The emergence of sensor networks (acoustic, radar, lidar and video) on passenger automotive vehicles is indicative of the increasing complexity and sophistication of the electronic functionality of the world around us, as we apply technology to make our lives more convenient. In the same way that the simple cellular phone has morphed into an all-encompassing entertainment and connectivity device—camera, video, MP3 player, Internet connection and, on occasion, a device to speak to somebody with—the average motor vehicle is increasingly becoming a platform for electronic systems that seeks to make our journeys as comfortable (multi-media entertainment), hassle-free (GPS navigation, tire-pressure monitors, rain/light sensors, etc.) and now as safe as possible.

By way of example, radars exist today on vehicles in production. But why do we need such technology? The arguments are simple. Over the last 10 to 15 years, despite the wide deployment of airbag technology, advanced mechanical designs (crumple zones), new materials, etc., the death rate due to car crashes has remained stubbornly flat. To put it into perspective: In 2001, on US roads, a fatality occurred every 12 minutes. The EU has a similarly tragic statistic. How does a “remote sensing” technology like radar change the equation? Most previous technological solutions addressed survivability. Solutions like radar are a paradigm shift, as they attempt to address collision avoidance… the best way to survive an accident is not to have one in the first place.

A sensor such as M/A-COM’s SRS (Short Range Sensor) is an example of a system based on mmWave technology, and is one of a family of technological solutions at play to address the next level in vehicle safety applications. This article will review the trends of technology implementation for microwave sensors (and others) in vehicles and highlight the directions that the industry is heading in. We will spotlight the direction of the vision of the OEMs for the vehicle of the future and how that is flowing down to the sensor and component manufacturers, within the boundary conditions imposed by spectral regulations. It will also discuss how understanding the intended application requirements of the sensor is the most efficient way for deriving lower-level specifications that can be used for technology definition and product development.

However, the challenge remains to deploy such complex systems in lower priced and affordable vehicles, across international boundaries. Attention to the harmonization of international regulatory requirements has an impact on volumes and thus price. Price drives the types of vehicle that such technology will be deployed on and ultimately the number of people that are able to benefit from increased levels of safety.

The Human Cost of the Automobile

In developed countries the car is a fact of life. It is practically essential to most people’s way of life. In the developing economies of China, India and the Far East, it is fast becoming the same ubiquitous aide to everyday life. With the prospect of the introduction by Tata of the $3000 car in India, it has every indication of only becoming more so. Society has a love/hate relationship with the automobile. On the one hand, we have the incredible freedom that affordable personal transportation brings and, on the other, we have a technology that brings along with it a number of societal and environmental impacts. Exhaust emissions by internal combustion engines and their impacts are well documented and frequently discussed. However, the human cost of the widespread use of the car is less well known. Most people have probably seen a car accident and some probably know people who have been involved with one. This prevalence is a result of the huge number of vehicles on the roads today, coupled with the ever-increasing distances people are traveling. In the US, motor vehicle accidents are the leading cause of death for people between the ages of 1 to 34 years old (National Vital Statistics report, September 2002).

The statistics are humbling. In 2003, in the US alone, there were over 42,000 deaths due to car accidents (US DoT). As shown in Figure 1, in the same year, Germany suffered the loss of 6605 of its citizens to car accidents (ADAC-Moterwelt 1/2004). To put this in perspective, in the US, there were more people killed by cars than by breast cancer (40,954 deaths due to breast cancer in 2003 according to the US Department of Health CDC).

While the absolute numbers involved in road deaths are staggering, the more sinister statistics are in the trend data. Despite the wide deployment of airbag technology, advanced mechanical designs (crumple zones), new materials, automatic braking system (ABS) and advanced stability controls to name but a few, the death rate due to car cashes has remained stubbornly flat (see Figure 2). What lies at the root cause of this statistic is the simple fact that most previous technological solutions addressed survivability. Advanced sensor technology, with mmWave radar playing a central role, is quietly causing a paradigm shift in the equation as these new technologies address collision avoidance. It can be summed up simply: The best way to survive a crash is to not have one in the first place. And a route to avoidance is awareness, whether it be at the driver level, the vehicle level or the interaction of the two.

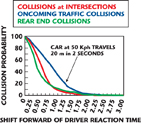

Of course, awareness is only part of the solution, but if we look at Figure 3, it is evident that a significant proportion of all fatalities result from a collision between two or more vehicles. Thus, a clear role exists for remote sensing technologies that are able to increase the awareness of the driver-vehicle system. At one level, it is to forewarn the driver and, at the other extreme, the vehicle itself taking control over the situation. This is further supported by noting the curve in Figure 4. It tells us that if we are able to give the driver an extra two seconds of reaction time, the probability of a collision reduces significantly. The role of remote sensing technologies is clear.

The graph of car-related fatalities by categories also highlights some of the clear geographic differences. The US and Germany both have a modest (11 and 12 percent, respectively) fatality rate due to vehicle-to-pedestrian accidents. Japan is notably different, with this percentage being much higher at 30 percent. Road conditions, driving styles and environmental conditions all contribute. Again, the need for remote sensing is clear, but the application and vehicle response is different. For example, there are experimental systems that sense an impact and raise the bonnet of a car at the time of impact. This reduces fatalities due to cranial impacts on the engine block. Making such technology cost effective is the key to large-scale deployment and adoption as standard equipment on vehicles. Remote sensing can play a major role here also, as having more time for the vehicle to react to a situation (more awareness) lessens the speed requirements on actuators. Thus, hydraulic or electrical actuation can be used instead of pyrotechnics that are costly and “once only and back to the shop” type solutions.

Economic Region Initiatives on Road Safety

The EU, US and Japan are not blind to the trends. Over the last few years, all have instigated regional and national programs at various levels to attempt to address the issues. The EU has a long running eSafety initiative. eSafety is a joint initiative of the European Commission, industry and other stakeholders, and aims to accelerate the development, deployment and use of intelligent integrated safety systems that use information and communication technologies in intelligent solutions in order to increase road safety and reduce the number of accidents on Europe’s roads.

In the US, the integrated vehicle-based safety system (IVBSS) program recently awarded a $25 M contract to the University of Michigan Transportation Research Institute (UMTRI). Partnering with UMTRI are Visteon, Eaton, Cognex, Honda R&D Americas, Battelle and the Michigan Department of Transportation. The consortium will develop and test a new, integrated crash warning system in a fleet of 16 passenger cars and 10 heavy-duty trucks. UMTRI will serve as the primary contractor, coordinating the work of the partnership and conducting the field experiments.

OEM Applications Today

Options or Standard Equipment?

Car manufacturers are often faced with a dichotomy. Safe cars sell and people expect the cars they drive to be safe. On the other hand, it is often the case that consumers, when faced with an options list, will pick more from the category of “driver comfort” rather than something that adds to the safety of the vehicle. Let us illustrate this point by proposing a hypothetical choice between two options which could be similarly priced when you are at the car dealership and we will let the reader play the mind game:

Option 1: A technology that pre-fills your brake cylinders before an impact, to shave 300 ms off your effective reaction time (thus statistically increasing your survival rate in an accident by 15 percent).

Option 2: The drop-down flat screen DVD player for the kids in the back seat.

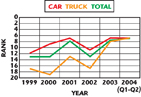

Where would you put your $500? While some people may argue that option 2 can also add to road safety (by keeping the children quiet in the back?), the point here is that when new technology is first introduced into the automotive world it is often in the form of options on the higher end vehicles. First, this allows the OEMs to recover some of their investment and also to test the waters in terms of customer acceptance of some of these new solutions. However, as shown in Figure 5, if we look at the TCE buyer behavior survey, of the 75 reasons to purchase an option, features that protect in an accident are increasing in rank but are still only at 7, not in the top slot.

To address this issue, most car manufacturers are introducing remote sensing technology into cars on the back of Driver Assistance/Comfort type functions and most (if not all) have plans to migrate the functions towards active safety over time. Forces that increase volumes, such as harmonization of regulations, help to push costs down. This in turn makes it more feasible to offer such technology as standard equipment (or indeed compulsory) so that the consumer does not have to choose between a comfort feature or one that enhances safety. Functions like seat belts, ABS and airbags all went this route, as are ESP-like functions at the moment.

Some Example OEM Applications

By way of example, in the US, the most prevalent driver assistance application on the market is park assist. Many vehicles today have park assist applications: Cadillacs, Buicks, Lincolns, Chrysler and others. Most of these park assist systems utilize ultrasonic technology; however, many have added vision systems to enhance the driver’s awareness in parking scenarios. This year, the Cadillac STS, DTS and the Buick Lucerne have begun to offer Side Blind Zone Alert as well. This is a system that will warn the driver of the presence of a vehicle in its side blind spot. Both park assist and blind spot detection can be characterized by short-range sensing and are promoted as driver assistance more than safety enhancing applications.

Perhaps more pertinent to this audience is the gradual adoption of mmWave radar technology as one of the leading contenders for the remote sensing technology in vehicles. While radar has been around for a while on luxury cars for ACC (Adaptive Cruise Control) applications, Mercedes was the first to introduce, in production series, a more comprehensive driver assistance system (Brake Assist Plus or BAS Plus) in 2005 and a year later in 2006 with the PRE-SAFE Brake in the S-class and CL-coupé models. In this particular deployment, the technology is based on both a long-range sensor and a suite of short-range radar sensors (at 77 GHz for long range and UWB at 24 GHz for short range in the front, side and rear). The safety aspect of the system will attempt to alert a driver when the possibility of a collision exists and, if the driver does not react, will progressively apply braking to attempt to prevent the crash. Toyota has also launched a similar system on its Lexus platform. The system combines information gathered from a front-mounted millimeter-wave radar, as used in Lexus’s established PCS system, and a twin-lens infrared stereo camera located on the top edge of the windscreen. Both of these deployments seek to address a range of applications, both in the driver assistance and the driver comfort application segments, and both attempt to facilitate this range of applications with the same set of sensor hardware (for example, the Mercedes system will also act as a back up aide, stop-and-go low speed ACC, etc.). This is an important strategy as it allows the cost for the more safety-oriented application to be offset by the driver comfort option (which as we may have illustrated, the customer may be more likely to pay for directly). With a suite of short-range sensors (30 m UWB radar type technology, for example) a significant number of new applications can be addressed with the same hardware. However, this puts more demanding specifications on the mmWave system design and components (see Figure 6). Figure 7 shows the diverse applications, what they do and how ready are they.

Technology Now

Remote sensing solutions currently available cover a wide range of technologies. It is probably fair to say that no one single technology is ideally suited to address all the applications and problems that need to be solved for a comprehensive safety system to work well over all conditions. Figure 8 is an attempt to depict the trade space among the competing technological solutions. It is clear from the table that most of the factors that are important to safety applications can be addressed relatively well by the use of some kind of radar. It is also true that the fusion of radar with an optical technique (such as video cameras) has the potential to produce overall a very effective solution. Shown in Figures 9 to 13 are examples of different types of remote sensors currently available on vehicles. Figures 9 and 13 show 77 GHz long-range radars originally deployed for ACC applications, Figure 10 is a video camera-based system, Figure 11 is a Lidar (or laser-based) system and Figure 12 is a 24 GHz UWB short-range sensor.

Radar Now?

The historical barriers that slowed the widespread deployment of radar sensor networks were threefold: Technological (mainly affordability); Applications (and the link to specifications); and Regulatory. Let us first consider the technological challenge of affordability. Although the cost structure of the microwave industry has changed enormously due to the charge led by the development of RF wireless devices, this has been largely below 10 GHz. Finding the appropriate balance between where regulations are most flexible, where the physical and electrical size of sensors gives the most information of the vehicles’ environment and where the cost of the available technology is compatible with consumer expectations, is a trade-off without a simple or ideal answer.

The second problem has been the ability to adequately and accurately define the application and thus determine a well-defined set of specifications for the underlying components and systems. Unlike the development of telecommunications equipment, where the hardware and software engineers can expect well-defined air interface documents, component specifications and interface protocols, the definition of radar sensor operational requirements has been partly an empirical problem due to the subjective nature of some of the requirements. Also, the interpretation of the same application (a parking aide, for example) may vary across geographical and cultural boundaries, as driving habits and road conditions differ considerably. Often a major route to finding what details matter from a sensor network down to circuit level implementation has been to install it on a vehicle and collect data. However, the discussion is irrelevant without a regulatory framework to work in (such as frequency allocations and rules). It is thus worth a short sojourn through this somewhat tangled path.

The Regulatory Framework

The Regulatory hurdle is a largely electro-political challenge of working with several global institutions to seek approval for consistent and harmonious spectrum allocations that support sensor development without interfering with other users. The themes at play here are frequency and power; the goal should be harmonization for a low cost solution that enables worldwide deployment to benefit the largest number of people.

At this time, there are three fundamental frequency bands at play in the various markets around the world. Figure 14 attempts to summarize these. Two are classified as ultra-wideband (UWB) and one as a long-range radar (LRR) band. Historically, there has been a worldwide frequency allocation at 77 GHz for ACC applications (autonomous cruise control, known as LRR) for some time. While the bandwidth allocated is adequate for the intended application (1 GHz of spectral occupancy), more advanced applications require higher resolution, which translates into wider spectral occupancies. More advanced safety applications require a greater degree of precision and certainty about the targets they see. This leads to higher requirements for resolution. Thus, two parallel frequency allocations for UWB for automotive applications have emerged.

The first of these is centered in the 79 GHz band with an allocated bandwidth of 4 GHz. As can be seen, this has been allocated in Europe, but is still pending in the two other major geo-political automotive markets. Currently there are no products in production for vehicles in this frequency band. However, significant research efforts exist to address both the semiconductor technologies and cost reduction strategies at these very high frequencies and also to examine the difficult deployment issues surrounding use of 79 GHz (for example, interactions and losses in a bumper fascia, etc.). An example would be the Kokon project, a comprehensive German government sponsored collaborative effort (see www.kokon-project.com).

The other UWB frequency allocation is based around 24 GHz (here we include the possible shift in EU regulations to cover a 26 GHz center frequency). This band has an allocated bandwidth of around 7 GHz in the US. While products are currently on the market on vehicles today (in both the EU and US), which meet the cost performance objectives of the applications required of them, there is still uncertainty about the regulatory environment in Europe and Japan. The 24 GHz band is shared with fixed services (point-to-point back haul) and also earth exploration satellite services and radio astronomy and the EU has currently mandated a “sunset date” on UWB at 24 GHz in 2013 (no more production after this date). This comes up for review in 2009, with a possible shift to 26 GHz being mooted. The regulation by the FCC is simpler (22 to 29 GHz) and the band is licensed for the foreseeable future. There are currently technical studies in progress in Japan on co-existence issues in the approximately 22 to 30 GHz band, with an initial outcome expected early 2008.

Suffice to say that worldwide, the regulatory framework is somewhat fragmented and in flux, neither of which is helpful for deploying radar-based safety systems in the international marketplace within which the automotive OEM’s function nor does it help the worldwide adoption of technology that has the potential to save lives. However, harmonization efforts are at work (refer to www.sara-group.org) that hope to create more cohesion across the different geographic and political market places. There is considerable debate over this issue worldwide. While 24 GHz solutions have the advantage of being able to offer lower cost solutions now (due to lower IC technology cost, availability of plastic package technology at 24 GHz, lower cost volume test solutions, etc.), they do trade some advantages that 79 GHz solutions offer, such as smaller size and the impact that the sensors may have on the vehicle styling.

The Future

What will drive the future direction of active safety systems and in particular the role that mmWave radar technology will play? Semiconductor technology, as an enabler, has the potential to reduce costs by higher levels of integration thus facilitating the deployment on affordable cars. Advanced applications, made possible by remote sensing, will enable car OEMs to offer a wider range of products and applications. Finally, higher volumes from new and emerging markets have the potential to drive the economies of scale necessary to put active safety systems within reach of everyone.

Semiconductor Technology Trends

One of the great debates regarding the development of sensor technology for future microwave and millimeter-wave sensors has been that of selecting the optimum semiconductor technology. Figure 15 illustrates some of the varying technology solutions that have been proposed as a function of operating frequency and level of integration. Traditionally, the choice has been restricted to GaAs or III-V semiconductors, which are superior in terms of their low noise, power and linearity capabilities. In order to minimize their area (cost), they have been largely restricted to single function circuits. Depending upon the specific radar architecture, these functions have been distributed across a frequency plan between 12 to 76 GHz, with several up- and down-conversion stages included to perform the frequency conversion. However, the rapid growth and relative maturity of high-speed SiGe processes has meant that for relatively short-range and low-power applications (such as automotive radar), there has been a move to substitute more highly integrated transceiver ICs in place of the single-function and more expensive GaAs-based circuits. There is still the trade-off between selecting the optimum process for a given application versus the level of integration to be addressed however, and as the frequency increases, the relative level of integration in the SiGe bipolar circuits tends to reduce. One of the ways that this can be addressed is by moving to a SiGe BiCMOS process, where the high performance front-end circuitry (Tx amplifier, Rx LNA) are realized using the bipolar process, but more flexibility and control is introduced by the availability of small-feature CMOS. Lastly, the rapidly decreasing technology size of CMOS has led to many proposals and development programs for an all RF-CMOS-based only front-end, with much higher integration.

As always, this becomes a question of a complex trade-off between technology and economics. The available market size for automotive sensors is still (at least) an order of magnitude smaller than that of the wireless industry, and so the economics of using the latest and greatest 65 nm (or smaller) technology node in CMOS may be less clear than utilizing a previous generation CMOS or SiGe BiCMOS process. In addition, many of the publications for all-CMOS solutions have not discussed the all-pervasive automotive requirements on reliability, operating life and temperature. Promising operation and results may not easily translate to extended operation at highly elevated junction temperatures. The end result may be a technology evolution arc that becomes a function of regulations (operating frequency) and the emergent volume of the market with time.

Emerging Markets

For many years, the US, Japan and Europe have lead the pack in terms of the volume of cars manufactured. Saturation has occurred in most of these traditional markets, with year-on-year volume growth being very modest. Increasing individual economic wealth and a large population are two key factors, which drive numbers in markets such as China and India. This can be clearly seen from the trend analysis shown in Figure 16.

These markets are quite different, however. The emphasis is on the small to micro-sized vehicle with very small engine sizes at very low cost. Almost, one would say, the rebirth of the original term “Volkswagen.” For radar and remote sensing technologies to be able to play a role here, the cost requirements and thus the scope for design innovation are significant. The most recent 2007 all inclusive safety package option on a high-end car will probably cost more than an entire vehicle in one of these emerging markets.

It is worth considering at this point another dynamic, which is different in the automotive world when compared to the conventional consumer market environment. The timescales involved are radically different. A typical product life cycle in consumer electronics is 12 months to maybe two years. In the automotive world, it takes that long just to have a piece of hardware qualified to go on a car. Patience and deep pockets are the name of the game for companies participating in this competitive marketplace. Worldwide production today is over 60 million cars a year, with a trajectory upwards. Thus, if mmWave and radar designers are able to design products that hit the cost/performance points required, there is a very real market out there with very real growth prospects (see Figure 17).

Conclusion

The deployment of mmWave-based radar technology for remote-sensing applications in cars is real and taking place in the market today. Parts of this complex story are still in flux: the shifting regulatory landscape and the continuing march of semiconductor technology to name two. It is clear, however, that the human benefits, the opportunity and the market are here now.

Radar system engineers and mmWave designers have a rare opportunity to participate in the widespread deployment of technology that will impact life saving applications. The intelligent choice of semiconductor processes will leverage economies of scale. More design innovation will improve the cost/performance ratio of systems and harmonization of worldwide regulation will drive cost through volume. Perhaps, some time in the future, such developments will allow regulatory bodies to consider such technology as compulsory (remember, safety belts once used to be optional equipment). With remote sensing as an enabler, OEMs are likely to develop more advanced applications that will contribute to a feature-rich driving environment that is safer for all.

Acknowledgments

The author would like to thank the team at Tyco Electronics for the significant support, guidance and input that made this article possible (both the R&D group and the Automotive Sensors Group, particularly Brad Kruse and Ralf Richter for their inputs). Notably Ian Gresham for inputs on semiconductor technology trends, Hiroyuki Akiyama for the view from the Far East, and Tom Rose (BTR) and Dave Williams for editing. JP Lanteri should take credit as the main impetus for starting the paper in the first place and for providing overall direction to the article.