5G technologies and standards have recently emerged from buzz and corporate blustering to real and rapidly paced definitions and development. When 5G visions were first announced, many considered the performance targets in these predictions to be pipe dreams. However, corporate initiatives to develop 5G technology with real 5G radio and networking platforms and international collaboration on 5G standards has proceeded at a pace few could predict. If this progress means to meet performance targets for 5G, manufacturers must accelerate their timetables and their supply chains to meet the demands of new and competitive 5G hardware and systems.

The race to capture the global business for upcoming 5G solutions—consumer, commercial and government—is starting to resemble the historic space race between Russia and the U.S. The major difference is this goes far beyond a race between two sovereign superpowers, with many international companies and countries in the competition. True 5G solutions require many layers of national and international regulation, as well. Major international telecommunications companies and manufacturers are all competing to demonstrate 5G capabilities and features, while simultaneously paving the way for viable mmWave radio access unit and radio access network (RAN) technology. With spectrum, radio and network standards solidifying ahead of schedule, the pioneering aspects of 5G—mainly the expansion into many more verticals or slices than mobile broadband—are gaining focus and investment.

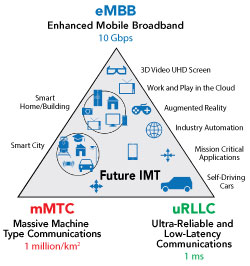

Figure 1 The primary use cases for 5G. Source: Werner Mohr, The 5G Infrastructure Association.

EARLY 5G FEATURES AND USE CASES

Though the expected features and use cases for 5G are diverse and extensive, the start of the 5G rollout will likely address only a few of the featured use cases: enhanced mobile broadband (eMBB), ultra-reliable low latency communications (URLLC) and massive Internet of Things (mIoT) or massive machine-type communications (mMTC), as illustrated in Figure 1. These provide increased throughput and performance for user equipment (UE), while offering a mobile network designed to support the massive number of new IoT, or Industry 4.0, applications. Interestingly, these early 5G features will likely be implemented at sub-6 GHz frequencies (current cellular bands, ≤ 1, 3.5 and 3.7 to 4.2 GHz and various combinations based on country) before 2020, offering opportunities in the vehicle and broadcast market, infrastructure and, primarily, mobile.

EARLY 5G FACTORS AND INFLUENCERS

The main 5G standards bodies and organizations are consistent with past generations of mobile wireless, i.e., 3GPP, GSMA, ITU and each country’s spectrum regulatory agency. Importantly, the heads of industry-leading companies are driving these organizations’ focus and standards developments. Other industry consortiums and alliances, such as the Next Generation Mobile Networks (NGMN) alliance and TM Forum, are also contributing and advising in the development of 5G standards and specifications.

With the forecast increase in competition for 5G services, and the need to provide lower cost data services now, there is a general impetus to hurry along the advent of 5G. With so many companies and countries taking the initiative with announcements of 5G deployments, these industry and international consortiums have been moving quickly with specifications, standards and spectrum allocation.

Referencing the Verizon 5G Technical Forum (V5GTF), companies feeling the pressure to commercialize more rapidly are even creating new forums to accelerate the development of 5G technologies. Another example of carrier-led efforts to advance 5G is the merger of the xRAN forum and C-RAN Alliance, with the focus of evolving RAN technology from hardware-defined to virtualized and software-driven. Industry forums in market verticals other than mobile are also forming to accelerate adoption and standardization. For example, the 5G Automotive Association encourages collaboration among telecommunication and automotive companies.

Some explanation for this rapid pace could be the concern that collaboration-based organizations have for early adopting companies and countries developing their own regional standards to meet the demand ahead of the competition. For example, some companies, namely AT&T and Verizon, have already claimed they will provide 5G services in select cities in 2018. These 5G services will not necessarily meet all 3GPP 5G specifications, but will likely provide superior throughput to current 4G services and be readily upgraded, most likely through software, to the final 5G specifications. Without 5G capable handsets, either sub-6 GHz or mmWave, it is likely that these companies will offer either hotspot or fixed wireless access (FWA) services instead.1-2 While the UE may not yet be available, 5G base station and terminal equipment is; Huawei recently announced 5G end-to-end solutions.3 These offer sub-3 GHz, C-Band and mmWave operation with massive MIMO technology and are reportedly fully 3GPP 5G compliant. In a demonstration with Telus in Canada, a 5G wireless to the home trial using Huawei equipment reportedly demonstrated 2 Gbps, single-user download speeds.4

With a lack of a standardized infrastructure in market verticals other than mobile wireless, however, the standardization and specification for vehicle and industrial applications may take far longer than anticipated. This could explain, somewhat, the additional focus of telecommunication service providers on 5G applications in the broadcast and home internet services markets. FWA using sub-6 GHz and mmWave 5G capabilities could provide gigabit internet speeds to homes without expensive fiber installation and even undercut the cable television and home phone service giants.

5G STANDARDS AND SPECIFICATIONS

The GSMA recently released a report, “Mobile Economy,” which claims that two-thirds of the world’s mobile connections will be running on 4G and 5G services by 2025, with 4G accounting for over half of the global connections and 5G accounting for approximately 14 percent.5 Not surprisingly, the demand has caused standards and specification organizations to step up their timetables, and market pressures are solidifying 5G radio specifications earlier than expected.6 However, the “5G precursor” specifications being released now are not the finalized 5G specifications and standards, rather evolutionary steps from 4G specifications that will be compatible with the future 5G specifications.

The latest 3GPP specification defines the non-standalone 5G new radio (NSA 5G NR),7 which requires an LTE anchor and 5G NR cell. The LTE anchor provides the control plane and control plane communications, while the 5G NR will provide enhanced data capacity. The NSA 5G NR specification currently only covers frequency range 1 (FR1), between 450 and 6000 MHz. These bands are designated in Table 5.2-1 in the 3GPP specification document 38101-1,8 and are subject to modification when Release 15 is issued in June 2018. The maximum bandwidth for FR1 NR bands is 100 MHz, of which only n41, n50, n77, n78 and n79 are capable. These bands are also designated as time-division duplex (TDD) bands, for which carrier aggregation (CA) should enable greater than 100 MHz functional bandwidth.

Also in this release are the descriptions of new RAN architecture options. The new architecture is built around a network virtualization strategy, where the control and user planes are separated. Referred to as network function virtualization (NFV) and software-defined networking (SDN), these features are designed to enable future network flexibility and a variety of applications. This methodology is meant to continue providing enhanced mobile telecommunications, while adding diversity of services—hence, independent network slicing.9