RF HARDWARE AND TEST SYSTEMS

Given the inclusion of new sub-6 GHz frequency bands in NSA 5G NR, new RF hardware is needed to support these new frequencies—specifically n77, n78 and n79—which were not previously used for mobile wireless. Though not determined in NSA 5G NR, frequency bands below 600 MHz may eventually be supported by 5G for massive low power connectivity such as IoT, Industry 4.0/Industrial IoT and other machine-type communications. The additional subcarrier channel spacing, bandwidth, CA and 4 x 4 MIMO specifications result in the need for large numbers of filters, antennas, LNAs, PAs and switches, with accompanying NSA 5G NR modems and RF transceivers.

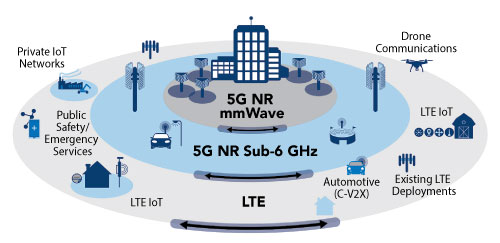

The early 5G modems and transceivers do not necessarily need to contend with these challenges, as these commercial devices can operate on select bands. However, 5G base stations for eMBB and future industrial and vehicle applications will require forward and backward compatibility. This means that 5G RF hardware will need to service all current mobile frequency bands, as well as 5G FR1 and 5G mmWave FR2 frequencies (see Figure 4). This is a particularly troublesome hardware challenge, as the hardware for many of the existing cellular frequencies may interfere with the NSA 5G NR bands, as dual connectivity is necessary to meet the throughput specifications. Also, the new NSA 5G NR frequency bands surround the ISM bands for Wi-Fi, Bluetooth and other wireless equipment operating in the unlicensed bands.

Figure 4 Once deployed, standalone 5G services, operating at sub-6 GHz and mmWave frequencies, will need to coexist with

With such closely packed bands and extremely wideband radios, the performance degradation from receiver desensitization is likely with inadequate filtering, PA linearity and harmonic suppression. New NSA 5G NR transmitters can operate with higher output power and higher peak-to-average power ratios for maximum throughput, which may cause problems with co-located 5G receivers in the same base station or nearby 5G devices.

Real estate for RF hardware, especially antennas, is already small in UEs, and 5G specifications may require 4 x 4 MIMO for the downlink and 2 x 2 MIMO for the uplink, meaning six independent RF pathways. 5G antenna tuning technologies will be critical to maximize antenna radiation efficiency over wide bandwidths. These RF pathways must also be much wider than 4G LTE pathways, as NSA 5G NR now supports 100 MHz bandwidth on a single carrier, with more CA options (up to 600 new combinations with Release 15). NSA 5G NR also allows for 200 MHz combined uplink and 400 MHz combined downlink bandwidth. This results in a substantial amount of data to process, challenging for energy efficient UEs and base stations.

It is probable that the RF hardware for UEs will be increasingly integrated, with filter banks, high density switches, antenna tuning, LNAs and PAs integrated into RFFEs with systems on chip (SoC) technologies. 5G UE antennas may also be integrated solutions, possibly with antenna tuning and some pre-filtering and beamforming features included. This level of integration is also plausible to achieve the cost targets to ensure handsets are affordable and meet phone form factors.17-19 With the increased complexity of 5G and the need for dense RF solutions, it is no surprise that many UE manufacturers are attracted to 5G modem-to-antenna solutions for faster development and deployment.

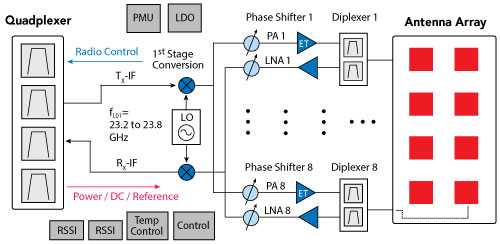

Many current 4G UEs and base stations rely on LDMOS, GaAs and SiGe PAs, with GaN a recent entry into the base station PA market. As the frequency is extended to sub-6 GHz, LDMOS, which struggle beyond 3 GHz, is less likely to meet 5G specifications, while GaN PAs—and possibly LNAs—are likely to be used in the infrastructure. GaAs and SiGe amplifiers will compete for amplifier and switching functions in the sub-6 GHz 5G applications. To maintain lower cost and smaller form factors than current mmWave PA, LNA and switch solutions provide, highly integrated RF silicon on insulator (SOI) technologies are likely to be used for 5G mmWave applications. Future RFFEs may use RF SOI, SiGe BiCMOS or RF CMOS SoCs that integrate the PA, LNA, switches and control functions to operate mmWave phased array beamforming antenna systems (see Figure 5). It is possible that future RF silicon technologies can be further integrated or combined with other technologies to include filtering and the digital hardware required to enable hybrid beamforming modules. Future variations of RF SOI or RF CMOS may even be integrated with more advanced digital hardware, such as FPGAs, memory and processors. Baseband processing and accessory DSP functions could be implemented in the package, as well, for compact 5G mmWave solutions.

Figure 5 5G FDD beamforming module architecture. Source: arXiv:1704.02540v3 [cs.IT].

As frequency routing and filtering is essential for 5G CA and back compatibility with prior mobile generations, integrated SAW, BAW, FBAR and other integrated resonators and filter technologies are essential for UEs and even compact small cells. With the potential for interference and design complexity, 5G modules for UEs will also likely incorporate Wi-Fi and Bluetooth modules, further increasing the filtering and frequency routing complexity. Other integration-capable technologies, such as RF SOI, may be employed for 5G RFFEs, as recent advances in RF SOI enable filter and amplifier co-integration. It may be several years before SOI filters are used for sub-6 GHz 5G applications, although it may be sooner for mmWave systems, as amplifier and switch integration possible with SOI technologies make this an attractive next step.

CONCLUSION

The rapid progression of 5G specifications and the rush of mobile wireless manufacturers and service providers to start 5G trials and deployments has led to a plethora of early 5G demonstrations and interim 5G specifications. In just the past few months, modem, transceiver and RF hardware manufacturers have been announcing 3GPP-compliant 5G solutions, which rely on heavy integration and software reprogrammability to meet current demand and provide future-proofing. This deep level of integration and soon-to-come 5G deployments will require flexible test and measurement systems which can be readily adapted to the changing standards and lessons learned from early trials.20 Access to 5G accessories and interconnect technologies, especially 28 GHz and other mmWave components and devices, will be essential to prevent delays in trials and deployments.

References

- S. Segan, “What is 5G,” PCMag, March 2018, www.pcmag.com/article/345387/what-is-5g.

- “Paving the Way for Wireless Internet TV to the Home,” RCR Wireless News and Anritsu, February 2018, www.rcrwireless.com/20180222/5g/paving-way-wireless-internet-tv-home.

- “Huawei Launches Full Range of 5G End-to-End Product Solutions,” Huawei, February 2018, www.huawei.com/en/press-events/news/2018/2/Huawei-Launches-Full-Range-of-5G-End-to-End-Product-Solutions.

- J. P. Tomás, “Huawei, Telus Launch 5G Fixed Wireless Trial in Canada,” RCR Wireless News, February 2018, www.rcrwireless.com/20180215/5g/huawei-telus-5g-fixed-wireless-tag23.

- “Two-Thirds of Mobile Connections Running on 4G/5G Networks by 2025, Finds New GSMA Study,” GSMA, February 2018, www.gsma.com/newsroom/press-release/two-thirds-mobile-connections-running-4g-5g-networks-2025-finds-new-gsma-study/.

- ”Video — NR First Specs & 5G System Progress,” 3GPP, January 2018, www.3gpp.org/news-events/3gpp-news/1934-nr_verticals.

- “3GPP Specification Series,” 3GPP, www.3gpp.org/DynaReport/38-series.htm.

- “Specification #: 38.101-1,” 3GPP, https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=3283.

- “Video Interview — On 5G Core Stage 3 Work,” 3GPP, January 2018, www.3gpp.org/news-events/3gpp-news/1940-ct_5g.

- “Global Mobile Industry Leaders Commit to Accelerate 5G NR for Large-Scale Trials and Deployments,” Qualcomm, February 2017, www.qualcomm.com/news/releases/2017/02/25/global-mobile-industry-leaders-commit-accelerate-5g-nr-large-scale-trials.

- B. Thomas, “Is Your Handset RF Ready for 5G?,” Qorvo, February 2018, www.qorvo.com/resources/d/is-your-handset-ready-for-5G-qorvo-white-paper.

- “Making 5G NR a Commercial Reality; A Unified, More Capable 5G Interface,” Qualcomm, December 2017, www.qualcomm.com/documents/accelerating-5g-new-radio-nr-enhanced-mobile-broadband-and-beyond.

- “Samsung Unveils the World’s First 5G FWA Commercial Solutions at MWC 2018,” Samsung, February 2018, https://news.samsung.com/global/samsung-unveils-the-worlds-first-5g-fwa-commercial-solutions-at-mwc-2018.

- “Intel Introduces Portfolio of Commercial 5G New Radio Modems, Extends LTE Roadmap with Intel XMM 7660 Modem,” Intel, November 2017, https://newsroom.intel.com/news/intel-introduces-portfolio-new-commercial-5g-new-radio-modem-family/.

- “NI and Samsung Collaborate on 5G New Radio Interoperability Device Testing for 28 GHz,” National Instruments, February 2018, www.ni.com/newsroom/release/ni-and-samsung-collaborate-on-5g-new-radio-interoperability-device-testing-for-28-ghz/en/.

- “Keysight Technologies, DatangMobile Demonstrate 5G-New Radio Solutions at Mobile World Congress 2018,” Keysight Technologies, February 2018, https://about.keysight.com/en/newsroom/pr/2018/27feb-nr18025.shtml.

- Y. Huo, X. Dong and W. Xu, “5G Cellular User Equipment: From Theory to Practical Hardware Design,” IEEE Access, Vol. 5, July 2017, pp. 13992-14010.

- “Qorvo® and National Instruments Demonstrate First 5G RF Front-End Module,” Qorvo, February 2018, www.qorvo.com/newsroom/news/2018/qorvo-and-national-instruments-demonstrate-first-5g-rf-front-end-module.

- P. Moorhead, “Qualcomm Raises Wireless Stakes With Full 5G Modules and More RF Offerings,” Forbes, February 2018, www.forbes.com/sites/patrickmoorhead/2018/02/27/qualcomm-raises-wireless-stakes-with-full-5g-modules-and-more-rf-offerings/#d192567ae9f2.

- “Frost & Sullivan Spots Five Areas in Radio Frequency Test & Measurement that Will Create Over $30 Billion in New Revenues by 2023,” Frost & Sullivan, February 2018, ww2.frost.com/news/press-releases/frost-sullivan-spots-five-areas-radio-frequency-test-measurement-will-create-over-30-billion-new-revenues-2023/.