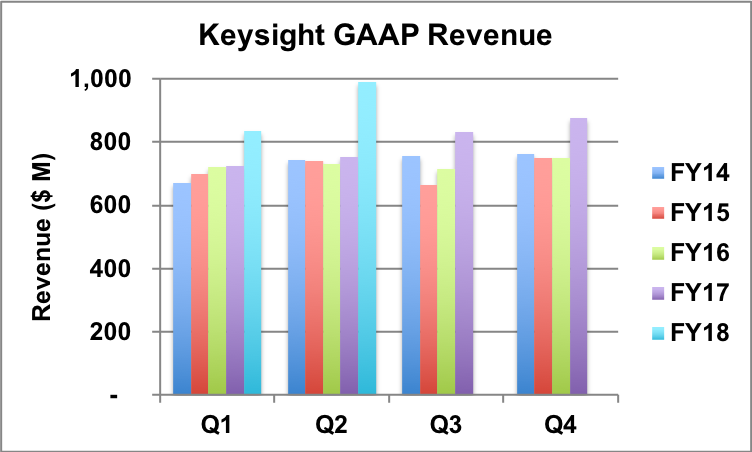

For the second fiscal quarter (Q2) ending April 30, Keysight achieved record GAAP revenue of $990 million, a jump of 31 percent above the prior year’s quarter. Orders grew 23 percent year-over-year (Y/Y) to $987 million.

Profit-wise, GAAP gross margin was 54.8 percent, operating margin was 10.1 percent, net income was $64 million — a 31 percent Y/Y improvement — and diluted earnings per share (EPS) was $0.34, compared to $0.24 in the year-ago quarter.

Keysight invested 16 percent of revenue in R&D during the quarter and generated $64 million in cash from operations.

Segment Results

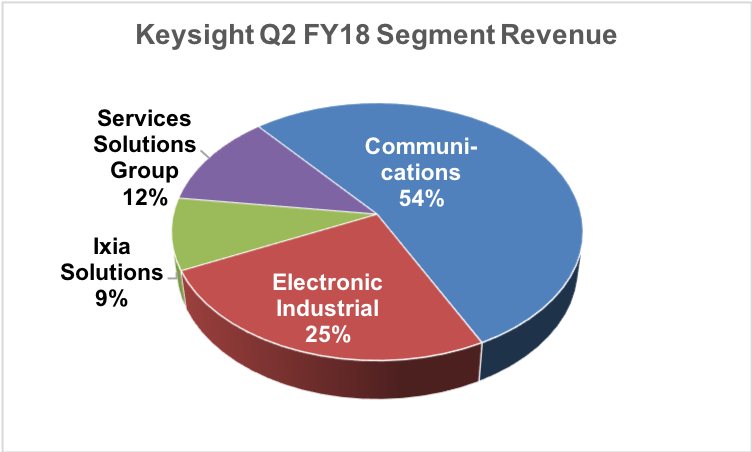

Except for Ixia, all business segments achieved double-digit revenue growth.

The Communications Solutions Group generated $536 million in non-GAAP revenue, up 26 percent Y/Y. The Electronic Industrial Solutions Group generated $255 million, 16 percent above the prior year’s quarter, and the Services Solutions group contributed $118 million, up 16 percent Y/Y. The Ixia Solution Group’s revenue was $90 million, a decline from the $124 million average run rate of the prior three quarters.

Keysight attributed the decline in Ixia revenue to completing the second phase of the integration with Keysight, following Ixia’s acquisition one year ago. The effort comprised consolidating 28 sites, transferring management and administrative functions to Keysight and aligning procurement, contract manufacturing, trade and logistics business processes.

Keysight CEO Ron Nersesian said, “This was an enormous effort and stabilization took longer than expected, impacting ISG's Q2 results. Many of these integration issues are now resolved.”

Except for the integration challenges with Ixia, Keysight delivered a positive outlook:

- Industry investment in 5G R&D is increasing, reflected in Keysight’s double-digit order growth.

- The automotive and energy sectors are strong, also reflected by double-digit order growth for electric vehicle, connected car and autonomous driving applications.

- Keysight sees strong global demand from aerospace and defense, with double-digit order growth.

- Despite a modest decline in semiconductor test, the general electronics test and measurement market is generating steady growth.

Keysight expects Q3 non-GAAP revenue to be in the range of $942 million to $972 million. The midpoint represents 11 percent Y/Y growth.

The stock market responded positively to Keysight’s performance and outlook, closing up 11 percent Thursday, compared to the closing price Wednesday, just prior to the earnings release.