In defense contracting, firm-fixed-price (FFP) contracts are becoming more common than cost-plus contracts. This fundamental shift begs an essential question: How can organizations evolve to compete successfully in an FFP world?

When the price is fixed, greater attention must be paid to any and all costs that whittle away at the resulting profit. To reduce the cost of test, two high-leverage action steps are available: pursue greater reuse of test assets across multiple products and product lines, and implement new strategies for test-asset acquisition.

Problem: Juggling risks and costs

For primes, existing product lifecycle (PLC) processes were created in a world of cost-plus contracts. When assumptions change, it can be worthwhile to examine those processes and redesign them for lower risks.

One key success factor is to modify core activities such that they can dynamically change while ensuring minimal fixed costs. For example, in the 1990s many commercial electronics companies began outsourcing the fabrication of printed-circuit boards to contract manufacturers. As market demand changed, this gave companies greater flexibility in managing the costs associated with labor and manufacturing assets.

Solution: Reducing the costs associated with test assets

It may come as a surprise, but test assets are often the third-most expensive capital investment across the PLC—development, production and support. When dealing with FFP contracts, this has two implications. First is the need to reduce operating expenses through greater utilization and optimized support of test assets. This starts with a common test strategy that enables greater reuse of hardware and software—and this can help maximize return on invested capital.

The second implication is the need to reconsider the acquisition strategies for test assets. In the past, “buy” was the default—and perhaps only—strategy deemed acceptable by many prime contractors. Today, with FFP contracts, renting and leasing become viable alternatives that can reduce risks.

Step 1: Enhancing reuse of test assets

Traditionally, the incentives associated with cost-plus contracts led most aero/defense companies to use a product-centric approach to design and manufacturing. Each customer is treated as an individual product line with a specific set of products. Also, each product—in design and production—has a unique test strategy that is developed and implemented separately from any other product or product line. Consequently, different sets of hardware and software are developed, no matter how similar these may be across the various products.

In contrast, many commercial manufacturers use a process-centric point of view that spans multiple products and product lines. Each customer is treated in a unique way; however, products are grouped according to common functions, features, or both. With this approach, synergies between hardware, software and test methods provide leverage across multiple product lines, independent of the end customer. This is the starting point for greater commonality, utilization and reuse, and the beginning of reductions in engineering effort and equipment expenditures.

This approach minimizes the risk and effort associated with developing, launching and manufacturing any new or enhanced product. Three key ideas help make asset reuse a reality: mixed-product manufacturing, common measurement blocks and a common-process test strategy.

Shifting to mixed-product manufacturing

This is crucial to process-centric manufacturing. One of the best-known examples is the model used by Toyota. One of its production facilities can build sedans, minivans and sports cars on the same assembly line with no interruption to the manufacturing flow. The net effect: rather than operating three separate lines that are partially utilized, one line runs at 100-percent utilization.

Identifying common measurement blocks

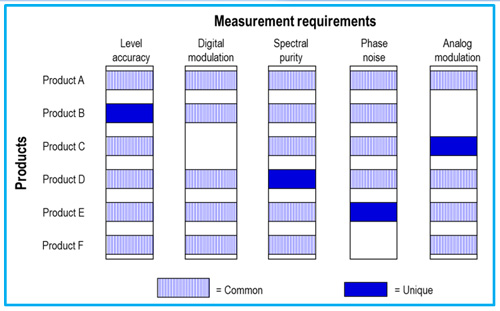

Mixed-product manufacturing relies on common process centers, and the starting point is identifying the common measurements that are required across a range of similar products. Creating a matrix that includes all products and measurements will make common and unique requirements readily apparent (Figure 1). When a majority of the tests are common, costs are reduced through use of common hardware and software elements.

Figure 1. Mapping measurement requirements versus similar products will help identify common and unique measurement blocks—and a majority may prove to be common.

Pursuing a common-process test strategy

As with common measurement blocks, a matrix is a good way illustrate the common-process concept. Individual products and their associated tests can be integrated into common measurement blocks. When several devices-under-test share common measurement needs, the business unit will benefit. Whether the focus is on radar, EW, avionics, or another area, all have common measurement needs that may differ in only a few specific details.

Step 2: Expanding acquisition strategies for test assets

Compared to the commercial world, product development in aero/defense is different due to the “zone of the unknown” between R&D and production. This is the time—weeks, months or longer—between submission of a proposal and the awarding of a contract.

This interval can increase the risks associated with the R&D phase, especially if “buy” is the default acquisition strategy for test assets. Whether the bias against renting or leasing is implicit or explicit, today’s period of change is an opportunity to reassess the underlying assumptions.

When flexible acquisition strategies are combined with the concepts of common hardware and software blocks, the result is an overall test strategy that can be optimized for reuse, utilization and flexibility. Purchased test assets can be continually rolled forward and reused with new products that have similar features, functionality and test needs. Demand peaks can be handled through renting or leasing.

The interplay of these concepts is summarized in Table 1. Matching each stage of the PLC with a favorable acquisition strategy can help reduce the total cost of ownership for test assets.

Table 1. The acquisition strategies offer potential advantages during each stage of the product lifecycle.

|

|

Development |

Production |

Support |

|

Buy |

Best with long development cycles and evolutionary products (i.e., those expected to change with time) |

Optimal for long-term production and production of evolutionary products |

Lowest cost for long-term support requirements |

|

Lease |

Effective with product development programs of one to three years, and when using direct allocation of costs |

Supports the pursuit of a fixed cost-of-test per unit, and production life of one to three years |

Provides flexibility when facing short-term increases in support needs |

|

Rent |

Effective for projects that last less than one year |

Effective when facing short-term upticks in production volume |

Provides flexibility when facing sudden increases in support needs |

Conclusion

For many years, commercial manufacturers have been combining these ideas to reduce exposure to cyclical demand and fixed costs. Leveraging their knowledge and experience can help aero/defense contractors compete more successfully in a world of FFP contracts. It will also position these organizations to more easily adapt with future changes in the business model.