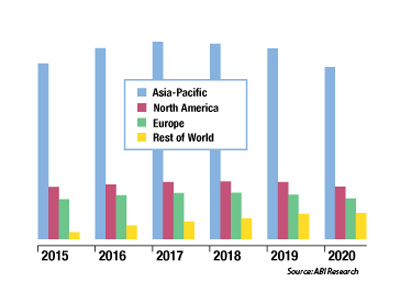

ABI Research just released numbers for the RF power market from 2014 showing that RF Power Semiconductors for Wireless Infrastructure “blew off the charts in 2014”. China and the Asia-Pacific region in general continued to be the main drivers for the RF Power Semiconductor devices that were sold into the mobile wireless infrastructure segment.  According to ABI Research’s Research Director Lance Wilson, “Again, for the foreseeable future the Asia-Pacific region, especially China, will dominate this market and remain the most important region and focus for high-power RF devices for wireless infrastructure.” This geographic area is far larger than any other region as shown in the graph. The “rest of the World” shows some good percentage grow in the coming years probably mostly from India. ABI said that the LTE and TD-LTE air interfaces will be the technology engines of growth for the next 5 years.

According to ABI Research’s Research Director Lance Wilson, “Again, for the foreseeable future the Asia-Pacific region, especially China, will dominate this market and remain the most important region and focus for high-power RF devices for wireless infrastructure.” This geographic area is far larger than any other region as shown in the graph. The “rest of the World” shows some good percentage grow in the coming years probably mostly from India. ABI said that the LTE and TD-LTE air interfaces will be the technology engines of growth for the next 5 years.

There has been a flurry of acquisition activity in the RF power market that started earlier this year with the announced acquisition of Freescale by NXP. At that time, NXP also announced it would divest its RF power business (in order to avoid any regulatory issues). More recently, Chinese state-owned JAC Capital announced they would purchase NXP’s RF power business showing a continued interest from the Chinese to expand into the semiconductor industry. In addition, Infineon acquired International Rectifier as the semiconductor industry continued to consolidate.

While the majority of RF power products for wireless infrastructure are still Si LDMOS, GaN is making some penetration into the market. The primary issue holding GaN back now that its performance has been proved is cost. In order to address this issue, Qorvo just announced their plan to double capacity by going to 6” GaN wafers next year and Macom continues down the path toward even larger GaN on Si wafers (as opposed to most other companies that are using GaN on SiC for RF power applications). As these strategies are implemented, it will drive down the cost of GaN probably near that of LDMOS making it competitive enough to make more significant gains in the marketplace. Other GaN market leaders Cree and Sumitomo have been relatively quiet even though Cree did announce that its RF power business will separate from the larger LED business allowing them to pursue their own growth strategies. Our technical editor, Gary Lerude, recently interviewed James Klein, president of Qorvo’s Infrastructure and Defense products group, and discussed some of these topics.

Although GaN devices had a meaningful share, 2014 was all about LDMOS which continues to dominate this segment by a large margin according to ABI, but I think that will start changing next year as these GaN cost reduction strategies take place. Unfortunately, with the slowdown in the Chinese market this year, infrastructure growth is bound to show some softness compared to 2014. Hopefully, the Chinese stock market/economy will figure it out and get back on the road to expansion. Either way, the RF power market is still undergoing a big shake out.