Demand for the new iPhone 7, particularly the iPhone 7 Plus, is greater than Apple's manufacturing capacity, and Apple's CEO, Tim Cook, isn't sure they can catch up with demand this quarter. That was the main takeaway from Apple's fiscal Q4 earnings call on October 25, where the company also projected a return to year-over-year growth in the December quarter.

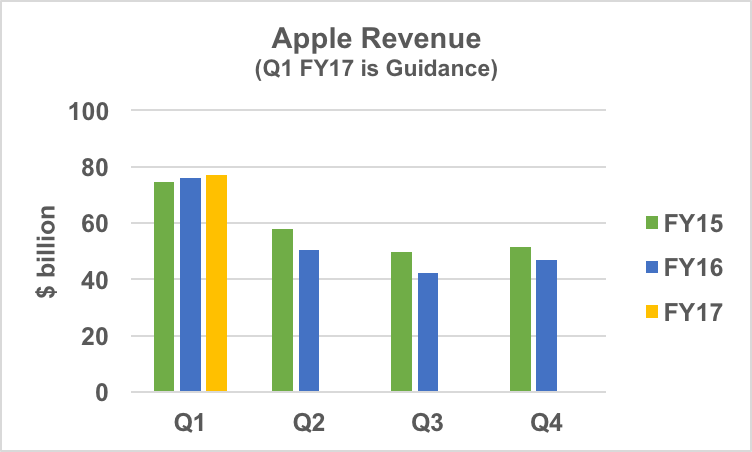

Apple's Q4 revenue was $46.9 billion, up 11 percent from Q3 and down 9 percent from the year-ago quarter. The company guided Q1 revenue to be in the range of $76 billion to $78 billion, which would return the company to modest year-over-year growth. Sequentially, it would be a jump of 64 percent, reflecting the strong demand for the iPhone 7.

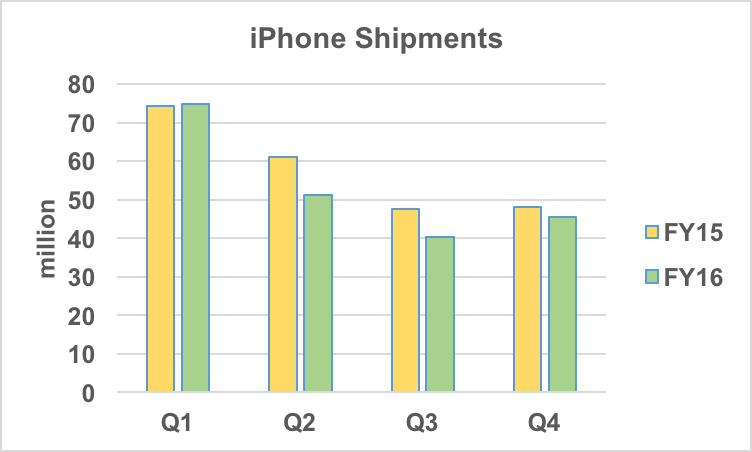

Apple shipped 45.5 million iPhones in Q4, a 13 percent sequential increase, down 5 percent from the prior year. iPhone average selling price (ASP) increased to $619 from $595 in Q3. Apple expects ASP to increase “markedly” in Q1, reflecting iPhone 7 sales.

Apple reported a record $6.3 billion in revenue from services, reflecting 24 percent year-over-year growth. The company ended the quarter with $238 billion in cash and marketable securities, an increase of $6.1 billion during the quarter. 91 percent of Apple's cash is outside the U.S.

Beyond Apple's inability to fully capitalize on the death of Samsung's Note 7, the other negative news was soft demand in China. Revenue in fiscal 2016 was down 17 percent compared with 2015, although Cook noted that 2015 revenue was 84 percent above 2014's. Looking at a two-year horizon, revenue from 2014 to 2016 grew at a 23 percent CAGR, which Cook called “a pretty good result.”

The strong demand for the iPhone 7 should be reflected in the quarterly financial results to be reported by the major mobile phone RF front-end manufacturers: Broadcom, Qorvo and Skyworks.