 2018.

After a steep decline in Q3 2018, 4.9 million units shipped in Q4 2018, a 13.6% fall year on year, which caused full-year 2018 sell-in to decline 8.6% to 19.2 million units. Oppo overtook Samsung for the first time to become the top vendor, shipping nearly 1.1 million smartphones to take a 22.2% market share. Huawei and Vivo are closing in on the top two at 13.1% and 12.7%, while Apple, in fifth place, reported its lowest Q4 market share in the country.

Competition has been intense, as several new players, such as Xiaomi, Honor, Lava and Wiko, have aggressively entered the market in the past two years. Consumer demand for smartphones, however, is not growing as the Thai market matures. The smartphone replacement cycle is lengthening, despite mobile operators offering attractive discounts to stimulate demand. And millions of feature phone users remain in rural areas, not planning to upgrade to smartphones.

In 2019, Canalys forecasts 4.1% year-on-year growth for Thailand, with positive economic growth after its general election, which will improve major operators’ business outlook and prompt further investment from foreign mobile vendors. Though 5G is not expected to roll out until late 2020, operators will start to market the concept to build consumer interest in technology upgrades, which will be vital for consumer demand to rebound later in the year.