Advances in military technology such as unmanned autonomous vehicles (UAV), real time video surveillance, networked communication systems, real time targeting and battlefield mapping are demanding much more capacity in satellite communications than is available today. A large amount of data needs to be transmitted in real time and via secure and protected communication systems, further compounding the capacity problem. In the Middle East conflicts, the military realized its lack of communications capacity was a critical issue and has used commercial systems to help carry the load. The current fleet of military communications satellites uses technology that is more than a decade old except for the two WGS satellites recently launched. The need to expand the capacity of these systems is great, but it is difficult to accomplish quickly due to the cost and long lead times to approve, build and launch systems.

Satellite communications play a vital role in providing voice and data to the warfighter and strategic command. The initial trend was for the military to use commercially available bandwidth to offset its demands. But with future militaries using a network-centric architecture that will integrate information from many sources and direct them in real time to the appropriate locations, it is clear they need additional dedicated and secure capacity. Future warfighter communication systems will be small, light and low enough in cost to allow most soldiers to carry their own communication devices and transmit monitored data collected from their individual sensors. Real time video is growing into wide use with various devices and sensors available in the field and on UAVs. Other surveillance sensors along with battlefield mapping and targeting data are quickly pushing the demand for more bandwidth in current and future systems at an astounding rate.

Microwave Journal surveyed some of the companies in our industry who supply components and subsystems to the satellite communications market about their participation in programs, new products and trends in the industry. Responding to our questions were Cobham Defense, Ducommun, e2v, Jersey Microwave, Microsemi, Micronetics, MITEQ and Xicom.

Mil SatCom Programs

In order to meet the emerging needs for more capable systems, the US military is deploying new systems such as Wideband Global SatCom (WGS – formerly Wideband Gapfiller Satellite), Warfighter Information Network – Tactical (WIN-T), Advanced Extremely High Frequency (AEHF) satellites and the Mobile User Objective System (MUOS). These new initiatives (along with some others) will greatly expand the capacity of military SatCom systems, but it might not be enough to meet current and future needs.

WGS is a high capacity system that will greatly increase the capacity available to the USAF to help meet the growing demand for military satellite communications. Boeing is the lead contractor for the program that includes three Block I and three Block II WGS satellites. WGS-1 was launched in October 2007 and WGS-2 in April 2009. WGS satellites have flexible coverage areas and the ability to connect X-band and Ka-band users via reconfigurable antennas and a digital channelizer. These are the first military satellites available with dual mode capability. The Block II satellites will include RF bypass to support airborne intelligence, surveillance and reconnaissance platforms requiring additional ultra-high bandwidth and data rates demanded by UAVs. Each unit is capable of routing 2.1 to 3.6 Gbps of data; that is more than 10 times the communications capacity of the previous Defense Satellite Communications Systems (DSCS) III satellite and provides more flexible coverage to any user in the field of view.1

WIN-T is the Army’s on-the-move, high-speed, high-capacity backbone communications network, linking warfighters on the battlefield with the Global Information Grid (GIG). The Joint Network Node (JNN) is now WIN-T Increment 1. WIN-T Increment 1 is defined as providing “networking at-the-halt” and is further divided into two sub increments defined as WIN-T Increment 1a, “extended networking at-the-halt”, and WIN-T Increment 1b, “enhanced networking at-the-halt”. WIN-T Increment 1a upgrades the former JNN satellite capability to access the Ka-band defense WGS, reducing reliance on commercial Ku-band satellite, while increment 1b introduces the Net Centric Waveform (NCW), a dynamic waveform that optimizes bandwidth and satellite utilization.

The AEHF System is a joint service satellite communications system that provides near-worldwide, secure, survivable and jam-resistant communications for high-priority military ground, sea and air assets. The AEHF satellites will have 12 times more communications capacity than the previous Milstar system it replaces. It will also usher in a new era of cooperation and interoperability with Canada, the Netherlands and the United Kingdom, under cooperative development partnerships and support tactical and strategic communications. The expected launch of the first satellite is 2010 and launch of the third and final satellite in 2012.

The MUOS communications satellite network is designed to replace the US Navy UHF Follow-On (UFO) satellite system. The MUOS system will provide UHF secure voice, data, video, network-centric communications in real-time to US and Allied mobile warfighters through 2030, and will be fully interoperable with the Joint Tactical Radio System (JTRS) and current radio systems. It is designed to provide global SatCom narrowband (64 kpbs and below) connectivity for voice, video and data.

Many of the companies we surveyed are involved in these critical programs along with others in the industry. Jersey Microwave stated that they are the first company qualified to provide Ka-band block upconverters into the amplifiers to support WGS and have delivered over 1100 block upconverters in support of the WIN-T program. Cobham Defense builds the space-based antenna unit for WGS and is supporting the space qualified units to meet their current demand. Microsemi is supplying frequency converters to the WIN-T program, while Xicom, Micronetics and Miteq are supplying various components to the WGS program and related equipment. In April, CPI was awarded a contract for Ka-band high-power satellite communications amplifiers to upgrade DataPath’s existing unit hub SatCom truck terminals used for the WIN-T program. These terminals were originally configured solely for Ku-band communications.

Satellite Links

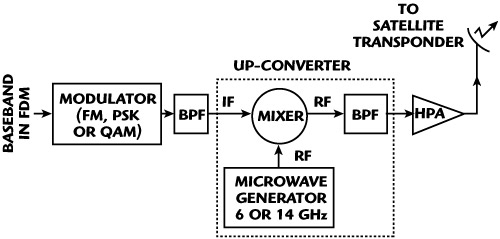

Figure 1 Simplified satellite uplink block diagram.

Satellite communication systems consist of an uplink from an Earth station to the satellite transponder and back to the Earth downlink. The uplink signal is generated from the transmitter that can be a solid-state power amplifier (SSPA), travelling wave tube amplifier (TWTA), or klystron power amplifier (KPA). The power amplifier units are typically mounted on the dish as close to the feed as possible to minimize losses. These dish mounted units are commonly called block upconverters (BUC), which typically up convert the incoming L-band cable signal to the microwave frequency for transmission to the satellite (typically C-, X-, Ku- or Ka-band). See Figure 1 for a typical simplified uplink block diagram.2 The output power and small size of the BUC unit are important so the transmission energy can be maximized. The combination of the BUC output power and antenna gain produces equivalent isotropic radiated power (EIRP) for link budget estimates.

We asked companies how SSPAs were progressing against the TWTs, which have been the mainstay of the high power industry for years. Many companies see the SSPAs going higher in power and becoming a more reliable solution eating away the market share of TWTs for low to medium power applications. Some see the newer GaN-based SSPAs growing while others see them as an unfulfilled promise. Microsemi commented that GaN is gaining traction to further extend the power range of SSPAs, and combined with more efficient spatial and waveguide power combining techniques, they are forcing TWT suppliers to share more of the market. The new spatial combining techniques also offer a “graceful” failure mechanism. If one or two devices in the combiner fail, the component still operates (at reduced power level), giving the system greater reliability but just not at the initial power level. GaN does require much higher voltages than previously used GaAs devices for these applications so associated regulation circuitry has to change and thermal handling is more of an issue. This can be more critical in space applications where it is difficult to remove the heat. Micronetics on the other hand said they have seen little effect from GaN on the high performance SatCom systems because of poor linearity, but are planning on reviewing higher frequency GaN devices in the near future for possible use in systems.

However, Miteq points out that there has been an emotional response to some decisions between SSPAs and TWTs. TWTs are still lighter in weight, more cost effective and have higher efficiency than SSPAs. They went on to say that with continuous and incremental improvements, TWTs have been proven over and over again that they are a viable alternative to solid state; in some cases a better alternative. With the advances in particle physics and material sciences, the TWT will continue to be a state-of-the-art technology in the high power, high frequency RF amplification market. In actuality, there has been a resurgence in lower frequencies due to the re-understanding that both technologies are viable depending on the application. Graham Gooday, e2v’s General Manager of Defence, commented, “Watt for watt, lower efficiency solid-state amplifiers are still broadly much larger and heavier than TWT amplifiers. Looking at it the other way, in power or size limited situations a TWT amplifier will still give you more signal power for the available space or power supply, with less waste heat to remove. That’s not a complacent position. Solid-state amplifiers can satisfy lower power, lower frequency requirements, but with programmes to improve the ruggedness, efficiency and operational life of TWT amplifiers we believe that we maintain a positive performance differentiation.”

Xicom offered an opinion somewhere in between as they use both technologies. They see growing demand for both. The power level at which the transition point between choosing a TWTA versus a SSPA has risen, in sync with the available power from a single transistor. However, the demands for high data rates still push many systems to require TWTAs in order to support the link budgets. This is also very frequency band dependent, as the amount of power achieved from a transistor is very different at C-band than at Ka-band.

For the GaAs-based device outlook, Strategy Analytics recently issued a market report indicating the demand for GaAs devices in SatCom/VSAT market will grow 4 percent through 2013 with steady demand due to long design cycles and pent up demand driven mostly by the consumer sector.3 Since GaAs is still used extensively in the space and ground segments, they expect a compound annual average growth rate of over 4 percent from 2008-2013 with MMICs being the majority of volume and GaAs revenue. The largest opportunities are for Ku- and Ka-band power amplifiers despite the threats from other technologies and they expect GaAs to remain the dominant technology solution.

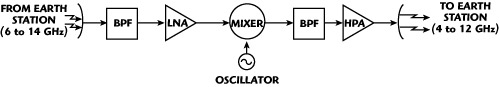

Figure 2 Simplified C-band satellite transponder block diagram.

The Earth station uplink signal is received by the satellite transponder and transmitted back to the Earth downlink station. Figure 2 shows a typical simplified block diagram of a C-band satellite transponder.2 The components and subsystems must be small, light weight, highly reliable and as efficient as possible to minimize the energy needed and heat dissipated. Every extra pound of weight is very costly to launch and it is very difficult to dissipate the heat in space. Efficiency is critical to reduce energy consumption as much as possible.

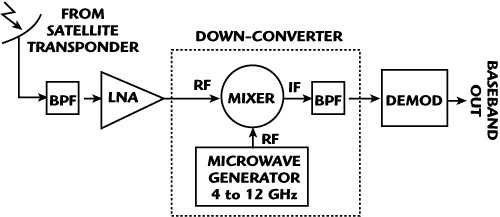

On the receive side, the downlink Earth station receives the signal from the satellite, amplifies it and downconverts it to the L-band cable transmission frequency. Figure 3 shows a typical simplified block diagram.2 The low noise amplifier is critical to the performance/sensitivity of the downlink so the low noise block (LNB) downconverter is the critical component in the system. The BUC and LNB along with the dish antenna make a two-way ground station system called a Very Small Aperture Terminal (VSAT).

Figure 3 Simplified satellite downlink block diagram.

Requirements and Challenges

Commercial satellites currently provide capacity for military applications such as communications, video and UAV missions. Many commercial satellites provide wider bandwidths and there are a much larger number of them compared to military satellites, making the capacity capability even broader. e2v commented, “Whilst there is some crossover traffic from military to commercial channels there remains a defined market for in-theatre defence specific equipment and there is no reason to think that is going to change. In fact, if anything, this market is becoming more demanding of the supplier base and of system performance, giving companies like e2v opportunities to shine.” However, it is likely that the military will continue to make extensive use of commercial capacity even after many of these new systems come online due to growing data needs in many areas.

The main difference between commercial and military satellites is that military systems provide highly secure, survivable, protected, global communications for the warfighter. Commercial systems are more vulnerable to security attacks, jamming and destructive events including nuclear attacks or other severe environmental situations. Military systems can resist these severe conditions and prevent jamming, interference, hacking, etc. Military systems are often optimized for certain types of data and capacity needs so they can offer a better fit to their specific mission. Another area where commercial systems cannot help is with polar coverage. Since there is little need for services in these areas, they do not have coverage there. Military systems need to have global coverage and AEHF will feature an Advanced Polar System for wideband, protected coverage. Commercial systems should be able to complement capacity, but cannot be relied on for all situations and needs.

There is a need to use higher frequency transmitters to provide more bandwidth and capacity, but the higher frequencies in general are attenuated more by the atmosphere (especially at 60 GHz where the 02 attenuation is high) and are more expensive and difficult to design. While there is a big push to use the higher frequencies to meet the growing capacity needs, the cost and design issues need to be overcome as these systems are realized. There is always a push for more power and more linear amplifier systems to improve performance.

Trends and Solutions

Euroconsult estimates that 1185 satellites will be built and launched between 2009 and 2018, which is an increase of about 50 percent compared to the previous decade of 1999 to 2008.4 Not all of these will be communications satellites and while there is ongoing defense and security concerns, demand for proprietary military satellite systems remains concentrated in a limited number of countries. But countries like the US that need to maintain a modern military must expand capacity to meet current and future needs.

Most agree that the current demand for Ku-band communications is strong, while the C-band is fading as broader bandwidth needs are met. Ka-band is growing quickly as military SatCom is increasing its bandwidth capabilities and pushing for higher frequencies. Jersey Microwave is developing a Ka-band Test Loop Translator to support upcoming Ka-band hardware in anticipation of the growing Ka-band market. As evidenced by WGS, future systems will use higher frequencies (Ka-band and above) plus dual- or tri-band systems to utilize current technology and add higher bandwidth capabilities. X-band for commercial systems has been slow, but military use should pick up over the new few years. A couple of the companies we surveyed also see some future demand for even higher frequency, higher bandwidth systems using Q- and V-bands.

In order to achieve these higher bandwidth needs, suppliers are designing higher frequency and broader bandwidth devices and subsystems. To increase efficiency with a given bandwidth, complex modulation schemes have evolved, which in turn requires more linear power requirements. Digital pre-distortion (DPD) has improved the linearity of SSPA designs and better broadband matching networks are now available. Microwave Journal reviewed some of the newer SSPA hardware at Satellite 2009 in late March in Washington, DC. Micronetics had its Ku-band high power transceivers on display, which are available with transmit powers of 10, 16, 20 and 40 W. Miteq was featuring its SSPA systems, including X-band configurations with up to 70 W for satellite uplink applications that come in outdoor antenna mount and rack mount systems. And Locus Microwave (now part of the Codan family) was displaying its 100 W Ku-band SSPA in a lightweight package of 7 lbs (also see the company’s 100 W X-band BUC product feature in this issue).

On the LNB side there was Teledyne Microwave featuring a Ka-band high performance LNB with a typical noise figure of 1.5 dB.

Also at Satellite 2009 were the latest TWT components, including MCL with its antenna mount TWT low power amplifier with 175 or 200 W at X-band. NEC had a 500 W Ka-band peak high power TWT featuring low power consumption and lightweight construction. Thales had on display a new line of TWTs (Periodic Permanent Magnet focused) that provide 750 W for DBS applications and is widely used in ground uplink systems. And e2v has its new StellarMini, which is the latest generation of the company’s high power TWTs. Xicom introduced a new suite of X- and Ka-band uplink amplifiers including both SSPA and TWTA designs for WGS satellites. The product offerings covered power levels from 35 to 2500 W in X-band and 10 to 500 W in Ka-band.

On the higher level product side at Satellite 2009, Cobham had its Atlantic Microwave antenna systems on display including the SAT Series Ka/Ku-band transportable SatCom Antenna system that uses a 1 meter multi-piece lightweight dual reflector. It can acquire and track a Ka- or Ku-band satellite and pass the data signal from the satellite to an external data receiver (see Figure 4).

Figure 4 Transportable Ka-/Ku-band SatCom antenna system.

Another part of this improving technology is better software to model 3D structures and package parasitics to design higher performing devices. Modeling becomes even more critical at the higher frequencies and the transitions between coax, CPW and microstrip need to be carefully designed using powerful finite element analysis tools. Microsemi emphasized that they build circuits using automated equipment to reduce variation in critical component placement and wire bonding. This automation supports tighter phase matching between power-combined channels reducing critical combiner losses.

There is always a trend for smaller, lighter weight and more efficient components and subsystems for SatCom systems especially for mobile and space applications. Jersey Microwave has recently developed a single module that contains a Ku-band block up and down converter for a custom military requirement in a 3.5 × 2.9 × 0.66 inch package. This small, lightweight, low power consumption unit is ideal for man-pack and airborne applications.

Packaging is another critical area for lighter more compact components and designs are much more sensitive at the higher frequencies. Rogers has developed a RT/duroid 5880LZ laminate with a new filler system that results in a low density (1.37 gm/cm3), lightweight material for high performance, weight sensitive applications. The 1.96 dielectric constant is among the lowest available for any microwave PCB material and ideal for antenna applications. Microsemi is now leveraging its Epsilon™ packaging technology for military use. It is essentially a laminate of soft board and FR4 coupled with palladium-doped plating to eliminate most of the metal packaging while simultaneously accommodating both surface-mount soldering and gold wire bonding. This greatly reduces the weight and cost of traditionally machined housings.

Conclusion

There is a large capacity crunch in military SatCom systems as current demands such as real time video surveillance, UAV monitoring, networked communications, real time targeting and battlefield mapping are demanding much more capacity. This is compounded by the future plans to convert the military to a network-centric force that will demand even more capacity. The military has responded with new programs such as WGS, WIN-T, AEHF and MUOS, while the microwave component and subsystem companies are responding with higher frequency, lower cost, lighter and more efficient products. The current demand is strong for Ku-band products with a growing demand for Ka-band products to increase the bandwidth of SatCom systems. X-band could see significant growth for small tactical and transportable terminals as mobile units find expanded roles that could change the nature of SatCom again. The BUC stops here with the government and industry as they respond to these current and future needs for capacity.

References

1. http://www.boeing.com/defense-space/space/bss/factsheets/702/wgs/wgs_factsheet.html.

2. http://itblogs.in/communication/technology/satellite-system-link-models/.

3. http://www.strategyanalytics.com/default.aspx?mod=ReportAbstractViewer&a0=4845.

4. http://www.euroconsult-ec.com/research-reports/space-industry-reports/satellites-to-be-built-launched-by-2018-29-29.html.