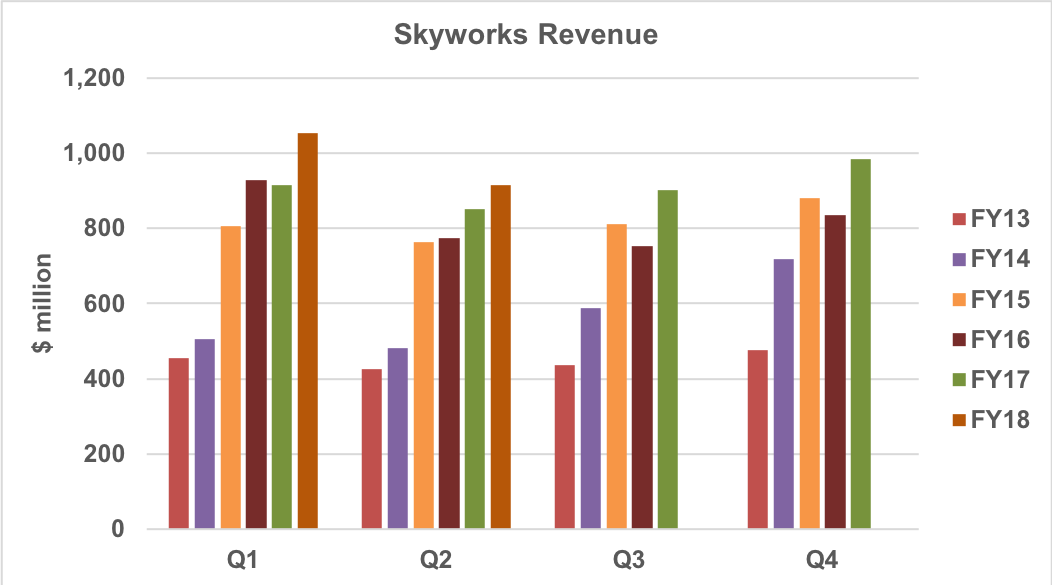

Despite the March quarter being a seasonal low for mobile phone semiconductor suppliers, Skyworks reported positive news: year-over-year (Y/Y) growth in revenue, gross margin and earnings. For Q2 of fiscal 2018, revenue grew 7 percent Y/Y to $913 million, non-GAAP gross margin increased 30 basis points (Y/Y) to 50.7 percent and earnings per share (EPS) grew 13 percent Y/Y to $1.64.

Compared to Skyworks’ record-setting Q1, Q2 revenue declined 13 percent and non-GAAP gross margin 70 basis points.

Approximately 27 percent of the quarter’s revenue — some $246 million — was from the “broad markets” segment, i.e., non-handset applications including Wi-Fi, IoT, automotive, cellular infrastructure and defense. Broad markets revenue grew approximately 10 percent sequentially and, as a percentage of total revenue, is expected to increase during the rest of the fiscal year, reflecting 10 to 15 percent Y/Y growth.

Skyworks generated $434 million in cash during Q2 and invested $90 million in capital equipment, ending the quarter with $1.3 billion in cash and no debt.

During the earnings call, Skyworks disclosed the ban on exporting products to ZTE represents a $25 million to $30 million reduction in annual revenue, mostly from mobile phone products.

The combination of ZTE and softness at “leading smartphone customers” is reflected in Skyworks’ guidance for the June quarter. The company expects revenue to be between $875 million and $900 million, a decline of 2.8 percent sequentially and down 1.5 percent Y/Y at the midpoint of the range.

Kris Sennesael, CFO, said sequential revenue growth will resume in the September quarter:

“Based on new program ramps heading into the second half of the calendar year, we anticipate a resumption of sequential revenue growth in the September quarter, with sustained momentum into the December period.”

Liam Griffin, Skyworks’ CEO, affirmed the outlook for growing Skyworks content in mobile phones, endorsing the company’s position in diversity receive (DRx) products and temperature compensated SAW filters (TC-SAW).

”I would say that our TC-SAW capabilities are not only world class in terms of output but in terms of performance. The quality of that technology right now has been advanced by Skyworks and allows us to push the frequency envelope wider and wider and broader and broader.”

Skyworks plans capital expenditures for the year at the high end of their model (6 to 13 percent of revenue), driven by two items:

- a “major ramp” of new platforms with leading customers that are “very content rich products with a lot of filters” and “complex integration.”

- investments to improve the “reach” of Skyworks’ filter technology.