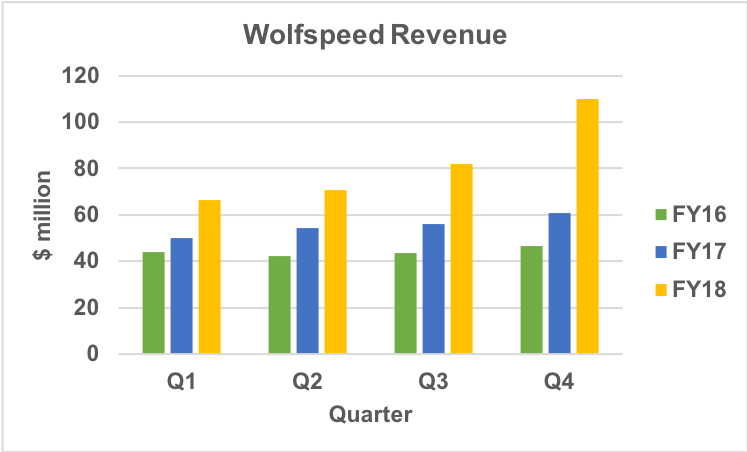

Reflecting strong demand for SiC and GaN, Wolfspeed’s fourth fiscal quarter (Q4) revenue grew 34 percent sequentially and 81 percent year-over-year (Y/Y) to $110 million. For the full fiscal year, Wolfspeed’s revenue was $329 million, 49 percent above the revenue achieved in fiscal 2017.

Wolfspeed, which is a Cree company, contributed 22 percent of Cree’s annual revenue in fiscal 2018.

Wolfspeed’s gross margin was 47.9 percent in Q4, compared to 48 percent in Q3 and 45.5 percent in Q4 of 2017.

Q4 revenue included a full quarter’s contribution from the Infineon RF power business, which was acquired by Cree on March 6. According to Cree CFO Mike McDevitt, Infineon’s financial results “exceeded our targets and were slightly accretive to Q4 non-GAAP earnings.”

McDevitt said Wolfspeed’s organic growth for the year was 35 percent, meaning Infineon contributed some $30 million in revenue from March 6 through June 24.

During the earnings call, Cree’s president and CEO, Gregg Lowe, said, “We completed the successful integration of the Infineon RF power business and delivered accretive non-GAAP results for the quarter. That was less than three months after closing the acquisition, a remarkable timeline for such a large integration comprised of 12 sites and roughly 260 employees around the world.”

Increasing Capacity

Since becoming Cree’s CEO in September 2017, Lowe has identified Wolfspeed as the company’s primary growth driver, capitalizing on the increasing demand for SiC in power electronics — particularly electric vehicles — and GaN for 5G wireless.

Responding to this market opportunity, the company is doubling power device capacity and wafer capacity for external materials customers by the end of calendar 2018. Cree invested $195 million in capital in fiscal 2018 and plans to invest an additional $220 million in fiscal 2019.

Lowe said, “We are tracking slightly ahead of our goal of doubling capacity for power devices and external materials sales by the end of (fiscal) Q2.”

Q1 Guidance

In fiscal Q1, Wolfspeed’s revenue is estimated to grow approximately 13 percent sequentially, including a small amount from ZTE. Commenting on ZTE, McDevitt said “The business could ramp steadily beyond Q1, but it’s too soon to say when it would be back to prior levels.”